Esconet Technologies established in 2012 specializes in providing IT solutions to meet needs. Their offerings include supercomputing solutions, data center facilities, with storage servers, network security, virtualization, and data protection measures.

Esconet has accumulated both expertise and a wide range of clients, from private and public sector entities, including the Ministry of Defence National Informatics Centre MeitY, National Informatics Centre Services Inc. – MeitY, Indian Institute of Technology Indraprastha Institute of Technology Limited, Bharat Electronics Limited, Oil & Natural Gas Commission Limited, Engineers India Limited, Hindustan National Glass & Industries Limited and numerous others.

Their wide range of solutions is designed to meet the requirements of medium businesses as well, as large corporations and clients, in the public sector. Moreover, Esconet goes beyond services by offering cloud solutions through their subsidiary, ZeaCloud Services. This guarantees that clients can benefit from state-of-the-art technology and enjoy an IT infrastructure experience.

Esconet saw the opportunity, in the market they decided to launch a HexaData brand. This brand focuses on of-the-line Servers, Workstations, and storage systems. Furthermore, Esconet’s partnership, with NVIDIA has led to advancements in the field of Artificial Intelligence (AI), and Machine Learning (ML) which have greatly improved their servers and workstations.

Esconet Technologies provides a selection of IT solutions encompassing high-performance servers, data storage options, virtualization software, backup and disaster recovery solutions network security tools, email systems, databases and log management software.

Their after sales services encompass installing IT hardware, deploying and integrating software, monitoring infrastructure setting up clouds, annual maintenance, backup management, with disaster recovery solutions smooth data migration processes, and consulting services from experienced professionals.

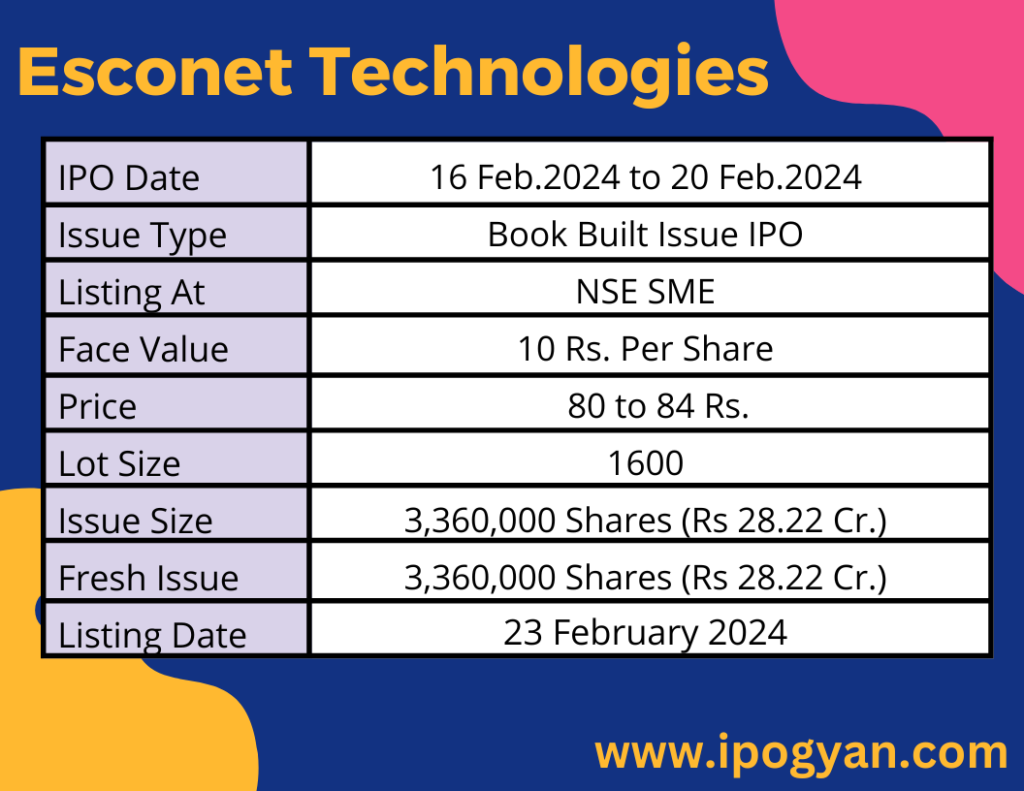

Esconet Technologies IPO Complete Details:

Esconet Technologies IPO Timetable:

