Gopal Namkeen, a known company, in the fast-moving consumer goods industry, provides a wide variety of items like traditional snacks, international snacks, and other consumer products. The brand has achieved success in market segments holding the fourth position among organized brands for ethnic snacks and being the leading producer of gathiya and snack pellets, in India.

In Gujarat, which is an area, for enjoying snacks Gopal Namkeen was positioned as the second-largest producer of organized ethnic namkeen and ranked fourth in the sale of packaged ethnic namkeen in India. Moreover, it also secured a spot in the papad market, within India. Gopal Namkeen has cleverly broadened its range of products to cater to consumer tastes with a total of 84 products and 276 different product variations.

Product Portfolio

- 8 Types Of Gathiya

- 31 Types Of Namkeen

- 12 Types Of Snack Pellets

- 8 Flavours of Waffers

- 4 Types Of Papad

- 6 Types Of Spices

- 5 Types Of Extruded Snacks

- 9 Other Products

- 1 Besan

Gopal Namkeen has a presence, across ten states and two Union Territories, supported by an established distribution network that includes depots, distributors, and logistics vehicles. The company has put in place a strong distribution management system to streamline operations and efficiently address customer needs.

Key Highlights

- First largest Gathiya Manufacturer in India

- First largest Snack Pellets Manufacturer in India

- Second largest Manufacturer of Organised Ethnic Namkeen in Gujarat

- Fourth largest Papad Manufacturer in India

- Primary Manufacturing Facilities with an installed capacity of 979.58 MT per day

- 8.01 Million Packets Sold Per Day

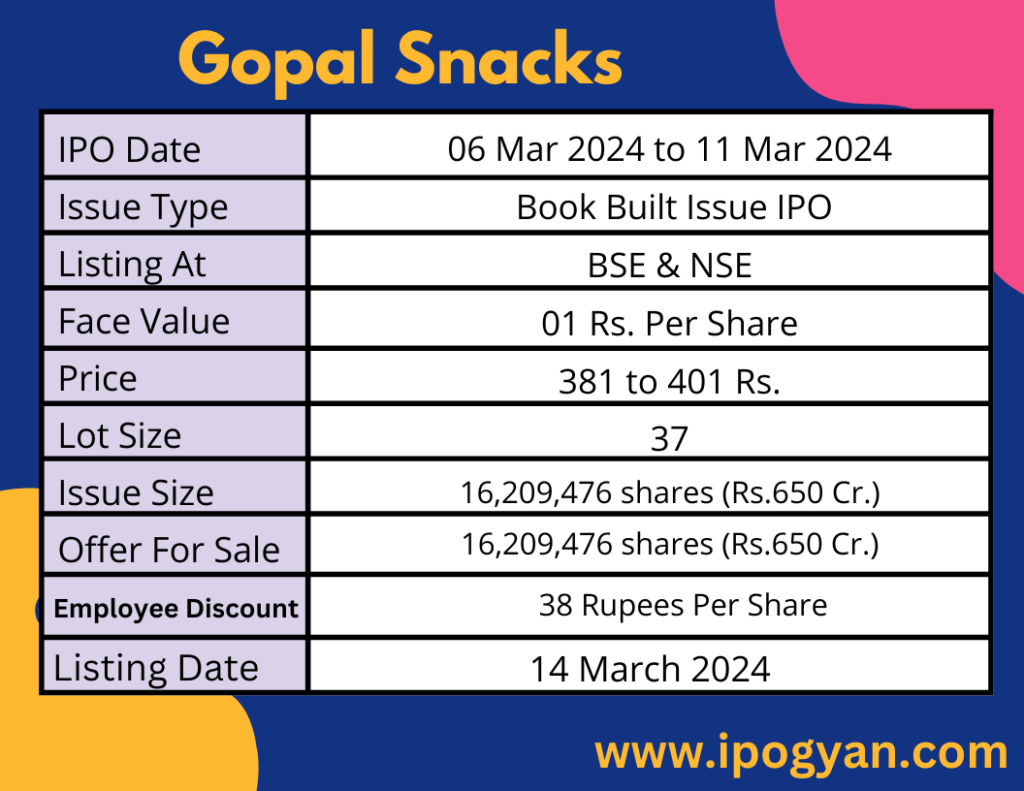

Gopal Namkeen IPO Complete Details:

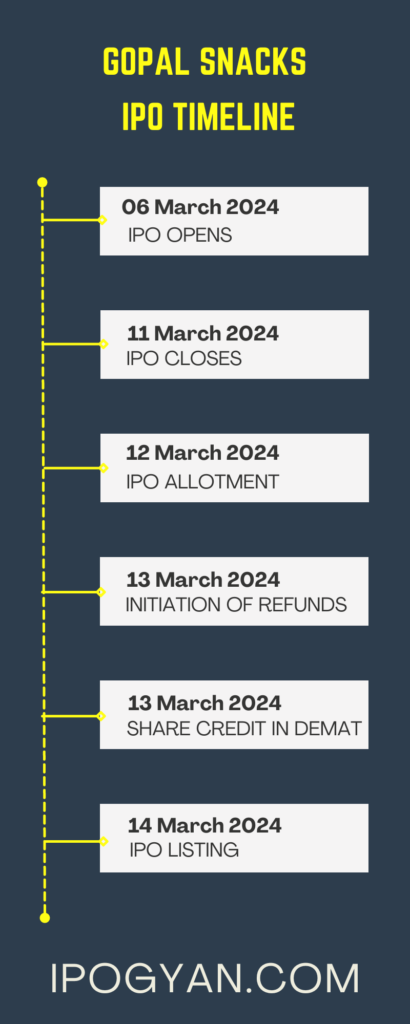

Gopal Namkeen IPO Timetable:

