Go Digit General Insurance strives to make insurance easier focusing on providing a smooth customer journey through creativity and openness. As an insurance provider, they use technology to transform how non-life insurance products are created, distributed, and serviced.

They manage all insurance tasks internally handling everything from finding policies to evaluating risks and providing customer service operating as a supervised organization. They provide insurance options such, as car, travel, home, marine, and liability coverage, among others with a focus, on tailoring plans to suit each person’s specific requirements.

Their modular APIs allow for data sharing, between their systems and third-party platforms used by partners reducing the need for involvement. These APIs are incorporated throughout their operations to streamline tasks such, as policy issuance, servicing, payments, and claims processing.

They provide a range of products including car, health, travel, home, sea, liability insurance, and more. Currently, they have launched 66 products, out of which 64 are still available while 2 are no longer offered as of December 31, 2022.

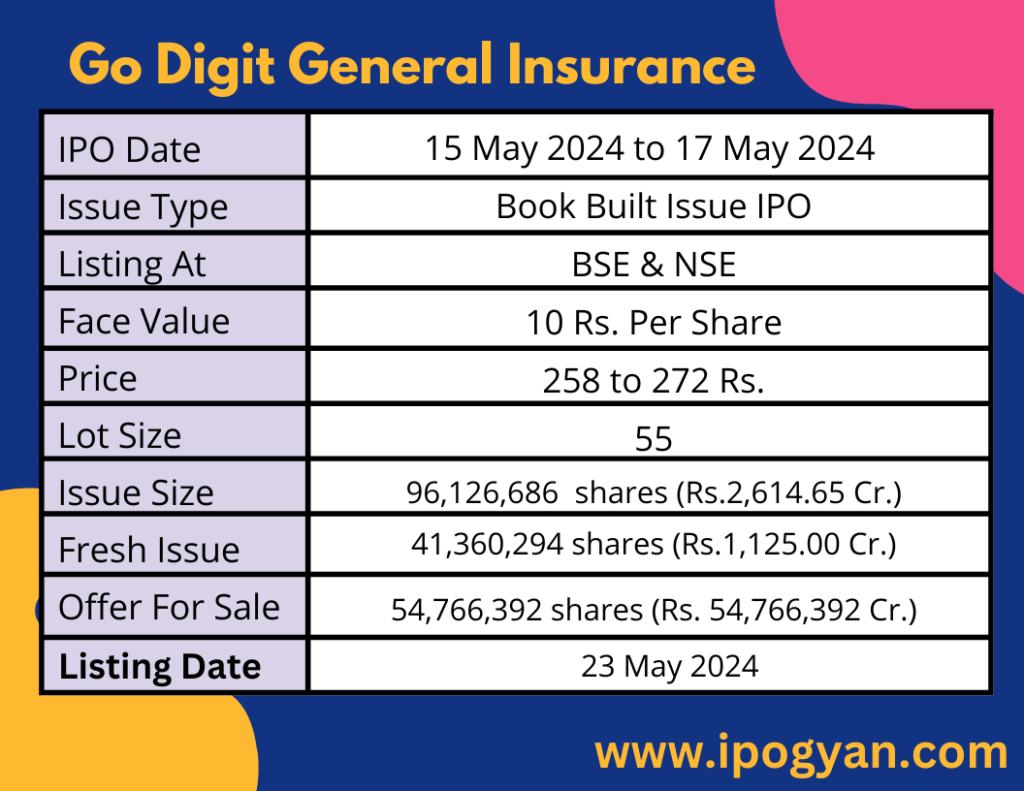

Go Digit General Insurance IPO Complete Details:

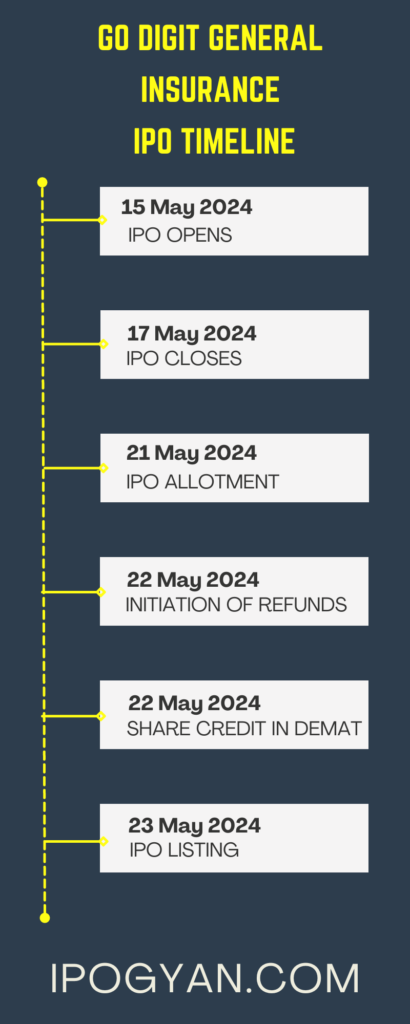

Go Digit General Insurance IPO Timetable:

