Allied Blenders stands as the largest Indian-owned and Indian-made foreign liquor (IMFL) producer and ranks as the third-largest IMFL company in India. It is one of the only four spirits companies in India with a pan-India sales and distribution network and is a leading exporter of IMFL, holding an estimated 11.8% market share in the Indian whisky market.

Over the years the company has expanded its range of products into categories and sectors. The product lineup consisted of 17 leading IMFL brands encompassing whisky, brandy, rum, and vodka. Notable brands such, as Officer’s Choice Whisky, Sterling Reserve, Officer’s Choice Blue, and ICONiQ Whisky have attained the prestigious ‘Millionaire Brand’ designation by selling more, than a million 9-liter cases in a year.

The company offers a variety of beverages including whisky, brandy, rum, vodka, and gin. They also market packaged drinking water under the Officer’s Choice, Officer’s Choice Blue, and Sterling Reserve labels.

Allied Blenders has positioned itself as a player, in the alcoholic beverages market with a presence in 30 States and Union Territories. Their reaching sales network spans across India with 12 sales support offices and comprehensive route-to-market capabilities in channels and regions. Their products are stocked in 79,329 outlets nationwide. They also export to 14 markets such, as the Middle East, North America, Africa, Asia, and Europe.

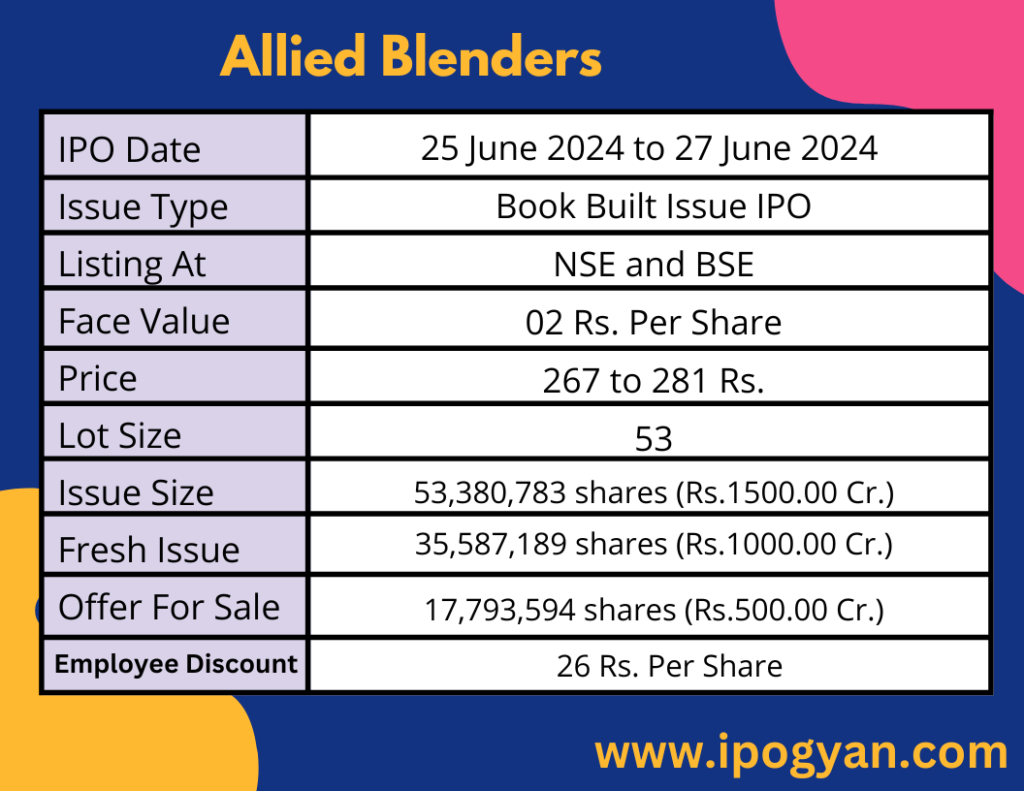

Allied Blenders IPO Complete Details:

Allied Blenders IPO Timetable:

