Indegene offers digital-based commercialization services to the life sciences sector catering to biopharmaceutical emerging biotech and medical device firms. They support in areas such, as drug research, clinical trials, regulatory approvals, pharmacovigilance, handling complaints, and sales and marketing. Their goal is to enhance the effectiveness, efficiency, and contemporary nature of product development, introduction, and sales by blending healthcare knowledge with technology solutions.

Their Enterprise Commercial Solutions specialize in marketing strategies supporting businesses in developing tailored marketing strategies reaching out to healthcare professionals (HCPs) and offering insights, into HCP preferences. The Omnichannel Activation solutions utilize tools to promote products to HCPs through various platforms.

Enterprise Medical Solutions creates centers of excellence (CoEs) to bring medical functions supporting tasks such, as medical writing, regulatory submissions, pharmacovigilance, and real world evidence (RWE) research. Additionally, they provide Enterprise Clinical Solutions to streamline drug discovery and clinical trial activities.

In addition Indegene offers services via its subsidiary DT Associates Limited, to assist life sciences firms in their transformation initiatives. Indegenes overarching goal is to aid life sciences companies in navigating the intricacies of the sector and attaining success, in the age of digitalization.

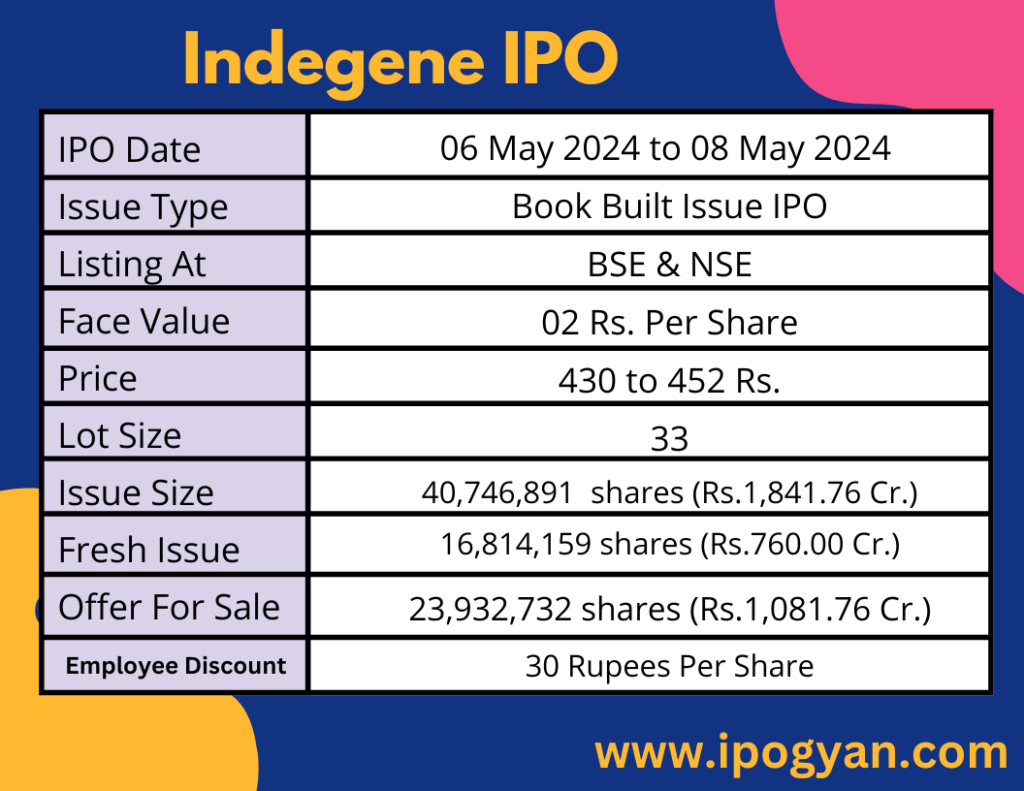

Indegene IPO Complete Details:

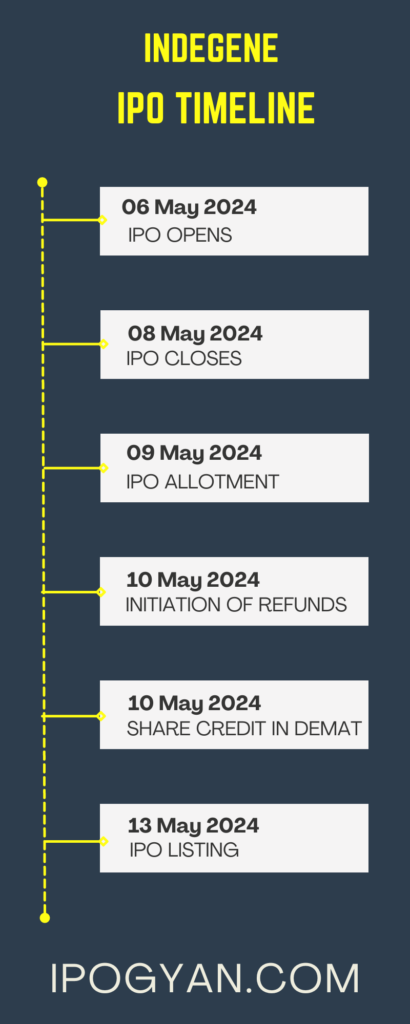

Indegene IPO Timetable:

