Hi-Green Carbon Limited, headquartered in Rajkot, Gujarat, is currently a subsidiary of the Radhe Group of Energy, which was founded by Dr. Shaileshkumar Vallabhdas Makadia. The company is expanding very fast in the renewable energy industry, with a mixed portfolio that includes castings, consumer goods, corporate farming, packaging, and herbal items.

Hi-Green Carbon Limited was founded with a mission to create wealth from waste by focusing on waste tyre recycling. The promoters and professionals work with the main goal of building a better environment for future generations through waste recycling.

The main business of the company is waste tyre recycling using a continuous pyrolysis process, which is a completely automated technology with little human participation. The process converts end-of-life tyers into energy components and raw materials, with major products including Recovered Carbon Black (rCB) and Steel Wires in the Raw Material Category, and Fuel Oil and Synthesis Gas in the Energy Components Category. The synthesis gas produced as a by-product is also used for manufacturing sodium silicate, commonly known as raw glass.

Hi-Green Carbon Limited commits to the highest quality standards and complies with the recycling industry’s most stringent Environmental, Health, and Safety (EHS) requirements.

The company’s manufacturing plant in Rajasthan is equipped with modern Supervisory Control and Data Acquisition (SCADA) systems and has a recycling capacity of 100 metric tons of waste tyres per day.

In its expansion plans, Hi-Green Carbon Limited is proposing the construction of a new manufacturing plant in the Dhule district of Maharashtra, with a capacity to recycle 100 metric tons of waste tyres per day. For this aim, the company has already purchased a land piece covering 21,500 square meters, which will greatly increase its present tyre processing capacity.

In the context of Hi-Green Carbon Limited’s major product offerings as outlined in their Draft Red Herring Prospectus:

a) Recovered Carbon Black (rCB): Recovered Carbon Black is a processed solid residue resulting from the pyrolysis of end-of-life tyres (ELTs). It has a wide range of uses, including use as a tyre reinforcing agent. Recovered carbon black has found expanded applications as a pigment, UV stabilizer, and conductive agent in various common and specialized products across multiple sectors:

Plastics: Carbon black is widely employed in plastic master-batch applications, encompassing uses in conductive packaging, films, fibers, moldings, pipes, and semi-conductive cable compounds.

Toners and Printing Inks: Carbon black plays an essential role in the formulation of toners and printing inks, by offering substantial flexibility in achieving precise color requirements and improving overall performance.

Coatings: Within the coatings industry, carbon black serves multiple functions, including pigmentation, conductivity enhancement, and UV protection.

Tyres and Industrial Rubber Products: Carbon black is integral to the manufacturing of tyres, contributing to tire inner liners, carcasses, sidewalls, and treads.

Activated Carbon: Carbon black can be subjected to further processing to yield activated carbon, which experiences substantial demand in the filter, purification, and chemical industries.

As a Fuel: Carbon black represents a valuable energy source, offering an environmentally favorable alternative to coal and petroleum coke (pat-coke) for combustion. Its use as a fuel generates reduced levels of pollution in comparison to pat-coke.

b) Fuel Oil: Fuel oil derived from the pyrolysis process, sometimes referred to as bio-crude or bio-oil, is being explored as a synthetic fuel substitute for petroleum. Tire-derived fuel (TDF), a form of fuel oil obtained from tire pyrolysis, boasts a higher energy content.

c) Sodium Silicate: Sodium silicates are translucent or crystalline solids or white powders. With the exception of silicon-rich variants, they are readily soluble in water, producing alkaline solutions.

d) Steel Wires: Steel tire wire scrap is obtained through the shredding of waste tyres. This scrap contains a carbon component and is a byproduct of the tire-shredding process.

