Honasa Consumer Incorporated in 2016 is the leading beauty and personal care company in India when it comes to revenue for the Financial Year 2022. Their main goal has always been to create products that cater to the beauty and personal care needs of consumers. Take their flagship brand, Mamaearth for example. It focuses on providing natural beauty products that are free from harmful toxins. Mamaearth has quickly become the growing BPC (beauty and personal care) brand in India.

Since launching Mamaearth in 2016, Honasa Consumer has added five new brands to its portfolio, namely The Derma Co., Aqualogica, Ayuga, BBlunt, and Dr. Sheth’s, and has built a ‘House of Brands’ architecture. As of September 30, 2022, its portfolio of brands with differentiated value propositions includes products in the baby care, face care, body care, hair care, color cosmetics, and fragrances segments.

Honasa Consumers achievements, with Mamaearth and its knack for recognizing and addressing emerging trends, have paved the way for the creation of strategies that have successfully propelled their brands to rapid growth. These strategies are based on a customer-focused approach that encompasses aspects of their business model, such, as practices, digital-first omnichannel distribution, and marketing techniques driven by technology and consumer data analysis.

Moreover, the company is consistently striving to establish connections, with its customers and enhance its brand reputation by creating brands that are driven by purpose and associated with social causes. As an example through the Mamaearth ‘Plant Goodness campaign, Honasa Consumer collaborates with a governmental organization to plant trees for every order placed on its direct-to-consumer platform. Furthermore, they share geotagged images of these trees with their customers. Similarly The Derma Co. Is involved in a ‘Young Scientists program that provides science education to children in areas of India. Additionally, Aqualogica supports the ‘Fresh Water for All’ initiative aimed at ensuring marginalized communities have access, to drinking water.

