LE TRAVENUES TECHNOLOGY (IXIGO) is a technology enterprise dedicated to empowering Indian travelers to plan, book, and manage their trips across rail, air, buses, and hotels. By leveraging artificial intelligence, machine learning, and data science innovations, IXIGO assists travelers in making smarter travel decisions on its OTA platforms, which include websites and mobile applications. IXIGO’s vision is to become the most customer-centric travel company, offering the best customer experience to its users. Focused on travel utility and customer experience for travelers in the ‘next billion user’ market segment, IXIGO’s approach is driven by technology, cost-efficiency, and a culture of innovation.

IXIGO’s online travel agency (OTA) platforms allow travelers to easily make reservations, for train tickets, flight tickets, bus tickets, and accommodations. These platforms also provide a range of travel tools and services created using algorithms and input from the public. These services include train PNR status and confirmation predictions, train seat availability alerts, train running status updates and delay predictions, alternate route or mode planning, flight status updates, automated web check-in, bus running status, pricing and availability alerts, deal discovery, destination content, personalized recommendations, instant fare alerts for flights, an AI-based travel itinerary planner, and automated customer support services.

Throughout its user’s interactions, LE TRAVENUES TECHNOLOGY (IXIGO) has effectively Offered tickets and Value Added Services or supplementary services related to its booking options. These offerings encompass ixigo Assured ixigo Assured Flex, Abhi Assured the choice of seats onboard dining selections, visa assistance, travel insurance, and vehicle rental services.

IXIGO IPO Complete Details:

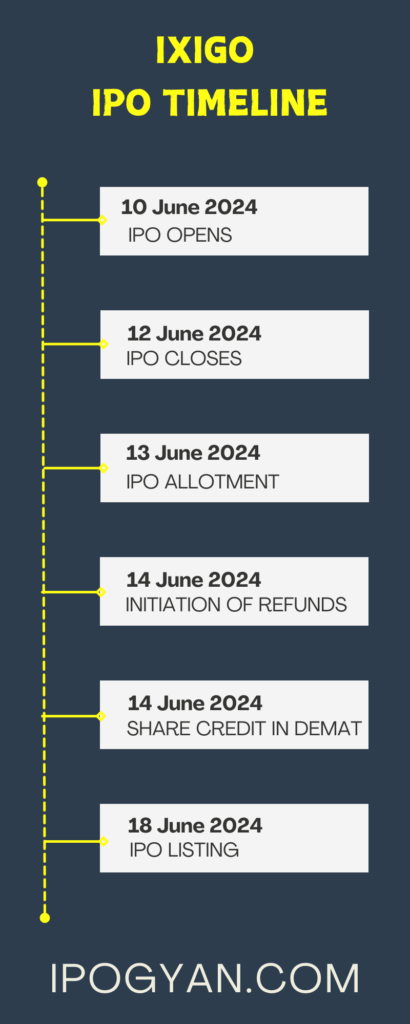

IXIGO IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of IXIGO is Around 23 Rs.

Objects Of Issue:

1. Partially funding the company’s working capital requirements

2. Investing in cloud infrastructure and technology

3. Financing inorganic growth through unidentified acquisitions, other strategic initiatives, and general corporate purposes

Promoters:

- DOES NOT HAVE AN IDENTIFIABLE PROMOTER

FAQs:

When IXIGO IPO is Opening?

IXIGO IPO is Opening on 10 June 2024.

When is the IXIGO IPO Closing?

IXIGO IPO is Closing on 12 June 2024.

What is the Issue Size of the IXIGO IPO?

The IPO Issue Size of IXIGO is 740.10 Crore.

Price Band of IXIGO IPO?

The price Band of the IXIGO IPO is 88 to 93 rupees per share.

What is the minimum investment for an IXIGO IPO?

The minimum investment for the IXIGO IPO is 14,973 Rupees.

Allotment Date of IXIGO IPO?

The Allotment of IXIGO IPO is on 13 June 2024.

Listing Date of IXIGO IPO?

The Listing Of IXIGO is Scheduled on 18 June 2024.

One Should Apply for IXIGO IPO or Not?

Will Update Soon..

How to apply for IXIGO IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find IXIGO IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IXIGO IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find IXIGO IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IXIGO IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find IXIGO IPO from the list ——–> Click on IXIGO IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of IXIGO?

Axis Capital Limited, Dam Capital Advisors Ltd, and JM Financial Limited are the Lead Managers of IXIGO.

Where To Check the Allotment of IXIGO IPO?

The allotment status for the IXIGO IPO will be accessible on the Link Intime India Private Ltd Website.

IXIGO IPO is going to be listed at?

IXIGO IPO is going to be listed at BSE, NSE.

What is the Lot Size of the IXIGO IPO?

The lot size of the IXIGO IPO is 161 Shares.

What is the P/E Ratio of the IXIGO?

The P/E Ratio of the IXIGO is 148.87.

What is the EPS of the IXIGO?

The EPS of the IXIGO is 0.62.

What is the ROE of the IXIGO?

The ROE of IXIGO is N/A.

What is the ROCE of the IXIGO?

The ROCE of IXIGO is N/A.