IRM Energy, founded in 2015, is an Indian city gas distribution (CGD) company that serves Banaskantha (Gujarat), Fatehgarh Sahib (Punjab), Diu & Gir Somnath (Union Territory of Daman and Diu/Gujarat), and Namakkal & Tiruchirappalli (Tamil Nadu).

The major focus of IRM Energy company is on creating and developing natural gas distribution networks to serve industrial, commercial, residential, and automobile customers. IRM Energy has established itself as a supplier of safe, clean, and cost-effective fuels for a variety of markets.

IRM Energy offer:

1)Compressed Natural Gas (CNG) for motor vehicles

2)Piped Natural Gas (PNG) for residential households, business organizations, and industrial units.

The business began in July 2017 after the Petroleum and Natural Gas Regulatory Board (PNGRB) granted them permission to operate in Banaskantha and Fatehgarh Sahib. Since then, they gradually expanded their reach, getting authorizations for Diu & Gir Somnath and, most recently, Namakkal & Tiruchirappalli. This growth shows their dedication to increasing their presence in their authorized geographical regions (GAs).

IRM Energy’s supply network includes medium-density polyethylene (MDPE) and steel pipes, which helps to enable natural gas to be delivered to their diversified customer base. The company has also built a network of CNG filling stations, which includes stations owned and run by the company “COCO Stations”, dealers (DODO Stations), and oil marketing companies (OMC Stations).

IRM Energy employs a unique and strategic sourcing strategy to assure a steady and efficient natural gas supply. Index linkages, long-term gas sale and purchase agreements (GSPAs) with large suppliers such as GAIL and RIL, gas transportation agreements (GTAs), and participation in the Indian Gas Exchange (IGX) for short-term gas procurement are all part of this plan. These strategies help the organisation manage price volatility and keep its clients’ prices competitive.

IRM Energy IPO Complete Details:

IRM Energy IPO Timetable:

