Mukka Proteins, a company that produces fish protein items offers fish meal, fish oil, and fish paste crucial, for making aqua feed, poultry feed, and pet food. Moreover, their products are used in pharmaceuticals, dietary supplements, soap production, leather processing, and paint making. The business operates both nationally and internationally and exports to, more than 10 countries including Bahrain, Bangladesh, Chile, Indonesia, Malaysia, Myanmar, Philippines, China Saudi Arabia South Korea Oman Taiwan Vietnam.

Mukka Proteins has a workforce of 385 people. Runs six manufacturing sites, with four in India and two in Oman under its division Ocean Aquatic Proteins LLC. Moreover, the company manages three blending centers and five storage facilities in India. These positioned locations along the coast guarantee affordable availability of pelagic fish like sardines, mackerel, and anchovies crucial, for their manufacturing processes.

As of December 31, 2022, Mukka Proteins has the ability to produce 115,050 tons, per annum (MTPA) of fish meal 16,950 MTPA of fish oil, and 20,340 MTPA of fish paste. The company obtains its materials from partner facilities and third-party manufacturing sites to maintain efficiency and secure essential resources.

Building and nurturing connections, with clients is crucial for Mukka Proteins as loyal customers play a role, in generating revenue over the long term. Each production site is furnished with biochemistry labs and certain sites also feature labs to guarantee product excellence and comply with regulatory standards. Raw materials are selected based on their quality cost-effectiveness and market accessibility, which may involve sourcing from suppliers.

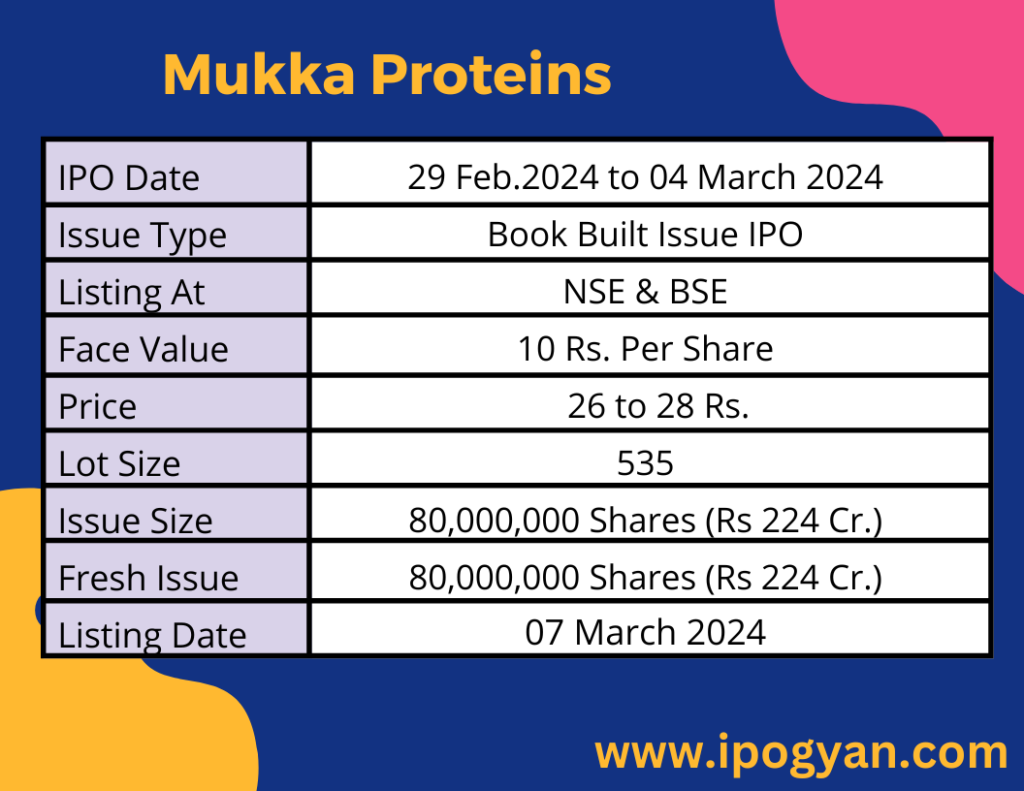

Mukka Proteins IPO Complete Details:

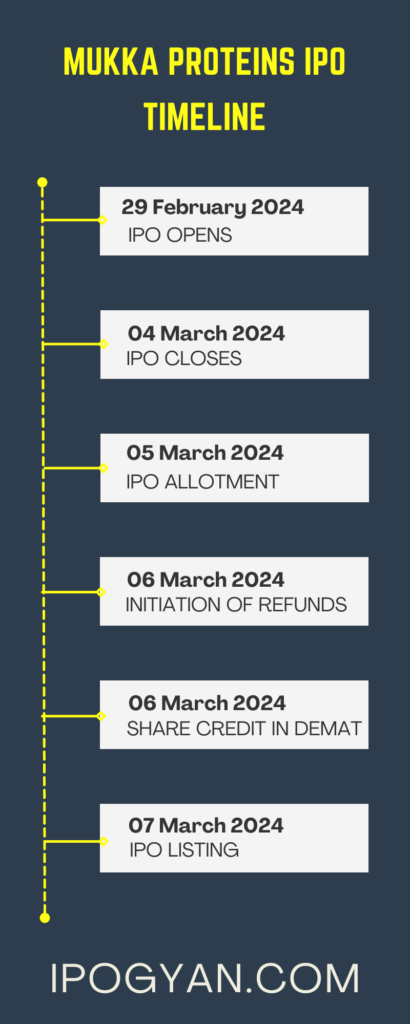

Mukka Proteins IPO Timetable:

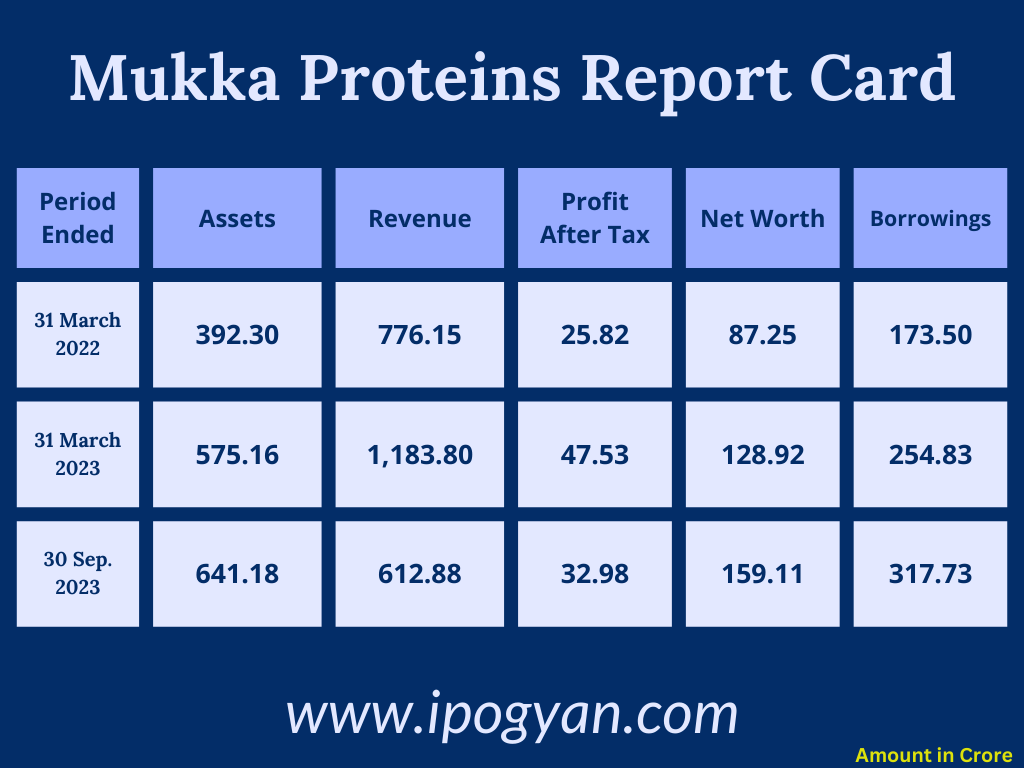

Company Financial Details:

AS OF NOW, the GMP Of Mukka Proteins is Around 16 Rs.

Objects Of Issue:

1. Meeting its own working capital needs through funding.

2. Investing in its associate, Ento Proteins Private Limited, to support its working capital requirements.

3. Pursuing general corporate objectives.

Promoters:

- KALANDAN MOHAMMED HARIS

- KALANDAN MOHAMMAD ARIF

- KALANDAN MOHAMMED ALTHAF

FAQs:

When Mukka Proteins IPO is Opening?

Mukka Proteins IPO is Opening on 29 February 2024.

When is the Mukka Proteins IPO Closing?

Mukka Proteins IPO is Closing on 04 March 2024.

What is the Issue Size of the Mukka Proteins IPO?

The IPO Issue Size of Mukka Proteins is 224 Crore.

Price Band of Mukka Proteins IPO?

The price Band of Mukka Proteins IPO is 26 to 28 rupees per share.

What is the minimum investment for a Mukka Proteins IPO?

The minimum investment for the Mukka Proteins IPO is 14,980 Rupees.

Allotment Date of Mukka Proteins IPO?

The Allotment of Mukka Proteins IPO is on 05 March 2024.

Listing Date of Mukka Proteins IPO?

The Listing Of Mukka Proteins is Scheduled on 07 March 2024.

One Should Apply for Mukka Proteins IPO or Not?

Will Update Soon..

How to apply for Mukka Proteins IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Mukka Proteins IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Mukka Proteins IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Mukka Proteins IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Mukka Proteins IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Mukka Proteins IPO from the list ——–> Click on Mukka Proteins IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Mukka Proteins?

Fedex Securities Private Limited is the Lead Manager of Mukka Proteins.

Where To Check the Allotment of Mukka Proteins IPO?

The allotment status for the Mukka Proteins IPO will be accessible on the Cameo Corporate Services Limited website.

Mukka Proteins IPO is going to be listed at?

Mukka Proteins IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Mukka Proteins IPO?

The lot size of the Mukka Proteins IPO is 535 Shares.

What is the P/E Ratio of the Mukka Proteins?

The P/E Ratio of the Mukka Proteins is 12.96.

What is the EPS of the Mukka Proteins?

The EPS of the Mukka Proteins is 2.16.

What is the ROE of the Mukka Proteins?

The ROE of Mukka Proteins is 36.71%.

What is the ROCE of the Mukka Proteins?

The ROCE of the Mukka Proteins is 17.62%.