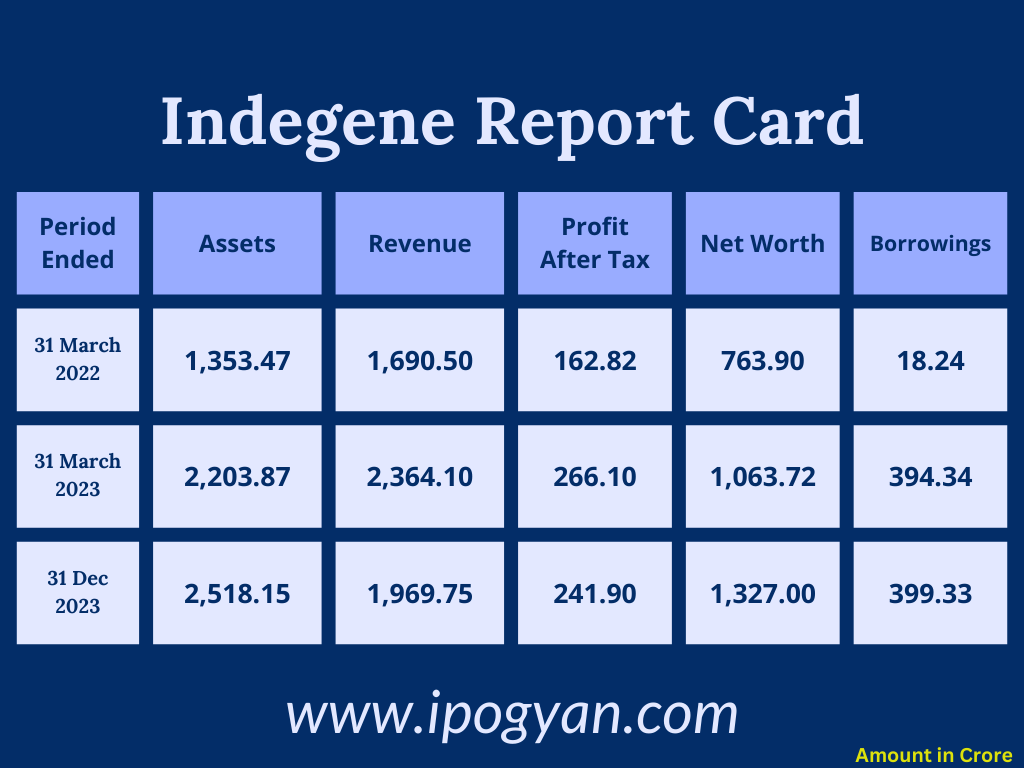

Company Financial Details:

AS OF NOW, the GMP Of Indegene is Around 243 Rs.

Objects Of Issue:

1. Repaying or prepaying the debts of one of their significant subsidiaries, ILSL Holdings, Inc.

2. Meeting the capital expenditure needs of both their company and another important subsidiary, Indegene, Inc.

3. Covering general corporate expenses and supporting inorganic growth initiatives.

Promoters:

- DOES NOT HAVE AN IDENTIFIABLE PROMOTER

FAQs:

When Indegene IPO is Opening?

Indegene IPO is Opening on 06 May 2024.

When is the Indegene IPO Closing?

Indegene IPO is Closing on 08 May 2024.

What is the Issue Size of the Indegene IPO?

The IPO Issue Size of Indegene is 1,841.76 Crore.

Price Band of Indegene IPO?

The price Band of the Indegene IPO is 430 to 452 rupees per share.

What is the minimum investment for Indegene IPO?

The minimum investment for the Indegene IPO is 14,916 Rupees.

Allotment Date of Indegene IPO?

The Allotment of Indegene IPO is on 09 May 2024.

Listing Date of Indegene IPO?

The Listing Of Indegene is Scheduled on 13 May 2024.

One Should Apply for Indegene IPO or Not?

Will Update Soon..

How to apply for Indegene IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Indegene IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Indegene IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Indegene IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Indegene IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Indegene IPO from the list ——–> Click on Indegene IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Indegene?

Kotak Mahindra Capital Company Limited, Citigroup Global Markets India Private Limited, J.P. Morgan India Private Limited, and Nomura Financial Advisory & Securities (India) Pvt Ltd are the Lead Managers of Indegene.

Where To Check the Allotment of Indegene IPO?

The allotment status for the Indegene IPO will be accessible on the Link Intime India Private Ltd Website.

Indegene IPO is going to be listed at?

Indegene IPO is going to be listed at BSE and NSE.

What is the Lot Size of the Indegene IPO?

The lot size of the Indegene IPO is 33 Shares.

What is the P/E Ratio of the Indegene?

The P/E Ratio of the Indegene is 37.78.

What is the EPS of the Indegene?

The EPS of the Indegene is 11.96.

What is the ROE of the Indegene?

The ROE of Indegene is N/A.

What is the ROCE of the Indegene?

The ROCE of Indegene is N/A.