Sahaj Solar has been, in the industry for ten years offering solutions in renewable energy across different sectors. Being involved in manufacturing and services gives the company a position, in the solar power market.

The company’s automated manufacturing plant creates mono and polycrystalline PV panels for projects in India and overseas. Additionally, the facility produces Mono PERC (Passivated Emitter and Rear Contact) modules that boast efficiencies of 21% or more. These solar PV panels are sold under the brand ‘SAHAJ’ recognized for providing solutions with its efficient production process and all-inclusive EPC services.

Sahaj Solar offers solar water pumping systems that use PV technology to transform sunlight into electricity, for running motors and pumps. These systems are capable of extracting water from bore wells, rivers, lakes, or ponds. The essential elements of the solar water pumping setup consist of Sahaj Solars panels module mounting structures (MMS) made by their subsidiary Veracity Energy and Infrastructure Private Limited and controllers developed by another subsidiary, Veracity Powertronics Private Limited.

Sahaj Solar, a company specializing in energy solutions provides a range of services such, as engineering, procurement, and construction (EPC). Their offerings cover everything, from designing and installing solar setups to building and maintaining large-scale solar power facilities.

Sahaj Solar caters to various clients serving both the government and private sectors. MGVCL, DGVCL, PGVCL, GEDA, HAREDA, MEDA, and the Maharashtra State Electricity Distribution Co. Ltd are among their government customers. On the private side, they work with companies, like Mahindra Susten Private Limited, Mahindra Solarize Private Limited, Secured Meters, Eglo, Shekhani Industries Nuvoco Cements (Lafarge Cements) Tenneco, Valeo, Rotomag, Premier Solar and Iron Mountain.

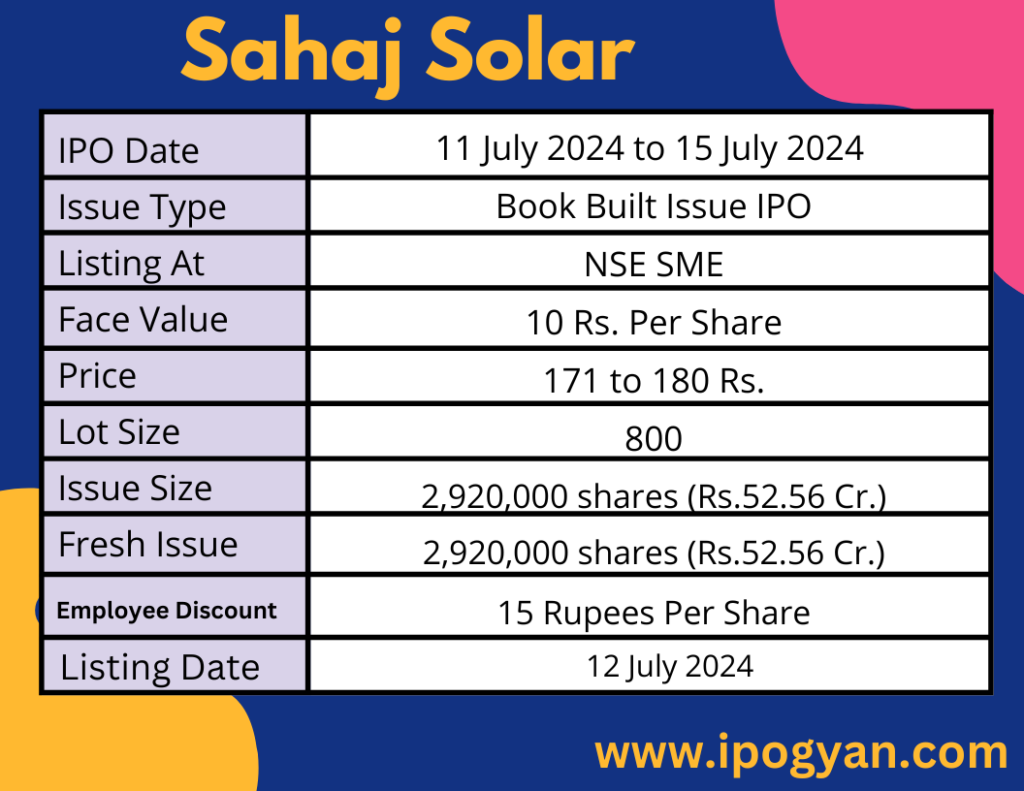

Sahaj Solar IPO Complete Details:

Sahaj Solar IPO Timetable:

