Unicommerce eSolutions is India’s largest e-commerce enablement Software-as-a-Service (SaaS) platform in the transaction processing or nerve center layer, in terms of revenue. This platform facilitates end-to-end e-commerce operations management for brands, sellers, and logistics service provider firms.

Unicommerce eSolutions’ SaaS products enable enterprise clients and small and medium business (SMB) clients to manage their entire journey of post-purchase e-commerce operations efficiently. These products include (i) the warehouse and inventory management system (WMS); (ii) the multi-channel order management system (OMS); (iii) the omnichannel retail management system (Omni-RMS); (iv) a seller management panel for marketplaces, housed in their platform, Uniware; (v) recently introduced post-order services related to logistics tracking and courier allocation (UniShip); and (vi) payment reconciliation (UniReco).

Additionally, Unicommerce offers several sub-modules that customers may use as part of their routine operations. Their products act as the nerve center for e-commerce fulfillment operations, ensuring that orders received from clients’ end customers are processed correctly, efficiently, and within timelines as per client needs. These products aid in streamlining e-commerce operations for clients and enable Unicommerce to become a critical part of the supply chain stack of its clients.

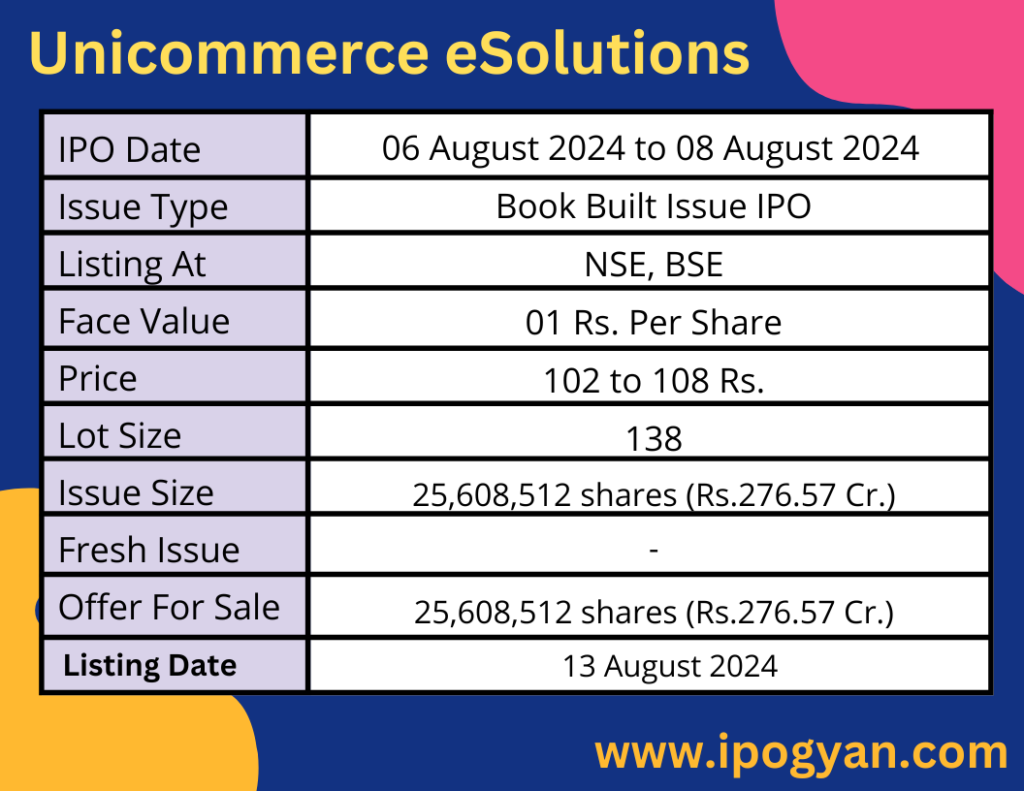

Unicommerce eSolutions IPO Complete Details:

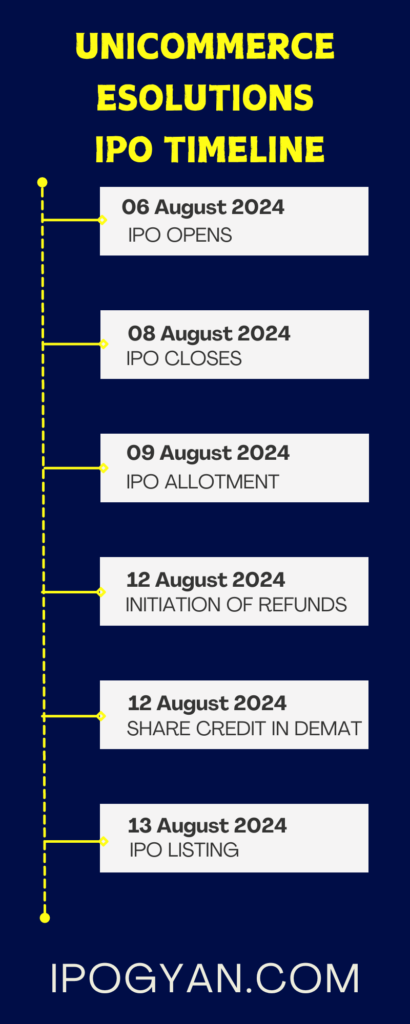

Unicommerce eSolutions IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Unicommerce eSolutions is Around 40 Rs.

Objects Of Issue:

The Company will not receive any proceeds from the Offer (the “Offer Proceeds”). All the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by each Selling Shareholder as part of the Offer.

Promoters:

- ACEVECTOR LIMITED(FORMERLY KNOWN AS SNAPDEAL LIMITED)

FAQs:

When Unicommerce eSolutions IPO is Opening?

Unicommerce eSolutions IPO is Opening on 06 August 2024.

When is the Unicommerce eSolutions IPO Closing?

Unicommerce eSolutions IPO is Closing on 08 August 2024.

What is the Issue Size of the Unicommerce eSolutions IPO?

The IPO Issue Size of Unicommerce eSolutions is 276.57 Crore.

Price Band of Unicommerce eSolutions IPO?

The price Band of the Unicommerce eSolutions IPO is 102 to 108 rupees per share.

What is the minimum investment for Unicommerce eSolutions IPO?

The minimum investment for the Unicommerce eSolutions IPO is 14,904 rupees.

Allotment Date of Unicommerce eSolutions IPO?

The Allotment of Unicommerce eSolutions IPO is on 09 August 2024.

Listing Date of Unicommerce eSolutions IPO?

The Listing Of Unicommerce eSolutions is Scheduled on 13 August 2024.

One Should Apply for Unicommerce eSolutions IPO or Not?

Will Update Soon..

Who is the Lead Manager of Unicommerce eSolutions?

IIFL Securities Ltd, and CLSA India Private Limited are the Lead Managers of Unicommerce eSolutions.

Where To Check the Allotment of Unicommerce eSolutions IPO?

The allotment status for the Unicommerce eSolutions IPO will be accessible on the Link Intime India Private Ltd Website.

Unicommerce eSolutions IPO is going to be listed at?

Unicommerce eSolutions IPO is going to be listed at NSE, BSE.

What is the Lot Size of the Unicommerce eSolutions IPO?

The lot size of the Unicommerce eSolutions IPO is 138 Shares.

What is the P/E Ratio of Unicommerce eSolutions?

The P/E Ratio of the Unicommerce eSolutions is 84.59.

What is the EPS of the Unicommerce eSolutions?

The EPS of Unicommerce eSolutions is 1.28.

What is the ROE of the Unicommerce eSolutions?

The ROE of Unicommerce eSolutions is 17.36%.

What is the ROCE of the Unicommerce eSolutions?

The ROCE of Unicommerce eSolutions is 25.93%.