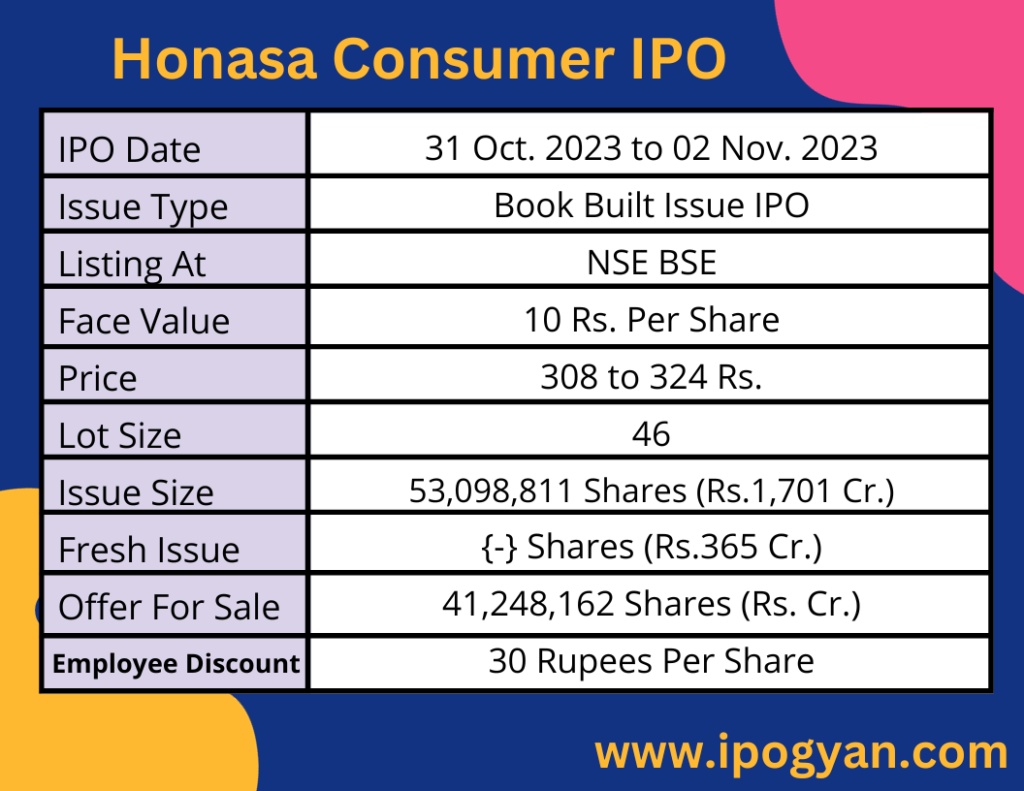

Honasa Consumer IPO Complete Details:

Honasa Consumer IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Honasa Consumer is Around 07 Rs.

Objects Of Issue:

- Allocating funds for advertising to boost brand awareness and improve brand visibility.

- Budgeting for the capital expenses required to establish new Exclusive Brand Outlets (EBOs) for our company.

- Investing in our subsidiary, Bhabani Blunt Hairdressing Private Limited (“BBlunt”), to support the expansion of new salon locations.

- Utilizing funds for general corporate needs and potential strategic acquisitions that have not yet been identified.

Promoters:

Varun Alagh:

- Position: Promoter, Chairman, Whole-time Director, and Chief Executive Officer

- Educational Background:

- Bachelor’s degree in Electrical Engineering from the University of Delhi, Delhi

- Post-graduate diploma in Business Management from XLRI, Jamshedpur

- Professional Experience: Previously worked with Hindustan Lever Limited, Diageo India Private Limited, and Coca-Cola India Private Limited for over a year.

Ghazal Alagh:

- Position: Promoter, full-time director, and Chief Innovation Officer

- Educational Background:

- Bachelor’s degree in Computer Applications from Panjab University, Chandigarh

- Certification in Software Engineering from the Academic Council of the NIIT Academy, New Delhi.

- Additional Note: Ghazal Alagh also appeared as a “Shark” on Shark Tank India Season 1.

FAQs:

When Honasa Consumer IPO is Opening?

Honasa Consumer IPO is Opening on 31 October 2023.

When Honasa Consumer IPO is Closing?

Honasa Consumer IPO is Closing on 02 November 2023.

What is the Issue Size of Honasa Consumer IPO?

The IPO Issue Size of Honasa Consumer is 365 Crore

Price Band of Honasa Consumer IPO?

The price Band of Honasa Consumer IPO is 308 to 324 rupees per share.

What is the minimum investment for a Honasa Consumer IPO?

The minimum investment for Honasa Consumer IPO is 14,904 Rupees.

Allotment Date of Honasa Consumer IPO?

The Allotment of Honasa Consumer IPO is on 07 November 2023.

Listing Date of Honasa Consumer IPO?

The Listing Of Honasa Consumer is Scheduled on 10 November 2023.

One Should Apply for Honasa Consumer IPO or Not?

will update soon

How to apply for Honasa Consumer IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Honasa Consumer IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Honasa Consumer IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Honasa Consumer IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Honasa Consumer IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Honasa Consumer IPO from the list ——–> Click on Honasa Consumer IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Honasa Consumer Lead Manager?

Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, JM Financial Limited, and J.P. Morgan India Private Limited are the Lead Managers of Honasa Consumer.

Where To Check the Allotment of Honasa Consumer IPO?

The allotment status for the Honasa Consumer IPO will be accessible on the Kfin Technologies Limited Website.

Honasa Consumer IPO is going to be listed at?

Honasa Consumer IPO is going to be listed at NSE BSE.

What is the Lot Size of the Honasa Consumer IPO?

The lot size of the Honasa Consumer IPO is 46 Shares.

What is the EPS of Honasa Consumer IPO?

The EPS of Honasa Consumer is 4.66 Rupees.

What is the P/E Ratio of Honasa Consumer IPO?

The P/E Ratio of Honasa Consumer is 105.54.