Italian Edibles has been committed to creating confectionery items, under the brand name “ofcour’s.” They offer a range of products such, as Rabdi, Milk Paste, Chocolate Paste, Lollipops, Candies, Jelly Candies, Multi-Grain Puff Rolls, and Fruit Based Products. The company’s values are centered around the ideas of sharing and bringing joy through creations.

Italian Edibles in response, to the diversity and multitude of festivals in India distributes its confectionery products throughout the entire country, including rural and semi-urban areas. Additionally, the company has expanded its market by exporting its products to nations such, as Nigeria, Yemen, Senegal, and Sudan. The main target audience comprises teenagers, young adults, and children residing in semi-parts of India.

As of August 31, 2023, some of the customers of Italian Edibles are Chocolate World, Yuvraj Agency, Bakewell Biscuits Private Limited, R. K. Prabhavati Traders, Mamta Stores, Ma Laxmi Traders, and Suria Distributor. One of their products is Jelly Candies which they supply to the Dharpal Premchand Ltd (BABA) group. The company takes pride in its distribution network that spans across 22 states, in India and includes 450 suppliers and distributors.

In addition, to their products, Italian Edibles also partners with customers to create Private labeled products. They offer a range of third-party products in the confectionery market available for wholesale purchase. These products come in packaging options, like Pet Jars, polypacks, and cardboard boxes.

Italian Edibles has been operating for 14 years. Has successfully built a brand both in India and internationally. They credit their achievements to their knowledge of target markets understanding of consumer preferences and their commitment, to creating products. The company’s distribution network, strict quality control processes, and strategic marketing efforts have played a role, in boosting their sales and overall growth over time.

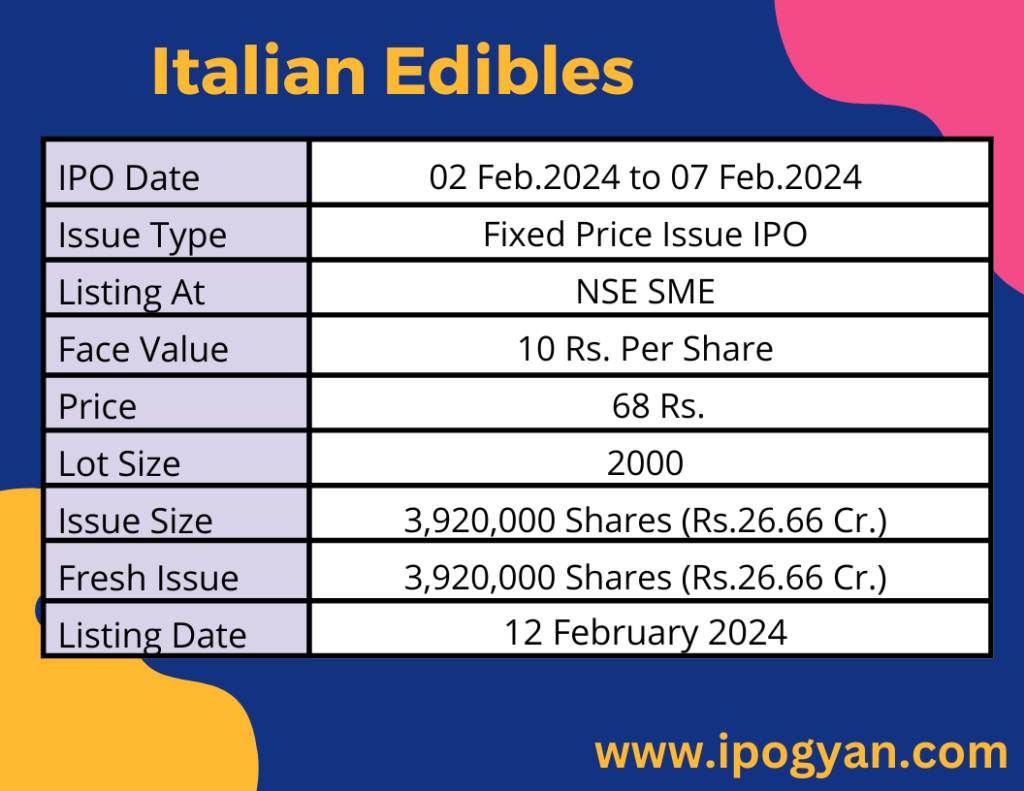

Italian Edibles IPO Complete Details:

Italian Edibles IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Italian Edibles is Around 00 Rs.

Objects Of Issue:

1) Establishment of the planned manufacturing facility;

2) Settling specific outstanding borrowings;

3) Addressing increased working capital needs; and

4) Covering general corporate expenditures.

Promoters:

Mr. Ajay Makhija:

– Position: Promoter and Managing Director

– Age: 58 years

– Education: Completed Higher Secondary education

Mr. Akshay Makhija:

– Position: Promoter Executive, Director, and Chief Executive Officer

– Age: 34 years

– Education: Holds a Bachelor’s degree in Business Administration from Devi Ahilya Vishwavidyalaya, Indore, and a Master’s degree in the field of Management from Punjab Technical University, Jalandhar.

– Experience: More than 14 years in the confectionery industry.

FAQs:

When Italian Edibles IPO is Opening?

Italian Edibles IPO is Opening on 02 February 2024.

When is the Italian Edibles IPO Closing?

Italian Edibles IPO is Closing on 07 February 2024.

What is the Issue Size of the Italian Edibles IPO?

The IPO Issue Size of Italian Edibles is 26.66 Crore.

Price Band of Italian Edibles IPO?

The price Band of Italian Edibles IPO is 68 rupees per share.

What is the minimum investment for an Italian Edibles IPO?

The minimum investment for the Italian Edibles IPO is 136,000 Rupees.

Allotment Date of Italian Edibles IPO?

The Allotment of Italian Edibles IPO is on 08 February 2024.

Listing Date of Italian Edibles IPO?

The Listing Of Italian Edibles is Scheduled on 12 February 2024.

One Should Apply for Italian Edibles IPO or Not?

Will Update Soon..

How to apply for Italian Edibles IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Italian Edibles IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Italian Edibles IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Italian Edibles IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Italian Edibles IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Italian Edibles IPO from the list ——–> Click on Italian Edibles IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Italian Edibles?

First Overseas Capital Limited is the Lead Manager of Italian Edibles.

Where To Check the Allotment of Italian Edibles IPO?

The allotment status for the Italian Edibles IPO will be accessible on the Bigshare Services Private Limited Website.

Italian Edibles IPO is going to be listed at?

Italian Edibles IPO is going to be listed at NSE SME.

What is the Lot Size of the Italian Edibles IPO?

The lot size of the Italian Edibles IPO is 2000 Shares.

What is the P/E Ratio of the Italian Edibles IPO?

The P/E Ratio of the Italian Edibles is 27.94.

What is the ROE of the Italian Edibles IPO?

The ROE of the Italian Edibles IPO is 24.50%.

What is the ROCE of the Italian Edibles IPO?

The ROCE of the Italian Edibles IPO is 19.32.

What is the EPS of the Italian Edibles IPO?

The EPS of the Italian Edibles IPO is 2.43.