Solve Plastic Products has always strived to offer customers the uPVC pipes and electrical conduits, on the market. By using cutting-edge technology and equipment the company has effectively manufactured cost-effective uPVC pipes and electrical conduits.

Solve Plastic Products is a quality-oriented and innovative company offering a wide, comprehensive, and cost-effective range of uPVC pipes and electrical conduits. The company is dedicated to expanding its product range to meet the needs of a rapidly growing India. The company’s vision prioritizes the use of environmentally friendly materials, reducing waste, eliminating the use of lead in its products, and ensuring the ethical disposal of waste materials.

Solve Plastic Products operates four manufacturing facilities, each equipped with advanced R&D labs, dedicated to delivering superior quality products. Under the brand name “Balco Pipes,” Solve Plastic Products Pipes has successfully manufactured and marketed its offerings, earning a strong reputation for its commitment to quality and service.

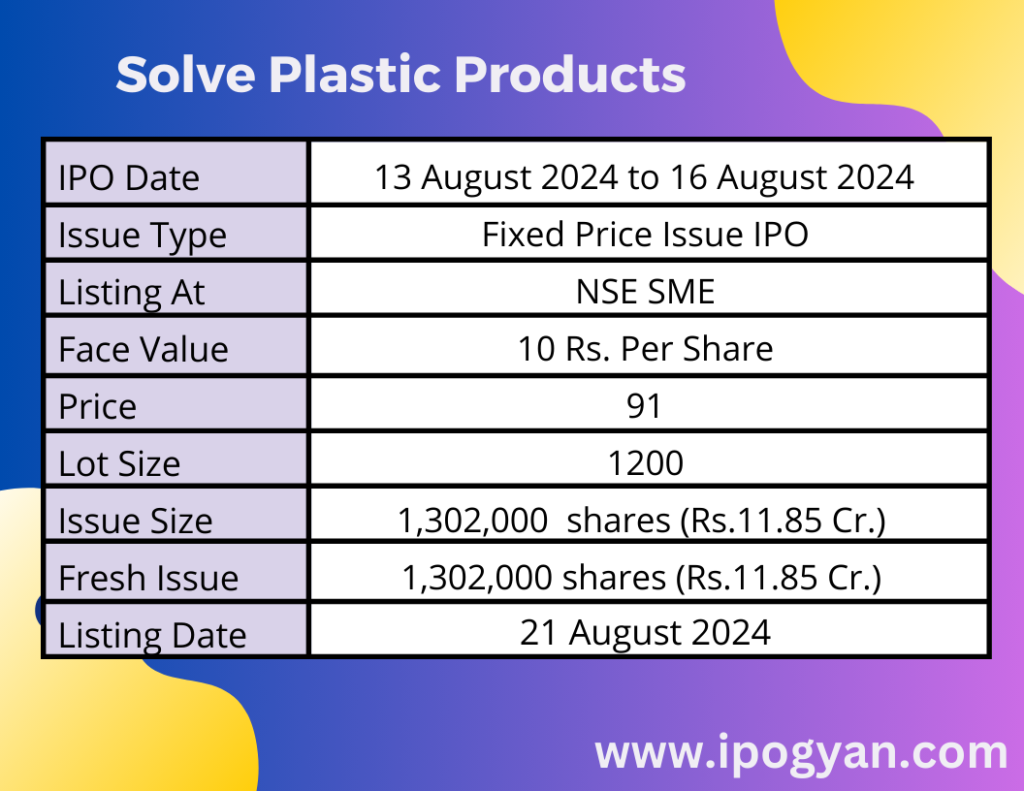

Solve Plastic Products IPO Complete Details:

Solve Plastic Products IPO Timetable:

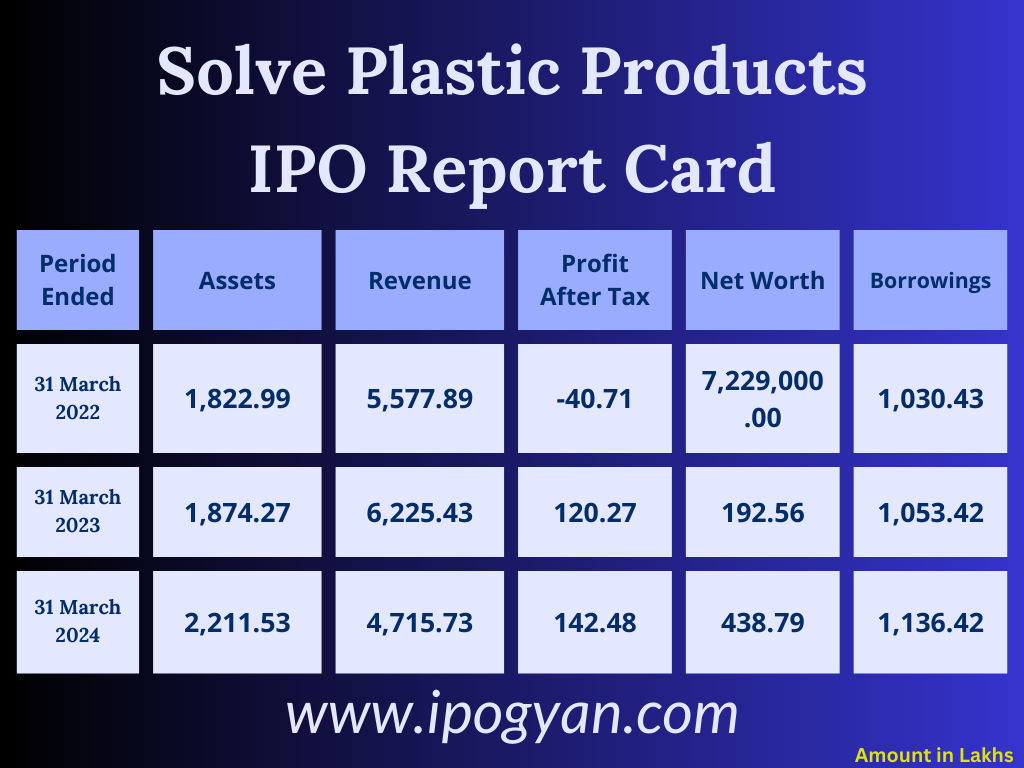

Company Financial Details:

AS OF NOW, the GMP Of Solve Plastic Products is Around 00 Rs.

Objects Of Issue:

A. Funding for capital expenditure related to the acquisition of additional plant and machinery

B. Meeting working capital requirements

C. Covering issue-related expenses

D. General corporate purposes

Promoters:

- Mr. Sudheer Kumar Balakrishnan Nairli>

- Mr. Susil Balakrishnan Nair

- Mr. Balakrishnan Nair

FAQs:

When Solve Plastic Products IPO is Opening?

Solve Plastic Products IPO is Opening on 13 August 2024.

When is the Solve Plastic Products IPO Closing?

Solve Plastic Products IPO is Closing on 16 August 2024.

What is the Issue Size of the Solve Plastic Products IPO?

The IPO Issue Size of Solve Plastic Products is 11.85 Crore.

Price Band of Solve Plastic Products IPO?

The price Band of the Solve Plastic Products IPO is 91 rupees per share.

What is the minimum investment for a Solve Plastic Products IPO?

The minimum investment for the Solve Plastic Products IPO is 109,200 rupees.

Allotment Date of Solve Plastic Products IPO?

The Allotment of Solve Plastic Products IPO is on 19 August 2024.

Listing Date of Solve Plastic Products IPO?

The Listing Of Solve Plastic Products is Scheduled on 21 August 2024.

One Should Apply for Solve Plastic Products IPO or Not?

Will Update Soon..

Who is the Lead Manager of Solve Plastic Products?

Finshore Management Services Limited is the Lead Manager of Solve Plastic Products.

Where To Check the Allotment of Solve Plastic Products IPO?

The allotment status for the Solve Plastic Products IPO will be accessible on the Integrated Registry Management Services Private Limited,

Solve Plastic Products IPO is going to be listed at?

Solve Plastic Products IPO is going to be listed at NSE SME.

What is the Lot Size of the Solve Plastic Products IPO?

The lot size of the Solve Plastic Products IPO is 1200 Shares.

What is the P/E Ratio of Solve Plastic Products?

The P/E Ratio of the Solve Plastic Products is 23.2.

What is the EPS of the Solve Plastic Products?

The EPS of Solve Plastic Products is 3.92.