Exicom Tele Systems, established in 1994 operates within two business sectors. The first focuses on providing charging systems(EV Chargers) for vehicles catering to residential, commercial, and public charging needs, in India. The second sector involves designing, producing, and maintaining infrastructure technology(EV Charger Business) for energy management at telecommunication sites and business settings in India as well, as internationally.

Exicom Tele Systems ventured into producing EV chargers in India in 2019 swiftly rising to the top as a player, with a considerable market presence in home and public charging sectors. Additionally, they have established footholds in the DC Power Systems and Li-ion Batteries sectors, for telecommunications infrastructure.

Their vehicle charging business provides charging options, such, as slow AC chargers designed for homes and fast DC chargers tailored for commercial and public settings. These offerings adhere to regulations and certification standards. The companys goal is to leverage the increasing interest in vehicles both in India and worldwide by offering infrastructure solutions that facilitate the shift, towards electrification.

Exicom Tele Systems through its Critical Power Business provides DC power conversion systems and energy storage solutions using Li-ion technology to ensure power in case of grid disruptions. These solutions have been implemented in countries, in Southeast Asia and Africa to meet the growing need for power supply, in telecom networks.

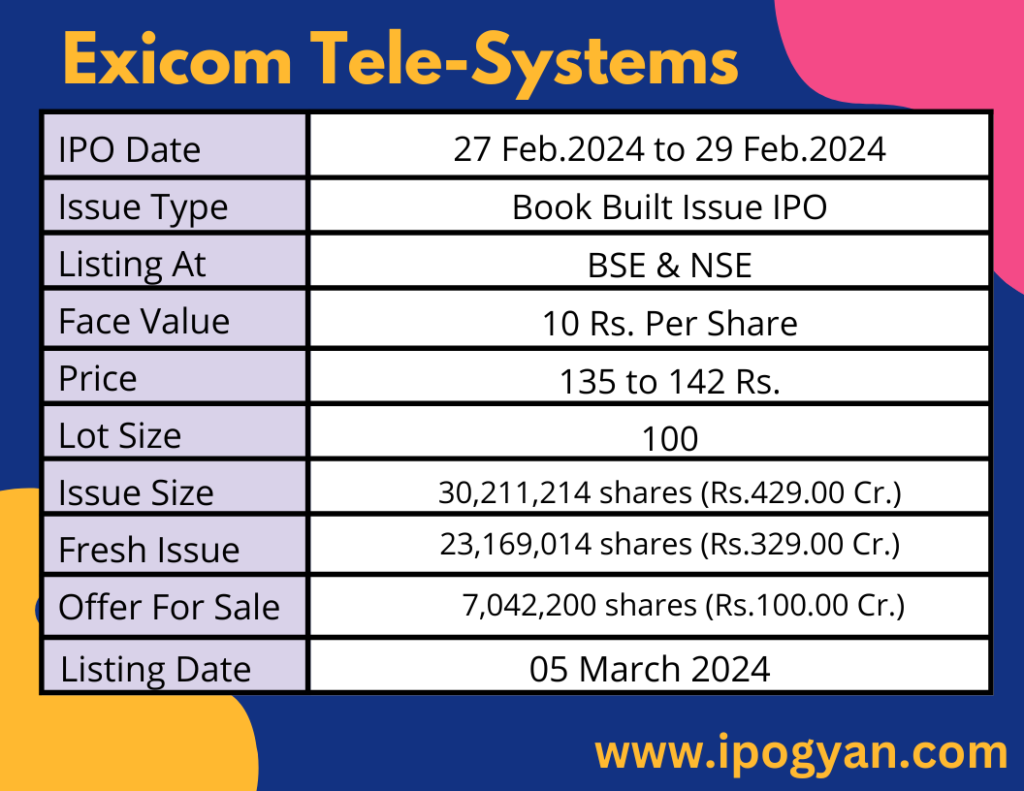

Exicom Tele Systems IPO Complete Details:

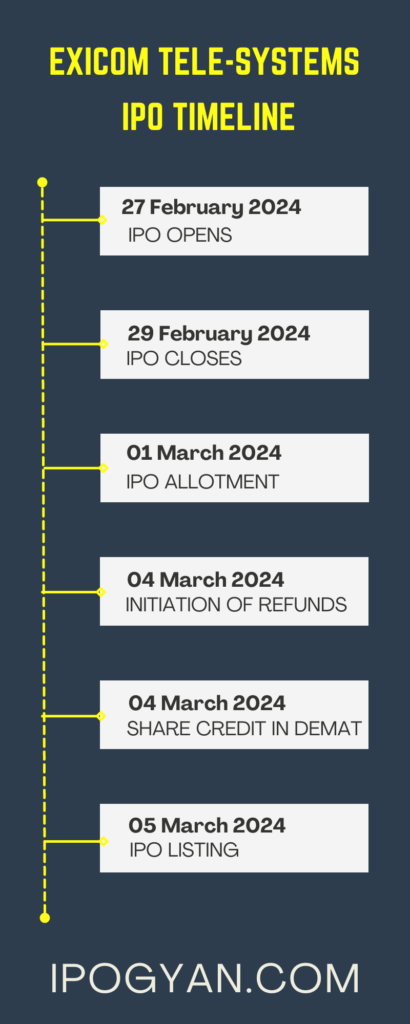

Exicom Tele Systems IPO Timetable:

