HOAC Foods India, founded in 2018 specializes in producing chakki atta (flour) herbs, spices, unpolished pulses, grains, and yellow mustard oil. The company sells its items, under the brand name “HARIOM” in and, around the Delhi NCR area via its Exclusive Brand Outlets. By obtaining materials from regions of India and processing them without artificial preservatives or chemicals HOAC Foods India offers a range of organic spices and flour that preserves the freshness and natural essence of each component.

HOAC Foods India’s senior management team is well-qualified, with experience in production, sales, procurement of agri-commodities, and franchisee relations. Currently, most sales are derived from the Delhi-NCR region. The company operates 4 company-owned and 6 franchisee-owned Exclusive Brand Outlets, supported by a sales and marketing team of 12 employees as of December 31, 2023. HOAC Foods India also utilizes a D2C platform through its mobile application available on Google Play Store and Apple’s App Store, and its company website.

HOAC Foods India’s product range includes MP Sharbati Atta, MP Lok One Atta, Multi-grain Atta, and various healthy flours. HOAC Foods India’s product portfolio includes 4 categories: Spices & Herbs, Oil, Wheat Flour (Chakki Atta) & Healthy Flour, Pulses, Rice & Grain, and other food products, comprising 153 product SKUs.

HOAC Foods India also offers tea masala and other grocery products such as mustard oil, sambhar masala, channa masala, chaat masala, and various grains and rice, sold exclusively through its brand retail outlets and D2C platforms. All products are packaged under the HARIOM brand name.

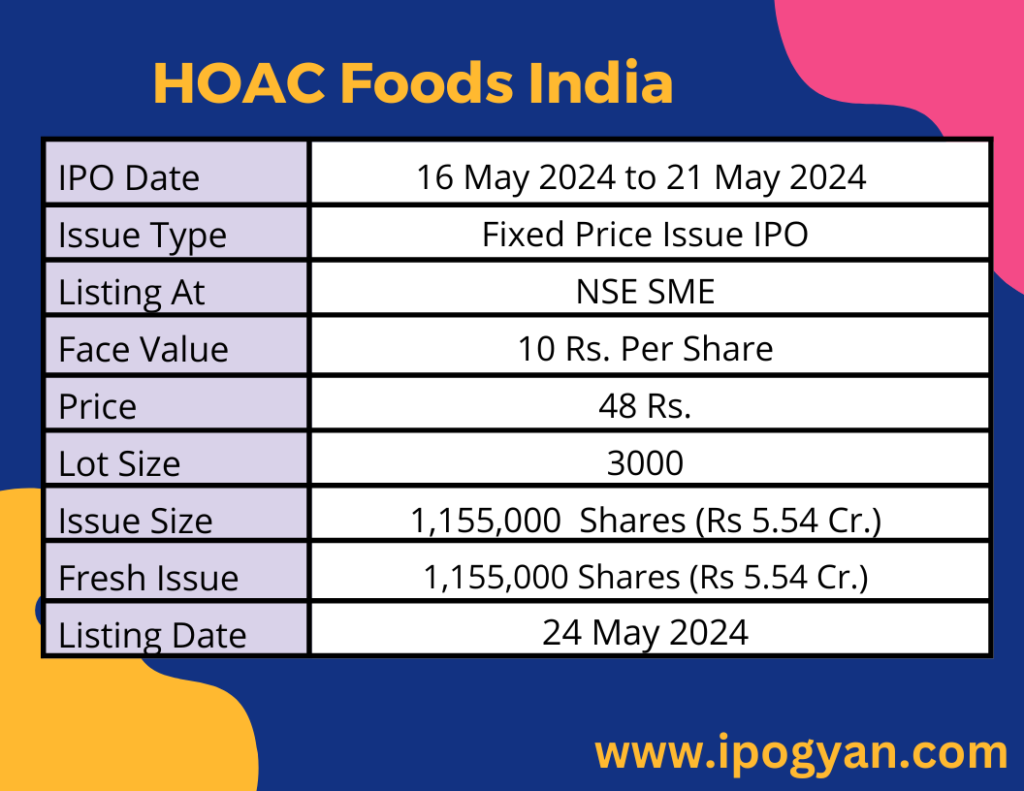

HOAC Foods India IPO Complete Details:

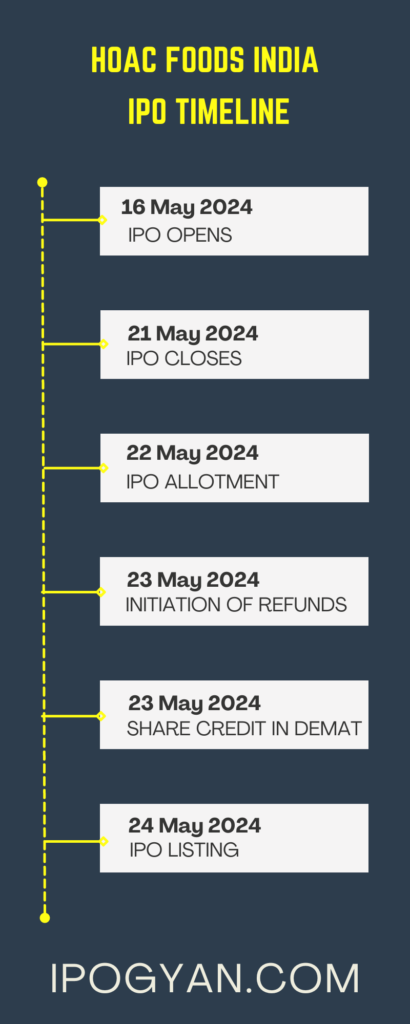

HOAC Foods India IPO Timetable:

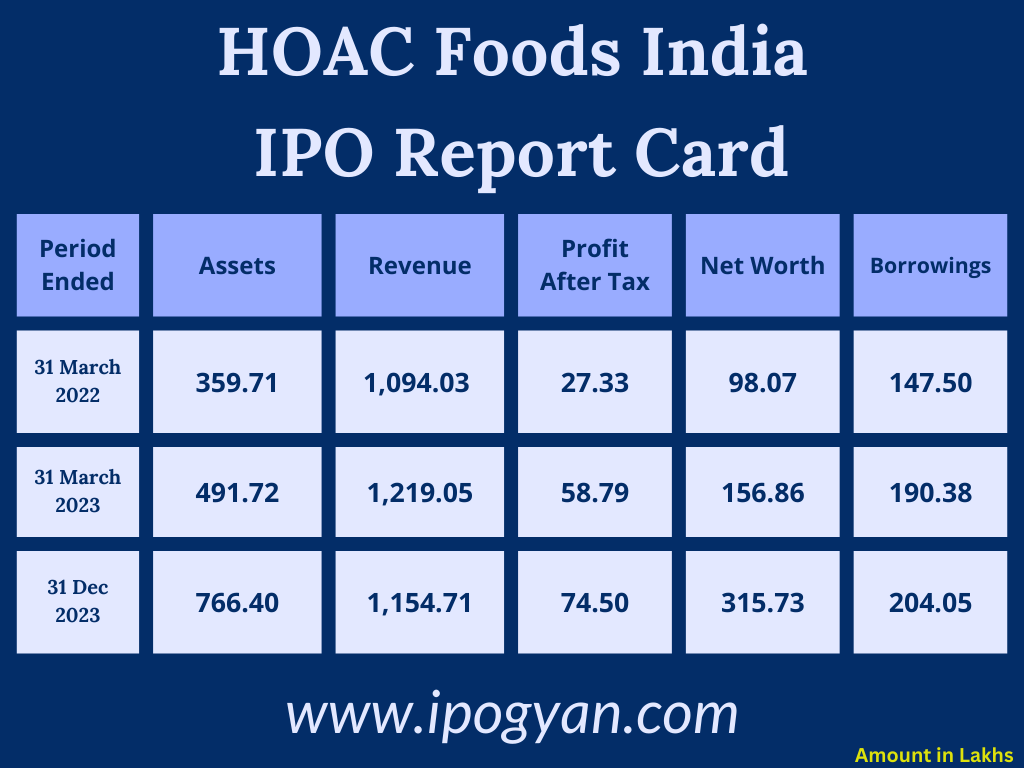

Company Financial Details:

AS OF NOW, the GMP Of HOAC Foods India is Around 75 Rs.

Objects Of Issue:

a) To fund the company’s working capital requirements

b) For general corporate purposes

Promoters:

- MR. RAMBABU THAKUR

- MRS. GAYTRI THAKUR

- MR. YASHWANT THAKUR

FAQs:

When HOAC Foods India IPO is Opening?

HOAC Foods India IPO is Opening on 16 May 2024.

When is the HOAC Foods India IPO Closing?

HOAC Foods India IPO is Closing on 21 May 2024.

What is the Issue Size of the HOAC Foods India IPO?

The IPO Issue Size of HOAC Foods India is 5.54 Crore.

Price Band of HOAC Foods India IPO?

The price Band of the HOAC Foods India IPO is 48 rupees per share.

What is the minimum investment for a HOAC Foods India IPO?

The minimum investment for the HOAC Foods India IPO is 144,000 Rupees.

Allotment Date of HOAC Foods India IPO?

The Allotment of HOAC Foods India IPO is on 22 May 2024.

Listing Date of HOAC Foods India IPO?

The Listing Of HOAC Foods India is Scheduled on 24 May 2024.

One Should Apply for HOAC Foods India IPO or Not?

Will Update Soon..

How to apply for HOAC Foods India IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find HOAC Foods India IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for HOAC Foods India IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find HOAC Foods India IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for HOAC Foods India IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find HOAC Foods India IPO from the list ——–> Click on HOAC Foods India IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of HOAC Foods India?

GYR Capital Advisors Private Limited is the Lead Manager of HOAC Foods India.

Where To Check the Allotment of HOAC Foods India IPO?

The allotment status for the HOAC Foods India IPO will be accessible on the Kfin Technologies Limited Website.

HOAC Foods India IPO is going to be listed at?

HOAC Foods India IPO is going to be listed at NSE SME.

What is the Lot Size of the HOAC Foods India IPO?

The lot size of the HOAC Foods India IPO is 3000 Shares.

What is the P/E Ratio of the HOAC Foods India?

The P/E Ratio of the HOAC Foods India is 21.95.

What is the EPS of the HOAC Foods India?

The EPS of the HOAC Foods India is 2.19.

What is the ROE of the HOAC Foods India?

The ROE of HOAC Foods India is 23.60%.

What is the ROCE of the HOAC Foods India?

The ROCE of HOAC Foods India is 23.43%.