ASK Automotive manufactures brake shoes and advanced braking systems, for two-wheelers in India, dominating the market with around 50% of the production volume in Fiscal 2022. This includes original equipment manufacturers (OEMs) and the branded independent aftermarket (IAM). With, over three decades of experience ASK Automotive has established itself as a trusted supplier of safety systems and critical engineering solutions. They have their design, development, and manufacturing capabilities. Their product range is versatile enough to cater to types of powertrains used by vehicle (EV) and internal combustion engine (ICE) OEMs.

With its, in-house expertise in design and engineering ASK excels at delivering precision components and solutions while prioritizing quality. This capability has allowed the company to expand its business into sectors, including non-automotive industries. ASK Automotive embarked on its journey in 1989 initially focusing on manufacturing brake shoe products for two-wheelers. Over time they expanded their offerings to include braking systems, lightweight aluminum precision solutions wheel assembly for original equipment manufacturers in the two-wheeler segment as well as safety control cables products. These high-quality products are supplied to OEMs operating both within the sector (two-wheelers, three-wheelers, passenger vehicles, and commercial vehicles) and beyond it (such, as all-terrain vehicles, power tools, and outdoor equipment).

ASK Automotive has a customer base, including the leading 2W OEMs, in India based on production volume and value for the year 2022. India boasts the motorized 2W market globally with a sale of 13.73 million units during the same fiscal year. Furthermore ASK Automotive expanded its supplies to 2W EV OEMs in India collaborating with companies such as TVS Motor Company Limited, Ather Energy Private Limited, Hero MotoCorp Limited, Greaves Electric Mobility Private Limited, Bajaj Auto Limited and Revolt Intellicorp Private Limited in fiscal year 2022. ASK Automotive has nurtured relationships, with all six 2W OEM customers for a period ranging from 15 to 29 years.

Beyond its domestic market, ASK Automotive increasingly caters to international customers in both the automotive and non-automotive sectors, exporting AB systems and ALP solutions. Automotive customers abroad include UFI Filters India Private Limited, Federal-Mogul Italy s.r.l. – racing & motorcycle division and FDP Virginia Inc. Non-automotive customers outside India include companies such as Stanley Black & Decker, Polaris Industries Inc., and MTD Products Inc.

ASK Automotive has 15 manufacturing facilities spread across five states in India. These facilities are strategically placed near their OEM customers. Furthermore, the company is currently working on establishing a manufacturing facility in Rajasthan. Has also acquired land, in Karnataka for future expansion purposes.

ASK Automotive is known for its expertise, in precision engineering and its ability to handle various aspects of the production process such as in-house tool design, design simulation, prototyping, and manufacturing. This gives the company an advantage when it comes to delivering high-quality products while keeping costs under control. Their team is skilled at designing and developing solutions that not only enhance vehicle safety, performance, durability, and efficiency for automotive OEMs but also provide critical systems, for ATVs, power tools, and outdoor equipment. Additionally in the EV sector, ASK Automotive focuses on creating solutions that contribute to improved management, vehicle range, performance, and safety.

ASK Automotive IPO Complete Details:

ASK Automotive IPO Timetable:

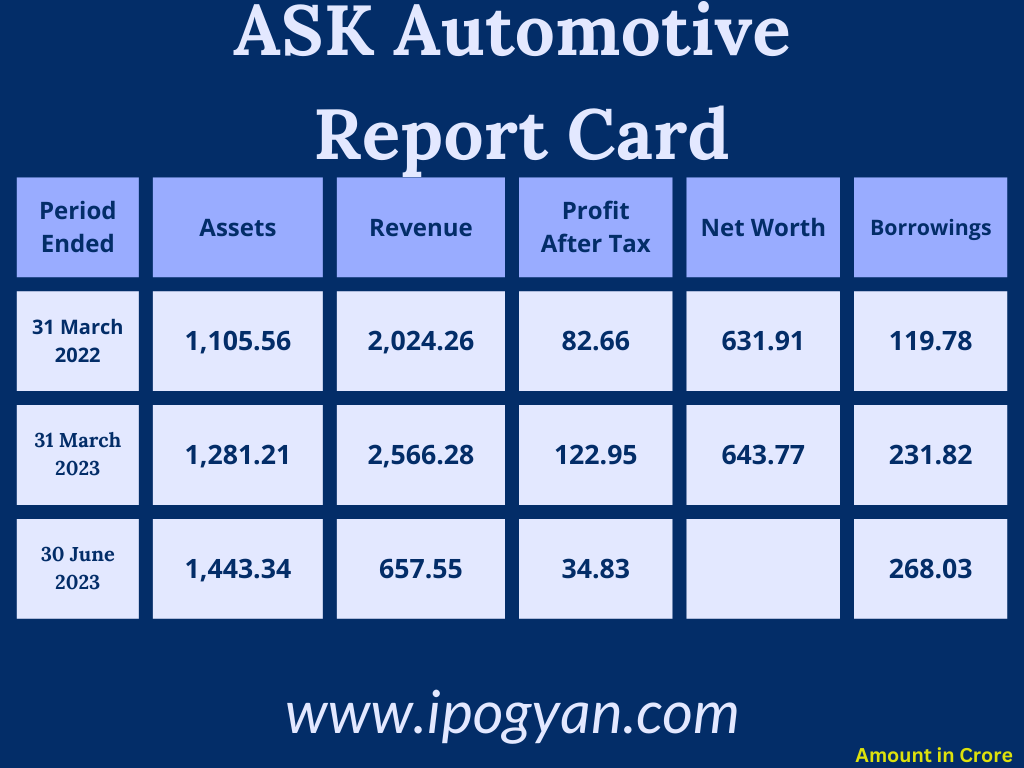

Company Financial Details:

AS OF NOW, the GMP OF ASK Automotive is Around 00 Rs.

Objects Of Issue:

The company will not receive any proceeds from the Offer. Instead, the Offer Proceeds will be received by the Promoter Selling Shareholders in proportion to the Offered Shares they sell as part of the Offer. This distribution will occur after deducting their share of the Offer-related expenses and the applicable taxes on those proceeds.

Promoters:

Kuldip Singh Rathee:

- Position: Chairman and Managing Director

- Educational Background: Bachelor’s degree in arts (economics honors) from the University of Delhi, New Delhi, Delhi

- Professional Experience: Served in the Central Reserve Police Force as Deputy Superintendent of Police (1974-1978); Enlisted as a contractor in Class I (B&R) with the Directorate General of Works, Central Public Works Department, Government of India; Experience in the real estate sector and manufacturing sector

Vijay Rathee:

- Position: Non-Executive Director

- Educational Background: Bachelor’s degree in science from Guru Nanak University, Amritsar, Punjab; Master’s degree in science (Zoology) from Birendra Narayan Chakravarty University, Kurukshetra, Haryana

- Professional Experience: Experience in the banking sector and the manufacturing sector; Previous role as an officer with Punjab & Sind Bank

FAQs:

When ASK Automotive IPO is Opening?

ASK Automotive IPO is Opening on 07 November 2023.

When is the ASK Automotive IPO Closing?

ASK Automotive IPO is Closing on 09 November 2023.

What is the Issue Size of the ASK Automotive IPO?

The IPO Issue Size of ASK Automotive is 834 Crore.

Price Band of ASK Automotive IPO?

The price Band of ASK Automotive IPO is 268 to 282 rupees per share.

What is the minimum investment for an ASK Automotive IPO?

The minimum investment for the ASK Automotive IPO is 14,946 Rupees.

Allotment Date of ASK Automotive IPO?

The Allotment of ASK Automotive IPO is on 15 November 2023.

Listing Date of ASK Automotive IPO?

The Listing Of ASK Automotive is Scheduled on 20 November 2023.

One Should Apply for ASK Automotive IPO or Not?

will update soon

How to apply for ASK Automotive IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find ASK Automotive IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for ASK Automotive IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find ASK Automotive IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for ASK Automotive IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find ASK Automotive IPO from the list ——–> Click on ASK Automotive IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of ASK Automotive?

JM Financial Limited, Axis Capital Limited, ICICI Securities Limited and IIFL Securities Ltd are the Lead Managers of ASK Automotive.

Where To Check the Allotment of ASK Automotive IPO?

The allotment status for the ASK Automotive IPO will be accessible on the Link Intime India Private Limited Website.

ASK Automotive IPO is going to be listed at?

ASK Automotive IPO is going to be listed at NSE BSE.

What is the Lot Size of the ASK Automotive IPO?

The lot size of the ASK Automotive IPO is 53 Shares.

What is the EPS of ASK Automotive IPO?

The EPS of ASK Automotive is 6.18 Rupees.

What is the P/E Ratio of ASK Automotive IPO?

The P/E Ratio of ASK Automotive is 45.63.

What is the ROE of the ASK Automotive IPO?

The ROE of ASK Automotive is N/A.

What is the ROCE of ASK Automotive IPO?

The ROCE of ASK Automotive is N/A.