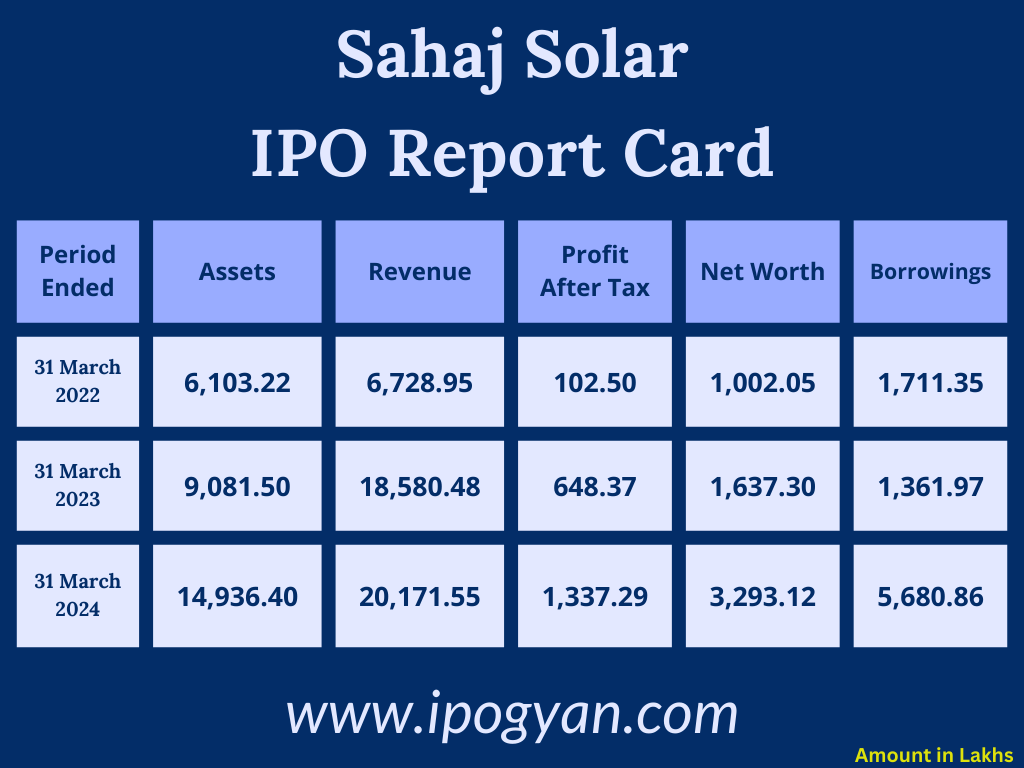

Company Financial Details:

AS OF NOW, the GMP Of Sahaj Solar is Around 145 Rs.

Objects Of Issue:

a) Working capital requirements of the company; and

b) General corporate purposes

Promoters:

- MR. PRAMIT BHARATKUMAR BRAHMBHATT

- MRS. VARNA PRAMIT BRAHMBHATT

- MR. MANAN BHARATKUMAR BRAHMBHATT

FAQs:

When Sahaj Solar IPO is Opening?

Sahaj Solar IPO is Opening on 11 July 2024.

When is the Sahaj Solar IPO Closing?

Sahaj Solar IPO is Closing on 15 July 2024.

What is the Issue Size of the Sahaj Solar IPO?

The IPO Issue Size of Sahaj Solar is 52.56 Crore.

Price Band of Sahaj Solar IPO?

The price Band of the Sahaj Solar IPO is 171 to 180 rupees per share.

What is the minimum investment for a Sahaj Solar IPO?

The minimum investment for the Sahaj Solar IPO is 144,000 Rupees.

Allotment Date of Sahaj Solar IPO?

The Allotment of Sahaj Solar IPO is on 16 July 2024.

Listing Date of Sahaj Solar IPO?

The Listing Of Sahaj Solar is Scheduled on 19 July 2024.

One Should Apply for Sahaj Solar IPO or Not?

Will Update Soon..

How to apply for Sahaj Solar IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Sahaj Solar IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Sahaj Solar IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Sahaj Solar IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Sahaj Solar IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Sahaj Solar IPO from the list ——–> Click on Sahaj Solar IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Sahaj Solar?

Kunvarji Finstock Pvt Ltd is the Lead Manager of Sahaj Solar.

Where To Check the Allotment of Sahaj Solar IPO?

The allotment status for the Sahaj Solar IPO will be accessible on the Kfin Technologies Limited Website.

Sahaj Solar IPO is going to be listed at?

Sahaj Solar IPO is going to be listed at NSE SME.

What is the Lot Size of the Sahaj Solar IPO?

The lot size of the Sahaj Solar IPO is 800 Shares.

What is the P/E Ratio of the Sahaj Solar?

The P/E Ratio of the Sahaj Solar is 10.86.

What is the EPS of the Sahaj Solar?

The EPS of the Sahaj Solar is 16.58.

What is the ROE of the Sahaj Solar?

The ROE of Sahaj Solar is 39.96%.

What is the ROCE of the Sahaj Solar?

The ROCE of Sahaj Solar is 26.47%.