Master Components Limited Incorporated in 1999 is a prominent player in the manufacturing of plastic engineering components and subassemblies for industrial capital goods, placing a strong emphasis on stringent quality testing to meet industry standards before delivering its products to clients. Their products are used by a variety of industries which includes industries like electrical, industrial, medical, and automotive.

Master Components Limited specialises in three types of manufacturing: thermoplastic injection moulding, thermoset injection moulding, and compression moulding. These processes take place within the company’s facility, utilizing machines with a capacity spanning from 60 to 450 tonnes, producing products weighing from 1gm to 1500gms. The steps involved in these processes are as follows:

- Procurement of Raw Materials: Raw materials are sourced from known suppliers. A comprehensive examination is performed to check that the quality and quantity of materials match to the standards specified in the invoice.

- Storage of Raw Material: The raw materials are loaded onto trolleys and assigned to designated racks. Hydraulic lifters are employed for efficient handling during this phase.

- Preparation of Raw Material: Raw materials are pre-heated using a humidifier to make them suitable for further processing.

- Compression of Moulded Parts: Compression moulding machines are used to create moulded components.

- Inspection: Manual inspection is carried out, employing weighing balances to verify the quality and weight of the components.

- Deflashing of Moulded Parts: To achieve a refined final product, moulded parts are manually deflashed, removing any excess material.

- Part Cleaning & Inspection: Moulded components go through a cleaning process to enhance their finishing. This is accomplished through a combination of compression and manual efforts.

- Pre-Dispatch Inspection Report: Before dispatch, components are subjected to a thorough manual inspection, using various instruments and gauges. Critical points are carefully verified to ensure that the product meets the required quality standards.

- Packing & Dispatch: The final products are then packed according to the customer’s specified schedule and lot requirements. These products are typically packed in polybags, honeycomb packaging, or boxes. Transportation arrangements are usually made by the customers, although occasionally, Master Components Limited may be responsible for arranging transportation.

This well-defined manufacturing process ensures that Master Components Limited consistently delivers high-quality products to its customers, meeting their specific requirements and quality standards.

As of September 30, 2022, Master Components Limited employs 27 on-payroll personnel and occasionally hires contract employees with professional expertise for project-specific tasks.