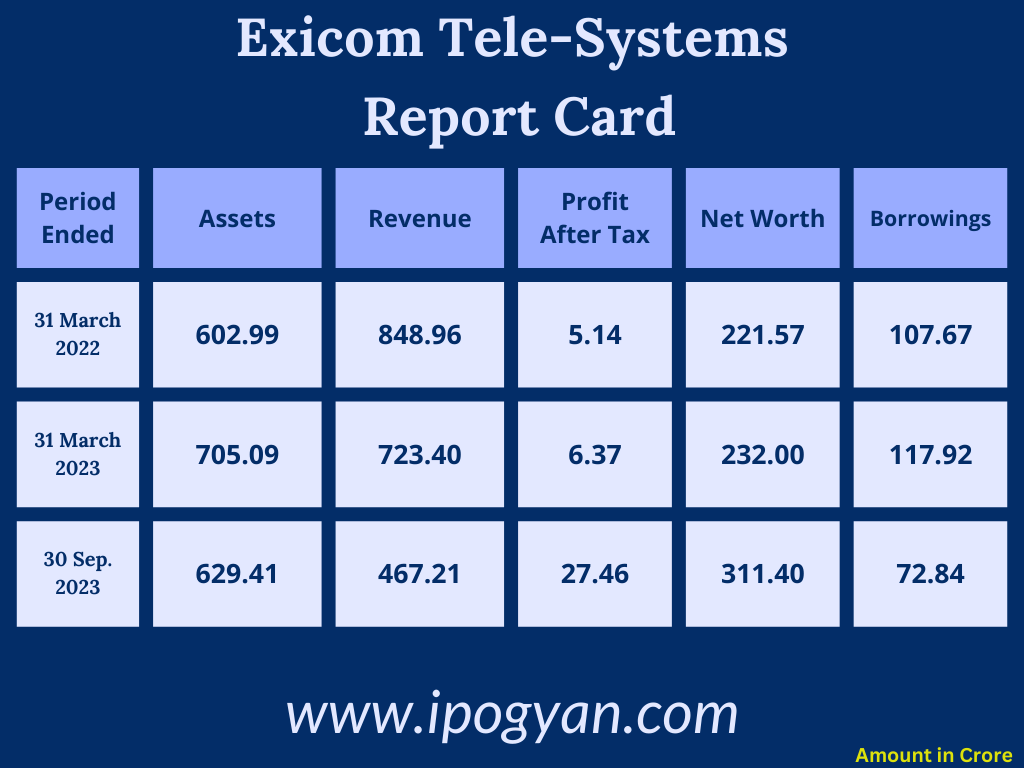

Company Financial Details:

AS OF NOW, the GMP Of Exicom Tele Systems is Around 132 Rs.

Objects Of Issue:

1. Providing partial funding for the establishment of production or assembly lines at the upcoming manufacturing facility in Telangana.

2. Repaying or pre-paying a portion or the entirety of specific loans taken by our company.

3. Assisting with the partial financing of increased working capital needs.

4. Investing in research and development as well as product enhancement initiatives.

5. Utilizing funds for general corporate endeavors.

Promoters:

- NEXTWAVE COMMUNICATIONS PRIVATE LIMITED

- ANANT NAHATA

FAQs:

When Exicom Tele Systems IPO is Opening?

Exicom Tele Systems IPO is Opening on 27 February 2024.

When is the Exicom Tele Systems IPO Closing?

Exicom Tele Systems IPO is Closing on 29 February 2024.

What is the Issue Size of the Exicom Tele Systems IPO?

The IPO Issue Size of Exicom Tele Systems is 429 Crore.

Price Band of Exicom Tele Systems IPO?

The price Band of Exicom Tele Systems IPO is 135 to 142 rupees per share.

What is the minimum investment for an Exicom Tele Systems IPO?

The minimum investment for the Exicom Tele Systems IPO is 14,200 Rupees.

Allotment Date of Exicom Tele Systems IPO?

The Allotment of Exicom Tele Systems IPO is on 01 March 2024.

Listing Date of Exicom Tele Systems IPO?

The Listing Of Exicom Tele Systems is Scheduled on 05 March 2024.

One Should Apply for Exicom Tele Systems IPO or Not?

Will Update Soon..

How to apply for Exicom Tele Systems IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Exicom Tele Systems IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Exicom Tele Systems IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Exicom Tele Systems IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Exicom Tele Systems IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Exicom Tele Systems IPO from the list ——–> Click on Exicom Tele Systems IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Exicom Tele Systems?

Monarch Networth Capital Limited, Unistone Capital Private Limited, and Systematix Corporate Services Limited are the Lead Managers of Exicom Tele Systems.

Where To Check the Allotment of Exicom Tele Systems IPO?

The allotment status for the Exicom Tele Systems IPO will be accessible on the Link Intime India Private Limited website.

Exicom Tele Systems IPO is going to be listed at?

Exicom Tele Systems IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Exicom Tele Systems IPO?

The lot size of the Exicom Tele Systems IPO is 100 Shares.

What is the P/E Ratio of the Exicom Tele Systems?

The P/E Ratio of the Exicom Tele Systems is 217.63.

What is the EPS of the Exicom Tele Systems?

The EPS of the Exicom Tele Systems is 0.65.

What is the ROE of the Exicom Tele Systems?

The ROE of Exicom Tele Systems is 13.38%.

What is the ROCE of the Exicom Tele Systems?

The ROCE of the Exicom Tele Systems is 10.92%.