Fedbank Financial Services, an NBFC focused on customers and backed by The Federal Bank Limited stands out in the financial industry. In Fiscal 2023 it has the second lowest costs of borrowing compared to players, in the MSMEs, gold loan, and MSME & gold loan sectors in India. Moreover among its peers in the NBFC sector Fedbank Financial Services has achieved growth in its Asset Under Management (AUM) with a Compound Annual Growth Rate (CAGR) of 33%, between Fiscals 2020 and 2023.

Fedbank Financial Services, one of the five bank-promoted NBFCs, in India, has gained recognition as the fastest-growing gold loan NBFC in the country as of March 31, 2023. A significant portion of their Loan Assets accounting for 85.98% is secured by assets such as gold or customer’s property. The company strategically focuses on catering to the MSMEs and emerging self-employed individuals (ESEIs) sector in India identifying substantial growth opportunities, within this segment.

Fedbank Financial Services has a range of products, on offer including mortgage loans (housing loans, small ticket loans against property, and medium ticket LAP) unsecured business loans, and gold loans. As of March 31, 2023, they have reported figures for their assets under management (AUM) in mortgage loans gold loans, and unsecured business loans. Moreover, they have received ratings from agencies like CARE (“AA” for their non-convertible debentures since 2022) and India Ratings and Research Private Limited (“AA ”, for their NCDs and bank loans since 2018).

With Federal Bank, as its stakeholder owning more than 51% of its total outstanding shares after the completion of the Offer, Fedbank Financial Services highlights its extensive history of operations proven track record, skilled management team, and the trust associated with the well-known “Federal Bank” brand. Based in Mumbai, Maharashtra it operates in 16 states and union territories throughout India with a presence, in the Western regions. The company has a network of 575 branches spread across 191 districts and adopts a doorstep approach that combines digital and physical initiatives to provide customized customer services.

Fedbank Financial Services employs a driven underwriting model that combines data and physical information to evaluate creditworthiness. Through a risk management strategy, they have successfully handled defaults and Non-Performing Assets (NPAs) across their range of products.

Fedbank Financial Services possesses advantages that contribute to its competitive edge, in the Indian retail credit sector. These include its presence in underexplored markets a focus on collateralized lending for retail loan offerings a strong underwriting capability, an experienced management team, a diversified funding profile an operational model driven by technology, and a commitment, to catering to underserved market segments.

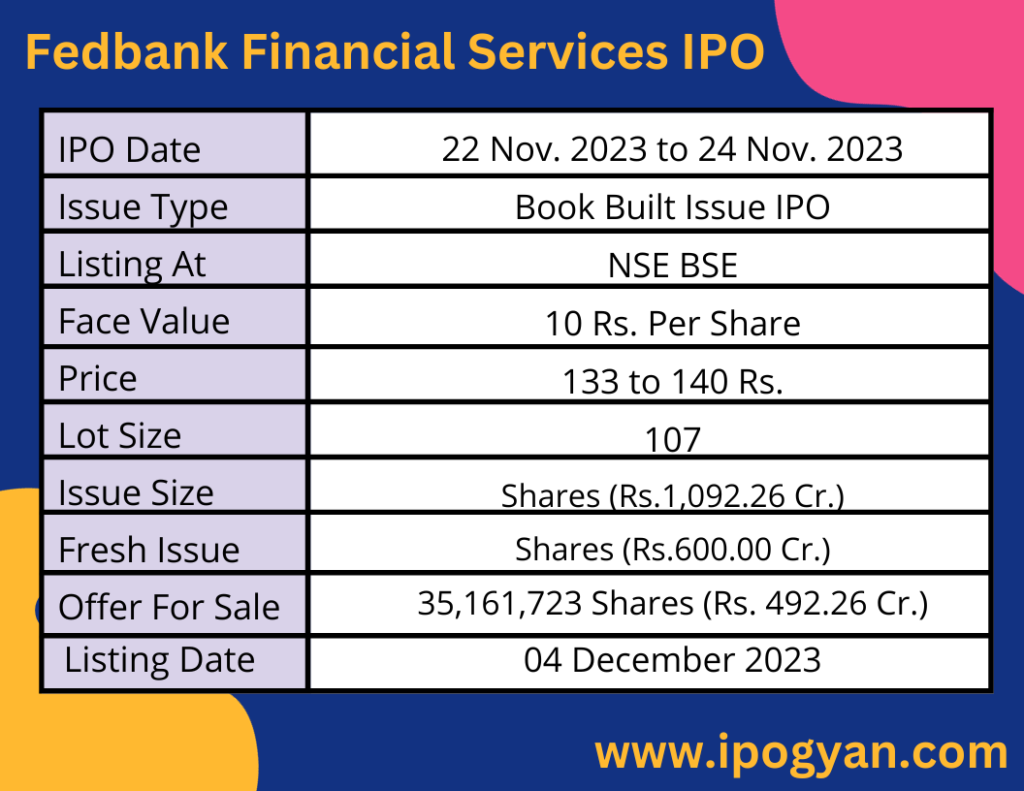

Fedbank Financial Services IPO Complete Details:

Fedbank Financial Services IPO Timetable:

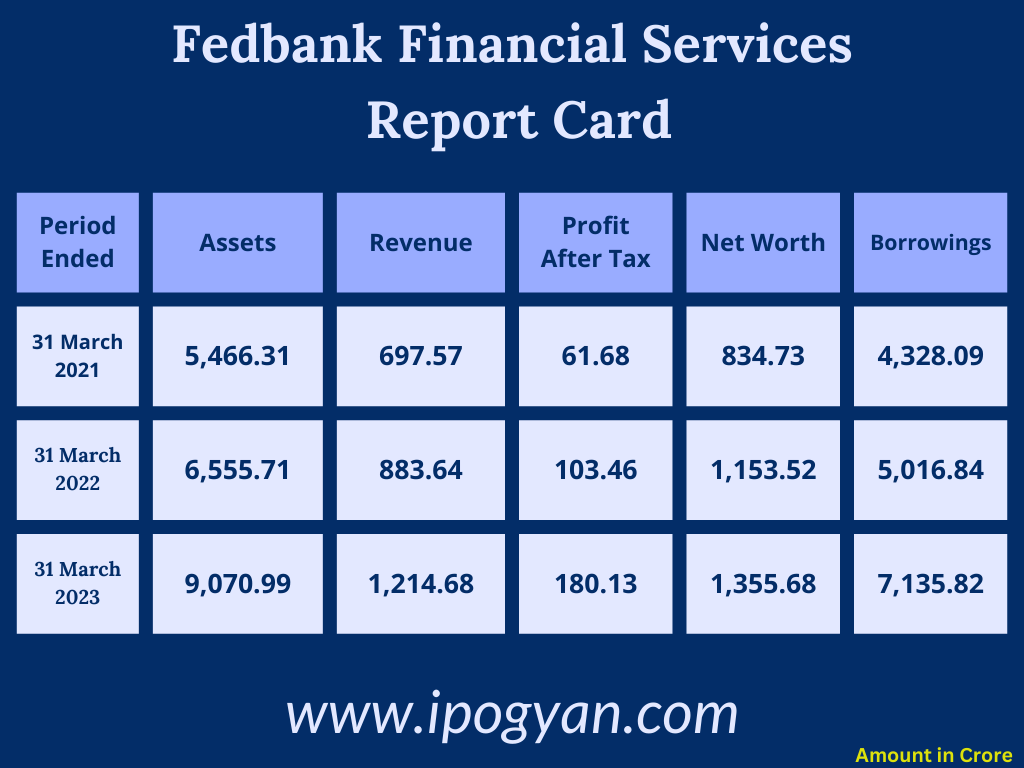

Company Financial Details:

AS OF NOW, the GMP OF Fedbank Financial Services is Around 13 Rs.

Objects Of Issue:

1) The company plans to use the funds raised from the shares to strengthen its Tier. I capital base. This will help meet capital needs resulting from business growth and asset expansion.

2) Furthermore a portion of the proceeds generated through the issuance of shares will be allocated to cover expenses related to the offering.

Promoters:

The promoter of Fedbank Financial Services is The Federal Bank Limited.

FAQs:

When Fedbank Financial Services IPO is Opening?

Fedbank Financial Services IPO is Opening on 22 November 2023.

When is the Fedbank Financial Services IPO Closing?

Fedbank Financial Services IPO is Closing on 24 November 2023.

What is the Issue Size of the Fedbank Financial Services IPO?

The IPO Issue Size of the Fedbank Financial Services is 1,092.26 Crore.

Price Band of Fedbank Financial Services IPO?

The price Band of Fedbank Financial Services IPO is 133 to 140 rupees per share.

What is the minimum investment for a Fedbank Financial Services IPO?

The minimum investment for the Fedbank Financial Services IPO is 14,980 Rupees.

Allotment Date of Fedbank Financial Services IPO?

The Allotment of Fedbank Financial Services IPO is on 30 November 2023.

Listing Date of Fedbank Financial Services IPO?

The Listing Of Fedbank Financial Services is Scheduled on 05 December 2023.

One Should Apply for Fedbank Financial Services IPO or Not?

will update soon

How to apply for a Fedbank Financial Services IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Fedbank Financial Services IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Fedbank Financial Services IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Fedbank Financial Services IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Fedbank Financial Services IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Fedbank Financial Services IPO from the list ——–> Click on Fedbank Financial Services IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of the Fedbank Financial Services?

ICICI Securities Limited, BNP Paribas, Equirus Capital Private Limited, and JM Financial Limited are the Lead Managers of the Fedbank Financial Services.

Where To Check the Allotment of Fedbank Financial Services IPO?

The allotment status for the Fedbank Financial Services IPO will be accessible on the Link Intime India Private Limited Website.

Fedbank Financial Services IPO is going to be listed at?

Fedbank Financial Services IPO is going to be listed at BSE NSE.

What is the Lot Size of the Fedbank Financial Services IPO?

The lot size of the Fedbank Financial Services IPO is 107 Shares.

What is the EPS of the Fedbank Financial Services IPO?

The EPS of the Fedbank Financial Services is 5.6 Rupees.

What is the P/E Ratio of the Fedbank Financial Services IPO?

The P/E Ratio of the Fedbank Financial Services is 25.04.

What is the RoNW of the Fedbank Financial Services IPO?

The RoNW of the Fedbank Financial Services is 13.29%.