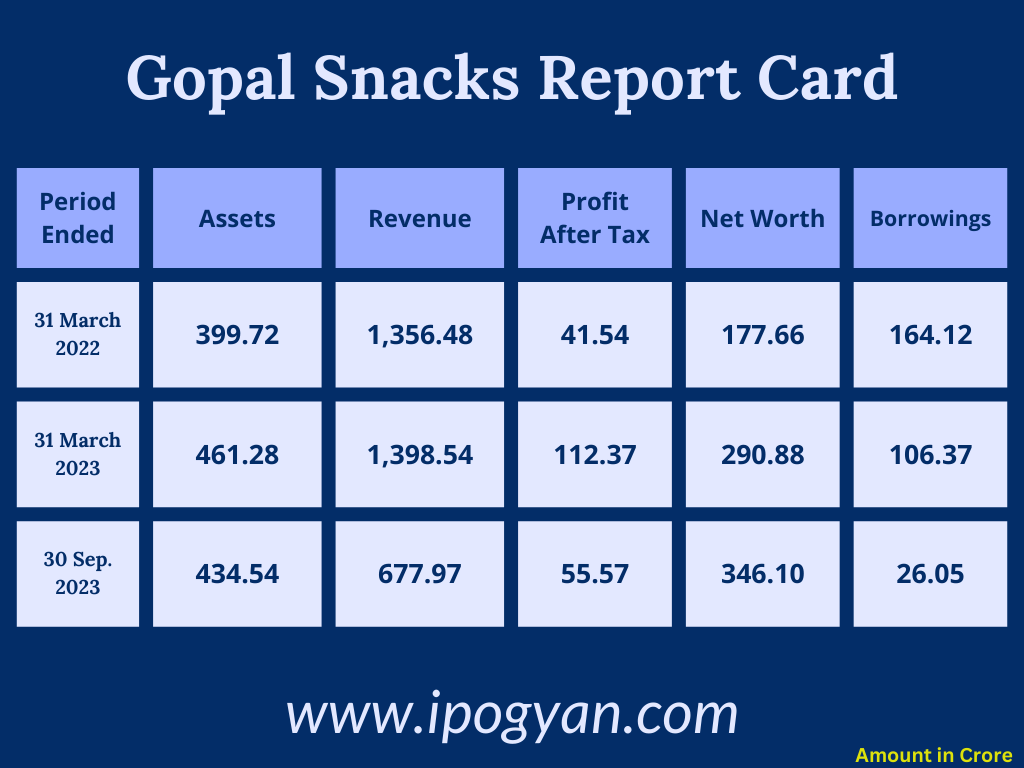

Company Financial Details:

AS OF NOW, the GMP Of Gopal Namkeen is Around 121 Rs.

Objects Of Issue:

The company will not receive any proceeds from the Offer (referred to as the “Offer Proceeds”). Instead, all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer.

Promoters:

- BIPINBHAI VITHALBHAI HADVANI

- DAKSHABEN BIPINBHAI HADVANI

- GOPAL AGRIPRODUCTS PRIVATE LIMITED

FAQs:

When Gopal Namkeen IPO is Opening?

Gopal Namkeen IPO is Opening on 06 March 2024.

When is the Gopal Namkeen IPO Closing?

Gopal Namkeen IPO is Closing on 11 March 2024.

What is the Issue Size of the Gopal Namkeen IPO?

The IPO Issue Size of Gopal Namkeen is 650 Crore.

Price Band of Gopal Namkeen IPO?

The price Band of Gopal Namkeen IPO is 381 to 401 rupees per share.

What is the minimum investment for a Gopal Namkeen IPO?

The minimum investment for the Gopal Namkeen IPO is 14,837 Rupees.

Allotment Date of Gopal Namkeen IPO?

The Allotment of Gopal Namkeen IPO is on 12 March 2024.

Listing Date of Gopal Namkeen IPO?

The Listing Of Gopal Namkeen is Scheduled on 14 March 2024.

One Should Apply for Gopal Namkeen IPO or Not?

Will Update Soon..

How to apply for Gopal Namkeen IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Gopal Namkeen IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Gopal Namkeen IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Gopal Namkeen IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Gopal Namkeen IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Gopal Namkeen IPO from the list ——–> Click on Gopal Namkeen IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Gopal Namkeen?

Intensive Fiscal Services Private Limited, Axis Capital Limited, and JM Financial Limited are the Lead Managers of Gopal Namkeen.

Where To Check the Allotment of Gopal Namkeen IPO?

The allotment status for the Gopal Namkeen IPO will be accessible on the Link Intime India Private Limited website.

Gopal Namkeen IPO is going to be listed at?

Gopal Namkeen IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Gopal Namkeen IPO?

The lot size of the Gopal Namkeen IPO is 37 Shares.

What is the P/E Ratio of the Gopal Namkeen?

The P/E Ratio of the Gopal Namkeen is 44.47.

What is the EPS of the Gopal Namkeen?

The EPS of the Gopal Namkeen is 9.02.

What is the ROE of the Gopal Namkeen?

The ROE of Gopal Namkeen is 16.05%.

What is the ROCE of the Gopal Namkeen?

The ROCE of the Gopal Namkeen is 20.83%.