Interarch Building Products is one of India’s leading turnkey pre-engineered steel construction solution providers, offering integrated facilities for design and engineering, manufacturing, and on-site project management for the installation and erection of pre-engineered steel buildings (PEB). Additionally, the company held the second-largest aggregate installed capacity of 141,000 metric tonnes per annum (MTPA) as of March 31, 2023.

Interarch Building Products PEB offerings are customized to meet customer requirements and are utilized in industrial, infrastructure, and building (residential, commercial, and non-commercial) applications. The company has executed many projects, from multi-level warehouses for e-commerce clients to paint production lines for FMCG companies. They have also delivered large-span PEBs for indoor stadiums and the cement industry.

Interarch Building Products offers its PEBs through two primary channels: (a) pre-engineered steel building contracts (PEB Contracts), where the company provides complete PEBs on a turnkey basis, including on-site project management for installation and erection; and (b) the sale of pre-engineered steel building materials (PEB Sales), which includes metal ceilings, corrugated roofing, PEB steel structures, non-industrial PEB buildings under the brand “Interarch Life,” and light gauge framing systems (LGFS).

Interarch’s industrial/manufacturing clients include Grasim Industries Limited, Berger Paints India Limited, Blue Star Climatech Limited, Timken India Limited, and Addverb Technologies Limited. In contrast, its infrastructure clients include InstaKart Services Private Limited.

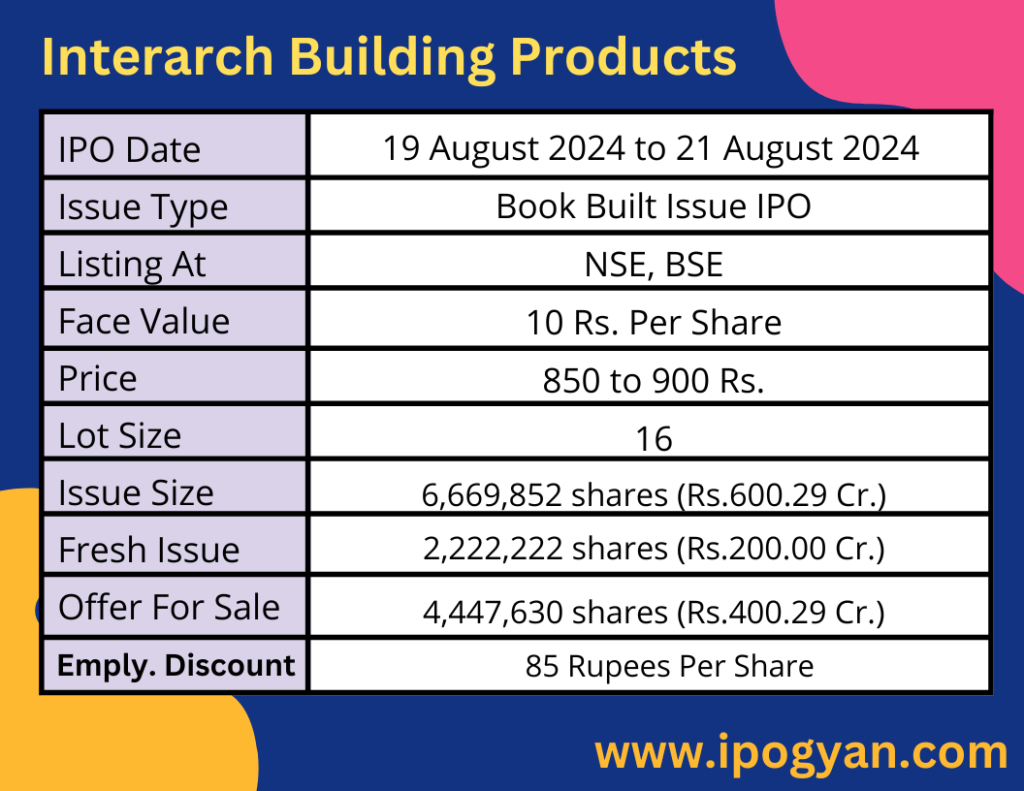

Interarch Building Products IPO Complete Details:

Interarch Building Products IPO Timetable:

