BLS E-Services, a known digital service provider leveraging technology operates in three areas of business; Business Correspondents Services, Assisted E-services, and E-Governance Services. Acting as business correspondents, for leading banks in India BLS E-Services along, with its subsidiaries ZMPL and Starfin enables banking transactions including opening accounts making deposits and withdrawals transferring funds, and collecting bill payments.

The company offers a range of e-services through retailers and digital stores. These services, known as BLS Touchpoints include things, like Point of Sale (PoS) services, ticketing options, and assisted e-commerce. Additionally, BLS E-Services works closely with state governments to provide e-government services through their network of merchants. This collaboration aims to assist citizens in obtaining documents and necessary services in a manner.

With the goal of providing a customer experience BLS E Services has adopted a “strategy that combines physical and digital channels. This integration involves over 92,000 merchant distribution outlets. Offers solutions such as assisted payment methods, remittance services, travel arrangements, education support, and insurance products. The emphasis is on building trust and delivering face-to-face guidance through their network of merchants in locations.

The company has a track record of acquisitions such, as Starfin, ZMPL, and BLS Kendras Private Limited, which it seamlessly integrated into its operations. By utilizing the influence of its merchants BLS E Services has expanded its offerings to include e-commerce and insurance broking services. Their aim is to connect women, rural individuals with resources, and those without access to banking systems with banking services, financial assistance, and insurance options. Through their user platform, BLS E-Services caters to the needs of both individuals and businesses, throughout their digital journeys.

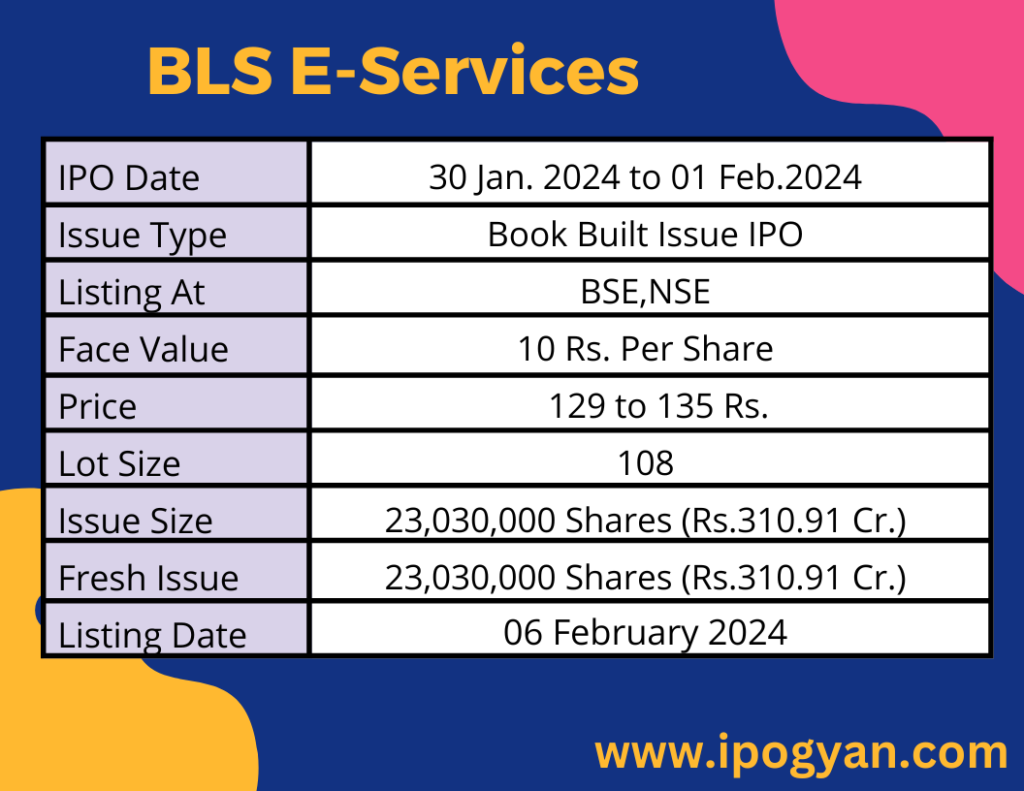

BLS E-Services IPO Complete Details:

BLS E-Services IPO Timetable:

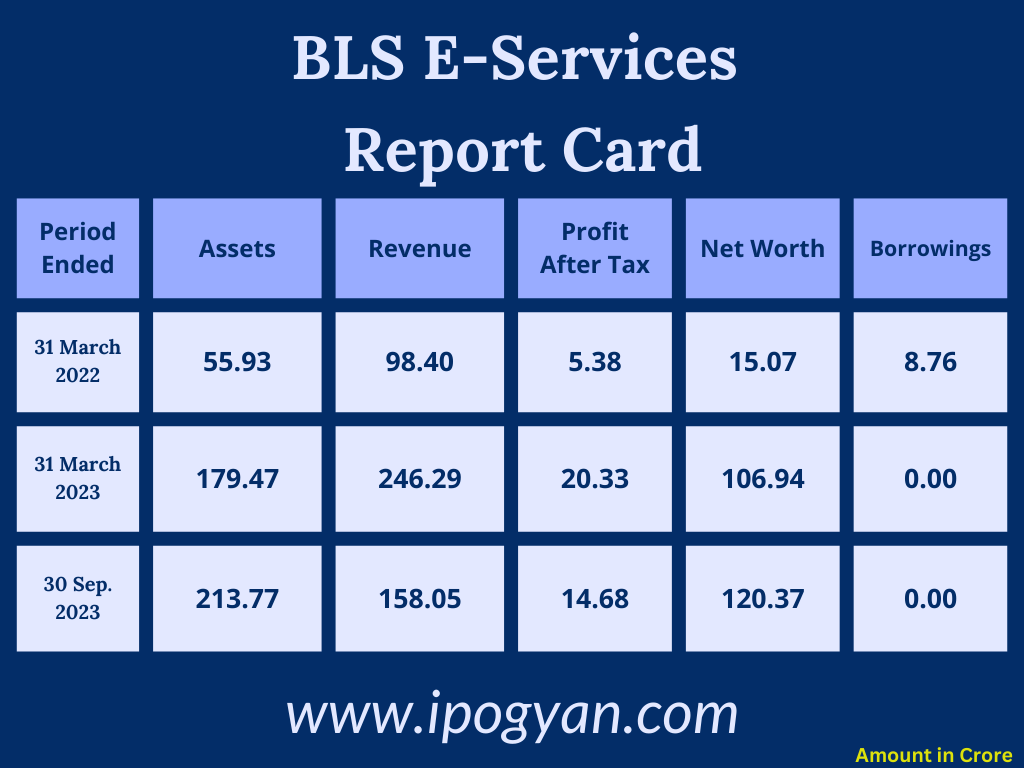

Company Financial Details:

AS OF NOW, the GMP Of BLS E-Services is Around 145 Rs.

Objects Of Issue:

1. Enhancing our technological infrastructure to foster new capabilities and streamlining our current platforms;

2. Supporting initiatives for natural expansion through the establishment of BLS Stores;

3. Attaining non-organic growth through strategic acquisitions; and

4. Addressing general corporate objectives.

Promoters:

The promoter of the company is BLS International Services Limited.

FAQs:

When BLS E-Services IPO is Opening?

BLS E-Services IPO is Opening on 30 January 2024.

When is the BLS E-Services IPO Closing?

BLS E-Services IPO is Closing on 01 February 2024.

What is the Issue Size of the BLS E-Services IPO?

The IPO Issue Size of BLS E-Services is 310.91 Crore.

Price Band of BLS E-Services IPO?

The price Band of BLS E-Services IPO is 129 to 135 rupees per share.

What is the minimum investment for a BLS E-Services IPO?

The minimum investment for the BLS E-Services IPO is 14,580 Rupees.

Allotment Date of BLS E-Services IPO?

The Allotment of BLS E-Services IPO is on 02 February 2024.

Listing Date of BLS E-Services IPO?

The Listing Of BLS E-Services is Scheduled on 06 February 2024.

One Should Apply for BLS E-Services IPO or Not?

Will Update Soon..

How to apply for BLS E-Services IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find BLS E-Services IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for BLS E-Services IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find BLS E-Services IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for BLS E-Services IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find BLS E-Services IPO from the list ——–> Click on BLS E-Services IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of BLS E-Services?

Unistone Capital Private Limited is the Lead Manager of BLS E-Services.

Where To Check the Allotment of BLS E-Services IPO?

The allotment status for the BLS E-Services IPO will be accessible on the Kfin Technologies Limited Website.

BLS E-Services IPO is going to be listed at?

BLS E-Services IPO is going to be listed at NSE and BSE.

What is the Lot Size of the BLS E-Services IPO?

The lot size of the BLS E-Services IPO is 108 Shares.

What is the P/E Ratio of the BLS E-Services IPO?

The P/E Ratio of the BLS E-Services is 44.31.

What is the ROE of the BLS E-Services IPO?

The ROE of the BLS E-Services IPO is 33.33%.

What is the ROCE of the BLS E-Services IPO?

The ROCE of the BLS E-Services IPO is 30.62.

What is the EPS of the BLS E-Services IPO?

The EPS of the BLS E-Services IPO is 3.05.