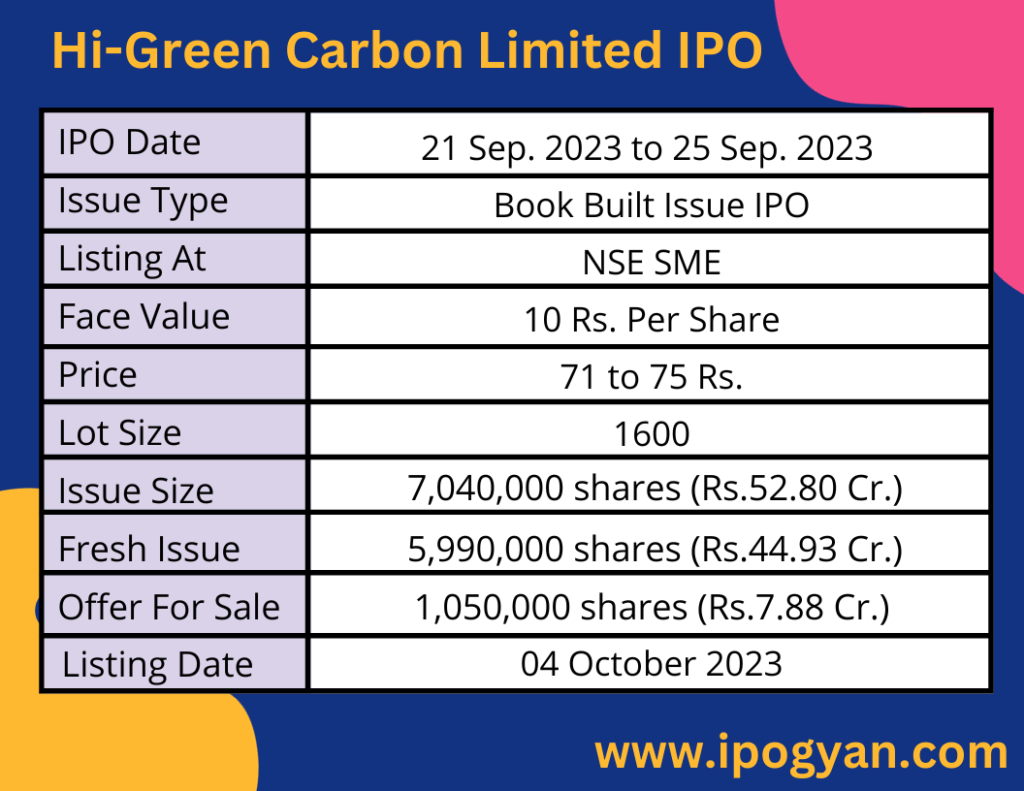

Hi-Green Carbon Limited IPO Complete Details:

Hi-Green Carbon Limited IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Hi-Green Carbon Limited is Around 45 Rs.

Objects Of Issue:

- Establishment of a New Manufacturing Facility in Maharashtra

- Fulfillment of Working Capital Needs

- General Corporate Objectives

- Covering Expenses Associated with the Public Offering

Promoters and Group:

The promoters of Hi-Green Carbon Limited include M/S RNG Finlease Private Limited, Mr. Amitkumar Hasmukhrai Bhalodi, Dr. Shaileshkumar Vallabhdas Makadia, Mrs. Krupa Chetankumar Dethariya, Mrs. Radhika Amitkumar Bhalodi, Mrs. Shriyakumari Shaileshkumar Makadia, and Mr. Koosh Chetankumar Dethariya.

FAQs:

When Hi-Green Carbon Limited’s IPO is Opening?

Hi-Green Carbon Limited IPO is Opening on 21 September 2023(Wednesday).

When Hi-Green Carbon Limited IPO is Closing?

Hi-Green Carbon Limited IPO is Closing on 25 September 2023(Friday).

What is the IPO Issue Size of Hi-Green Carbon Limited?

The IPO Issue Size of Hi-Green Carbon Limited is 52.80 Crore.

Price Band of Hi-Green Carbon Limited IPO?

The price Band of Hi-Green Carbon Limited IPO is 71 to 75 rupees per share.

What is the minimum investment for Hi-Green Carbon Limited IPO?

The minimum investment for Hi-Green Carbon Limited IPO is 120,000 Rupees.

Allotment Date of Hi-Green Carbon Limited IPO?

The Allotment of Hi-Green Carbon Limited IPO is on 28 September 2023(Thursday).

Listing Date of Hi-Green Carbon Limited IPO?

The Listing Of Hi-Green Carbon Limited is Scheduled on 04 October 2023(Wednesday).

One Should Apply Hi-Green Carbon Limited IPO or Not?

will update soon!

How to apply for Hi-Green Carbon Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Hi-Green Carbon Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Hi-Green Carbon Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Hi-Green Carbon Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Hi-Green Carbon Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Hi-Green Carbon Limited IPO from the list ——–> Click on Hi-Green Carbon Limited IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Hi-Green Carbon Limited IPO’s Lead Manager?

Beeline Broking Ltd is the Lead Manager of Hi-Green Carbon Limited.

Where To Check the Allotment of Hi-Green Carbon Limited IPO?

The allotment status for the Hi-Green Carbon Limited IPO will be accessible on the Link Intime India Private Ltd Website.

What is the Earning Per Share (EPS) of Hi-Green Carbon Limited?

The earning Per Share (EPS) of Hi-Green Carbon Limited is 5.71 Rs.

What is the P/E Ratio of Hi-Green Carbon Limited?

The P/E Ratio of Hi-Green Carbon Limited is 13.13.