Deepak Chemtex primarily focuses on producing colorants that are used in a variety of industries, including Food, Drug, Cosmetics, Cleaning compounds, Agriculture and more. The company manufactures colorants that are composed of chemical intermediates, pigments, or dyes and additives. These colorants play a role, in adding colors to a wide range of consumable products such as confectionery items, bakery goods, desserts, beverages, dairy products, seasonings, pet foods, pharmaceuticals as well, as cosmetics and personal care products.

Established in 1997, Deepak Chemtex has evolved into a manufacturer of a comprehensive range of FD&C (Food, Drug, and Cosmetic) colors. The product portfolio extends to salt-free dyes for the inkjet industry, pond dyes for water bodies, and other colorants used in car wash products, sanitation cleaners, detergents, soaps, fuels, oils, lubricants, smoke, seed treatment, crop protection, fertilizer indicators, floral dyes, among others.

The manufacturing facility of the company is situated in the Ratnagiri District, within Maharashtra. It is equipped with glass-lined reactors, boilers, and stainless steel equipment. The facility undergoes audits from clients. Employs various production processes such as Sulphonation, Condensation, Bromination, Oxidation, Reduction, High-pressure reactions, and Purification. Quality is an aspect that the company focuses on. They have a framework, in place that includes shade testing, heavy metals detection, microbiological contamination tests, and particle size analysis conducted by their team.

Deepak Chemtex sells its products to countries like China, France, Kenya, Mexico, Europe, Japan, Australia, the United Kingdom and the United States. The range of products has grown from, about 50 items in Fiscal Year 2021 to 100 items in Fiscal Year 2023. The company serves a range of international customers, some of whom obtain EN 71 (European Standard) certification, for their products.

Flexible packing options, including IBC Tank Packing, HDPE Drum Packing, Cardboard Drum Packing, Carton Packaging, and Container Stuffing, are provided by Deepak Chemtex to ensure the safe transit of its product. The company further expands its operations through subsidiaries, namely DCPL Speciality Chemicals Private Limited and South West Chemicals Corporation in New Jersey, USA.

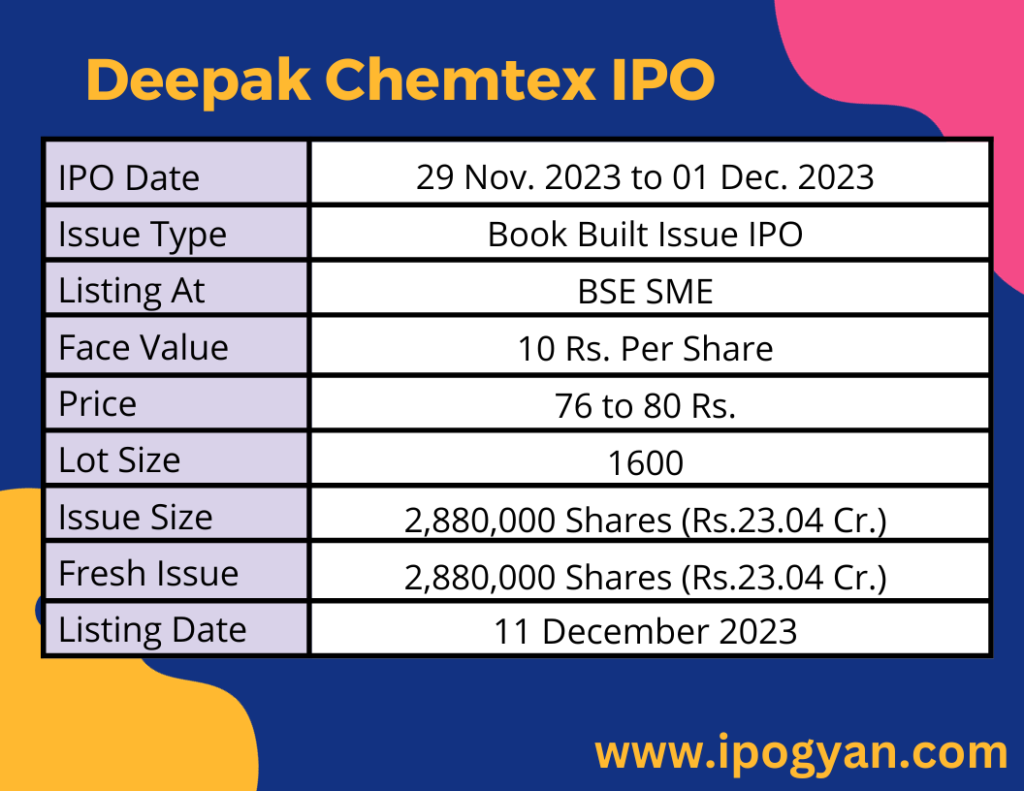

Deepak Chemtex IPO Complete Details:

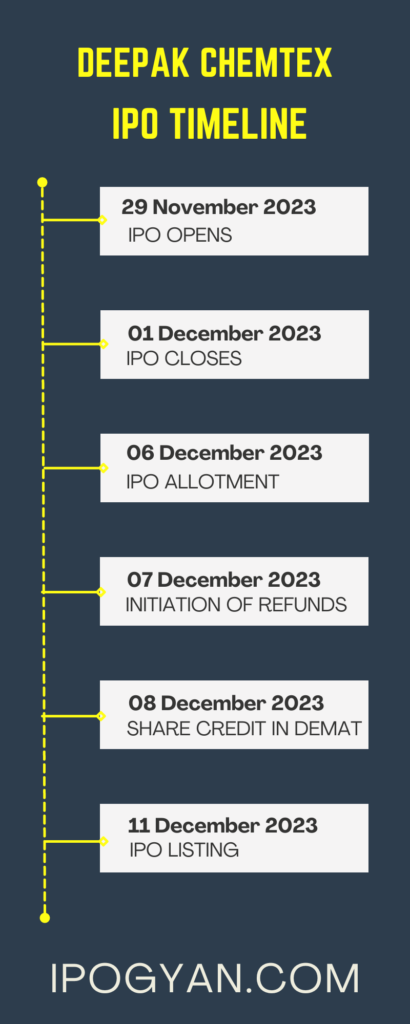

Deepak Chemtex IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Deepak Chemtex is Around 00 Rs.

Objects Of Issue:

1. Securing capital for the installation of plant and machinery within our current facilities.

2. Allocating funds to support the capital expenditure of our subsidiary, DCPL Speciality Chemicals Private Limited, for the installation of plant and machinery.

3. Obtaining financial support to address working capital needs.

4. Meeting general corporate objectives and purposes.

Promoters:

1. Saurabh Deepak Arora:

– Position: Chairman & Managing Director

– Experience: Over 26 years in the Chemical and Colorant industry

– Education: Bachelor of Science from Ruia College, Matunga, Mumbai (2001)

2. Trishla Baid:

– Position: Whole-time Director and CFO

– Education: Bachelor of Arts from Stela Maris College, Chennai (1998)

– Experience: Around 21 years in various sectors, including accounts and finance

FAQs:

When Deepak Chemtex IPO is Opening?

Deepak Chemtex IPO is Opening on 29 November 2023.

When is the Deepak Chemtex IPO Closing?

Deepak Chemtex IPO is Closing on 01 December 2023.

What is the Issue Size of the Deepak Chemtex IPO?

The IPO Issue Size of the Deepak Chemtex is 23.04 Crore.

Price Band of Deepak Chemtex IPO?

The price Band of Deepak Chemtex IPO is 76 to 80 rupees per share.

What is the minimum investment for a Deepak Chemtex IPO?

The minimum investment for the Deepak Chemtex IPO is 128,000 Rupees.

Allotment Date of Deepak Chemtex IPO?

The Allotment of Deepak Chemtex IPO is on 06 December 2023.

Listing Date of Deepak Chemtex IPO?

The Listing Of Deepak Chemtex is Scheduled on 11 December 2023.

One Should Apply for Deepak Chemtex IPO or Not?

will update soon

How to apply for a Deepak Chemtex IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Deepak Chemtex IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Deepak Chemtex IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Deepak Chemtex IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Deepak Chemtex IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Deepak Chemtex IPO from the list ——–> Click on Deepak Chemtex IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of the Deepak Chemtex?

Hem Securities Limited is the Lead Manager of the Deepak Chemtex.

Where To Check the Allotment of Deepak Chemtex IPO?

The allotment status for the Deepak Chemtex IPO will be accessible on the Bigshare Services Private Limited Website.

Deepak Chemtex IPO is going to be listed at?

Deepak Chemtex IPO is going to be listed at BSE SME.

What is the Lot Size of the Deepak Chemtex IPO?

The lot size of the Deepak Chemtex IPO is 1600 Shares.

What is the EPS of the Deepak Chemtex IPO?

The EPS of the Deepak Chemtex is 7.9 Rupees.

What is the P/E Ratio of the Deepak Chemtex IPO?

The P/E Ratio of the Deepak Chemtex is 10.14.

What is the ROE of the Deepak Chemtex IPO?

The ROE of the Deepak Chemtex is 50.27%.

What is the ROCE of the Deepak Chemtex IPO?

The ROCE of the Deepak Chemtex is 49.65%.