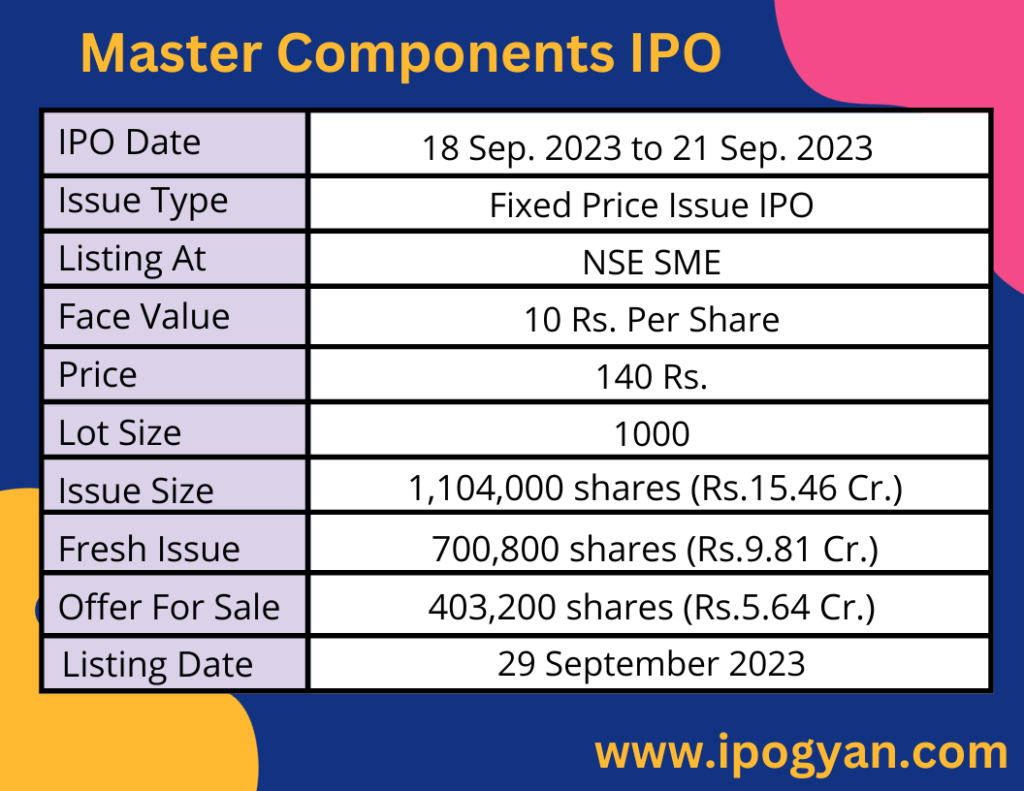

Master Components Limited IPO Complete Details:

Master Components Limited IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Master Components Limited is Around Rs.

Objects Of Issue:

- Working Capital Funding: Securing funds for day-to-day operational needs.

- Corporate Financing: Obtaining funds for general business purposes.

Promoters:

1)Mudduraj Kulkarni:

- Age: 56 years

- Position: Founding Promoter, currently designated as Chairman and Managing Director

- Education: Diploma in Tool and Die Making from Nettur Technical Training Foundation in 1988

- Experience: Over 3 decades of experience in Tool design, Manufacturing, Vendor development, and assembly line commissioning.

- Previous Association: Worked with Crompton Greaves Limited, actively involved in troubleshooting activities and ISO 9001 accreditation.

- Responsibilities: Currently oversees the overall functioning of the Company, is instrumental in making strategic decisions, and has been a guiding force behind the company’s growth.

2)Shrikant Joshi:

- Age: 55 years

- Position: Founding Promoter, currently designated as Whole-Time Director and Chief Financial Officer

- Education: Diploma in Tool and Die Making from Nettur Technical Training Foundation in 1988

- Experience: Over 3 decades of experience in the selection, commissioning, and productionization of CAD/CAM Centre, which involves Charmilles wire cut & spark erosion machine, Deckel maho machining center, and Pro-engineer software.

- Previous Association: Worked with Crompton Greaves Limited before the inception of the company.

- Responsibilities: Manages overall sourcing of raw materials and efficiently mobilizes funds for the company’s operations.

FAQs:

When Master Components Limited’s IPO is Opening?

Master Components Limited IPO is Opening on 18 September 2023(Monday).

When Master Components Limited IPO is Closing?

Master Components Limited IPO is Closing on 21 September 2023(Thursday).

What is the IPO Issue Size of Master Components Limited?

The IPO Issue Size of Master Components Limited is 15.46 Crore.

Price Band of Master Components Limited IPO?

The price Band of Master Components Limited IPO is 140 rupees per share.

What is the minimum investment for Master Components Limited IPO?

The minimum investment for Master Components Limited IPO is 140,000 Rupees.

Allotment Date of Master Components Limited IPO?

The Allotment of Master Components Limited IPO is on 26 September 2023(Tuesday).

Listing Date of Master Components Limited IPO?

The Listing Of Master Components Limited is Scheduled on 29 September 2023(Tuesday).

One Should Apply Master Components Limited IPO or Not?

will update soon!

How to apply for Master Components Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Master Components Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Master Components Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Master Components Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Master Components Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Master Components Limited IPO from the list ——–> Click on Master Components Limited IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Master Components Limited IPO’s Lead Manager?

Aryaman Financial Services Limited is the Lead Manager of Master Components Limited IPO.

Where To Check the Allotment of Master Components Limited IPO?

The allotment status for the Master Components Limited IPO will be accessible on the Bigshare Services Pvt Ltd Website.

What is the P/E Ratio of Master Components Limited?

The P/E Ratio of TMaster Components Limited is 27.09.

What is the Earning Per Share (EPS) of Master Components Limited?

Earning Per Share (EPS) of Master Components Limited is 5.17 Rs.

What is the ROE of Master Components Limited?

The ROE of Master Components Limited is 59.68 %.