Jana Small Finance Bank is currently positioned as the fourth largest Small Finance Bank in terms of its Assets Under Management (AUM) and deposit size. It boasts 754 banking outlets spread across 22 states and two union territories, including 272 outlets located in underserved areas. Since its establishment, in 2008 the bank has catered to 12 million customers with a count of around 4.57 million active customers, as of March 31, 2023.

The bank offers a range of secured loan options such, as loans for businesses microloans backed by property (Micro LAP) loans for MSMEs, affordable housing loans term loans for NBFCs, loans, against fixed deposits two wheeler loans and gold loans. They also provide loan options including micro business loans, agricultural and allied loans, and group loans using the Joint Liability Group (JLG) model.

The bank functions, as a representative for insurance products from third-party companies providing services such, as POS terminals and payment gateways. They offer their range of products and services through channels, including banking branches, ATMs, business correspondents, mobile banking platforms, internet portals, and SMS notifications.

Jana Small Finance Bank has made investments in enhancing its technology infrastructure allowing for onboarding through platforms such, as DIGIGEN and video KYC. Additionally, they have utilized data analytics to gain insights into customer behavior. The bank’s shareholders consist of entities, like TPG, HarbourVest Group, Amansa Capital, Morgan Stanley, and Hero Ventures.

Jana Small Finance Bank IPO Complete Details:

Jana Small Finance Bank IPO Timetable:

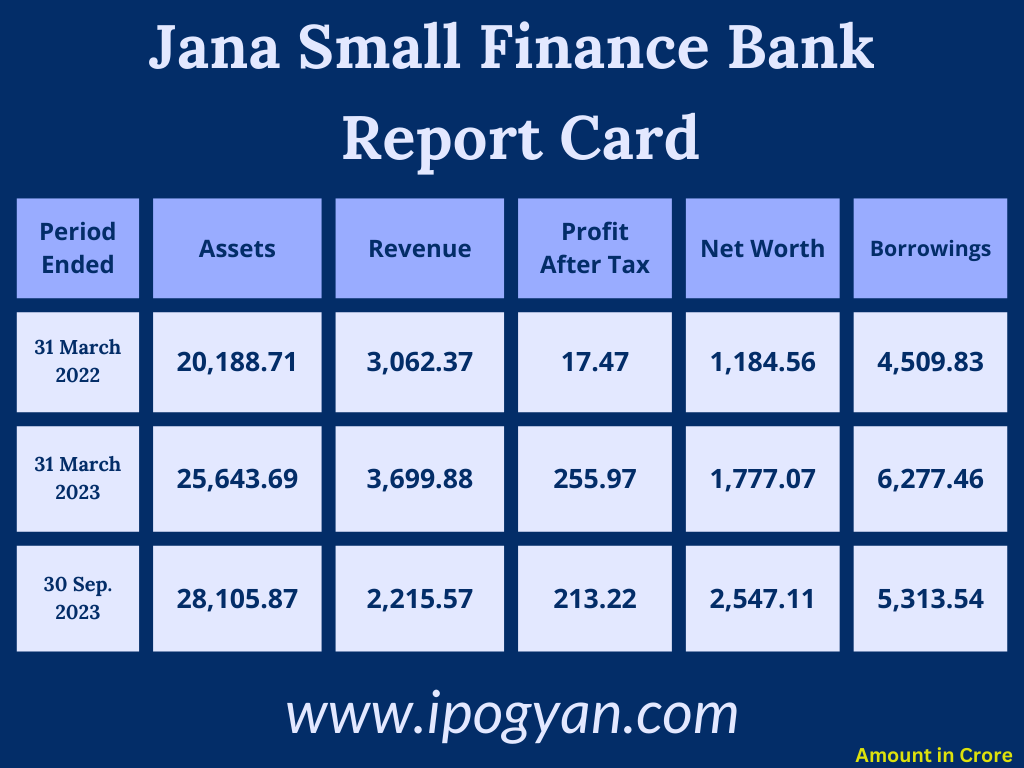

Company Financial Details:

AS OF NOW, the GMP Of Jana Small Finance Bank is Around 66 Rs.

Objects Of Issue:

The bank intends to utilize the net proceeds from the Fresh Issue to strengthen its Tier-1 capital base, thereby meeting future capital requirements. Additionally, funds from the Fresh Issue will be allocated to cover expenses related to the Offer.

Promoters:

- JANA CAPITAL LIMITED

- JANA HOLDINGS LIMITED

FAQs:

When Jana Small Finance Bank IPO is Opening?

Jana Small Finance Bank IPO is Opening on 07 February 2024.

When is the Jana Small Finance Bank IPO Closing?

Jana Small Finance Bank IPO is Closing on 09 February 2024.

What is the Issue Size of the Jana Small Finance Bank IPO?

The IPO Issue Size of Jana Small Finance Bank is 570 Crore.

Price Band of Jana Small Finance Bank IPO?

The price Band of Jana Small Finance Bank IPO is 393 to 414 rupees per share.

What is the minimum investment for a Jana Small Finance Bank IPO?

The minimum investment for the Jana Small Finance Bank IPO is 14,904 Rupees.

Allotment Date of Jana Small Finance Bank IPO?

The Allotment of Jana Small Finance Bank IPO is on 12 February 2024.

Listing Date of Jana Small Finance Bank IPO?

The Listing Of Jana Small Finance Bank is Scheduled on 14 February 2024.

One Should Apply for Jana Small Finance Bank IPO or Not?

Will Update Soon..

How to apply for Jana Small Finance Bank IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Jana Small Finance Bank IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Jana Small Finance Bank IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Jana Small Finance Bank IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Jana Small Finance Bank IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Jana Small Finance Bank IPO from the list ——–> Click on Jana Small Finance Bank IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Jana Small Finance Bank?

Axis Capital Limited, ICICI Securities Limited, and SBI Capital Markets Limited are the Lead Managers of Jana Small Finance Bank.

Where To Check the Allotment of Jana Small Finance Bank IPO?

The allotment status for the Jana Small Finance Bank IPO will be accessible on the Kfin Technologies Limited Website.

Jana Small Finance Bank IPO is going to be listed at?

Jana Small Finance Bank IPO is going to be listed at NSE and BSE.

What is the Lot Size of the Jana Small Finance Bank IPO?

The lot size of the Jana Small Finance Bank IPO is 36 Shares.

What is the P/E Ratio of the Jana Small Finance Bank IPO?

The P/E Ratio of the Jana Small Finance Bank is 15.11.

What is the ROE of the Jana Small Finance Bank IPO?

The ROE of the Jana Small Finance Bank IPO is 16.78%.

What is the ROCE of the Jana Small Finance Bank IPO?

The ROCE of the Jana Small Finance Bank IPO is N/A.

What is the EPS of the Jana Small Finance Bank IPO?

The EPS of the Jana Small Finance Bank IPO is 27.4.