Rashi Peripherals, a company established in 1989 has accumulated more than three decades of experience, in distributing ICT products in India. Originally involved in manufacturing the company shifted its focus to distributing global technology brands within India after the liberalization of the Indian IT sector, in 1991.

Rashi Peripherals has played a role, in bringing structure and organization to the distribution of ICT products in India over the years. It has been instrumental in introducing global technology brands into the market. Reports indicate that the company has consistently grown its operations distributing 293.63 million units of ICT products, between 2002 and the six-month period ending on September 30, 2022.

Rashi Peripherals operates in two areas of business:

1) Personal Computing, Enterprise and Cloud Solutions (referred to as “PES”), and

2) Lifestyle and IT Essentials (known as “LIT”).

They offer a range of products including computing devices, enterprise solutions, lifestyle peripherals, and IT essentials. Their distribution network covers India with 50 branches that serve as sales and service centers along, with 62 warehouses, as of September 30, 2022.

Rashi Peripherals has a distribution network that spans 730 locations in India. They work with a variety of channel partners, including resellers, regional distributors, retailers, and system integrators. As of September 30 2022, the company has built relationships with 8,657 customers. They reach their customers through channels such, as General Trade, Modern Trade, and E-Commerce.

As of September 30, 2022, Rashi Peripherals acts as a distribution partner, for 48 global technology brands. They distribute products across categories such as computing, mobility, enterprise solutions, components, lifestyle gadgets, storage devices, and memory products. Some notable brands, in their portfolio include ASUS Global Pte. Ltd., Dell International Services India Private Limited, HP India Sales Private Limited, Logitech Asia Pacific Limited, NVIDIA Corporation, and others.

Rashi Peripherals IPO Complete Details:

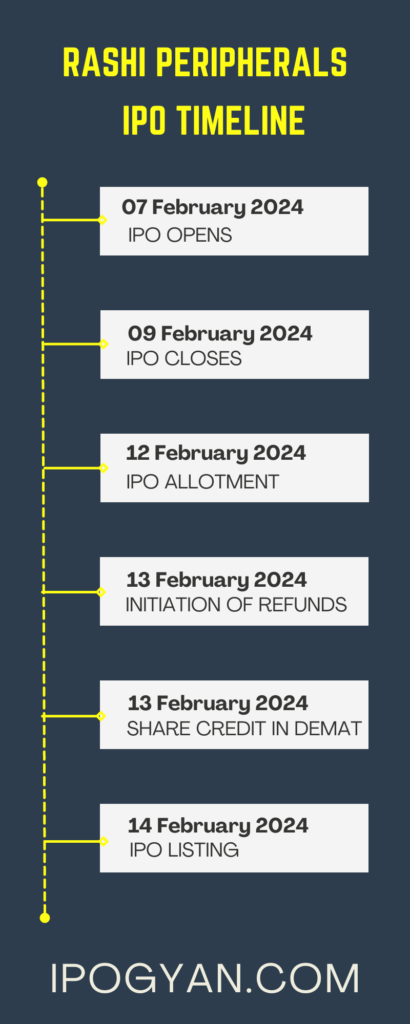

Rashi Peripherals IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP Of Rashi Peripherals is Around 85 Rs.

Objects Of Issue:

1. The company aims to make prepayments or scheduled repayments for some or all of the existing loans it has taken.

2. To secure funds to meet the working capital requirements.

3. The company intends to utilize the funds for general corporate purposes.

Promoters:

- Krishna Kumar Choudhary

- Sureshkumar Pansari

- Kapal Suresh Pansari

- Keshav Krishna Kumar Choudhary

- Chaman Pansari

- Krishna Kumar Choudhary (HUF)

- Suresh M Pansari HUF

FAQs:

When Rashi Peripherals IPO is Opening?

Rashi Peripherals IPO is Opening on 07 February 2024.

When is the Rashi Peripherals IPO Closing?

Rashi Peripherals IPO is Closing on 09 February 2024.

What is the Issue Size of the Rashi Peripherals IPO?

The IPO Issue Size of Rashi Peripherals is 600 Crore.

Price Band of Rashi Peripherals IPO?

The price Band of Rashi Peripherals IPO is 295 to 311 rupees per share.

What is the minimum investment for a Rashi Peripherals IPO?

The minimum investment for the Rashi Peripherals IPO is 14,928 Rupees.

Allotment Date of Rashi Peripherals IPO?

The Allotment of Rashi Peripherals IPO is on 12 February 2024.

Listing Date of Rashi Peripherals IPO?

The Listing Of Rashi Peripherals is Scheduled on 14 February 2024.

One Should Apply for Rashi Peripherals IPO or Not?

Will Update Soon..

How to apply for Rashi Peripherals IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Rashi Peripherals IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Rashi Peripherals IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Rashi Peripherals IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Rashi Peripherals IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Rashi Peripherals IPO from the list ——–> Click on Rashi Peripherals IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Rashi Peripherals?

JM Financial Limited and ICICI Securities Limited are the Lead Managers of Rashi Peripherals.

Where To Check the Allotment of Rashi Peripherals IPO?

The allotment status for the Rashi Peripherals IPO will be accessible on the Link Intime India Private Limited Website.

Rashi Peripherals IPO is going to be listed at?

Rashi Peripherals IPO is going to be listed at NSE and BSE.

What is the Lot Size of the Rashi Peripherals IPO?

The lot size of the Rashi Peripherals IPO is 48 Shares.

What is the P/E Ratio of the Rashi Peripherals IPO?

The P/E Ratio of the Rashi Peripherals is 11.75.

What is the ROE of the Rashi Peripherals IPO?

The ROE of the Rashi Peripherals IPO is 19.33.

What is the ROCE of the Rashi Peripherals IPO?

The ROCE of the Rashi Peripherals IPO is 14.21.

What is the EPS of the Rashi Peripherals IPO?

The EPS of the Rashi Peripherals IPO is 26.46.