Premier Energies boasts a 29-year history in the sector and has emerged as India’s second-largest integrated solar cell and module producer boasting an annual capacity of 2 GW for solar cells and 3.36 GW for solar modules. Additionally, when it comes to cells, Premier Energies is the largest domestic manufacturer by annual installed capacity. The company’s activities span across areas including manufacturing photovoltaic (PV) cells crafting custom-designed panels, for specific needs undertaking EPC projects generating independent power providing O&M services for EPC projects, and retailing other solar-related goods.

Premier Energies EPC division has completed projects, in India, such as rooftop installations, canal top initiatives, and various large-scale solar power ventures. Some noteworthy endeavors include a 100 MW project for a Navratna public sector entity, a 20 MW canal bank and canal top project in Uttarakhand for a state government power generation company, and 18 MW and 15 MW projects in Karnataka. Moreover, Premier Energies manages a 2 MW facility established in 2012 as part of the Jawaharlal Nehru National Solar Mission, in Jharkhand, India.

The company caters to a variety of clients, including independent power producers (IPPs) original equipment manufacturers (OEMs), off-grid operators, like National Thermal Power Corporation Limited (NTPC), TATA Power Solar Systems Limited, Panasonic Life Solutions Private Limited, Continuum Green Energy (India) Private Limited, Shakti Pumps (India) Limited, First Energy 6 Private Limited, Bluepine Energies Private Limited, Luminous Power Technologies Private Limited, Hartek Solar Private Limited, Green Infra Wind Energy Limited, Madhav Infra Projects Limited, SolarSquare Energy Private Limited and Axitec Energy India Private Limited.

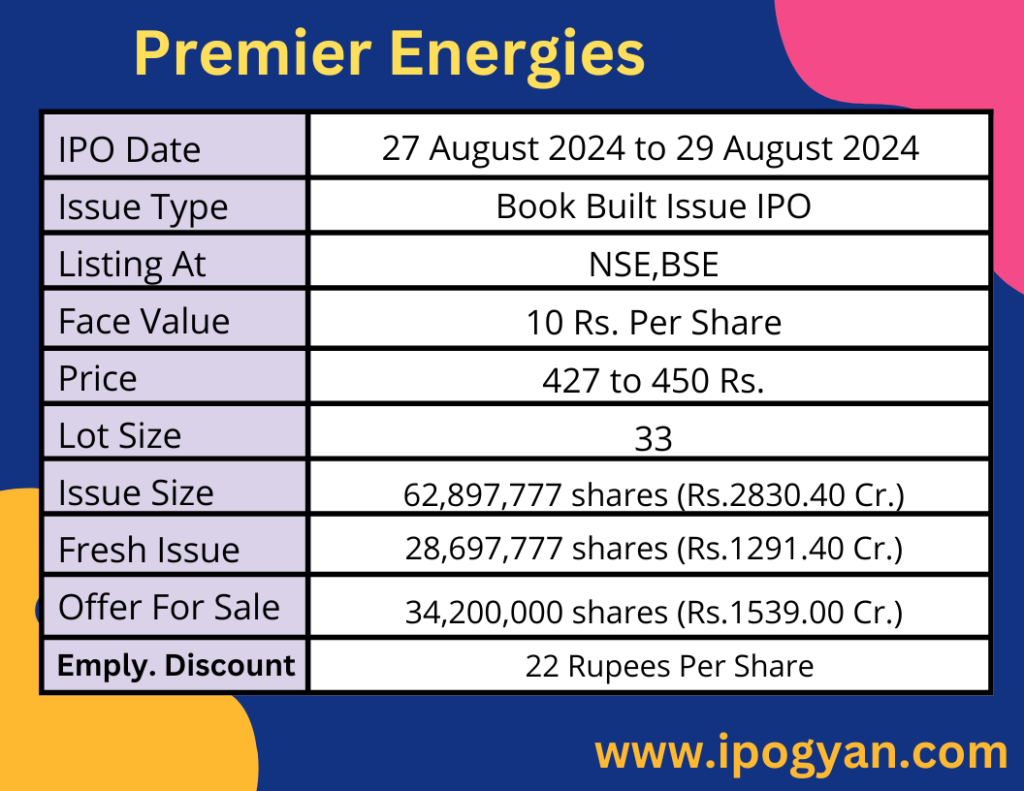

Premier Energies IPO Complete Details:

Premier Energies IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Premier Energies is Around 333 Rs.

Objects Of Issue:

- Investing in subsidiary Premier Energies Global Environment Private Limited (“PEGEPL”) to help fund the development of a 4 GW Solar PV TOPCon Cell and 4 GW Solar PV TOPCon Module manufacturing plant, in Hyderabad, Telangana, India.

- General corporate purposes.

Promoters:

- SURENDER PAL SINGH SALUJA

- CHIRANJEEV SINGH SALUJA

FAQs:

When Premier Energies IPO is Opening?

Premier Energies IPO is Opening on 27 August 2024.

When is the Premier Energies IPO Closing?

Premier Energies IPO is Closing on 29 August 2024.

What is the Issue Size of the Premier Energies IPO?

The IPO Issue Size of Premier Energies is 2,830.40 Crore.

Price Band of Premier Energies IPO?

The price Band of the Premier Energies IPO is 427 to 450 rupees per share.

What is the minimum investment for a Premier Energies IPO?

The minimum investment for the Premier Energies IPO is 14,850 rupees.

Allotment Date of Premier Energies IPO?

The Allotment of Premier Energies IPO is on 30 August 2024.

Listing Date of Premier Energies IPO?

The Listing Of Premier Energies is Scheduled on 03 September 2024.

One Should Apply for Premier Energies IPO or Not?

Will Update Soon..

Who is the Lead Manager of Premier Energies?

Kotak Mahindra Capital Company Limited, J.P. Morgan India Private Limited, and ICICI Securities Limited are the Lead Managers of Premier Energies.

Where To Check the Allotment of Premier Energies IPO?

The allotment status for the Premier Energies IPO will be accessible on the Kfin Technologies Limited Website,

Premier Energies IPO is going to be listed at?

Premier Energies IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Premier Energies IPO?

The lot size of the Premier Energies IPO is 33 Shares.

What is the P/E Ratio of Premier Energies?

The P/E Ratio of the Premier Energies is 82.09.

What is the EPS of the Premier Energies?

The EPS of Premier Energies is 5.48.