DelaPlex is a known company that focuses on providing technology and software development solutions as well, as consulting services. Their main goal is to assist client companies in achieving growth generating revenue and increasing their value in the marketplace. DelaPlex has built expertise and partnerships with industry players enabling them to offer the most up-to-date technology, tools, and software development solutions on a global scale. As a trusted global technology partner, DelaPlex specializes in areas such, as Supply Chain Consulting, Custom Software Development, Cloud Services, and Data Science.

DelaPlex is primarily focused on transforming supply chains to shape the future of supply chain management through the use of IT and digital transformation. The company helps clients optimize their supply chain value by identifying business opportunities creating plans predicting sales figures evaluating risk factors and implementing creative solutions.

DelaPlex provides a range of services, in the field of Consultation and Software Solutions. They offer a suite of services that leverage their deep industry expertise unique consulting methods, advanced analytics, and state-of-the-art technologies. The company’s focus on innovation and their deep understanding of the evolving supply chain landscape guarantees improved efficiency, cost-effectiveness, and operational excellence.

DelaPlex takes a client-focused approach working with a range of clients, across industries and demographics. They use their presence and industry knowledge to offer solutions that cater to each client’s specific needs and challenges. By collaborating with service and technology providers DelaPlex creates a thriving ecosystem through its centers of excellence (CoEs) which continuously drive innovation and problem-solving in areas such, as software-defined data centers, integrated infrastructure, cloud technologies, DevOps, security solutions, data analytics and artificial intelligence.

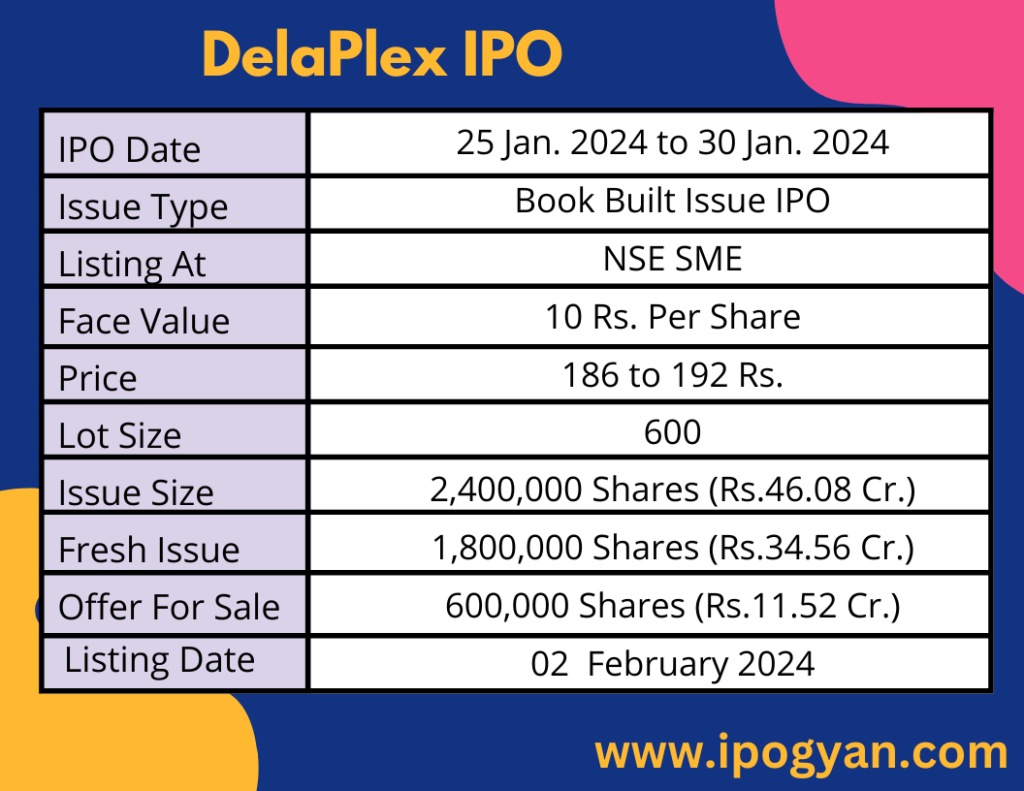

DelaPlex IPO Complete Details:

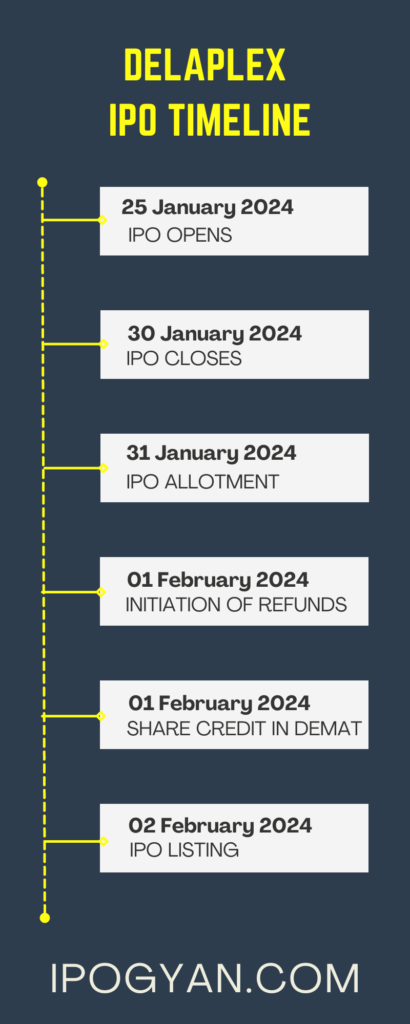

DelaPlex IPO Timetable:

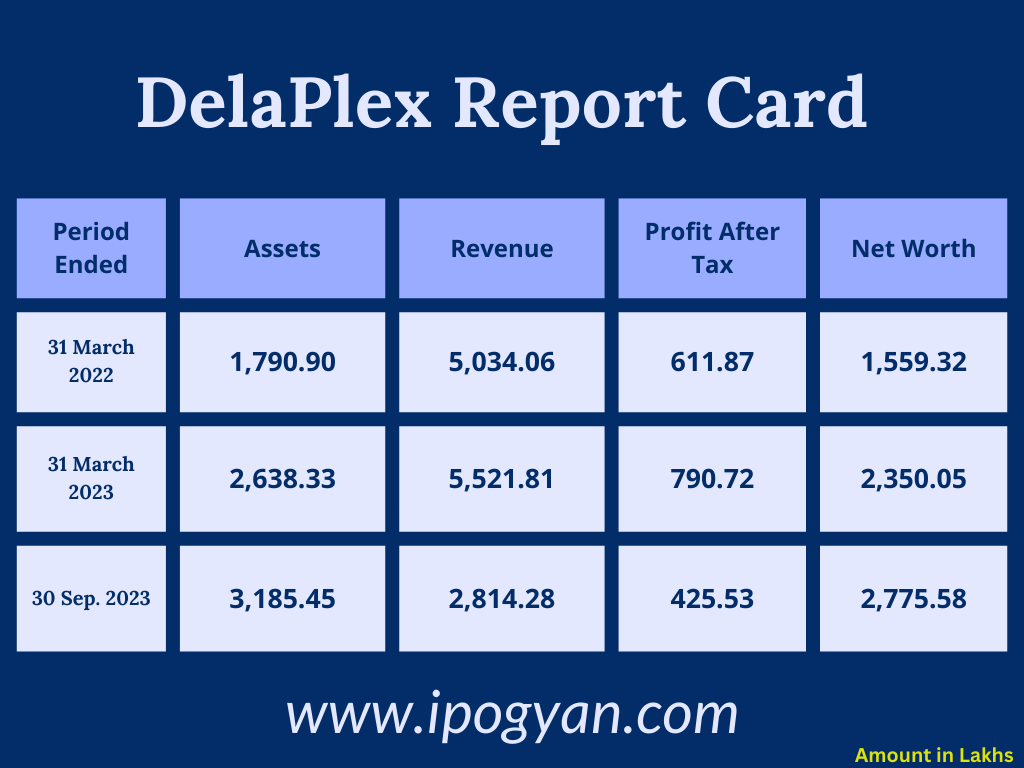

Company Financial Details:

AS OF NOW, the GMP Of DelaPlex is Around 125 Rs.

Objects Of Issue:

1. Allocation of funds for enhancing awareness through Advertisement, Sales, and Marketing expenses in the APAC region.

2. Financing Working Capital needs for our Company.

3. Funding capital expenditures for the purchase of office laptops.

4. Allocated for general corporate purposes and potential unidentified inorganic acquisitions.

Promoters:

Mr. Nitin Sachdeva:

– Age: 47 years

– Position: Promoter, Chairman, and Managing Director

– Education: Bachelors’ of Commerce from Nagpur University, Final Examination conducted by the Institute of Chartered Accountants of India

Mr. Manish Iqbalchand Sachdeva:

– Age: 50 years

– Position: Promoter and Non-Executive Director

– Education: Bachelor in Engineering (Computer Technology) from Nagpur University (1994), Master of Engineering from The Birla Institute of Technology & Science (1996)

FAQs:

When DelaPlex IPO is Opening?

DelaPlex IPO is Opening on 25 January 2024.

When is the DelaPlex IPO Closing?

DelaPlex IPO is Closing on 30 January 2024.

What is the Issue Size of the DelaPlex IPO?

The IPO Issue Size of DelaPlex is 46.08 Crore.

Price Band of DelaPlex IPO?

The price Band of DelaPlex IPO is 186 to 192 rupees per share.

What is the minimum investment for a DelaPlex IPO?

The minimum investment for the DelaPlex IPO is 115,200 Rupees.

Allotment Date of DelaPlex IPO?

The Allotment of DelaPlex IPO is on 31 January 2024.

Listing Date of DelaPlex IPO?

The Listing Of DelaPlex is Scheduled on 02 February 2024.

One Should Apply for DelaPlex IPO or Not?

MAY APPLY

How to apply for DelaPlex IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find DelaPlex IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for DelaPlex IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find DelaPlex IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for DelaPlex IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find DelaPlex IPO from the list ——–> Click on DelaPlex IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of DelaPlex?

Shreni Shares Limited is the Lead Manager of DelaPlex.

Where To Check the Allotment of DelaPlex IPO?

The allotment status for the DelaPlex IPO will be accessible on the Bigshare Services Private Limited Website.

DelaPlex IPO is going to be listed at?

DelaPlex IPO is going to be listed at NSE SME.

What is the Lot Size of the DelaPlex IPO?

The lot size of the DelaPlex IPO is 600 Shares.

What is the P/E Ratio of the DelaPlex IPO?

The P/E Ratio of the DelaPlex is 17.75.

What is the ROE of the DelaPlex IPO?

The ROE of the DelaPlex IPO is 40.45%.

What is the ROCE of the DelaPlex IPO?

The ROCE of the DelaPlex IPO is 56.73%.

What is the EPS of the DelaPlex IPO?

The EPS of the DelaPlex IPO is 10.82.