DEE Development Engineers is an engineering company that offers specialized process piping solutions for a range of sectors such, as oil and gas power (including nuclear) chemicals, and other related industries.

The company manufactures and supplies high-pressure piping systems, piping spools, high-frequency induction pipe bends, LSAW pipes, industrial pipe fittings, pressure vessels, industrial stacks, modular skids, and accessories such as boiler superheater coils, desuperheaters, and other customized components. DEE Development Engineers is recognized as one of the leading process pipe solution providers globally, renowned for its technical capability to address complex process piping requirements across multiple industrial segments. It is also the largest process piping solutions provider in India in terms of installed capacity.

DEE Development Engineers offers a range of specialized process piping solutions, including engineering services, for project stages like pre-bid, basic, detailed, and support. They also provide prefabrication options such as cutting and beveling using both CNC machines, welding services with semi fully automatic robotic machines, radiography (both conventional and digital) post-weld heat treatment, hydro testing, pickling, and passivation services grit blasting, and painting. The company is known for its expertise in working with challenging metals, like grades of carbon steel, stainless steel, duplex stainless steel, alloy steel, Inconel, and Hastelloy.

DEE Development Engineers provided goods to customers in locations serving both global markets such, as the USA, Europe, Japan, Canada, the Middle East, Nigeria, Vietnam, Singapore, China, and Taiwan.

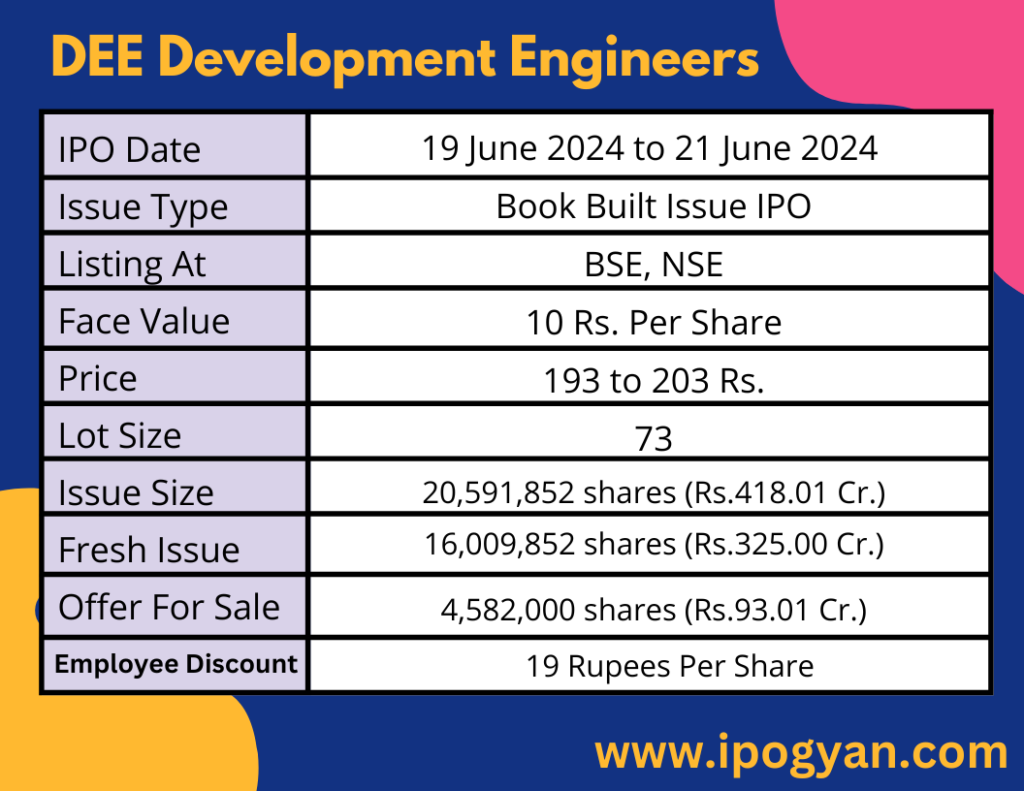

DEE Development Engineers IPO Complete Details:

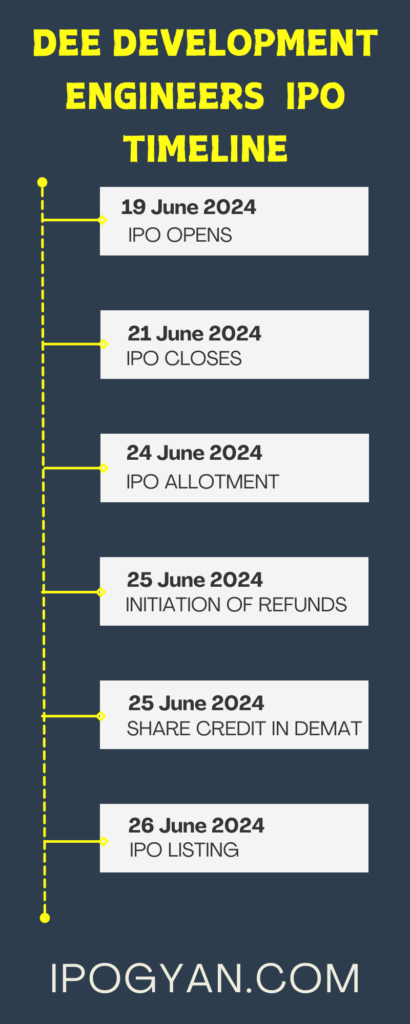

DEE Development Engineers IPO Timetable:

