Kaushalya Logistics started its operations by establishing Kaushalya Buildcon Private Limited in 2007 specializing in construction projects including buildings, residential structures, and factory sheds. As time went on the company expanded its services to provide support, for the cement industry. In 2010 it began its logistics operations with four warehouses. Has since grown steadily. Currently, Kaushalya Logistics oversees the management of 70 warehouses on behalf of Dalmia Cement Bharat Limited in states such, as Bihar, Tamil Nadu, and Kerala.

Kaushalya Logistics Limited is involved in three sectors; logistics, e-commerce, and commercial real estate

1. Logistics:

Specializes in Clearing and Forwarding (C&F) services for major cement companies, with a focus on Dalmia Cement Bharat Limited. Offers comprehensive logistics and transportation solutions, including warehousing, distribution, and door-to-door delivery.

2. E-Commerce:

The company is involved in selling electronics and white goods through a retail platform. Their main focus is, on bulk purchases effective inventory management, and utilizing third-party support to handle all aspects of our operations from start to finish.

3. Commercial Real Estate:

The company has expanded its operations to include estate, where it now owns and leases 18 retail shops, in Udaipur. This investment provides a source of income that contributes to the overall stability of the company’s business portfolio.

The key, to the success of Kaushalya Logistics Limited is its approach, which involves optimizing effectiveness and fostering strategic collaborations, in the fields of logistics, e-commerce, and commercial real estate.

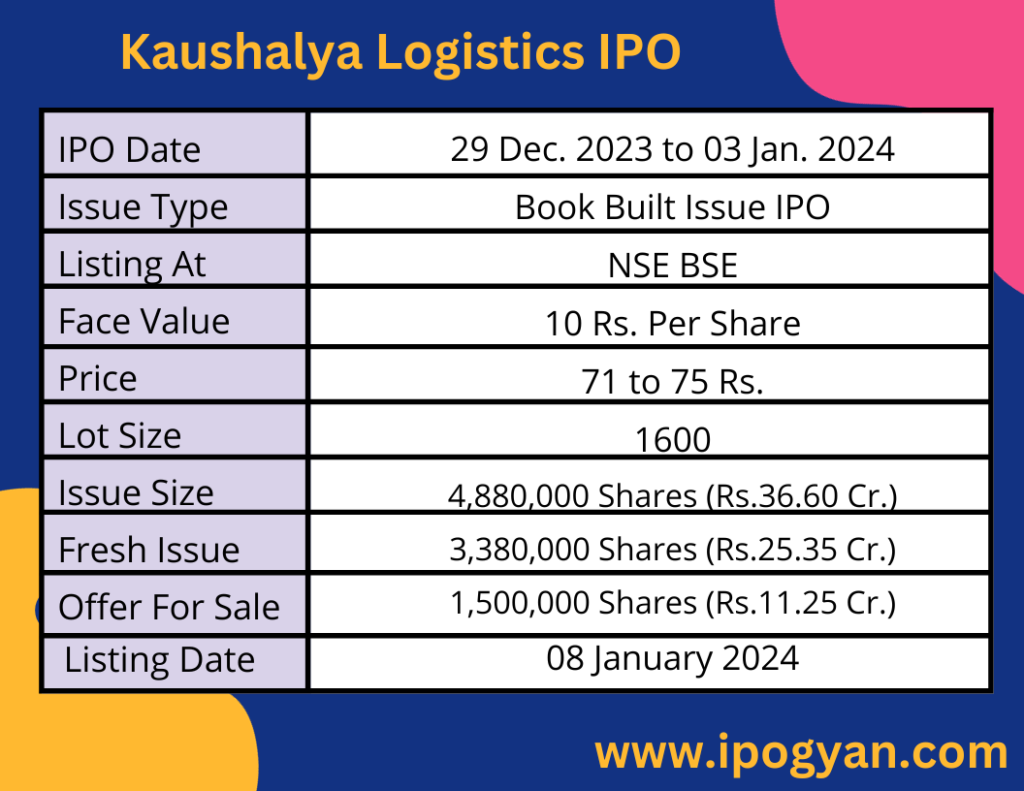

Kaushalya Logistics IPO Complete Details:

Kaushalya Logistics IPO Timetable:

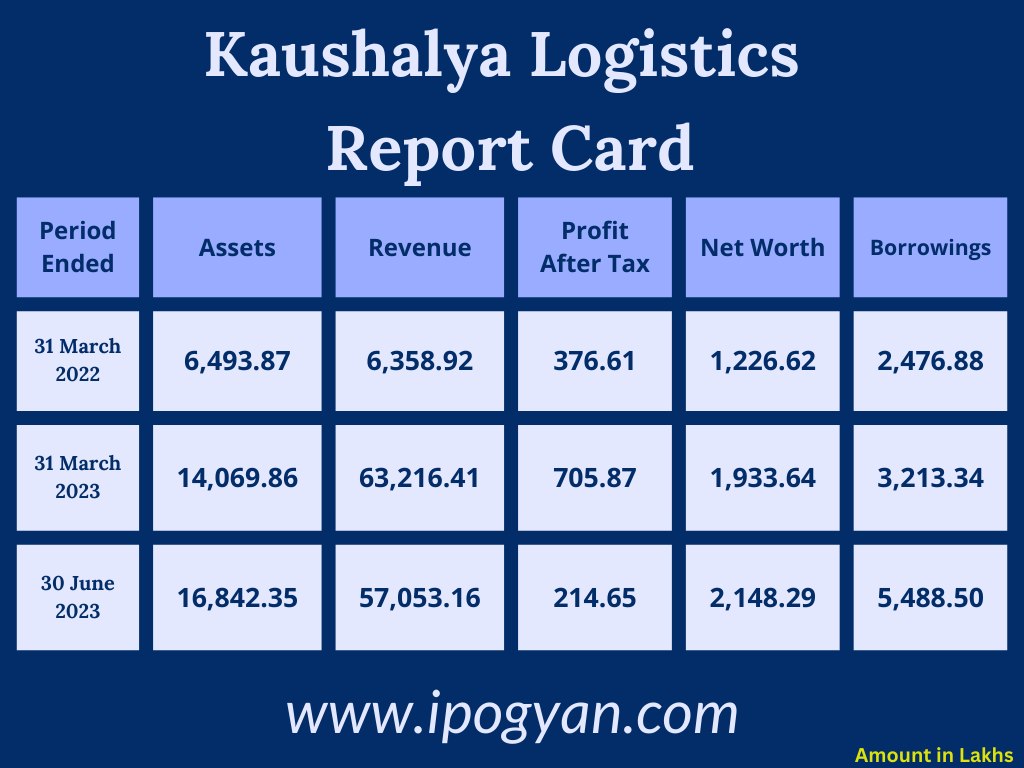

Company Financial Details:

AS OF NOW, the GMP OF Kaushalya Logistics is Around 60 Rs.

Objects Of Issue:

• Settling Unsecured Loan Obligations

• Supporting the Working Capital Needs of our Company

• Addressing General Corporate Requirements

Promoters:

Mr. Uddhav Poddar

- Age: 41 years

- Position: Promoter and Managing Director

- Education: Bachelor of Commerce from Delhi University

- Experience: Over 15 years of overseeing managerial and operational functions of the entire group

FAQs:

When Kaushalya Logistics IPO is Opening?

Kaushalya Logistics IPO is Opening on 29 December 2023.

When is the Kaushalya Logistics IPO Closing?

Kaushalya Logistics IPO is Closing on 03 January 2024.

What is the Issue Size of the Kaushalya Logistics IPO?

The IPO Issue Size of Kaushalya Logistics is 36.60 Crore.

Price Band of Kaushalya Logistics IPO?

The price Band of Kaushalya Logistics IPO is 71 to 75 rupees per share.

What is the minimum investment for Kaushalya Logistics IPO?

The minimum investment for the Kaushalya Logistics IPO is 120,000 Rupees.

Allotment Date of Kaushalya Logistics IPO?

The Allotment of Kaushalya Logistics IPO is on 04 January 2024.

Listing Date of Kaushalya Logistics IPO?

The Listing Of Kaushalya Logistics is Scheduled on 08 January 2024.

One Should Apply for Kaushalya Logistics IPO or Not?

will update soon

How to apply for Kaushalya Logistics IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Kaushalya Logistics IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Kaushalya Logistics IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Kaushalya Logistics IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Kaushalya Logistics IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Kaushalya Logistics IPO from the list ——–> Click on Kaushalya Logistics IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of the Kaushalya Logistics?

Khandwala Securities Limited is the Lead Manager of Kaushalya Logistics.

Where To Check the Allotment of Kaushalya Logistics IPO?

The allotment status for the Kaushalya Logistics IPO will be accessible on the Skyline Financial Services Private Limited Website.

Kaushalya Logistics IPO is going to be listed at?

Kaushalya Logistics IPO is going to be listed at NSE SME.

What is the Lot Size of the Kaushalya Logistics IPO?

The lot size of the Kaushalya Logistics IPO is 1600 Shares.

What is the P/E Ratio of the Kaushalya Logistics IPO?

The P/E Ratio of the Kaushalya Logistics is 16.2 .

What is the ROE of the Kaushalya Logistics IPO?

The ROE of the Kaushalya Logistics IPO is 4713.49%.

What is the ROCE of the Kaushalya Logistics IPO?

ROCE of the Kaushalya Logistics IPO is 70.48%.