Flair Writing Industries takes pride in offering a range of products that cater to budgets appealing to a diverse group of consumers such, as students, professionals, and offices. The company specializes in producing and distributing writing instruments, like pens, stationery items, and calculators. Building on its manufacturing capabilities and loyal customer base Flair Writing Industries has expanded its offerings to include products and stainless steel bottles.

During the year 2023 Flair Writing Industries experienced sales of pens reaching a total of 1,303.60 million units. The majority of these pens 74.82% were sold within the market while the remaining 25.18% were exported globally. When compared to players, in the writing and creative instruments industry what sets Flair apart is its extensive distribution network in India. As of March 31 2023, Flair boasts a network comprising, around 7,700 distributors and dealers and 315,000 wholesalers and retailers.

Flair Writing Industries produces and sells brands, such, as “Flair ” “Hauser,” “Pierre Cardin ” and the introduced “ZOOX.” These brands cater to segments of the market including market, premium, mid-premium, and high-end writing instruments. In addition to this, the company also manufactures writing instruments for companies under their brand name (OEM). They offer customized gifting products for clients, which include a range of pens (ball pens, fountain pens, gel pens, roller pens, and metal pens) stationery items (mechanical pencils, highlighters, correction pens, markers) gel crayons, and kids stationery kits) as well, as calculators.

Flair Writing Industries also introduced a line of products called “Flair Creative” which includes products like watercolors, crayons, sketch pens, erasers, wooden pencils, geometry boxes, fine liners, sharpeners, and scales.

The company has recently diversified its operations by venturing into the production of household items. This includes casseroles, bottles, storage containers, serving solutions, cleaning solutions, baskets, and paper bins. They have accomplished this expansion through their subsidiary called FWEPL.

Flair Writing Industries has received an order, from an OEM customer, with whom they have had a standing relationship of over 15 years. They have already commissioned one manufacturing line in March 2023. They are planning to commission two lines in the second half of the Financial Year 2024. These additional lines will be located at their manufacturing plant in Valsad, Gujarat. The company operates a total of 11 manufacturing plants situated across regions, including Valsad and Naigaon (near Mumbai) in Maharashtra, Daman (Union Territory of Dadra and Nagar Haveli well as Daman and Diu), and Dehradun, in Uttarakhand.

Flair Writing Industries, in India, connects with customers through a ranging sales and distribution network that includes super stockists, distributors, direct dealers, wholesalers, and retailers. This extensive network helps them understand customer preferences and gather market feedback. As of March 31, 2023, the company had 131 super stockists across India supported by a team of 900 sales and marketing employees. The company has maintained standing relationships with the 5 super stockists who have been contributing to their revenue for approximately 25 years on average. As of March 31, 2023, the company’s retail distribution covers an expanse of 2,387 cities, towns, and villages, throughout India.

Flair Writing Industries IPO Complete Details:

Flair Writing Industries IPO Timetable:

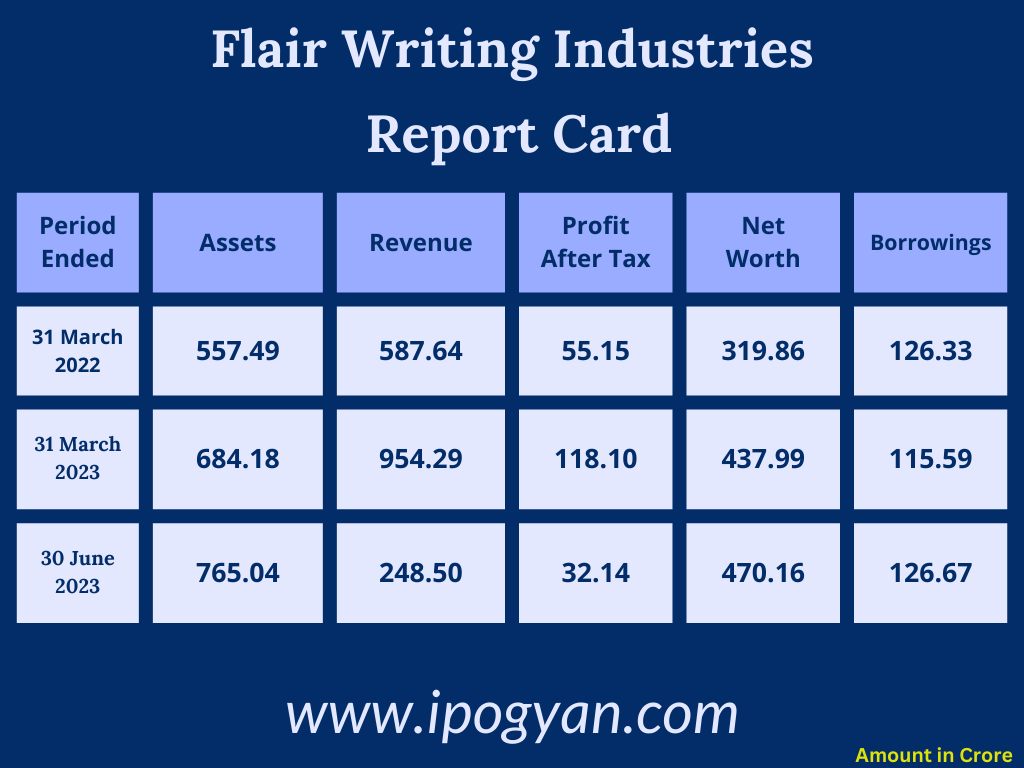

Company Financial Details:

AS OF NOW, the GMP OF Flair Writing Industries is Around 53 Rs.

Objects Of Issue:

1. The establishment of a new manufacturing facility for writing instruments in District Valsad, Gujarat (“New Valsad Unit”) is underway.

2. Capital expenditure funding is being sought for both our Company and our Subsidiary, FWEPL.

3. Adequate funding for working capital requirements is being pursued for our Company and its Subsidiaries, FWEPL and FCIPL.

4. The exploration of options includes the potential partial or full repayment/pre-payment of specific borrowings obtained by our Company and its Subsidiaries, FWEPL and FCIPL.

5. Consideration is being given to utilizing funds for general corporate purposes by our Company and its Subsidiaries.

Promoters:

1)Khubilal Jugraj Rathod

Position: Chairman and Full-time Director

Education: Matriculate

Experience: Over 48 years in the writing instruments industry

2)Vimalchand Jugraj Rathod

Position: Managing Director

Education: Fellow member of the Institute of Chartered Accountants of India, Bachelor of Commerce degree from Bangalore University

Experience: Over 40 years in the writing instruments industry

FAQs:

When Flair Writing Industries IPO is Opening?

Flair Writing Industries IPO is Opening on 22 November 2023.

When is the Flair Writing Industries IPO Closing?

Flair Writing Industries IPO is Closing on 24 November 2023.

What is the Issue Size of the Flair Writing Industries IPO?

The IPO Issue Size of the Flair Writing Industries is 593 Crore.

Price Band of Flair Writing Industries IPO?

The price Band of Flair Writing Industries IPO is 288 to 304 rupees per share.

What is the minimum investment for a Flair Writing Industries IPO?

The minimum investment for the Flair Writing Industries IPO is 14,896 Rupees.

Allotment Date of Flair Writing Industries IPO?

The Allotment of Flair Writing Industries IPO is on 30 November 2023.

Listing Date of Flair Writing Industries IPO?

The Listing Of Flair Writing Industries is Scheduled on 05 December 2023.

One Should Apply for Flair Writing Industries IPO or Not?

will update soon

How to apply for a Flair Writing Industries IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Flair Writing Industries IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Flair Writing Industries IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Flair Writing Industries IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for a Flair Writing Industries IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Flair Writing Industries IPO from the list ——–> Click on Flair Writing Industries IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of the Flair Writing Industries?

Nuvama Wealth Management Limited and Axis Capital Limited are the Lead Managers of the Flair Writing Industries.

Where To Check the Allotment of Flair Writing Industries IPO?

The allotment status for the Flair Writing Industries IPO will be accessible on the Link Intime India Private Limited Website.

Flair Writing Industries IPO is going to be listed at?

Flair Writing Industries IPO is going to be listed at BSE NSE.

What is the Lot Size of the Flair Writing Industries IPO?

The lot size of the Flair Writing Industries IPO is 49 Shares.

What is the EPS of the Flair Writing Industries IPO?

The EPS of the Flair Writing Industries is 12.66 Rupees.

What is the P/E Ratio of the Flair Writing Industries IPO?

The P/E Ratio of the Flair Writing Industries is 24.01.

What is the RoNW of the Flair Writing Industries IPO?

The RoNW of the Flair Writing Industries is 31.17%.

What is the ROE of the Flair Writing Industries IPO?

The ROE of the Flair Writing Industries is 31.17%.

What is the ROCE of the Flair Writing Industries IPO?

The ROCE of the Flair Writing Industries is 31.24%.