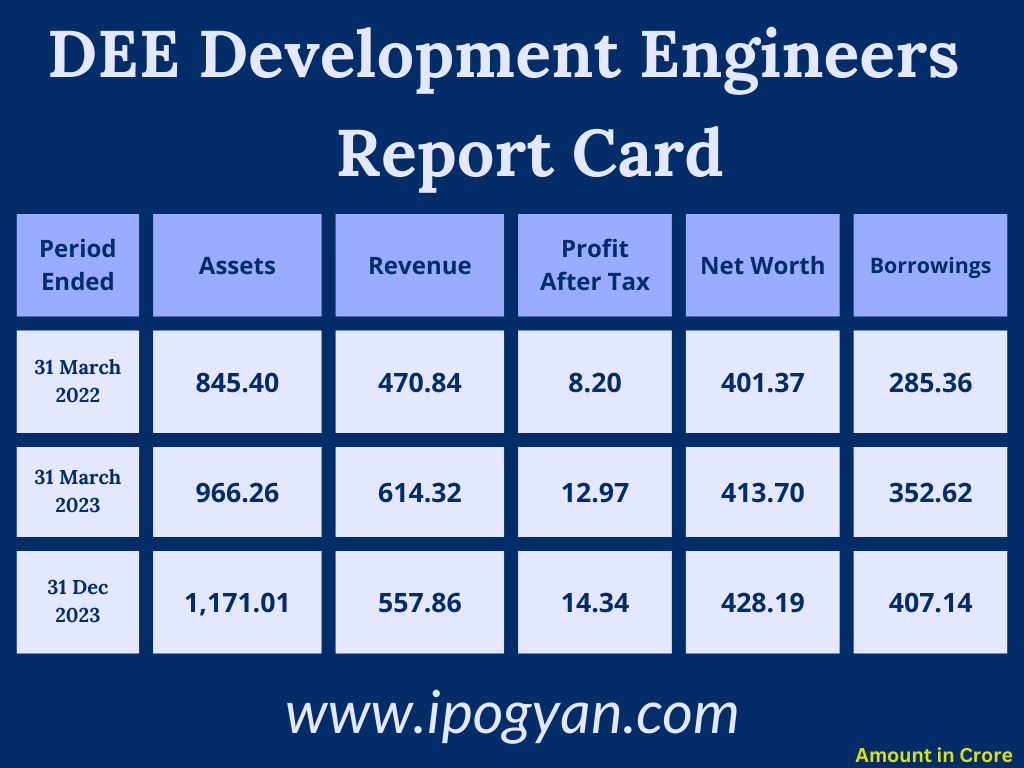

Company Financial Details:

AS OF NOW, the GMP Of DEE Development Engineers is Around 50 Rs.

Objects Of Issue:

1. Funding the working capital requirements of the company.

2. Prepaying or repaying all or a portion of certain outstanding borrowings availed by the company and its subsidiaries, DEE Piping Systems (Thailand) Co. Limited and DEE Fabricom India Private Limited.

3. General corporate purposes.

Promoters:

- KRISHAN LALIT BANSAL

FAQs:

When DEE Development Engineers IPO is Opening?

DEE Development Engineers IPO is Opening on 19 June 2024.

When is the DEE Development Engineers IPO Closing?

DEE Development Engineers IPO is Closing on 21 June 2024.

What is the Issue Size of the DEE Development Engineers IPO?

The IPO Issue Size of DEE Development Engineers is 418.01 Crore.

Price Band of DEE Development Engineers IPO?

The price Band of the DEE Development Engineers IPO is 193 to 203 rupees per share.

What is the minimum investment for a DEE Development Engineers IPO?

The minimum investment for the DEE Development Engineers IPO is 14,819 Rupees.

Allotment Date of DEE Development Engineers IPO?

The Allotment of DEE Development Engineers IPO is on 24 June 2024.

Listing Date of DEE Development Engineers IPO?

The Listing Of DEE Development Engineers is Scheduled on 26 June 2024.

One Should Apply for DEE Development Engineers IPO or Not?

Will Update Soon..

How to apply for DEE Development Engineers IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find DEE Development Engineers IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for DEE Development Engineers IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find DEE Development Engineers IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for DEE Development Engineers IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find DEE Development Engineers IPO from the list ——–> Click on DEE Development Engineers IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of DEE Development Engineers?

SBI Capital Markets Limited and Equirus Capital Private Limited are the Lead Managers of DEE Development Engineers.

Where To Check the Allotment of DEE Development Engineers IPO?

The allotment status for the DEE Development Engineers IPO will be accessible on the Link Intime India Private Ltd Website.

DEE Development Engineers IPO is going to be listed at?

DEE Development Engineers IPO is going to be listed at BSE, NSE.

What is the Lot Size of the DEE Development Engineers IPO?

The lot size of the DEE Development Engineers IPO is 73 Shares.

What is the P/E Ratio of the DEE Development Engineers?

The P/E Ratio of the DEE Development Engineers is 83.

What is the EPS of the DEE Development Engineers?

The EPS of the DEE Development Engineers is 2.45.

What is the ROE of the DEE Development Engineers?

The ROE of DEE Development Engineers is N/A.

What is the ROCE of the DEE Development Engineers?

The ROCE of DEE Development Engineers is 3.91%.