AKME FINTRADE (INDIA), a non-banking finance company (NBFC) incorporated in 1996 and registered with the Reserve Bank of India as a Non-systemically Important Non-Deposit Taking Company, has over two decades of lending experience in rural and semi-urban areas of India. The company primarily focuses on providing lending solutions that cater to the needs and aspirations of the rural and semi-urban populace. Its portfolio includes Vehicle financing, which includes Used Commercial Vehicle loans, 2 Wheeler Loans, and Used 2 Wheeler Loans and Business Finance, aimed at small business owners and SME/MSME business owners.

AKME FINTRADE’s digital lending platform, www.aasaanloans.com, is currently under development and being rolled out in phases. Initially deployed to a select group of users for User Acceptance Testing (UAT) with a focus on Two-wheeler finance, the IT team is also developing products for loans against property, commercial vehicle financing, and secured business loans, which will be introduced gradually.

AKME FINTRADE operates in rural and semi-urban geographies across four Indian states: Rajasthan, Maharashtra, Madhya Pradesh, and Gujarat. Its registered office is located in Udaipur, Rajasthan. The company has nine branches and over 23 points of presence, including digital and physical branches, and has served over 200,000 customers to date.

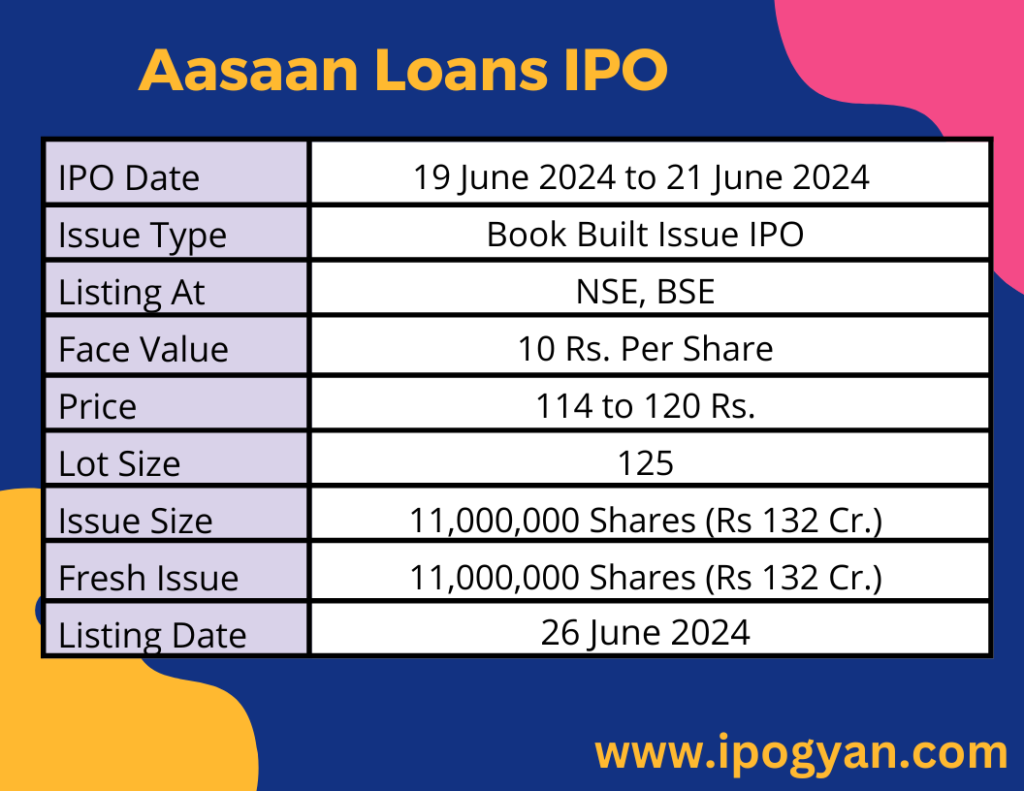

AKME FINTRADE (INDIA) IPO Complete Details:

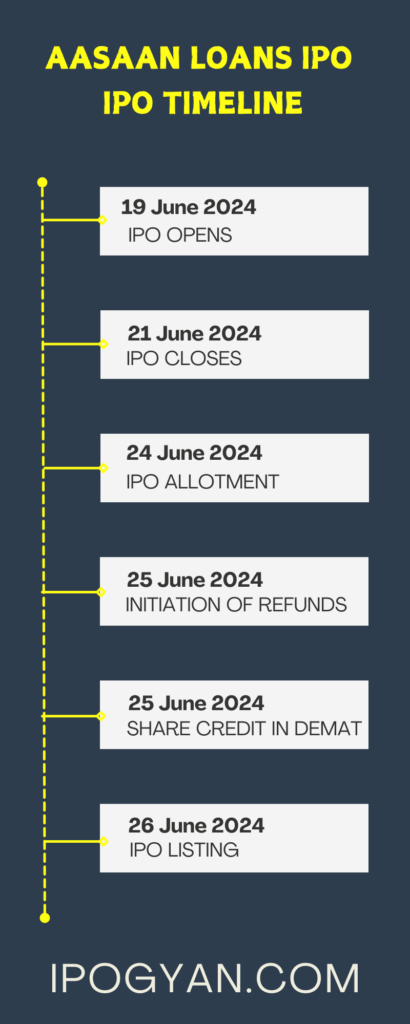

AKME FINTRADE (INDIA) IPO Timetable:

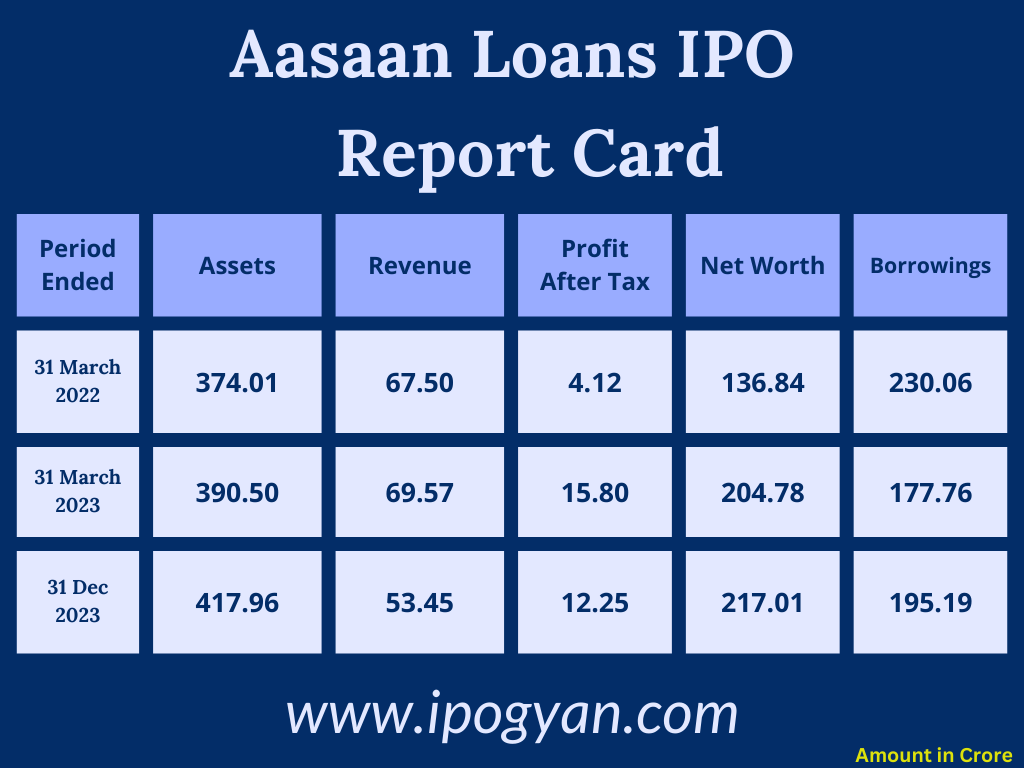

Company Financial Details:

AS OF NOW, the GMP Of AKME FINTRADE (INDIA) is Around 48 Rs.

Objects Of Issue:

The Net Proceeds of the Fresh Issue are proposed to be utilized by AKME FINTRADE (INDIA) to augment its capital base to meet future capital requirements.

Promoters:

- NIRMAL KUMAR JAIN

- MANJU DEVI JAIN

- DIPESH JAIN

- NIRMAL KUMAR JAIN HUF

FAQs:

When AKME FINTRADE (INDIA) IPO is Opening?

AKME FINTRADE (INDIA) IPO is Opening on 19 June 2024.

When is the AKME FINTRADE (INDIA) IPO Closing?

AKME FINTRADE (INDIA) IPO is Closing on 21 June 2024.

What is the Issue Size of the AKME FINTRADE (INDIA) IPO?

The IPO Issue Size of AKME FINTRADE (INDIA) is 132 Crore.

Price Band of AKME FINTRADE (INDIA) IPO?

The price Band of the AKME FINTRADE (INDIA) IPO is 114 to 120 rupees per share.

What is the minimum investment for a AKME FINTRADE (INDIA) IPO?

The minimum investment for the AKME FINTRADE (INDIA) IPO is 15,000 Rupees.

Allotment Date of AKME FINTRADE (INDIA) IPO?

The Allotment of AKME FINTRADE (INDIA) IPO is on 24 June 2024.

Listing Date of AKME FINTRADE (INDIA) IPO?

The Listing Of AKME FINTRADE (INDIA) is Scheduled on 26 June 2024.

One Should Apply for AKME FINTRADE (INDIA) IPO or Not?

Will Update Soon..

How to apply for AKME FINTRADE (INDIA) IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find AKME FINTRADE (INDIA) IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for AKME FINTRADE (INDIA) IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find AKME FINTRADE (INDIA) IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for AKME FINTRADE (INDIA) IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find AKME FINTRADE (INDIA) IPO from the list ——–> Click on AKME FINTRADE (INDIA) IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of AKME FINTRADE (INDIA)?

Gretex Corporate Services Limited is the Lead Manager of AKME FINTRADE (INDIA).

Where To Check the Allotment of AKME FINTRADE (INDIA) IPO?

The allotment status for the AKME FINTRADE (INDIA) IPO will be accessible on the Bigshare Services Pvt Ltd Website.

AKME FINTRADE (INDIA) IPO is going to be listed at?

AKME FINTRADE (INDIA) IPO is going to be listed at NSE,BSE.

What is the Lot Size of the AKME FINTRADE (INDIA) IPO?

The lot size of the AKME FINTRADE (INDIA) IPO is 125 Shares.

What is the P/E Ratio of the AKME FINTRADE (INDIA)?

The P/E Ratio of the AKME FINTRADE (INDIA) is n/a.

What is the EPS of the AKME FINTRADE (INDIA)?

The EPS of the AKME FINTRADE (INDIA) is 3.85.

What is the ROE of the AKME FINTRADE (INDIA)?

The ROE of AKME FINTRADE (INDIA) is 5.64%.

What is the ROCE of the AKME FINTRADE (INDIA)?

The ROCE of AKME FINTRADE (INDIA) is n/a.