Blue Jet Healthcare founded in 1968 is a company that specializes in pharmaceutical and healthcare ingredients and intermediates. The company has a business model focused on contract development and manufacturing organization (CDMO) specializing in chemistry capabilities, for media intermediates and high-intensity sweeteners. Their success is attributed to their investments, in research and development (R&D) as well as their robust manufacturing infrastructure.

Blue Jet Healthcare has a range of skills and manufacturing capabilities when it comes to media intermediates and high-intensity sweeteners, like saccharin and its salts. They produce products in their facilities, including important initial materials and advanced intermediate substances. This enables them to have control, over their production process ensuring quality and cost effectiveness.

In the three years Blue Jet Healthcare has issued invoices to, over 350 customers across 35 countries. They have established a customer base by partnering, with both cutting-edge companies and multinational providers of generic pharmaceuticals. This partnership has been strengthened through long-term contracts, which showcase their dedication to providing top-notch services.

Blue Jet Healthcare primarily categorizes its operations into three product categories; (1) contrast media intermediates, (2) high-intensity sweeteners, and (3) pharmaceutical intermediates and active pharmaceutical ingredients (APIs).

1. Contrast Media Intermediates: Blue Jet Healthcare specializes in producing and supplying key intermediates for contrast media used in medical imaging, including X-rays, CT scans, MRI, and ultrasound. The global contrast media market is substantial and expected to grow, with Blue Jet Healthcare maintaining long-term relationships with major manufacturers in the industry.

2. High Intensity Sweeteners: The company engages in the creation, production, and promotion of high-intensity sweeteners with attention, to saccharin and its derivatives. Their approach prioritizes both sustainability and efficient manufacturing. The worldwide market for high-intensity sweeteners encompasses a range of products such, as sucralose, aspartame, saccharin, stevia, and neotame.

3. Pharma Intermediates and APIs: Blue Jet Healthcare functions, as a Contract Development and Manufacturing Organization (CDMO) in the intermediates and active pharmaceutical ingredients (APIs) domain. They work together with both innovator and generic pharmaceutical companies providing intermediates for APIs in therapeutic fields, like cardiovascular health, oncology, and the central nervous system.

Blue Jet Healthcare IPO Complete Details:

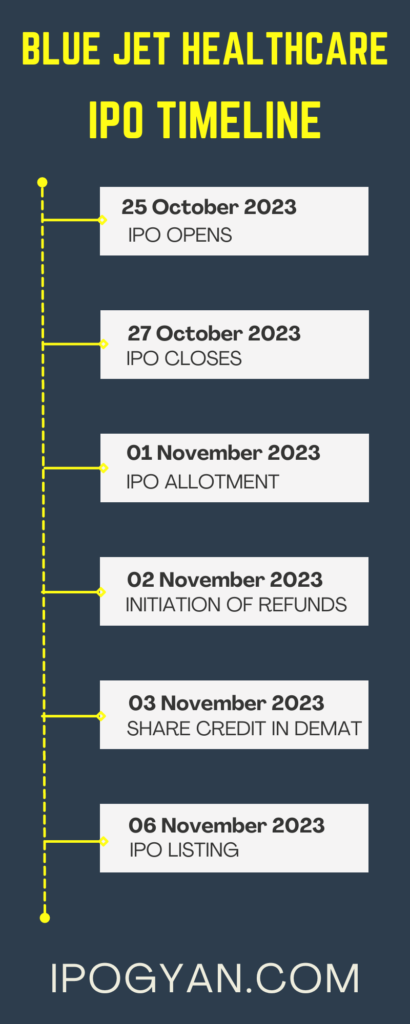

Blue Jet Healthcare IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Blue Jet Healthcare is Around 00 Rs.

Objects Of Issue:

The company will not directly benefit from the offer financially as all the proceeds will be received by the selling shareholders. The distribution of these proceeds will be based on the proportion of shares sold by each selling shareholder as part of the offer.

Promoters:

Akshay Bansarilal Arora:

- Age: 59 years

- Position: Executive Chairman of the Company

- Nationality: Indian

Shiven Akshay Arora:

- Age: 28 years

- Position: Managing Director of the Company

- Nationality: Indian

Archana Akshay Arora:

- Age: 52 years

- Position: Head of Business Development of the Company

- Nationality: Indian

FAQs:

When Blue Jet Healthcare IPO is Opening?

Blue Jet Healthcare IPO is Opening on 25 October 2023.

When Blue Jet Healthcare IPO is Closing?

Blue Jet Healthcare IPO is Closing on 27 October 2023.

What is the IPO Issue Size of Blue Jet Healthcare?

The IPO Issue Size of Blue Jet Healthcare is 840.27 Crore

Price Band of Blue Jet Healthcare IPO?

The price Band of Blue Jet Healthcare IPO is 329 to 346 rupees per share.

What is the minimum investment for a Blue Jet Healthcare IPO?

The minimum investment for Blue Jet Healthcare IPO is 14,878 Rupees.

Allotment Date of Blue Jet Healthcare IPO?

The Allotment of Blue Jet Healthcare IPO is on 01 November 2023.

Listing Date of Blue Jet Healthcare IPO?

The Listing Of Blue Jet Healthcare is Scheduled on 06 November 2023.

One Should Apply for Blue Jet Healthcare IPO or Not?

will update soon

How to apply for Blue Jet Healthcare IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Blue Jet Healthcare IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Blue Jet Healthcare IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Blue Jet Healthcare IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Blue Jet Healthcare IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Blue Jet Healthcare IPO from the list ——–> Click on Blue Jet Healthcare IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Blue Jet Healthcare IPO’s Lead Manager?

Kotak Mahindra Capital Company Limited, ICICI Securities Limited, and J.P. Morgan India Private Limited are the Lead Managers of Blue Jet Healthcare.

Where To Check the Allotment of Blue Jet Healthcare IPO?

The allotment status for the Blue Jet Healthcare IPO will be accessible on the Link Intime India Private Limited Website.

Blue Jet Healthcare IPO is going to be listed at?

Blue Jet Healthcare IPO is going to be listed at NSE, BSE.

What is the Lot Size of the Blue Jet Healthcare IPO?

The lot size of the Blue Jet Healthcare IPO is 43 Shares.

What is the EPS of Blue Jet Healthcare IPO?

The EPS of Blue Jet Healthcare is 09.23 Rupees.

What is the P/E Ratio of Blue Jet Healthcare IPO?

The P/E Ratio of Blue Jet Healthcare is 37.49.

What is the ROE of a Blue Jet Healthcare IPO?

The ROE of a Blue Jet Healthcare IPO is 26.60%.

What is the ROCE of a Blue Jet Healthcare IPO?

The ROCE of a Blue Jet Healthcare IPO is 31.91%.