Akiko Global Services started its operations in 2018. Currently serves as a Channel Partner (DSA) for leading Banks and NBFCs. The company’s operational strategy includes telecalling, initiatives, and a hands-on approach, to marketing to attract customers online. Specializing in credit cards and loans Akiko Global Services provides support and assistance to individuals and businesses navigating the array of financial products available. Whether selecting the credit card for maximizing rewards or securing a loan, the dedicated team offers well-informed and personalized recommendations for personal or business purposes.

Akiko Global Services has earned a reputation, as a partner for leading banks and Non-Banking Financial Companies (NBFCs) in India. They focus on offering and selling products like credit cards and loans. Their proficiency is boosted by the use of a Customer Relationship Management (CRM) system in their activities. All potential leads are carefully tracked within their CRM software, which their, in-house IT experts created.

Akiko Global Services IPO Complete Details:

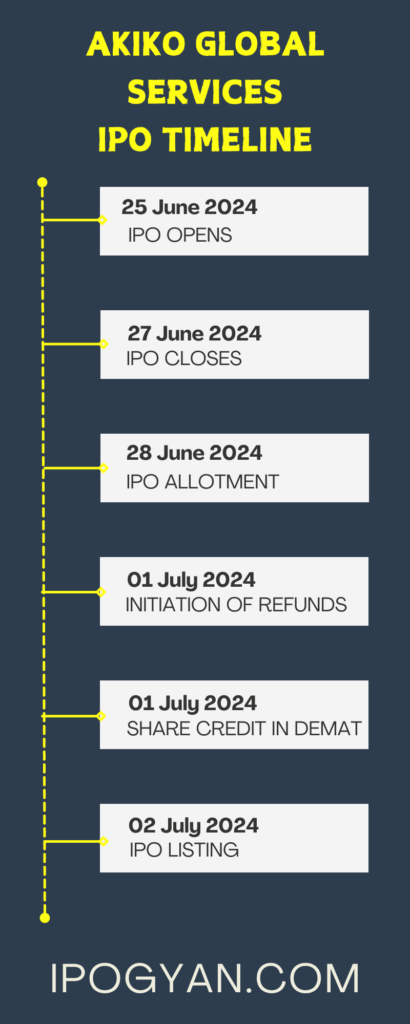

Akiko Global Services IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Akiko Global Services is Around 18 Rs.

Objects Of Issue:

1. Implementation of an ERP Solution and TeleCRM

2. Development of a Mobile Application for financial product solutions

3. Meeting working capital requirements

4. Enhancing visibility and awareness of our brands, including but not limited to “Akiko Global” and “Moneyfair”

5. General corporate purposes

6. Covering issue expenses

Promoters:

- Mr. Ankur Gaba

- Ms. Richa Gaba

- Mr. Puneet Mehta

- Mr. Gurjeet Singh Walia

FAQs:

When Akiko Global Services IPO is Opening?

Akiko Global Services IPO is Opening on 25 June 2024.

When is the Akiko Global Services IPO Closing?

Akiko Global Services IPO is Closing on 27 June 2024.

What is the Issue Size of the Akiko Global Services IPO?

The IPO Issue Size of Akiko Global Services is 23.11 Crore.

Price Band of Akiko Global Services IPO?

The price Band of the Akiko Global Services IPO is 73 to 77 rupees per share.

What is the minimum investment for an Akiko Global Services IPO?

The minimum investment for the Akiko Global Services IPO is 123,200 Rupees.

Allotment Date of Akiko Global Services IPO?

The Allotment of Akiko Global Services IPO is on 28 June 2024.

Listing Date of Akiko Global Services IPO?

The Listing Of Akiko Global Services is Scheduled on 02 July 2024.

One Should Apply for Akiko Global Services IPO or Not?

Will Update Soon..

How to apply for Akiko Global Services IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Akiko Global Services IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Akiko Global Services IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Akiko Global Services IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Akiko Global Services IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Akiko Global Services IPO from the list ——–> Click on Akiko Global Services IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Akiko Global Services?

Fast Track Finsec Pvt Ltd is the Lead Manager of Akiko Global Services.

Where To Check the Allotment of Akiko Global Services IPO?

The allotment status for the Akiko Global Services IPO will be accessible on the Skyline Financial Services Private Ltd Website.

Akiko Global Services IPO is going to be listed at?

Akiko Global Services IPO is going to be listed at NSE SME.

What is the Lot Size of the Akiko Global Services IPO?

The lot size of the Akiko Global Services IPO is 1600 Shares.

What is the P/E Ratio of the Akiko Global Services?

The P/E Ratio of the Akiko Global Services is 13.2.

What is the EPS of the Akiko Global Services?

The EPS of the Akiko Global Services is 5.83.

What is the ROE of the Akiko Global Services?

The ROE of Akiko Global Services is 32.44%.

What is the ROCE of the Akiko Global Services?

The ROCE of Akiko Global Services is 29.23%.