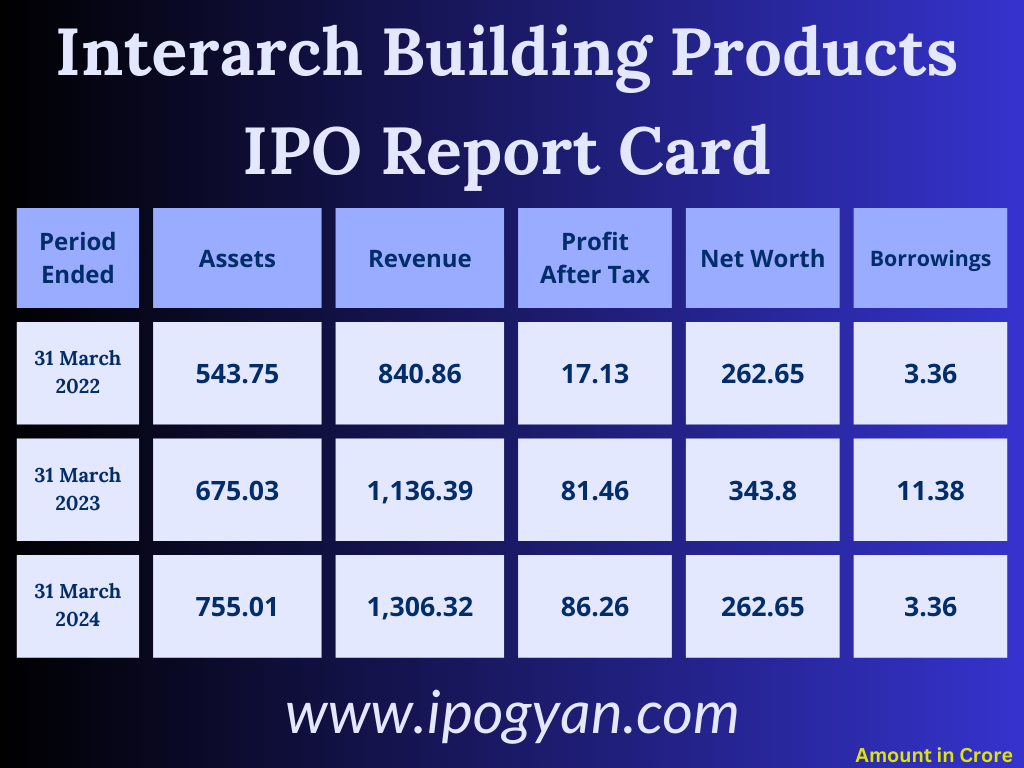

Company Financial Details:

AS OF NOW, the GMP Of Interarch Building Products is Around 333 Rs.

Objects Of Issue:

1. Financing the capital expenditure for setting up a new PEB manufacturing unit as part of Phase 2 of the capacity development plan at the planned Andhra Pradesh Manufacturing Facility (“Project”).

2. Financing the capital expenditure for upgrading the Kichha Manufacturing Facility, Tamil Nadu Manufacturing Facility I, Tamil Nadu Manufacturing Facility II, and Pantnagar Manufacturing Facility.

3. Funding investment in information technology (IT) assets to upgrade the existing IT infrastructure of the company.

4. Funding incremental working capital requirements.

5. Covering general corporate purposes.

Promoters:

- ARVIND NANDA

- GAUTAM SURI

- ISHAAN SURI

- VIRAJ NANDA

FAQs:

When Interarch Building Products IPO is Opening?

Interarch Building Products IPO is Opening on 19 August 2024.

When is the Interarch Building Products IPO Closing?

Interarch Building Products IPO is Closing on 21 August 2024.

What is the Issue Size of the Interarch Building Products IPO?

The IPO Issue Size of Interarch Building Products is 600.29 Crore.

Price Band of Interarch Building Products IPO?

The price Band of the Interarch Building Products IPO is 850 to 900 rupees per share.

What is the minimum investment for an Interarch Building Products IPO?

The minimum investment for the Interarch Building Products IPO is 14,400 rupees.

Allotment Date of Interarch Building Products IPO?

The Allotment of Interarch Building Products IPO is on 22 August 2024.

Listing Date of Interarch Building Products IPO?

The Listing Of Interarch Building Products is Scheduled on 26 August 2024.

One Should Apply for Interarch Building Products IPO or Not?

Will Update Soon..

Who is the Lead Manager of Interarch Building Products?

Ambit Private Limited and Axis Capital Limited are the Lead Managers of Interarch Building Products.

Where To Check the Allotment of Interarch Building Products IPO?

The allotment status for the Interarch Building Products IPO will be accessible on the Link Intime India Private Ltd Website,

Interarch Building Products IPO is going to be listed at?

Interarch Building Products IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Interarch Building Products IPO?

The lot size of the Interarch Building Products IPO is 16 Shares.

What is the P/E Ratio of Interarch Building Products?

The P/E Ratio of the Interarch Building Products is 15.04.

What is the EPS of the Interarch Building Products?

The EPS of Interarch Building Products is 59.84.