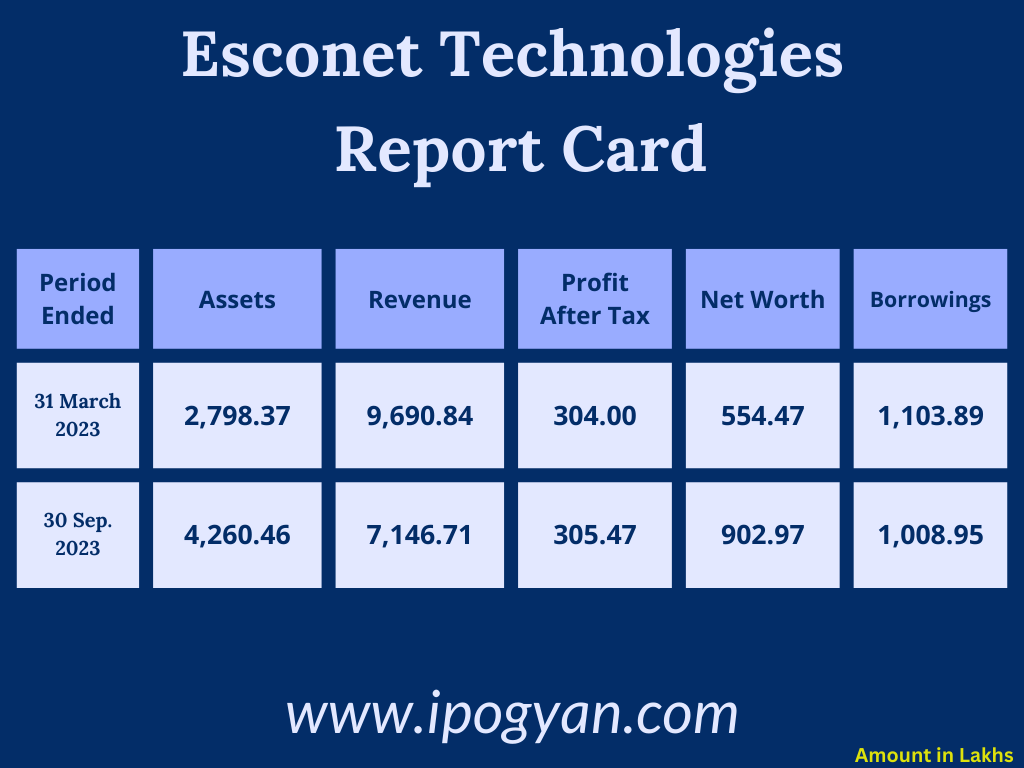

Company Financial Details:

AS OF NOW, the GMP Of Esconet Technologies is Around 40 Rs.

Objects Of Issue:

1) Esconet Technologies Limited is evaluating its working capital needs.

2) Investment is being considered for Zeacloud Services Private Limited, a wholly-owned subsidiary, to cover its capital expenditure expenses.

3) For general corporate expenses.

Promoters:

- MR. SANTOSH KUMAR AGRAWAL

- MR. SUNIL KUMAR AGRAWAL

FAQs:

When Esconet Technologies IPO is Opening?

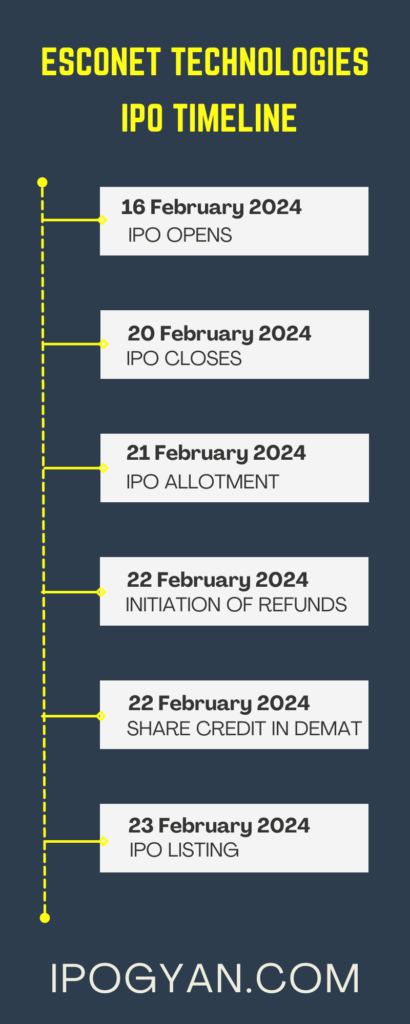

Esconet Technologies IPO is Opening on 16 February 2024.

When is the Esconet Technologies IPO Closing?

Esconet Technologies IPO is Closing on 20 February 2024.

What is the Issue Size of the Esconet Technologies IPO?

The IPO Issue Size of Esconet Technologies is 28.22 Crore.

Price Band of Esconet Technologies IPO?

The price Band of Esconet Technologies IPO is 80 to 84 rupees per share.

What is the minimum investment for an Esconet Technologies IPO?

The minimum investment for the Esconet Technologies IPO is 134,400 Rupees.

Allotment Date of Esconet Technologies IPO?

The Allotment of Esconet Technologies IPO is on 21 February 2024.

Listing Date of Esconet Technologies IPO?

The Listing Of Esconet Technologies is Scheduled on 23 February 2024.

One Should Apply for Esconet Technologies IPO or Not?

Will Update Soon..

How to apply for Esconet Technologies IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Esconet Technologies IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Esconet Technologies IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Esconet Technologies IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Esconet Technologies IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Esconet Technologies IPO from the list ——–> Click on Esconet Technologies IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Esconet Technologies?

Corporate Capital Ventures Private Limited is the Lead Manager of Esconet Technologies.

Where To Check the Allotment of Esconet Technologies IPO?

The allotment status for the Esconet Technologies IPO will be accessible on the Skyline Financial Services Private Limited website.

Esconet Technologies IPO is going to be listed at?

Esconet Technologies IPO is going to be listed at NSE SME.

What is the Lot Size of the Esconet Technologies IPO?

The lot size of the Esconet Technologies IPO is 1600 Shares.

What is the P/E Ratio of the Esconet Technologies IPO?

The P/E Ratio of the Esconet Technologies is 24.87.

What is the ROE of the Esconet Technologies IPO?

The ROE of the Esconet Technologies IPO is 75.54%.

What is the ROCE of the Esconet Technologies IPO?

The ROCE of the Esconet Technologies IPO is 59.11%.

What is the EPS of the Esconet Technologies IPO?

The EPS of the Esconet Technologies IPO is 39.63.