Capital Small Finance Bank started its operations in 2016 as India’s first small finance bank, in India. Over the years it has become one of the performing SFBs in the country achieving results in key areas like cost of funds, retail deposits, and CASA deposits, for the fiscal year 2023.

Capital Small Finance Bank prioritizes the development of a banking franchise tailored for the sector. Their main target audience consists of individuals belonging to the middle-income group in semi-urban areas. The bank strives to establish itself as the institution, for its customers, through a comprehensive range of products exceptional customer service, an extensive network of physical branches and continuously improving digital channels.

The bank has strategically grown its operations in the states of Punjab, Haryana, Rajasthan, Delhi, and Himachal Pradesh as well, as UT Chandigarh. It has a number of branches among Small Finance Banks (SFBs) in Punjab. Ranks fifth, among private-sector banks. Most of its branches are situated in semi-urban regions serving a portion of its customer base.

Capital Small Finance Bank has managed to attract a number of deposits by providing competitive interest rates. What’s impressive is that they have achieved this without having to increase deposit rates in comparison, to their competitors. They have a range of depositors with the 20 accounting, for only a small portion of their overall deposits. Additionally, the bank generates income through the products and services that they offer.

By harnessing the power of technology the bank has greatly expanded its interactions and transactions, with customers leading to improved outreach and efficiency. Over time there has been an increase, in transactions, which highlights the banks dedication to innovation and prioritizing customer needs.

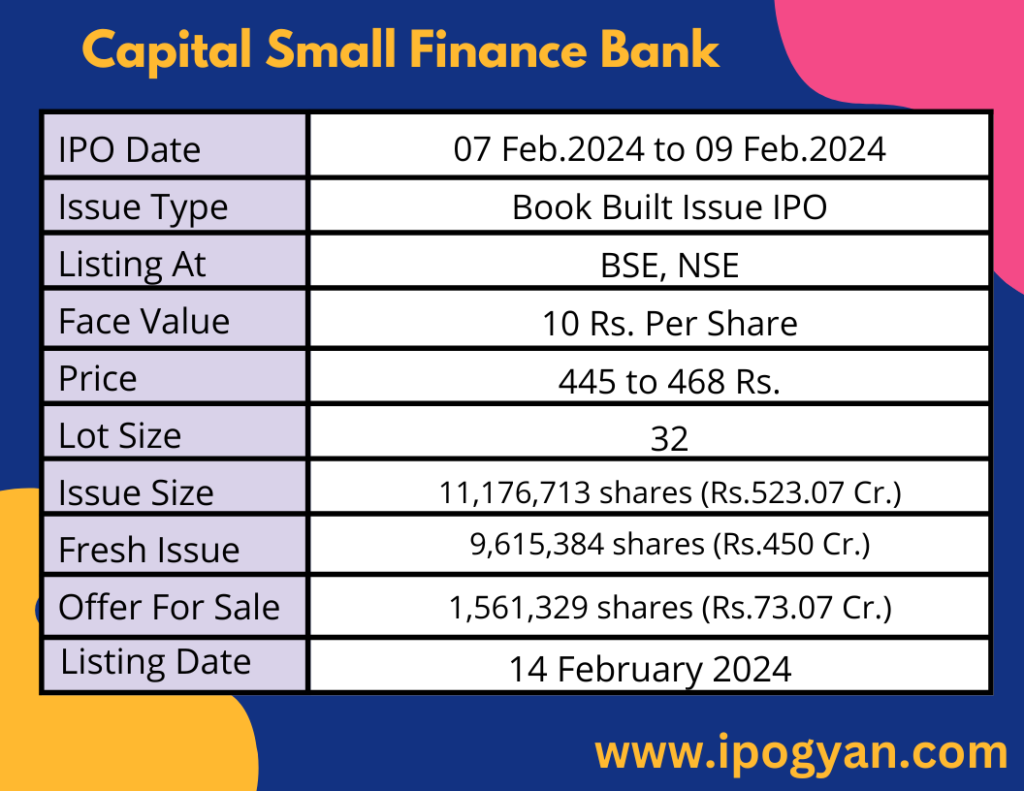

Capital Small Finance Bank IPO Complete Details:

Capital Small Finance Bank IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Capital Small Finance Bank is Around 37 Rs.

Objects Of Issue:

The bank intends to use the Net Proceeds from the Fresh Issue to enhance its Tier-I capital base in order to fulfill its future capital requirements. Additionally, the proceeds from the Fresh Issue will be allocated towards covering expenses related to the Offer.

Promoters:

- SARVJIT SINGH SAMRA

- AMARJIT SINGH SAMRA

- NAVNEET KAUR SAMRA

- SURINDER KAUR SAMRA

- DINESH GUPTA

FAQs:

When Capital Small Finance Bank IPO is Opening?

Capital Small Finance Bank IPO is Opening on 07 February 2024.

When is the Capital Small Finance Bank IPO Closing?

Capital Small Finance Bank IPO is Closing on 09 February 2024.

What is the Issue Size of the Capital Small Finance Bank IPO?

The IPO Issue Size of Capital Small Finance Bank is 523.07 Crore.

Price Band of Capital Small Finance Bank IPO?

The price Band of Capital Small Finance Bank IPO is 445 to 468 rupees per share.

What is the minimum investment for a Capital Small Finance Bank IPO?

The minimum investment for the Capital Small Finance Bank IPO is 14,976 Rupees.

Allotment Date of Capital Small Finance Bank IPO?

The Allotment of Capital Small Finance Bank IPO is on 12 February 2024.

Listing Date of Capital Small Finance Bank IPO?

The Listing Of Capital Small Finance Bank is Scheduled on 14 February 2024.

One Should Apply for Capital Small Finance Bank IPO or Not?

Will Update Soon..

How to apply for Capital Small Finance Bank IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Capital Small Finance Bank IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Capital Small Finance Bank IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Capital Small Finance Bank IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Capital Small Finance Bank IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Capital Small Finance Bank IPO from the list ——–> Click on Capital Small Finance Bank IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Capital Small Finance Bank?

Nuvama Wealth Management Limited, Dam Capital Advisors Limited, and Equirus Capital Private Limited are the Lead Managers of Capital Small Finance Bank.

Where To Check the Allotment of Capital Small Finance Bank IPO?

The allotment status for the Capital Small Finance Bank IPO will be accessible on the Link Intime India Private Limited Website.

Capital Small Finance Bank IPO is going to be listed at?

Capital Small Finance Bank IPO is going to be listed at NSE and BSE.

What is the Lot Size of the Capital Small Finance Bank IPO?

The lot size of the Capital Small Finance Bank IPO is 32 Shares.

What is the P/E Ratio of the Capital Small Finance Bank IPO?

The P/E Ratio of the Capital Small Finance Bank is 17.68.

What is the ROE of the Capital Small Finance Bank IPO?

The ROE of the Capital Small Finance Bank IPO is 16.45%.

What is the ROCE of the Capital Small Finance Bank IPO?

The ROCE of the Capital Small Finance Bank IPO is N/A.

What is the EPS of the Capital Small Finance Bank IPO?

The EPS of the Capital Small Finance Bank IPO is 26.48.