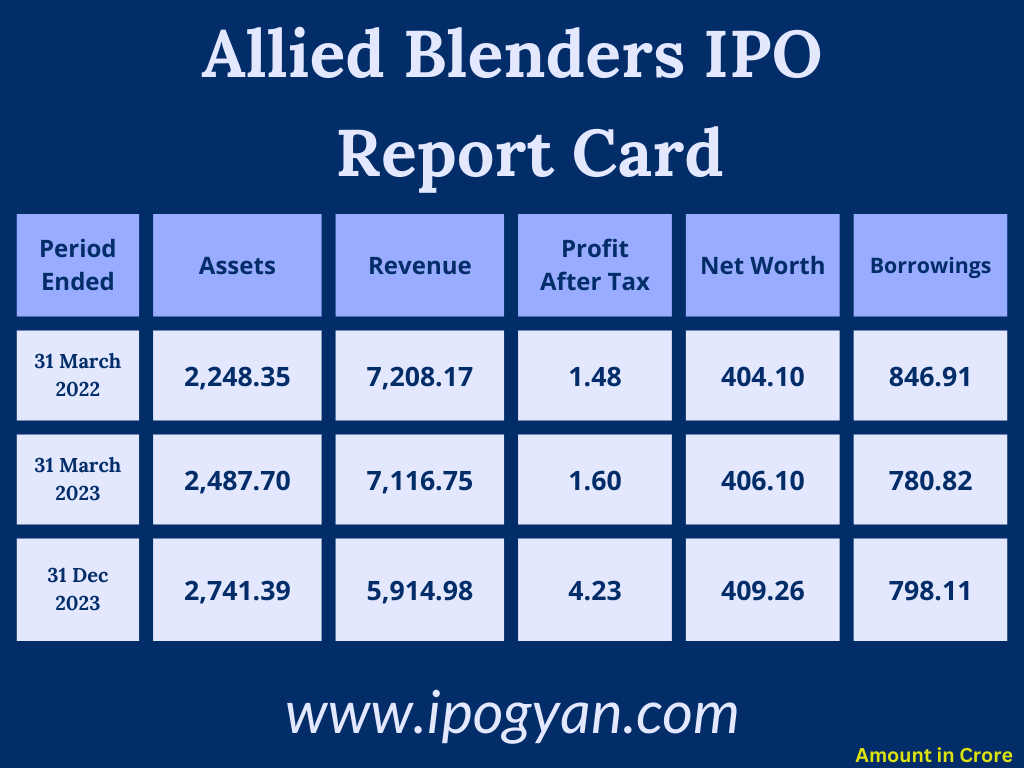

Company Financial Details:

AS OF NOW, the GMP Of Allied Blenders is Around 78 Rs.

Objects Of Issue:

1. Prepayment or scheduled repayment of a portion of certain outstanding borrowings obtained by the Company.

2. General corporate purposes.

Promoters:

- KISHORE RAJARAM CHHABRIA

- BINA KISHORE CHHABRIA

- RESHAM CHHABRIA JEETENDRA HEMDEV

- BINA CHHABRIA ENTERPRISES PRIVATE LIMITED

- BKC ENTERPRISES PRIVATE LIMITED

- ORIENTAL RADIOS PRIVATE LIMITED

- OFFICER’S CHOICE SPIRITS PRIVATE LIMITED

FAQs:

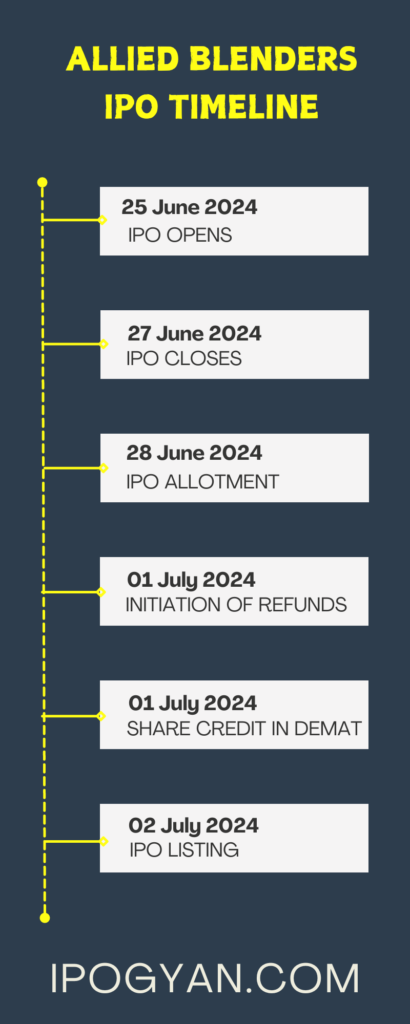

When Allied Blenders IPO is Opening?

Allied Blenders IPO is Opening on 25 June 2024.

When is the Allied Blenders IPO Closing?

Allied Blenders IPO is Closing on 27 June 2024.

What is the Issue Size of the Allied Blenders IPO?

The IPO Issue Size of Allied Blenders is 1,500.00 Crore.

Price Band of Allied Blenders IPO?

The price Band of the Allied Blenders IPO is 267 to 281 rupees per share.

What is the minimum investment for an Allied Blenders IPO?

The minimum investment for the Allied Blenders IPO is 14,893 Rupees.

Allotment Date of Allied Blenders IPO?

The Allotment of Allied Blenders IPO is on 28 June 2024.

Listing Date of Allied Blenders IPO?

The Listing Of Allied Blenders is Scheduled on 02 July 2024.

One Should Apply for Allied Blenders IPO or Not?

Will Update Soon..

How to apply for Allied Blenders IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Allied Blenders IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Allied Blenders IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Allied Blenders IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Allied Blenders IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Allied Blenders IPO from the list ——–> Click on Allied Blenders IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Allied Blenders?

ICICI Securities Limited, Nuvama Wealth Management Limited, and LTI Capital Ltd are the Lead Managers of Allied Blenders.

Where To Check the Allotment of Allied Blenders IPO?

The allotment status for the Allied Blenders IPO will be accessible on the Link Intime India Private Ltd Website.

Allied Blenders IPO is going to be listed at?

Allied Blenders IPO is going to be listed at NSE and BSE.

What is the Lot Size of the Allied Blenders IPO?

The lot size of the Allied Blenders IPO is 53 Shares.

What is the P/E Ratio of the Allied Blenders?

The P/E Ratio of the Allied Blenders is 4284.57.

What is the EPS of the Allied Blenders?

The EPS of the Allied Blenders is 0.07.

What is the ROE of the Allied Blenders?

The ROE of Allied Blenders is 1.03%.

What is the ROCE of the Allied Blenders?

The ROCE of Allied Blenders is 24.35%.