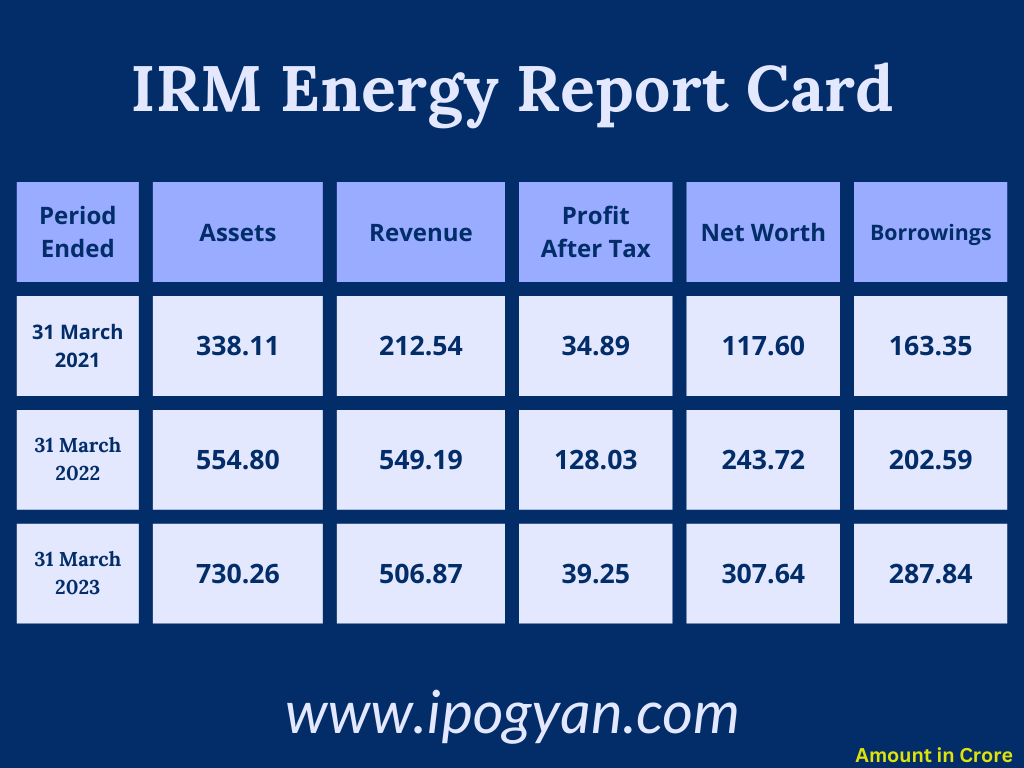

Company Financial Details:

AS OF NOW, the GMP OF IRM Energy is Around 80 Rs.

Objects Of Issue:

1. Funding the capital expenditure requirements for the development of the City Gas Distribution network in the Geographical Areas of Namakkal and Tiruchirappalli (Tamil Nadu) in Fiscal 2024, Fiscal 2025, and Fiscal 2026 is a priority.

2. The aim is to prepay or repay all or a portion of certain outstanding borrowings availed by the Company.

3. Additionally, allocating funds for general corporate purposes is also an objective.

Promoters:

Dr. Rajiv Indravadan Modi

- Age: 62

- Qualifications:

- Bachelor of Technology in chemical engineering from Indian Institute of Technology, Bombay

- Diploma in Biochemical Engineering from University College London

- Doctor of Philosophy (Biological Sciences) from the University of Michigan

- Fellow member at the Indian National Academy of Engineering

- Roles:

- Promoter and Non-Executive Director of the Company

- Chairman of the Board of Governors of IIT Guwahati

- Chairperson of the Board of Governors of IIT Gandhinagar, Gujarat

- Member of the Board of Governors of the Academy of Scientific and Innovative Research

- Chairman and Managing Director of Cadila Pharmaceuticals Limited

- Experience: Over thirty years as an industrialist in the pharmaceuticals industry

FAQs:

When IRM Energy IPO is Opening?

IRM Energy IPO is Opening on 18 October 2023.

When IRM Energy IPO is Closing?

IRM Energy IPO is Closing on 20 October 2023.

What is the IPO Issue Size of IRM Energy?

The IPO Issue Size of IRM Energy is 545.40 Crore.

Price Band of IRM Energy IPO?

The price Band of IRM Energy IPO is 480 to 505 rupees per share.

What is the minimum investment for an IRM Energy IPO?

The minimum investment for IRM Energy IPO is 14,645 Rupees.

Allotment Date of IRM Energy IPO?

The Allotment of IRM Energy IPO is on 26 October 2023.

Listing Date of IRM Energy IPO?

The Listing Of IRM Energy is Scheduled on 31 October 2023.

One Should Apply for IRM Energy IPO or Not?

will update soon

How to apply for IRM Energy IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find IRM Energy IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IRM Energy IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find IRM Energy IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IRM Energy IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find IRM Energy IPO from the list ——–> Click on IRM Energy IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is IRM Energy IPO’s Lead Manager?

HDFC Bank Limited and BOB Capital Markets Limited are the Lead Managers of IRM Energy.

Where To Check the Allotment of IRM Energy IPO?

The allotment status for the IRM Energy IPO will be accessible on the Link Intime India Private Limited Website.

IRM Energy IPO is going to be listed at?

IRM Energy IPO is going to be listed at NSE BSE.

What is the Lot Size of the IRM Energy IPO?

The lot size of the IRM Energy IPO is 29 Shares.

What is the EPS of IRM Energy IPO?

The EPS of IRM Energy is 43.88.

What is the P/E Ratio of IRM Energy IPO?

The P/E Ratio of IRM Energy is N/A.

What is the ROE of an IRM Energy IPO?

The ROE of an IRM Energy IPO is 52.53%.

What is the ROCE of an IRM Energy IPO?

The ROCE of an IRM Energy IPO is 39.01%.