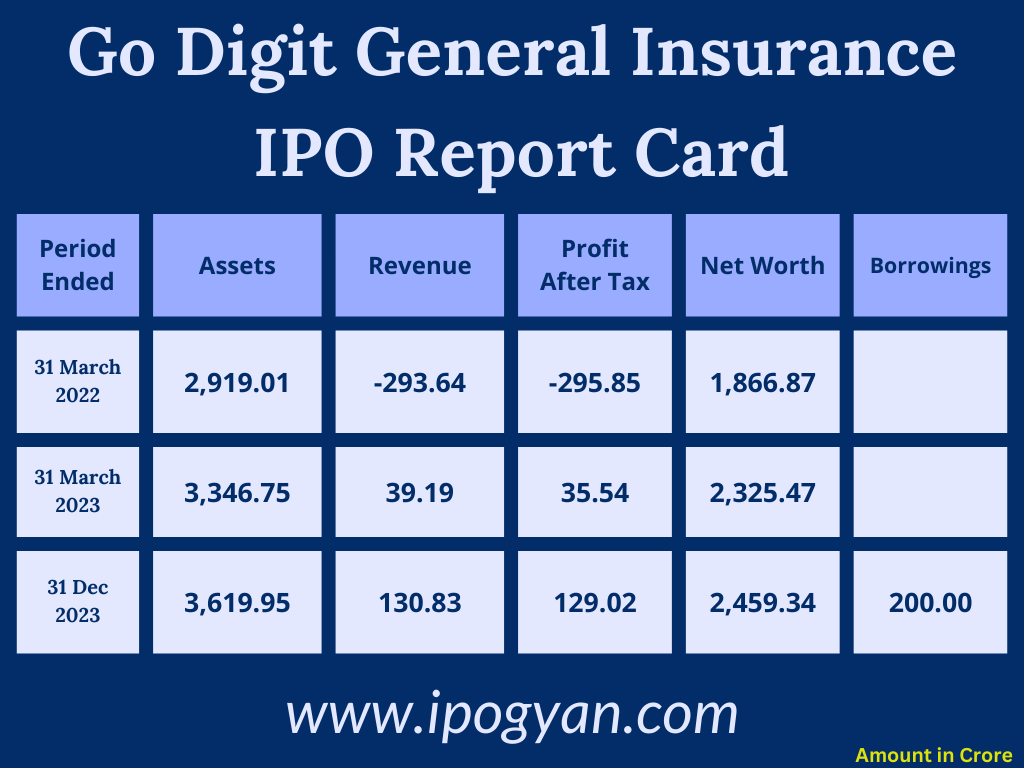

Company Financial Details:

AS OF NOW, the GMP Of Go Digit General Insurance is Around 43 Rs.

Objects Of Issue:

1. The company plans to utilize the proceeds for two main purposes:

– Supporting its current business activities.

– Funding activities outlined in its future plans.

2. Listing the Equity Shares on the Stock Exchanges is expected to:

– Increase visibility.

– Improve the company’s brand image among both current and potential customers.

Promoters:

- KAMESH GOYAL

- GO DIGIT INFOWORKS SERVICES PRIVATE LIMITED

- OBEN VENTURES LLP

- FAL CORPORATION

FAQs:

When Go Digit General Insurance IPO is Opening?

Go Digit General Insurance IPO is Opening on 15 May 2024.

When is the Go Digit General Insurance IPO Closing?

Go Digit General Insurance IPO is Closing on 17 May 2024.

What is the Issue Size of the Go Digit General Insurance IPO?

The IPO Issue Size of Go Digit General Insurance is 2,614.65 Crore.

Price Band of Go Digit General Insurance IPO?

The price Band of the Go Digit General Insurance IPO is 258 to 272 rupees per share.

What is the minimum investment for a Go Digit General Insurance IPO?

The minimum investment for the Go Digit General Insurance IPO is 14,960 Rupees.

Allotment Date of Go Digit General Insurance IPO?

The Allotment of Go Digit General Insurance IPO is on 21 May 2024.

Listing Date of Go Digit General Insurance IPO?

The Listing Of Go Digit General Insurance is Scheduled on 23 May 2024.

One Should Apply for Go Digit General Insurance IPO or Not?

Will Update Soon..

How to apply for Go Digit General Insurance IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Go Digit General Insurance IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Go Digit General Insurance IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Go Digit General Insurance IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Go Digit General Insurance IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Go Digit General Insurance IPO from the list ——–> Click on Go Digit General Insurance IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Go Digit General Insurance?

ICICI Securities Limited, Morgan Stanley India Company Pvt Ltd, Axis Capital Limited, Hdfc Bank Limited, IIFL Securities Ltd, and Nuvama Wealth Management Limited are the Lead Managers of Go Digit General Insurance.

Where To Check the Allotment of Go Digit General Insurance IPO?

The allotment status for the Go Digit General Insurance IPO will be accessible on the Link Intime India Private Ltd Website.

Go Digit General Insurance IPO is going to be listed at?

Go Digit General Insurance IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Go Digit General Insurance IPO?

The lot size of the Go Digit General Insurance IPO is 55 Shares.

What is the P/E Ratio of the Go Digit General Insurance?

The P/E Ratio of the Go Digit General Insurance is 670.31.

What is the EPS of the Go Digit General Insurance?

The EPS of the Go Digit General Insurance is 0.41.

What is the ROE of the Go Digit General Insurance?

The ROE of Go Digit General Insurance is N/A.

What is the ROCE of the Go Digit General Insurance?

The ROCE of Go Digit General Insurance is N/A.