KP Green Engineering, founded in 2001 focuses on producing a variety of hot dip steel items. Their product range includes lattice tower structures, substation structures, solar module mounting structures, cable trays, earthing strips, beam crash barriers, and other infrastructure solutions. They provide customized solutions covering engineering, design, fabrication, galvanization, and deployment with their, in-house facilities, for fabrication and hot dip galvanizing.

The business is recognized as an approved supplier, for GETCO (Gujarat Energy Transmission Corporation Limited) and MSETCL (Maharashtra State Electricity Transmission Company) for capacities of 400 kW and 220 kW, respectively. Their dedication to providing top-notch products and services is shown through their ties to reliability, customer happiness, and sustained prosperity. They run an equipped internal quality assurance lab for inspecting product quality and, after production meeting the varied requirements of their customers.

Apart, from their services KP Green Engineering also offers fault repair services (FRT) for optical fiber cables used by telecom companies. They also undertake projects for galvanizing and solar panel installations. They are planning to expand by setting up a manufacturing facility in Matar, Bharuch which will significantly increase their production capacity from 53,000 MT to over 290,000 MT. This expansion will involve introducing products, like structures, floor grids, prefabricated buildings, and heavy fabrications to cater to changing market needs.

Their core business activities include:

1. Manufacturing of Fabricated and Galvanized Products

2. Services:

– Fault Rectification Services (FRT)

– Job Work for Galvanizing

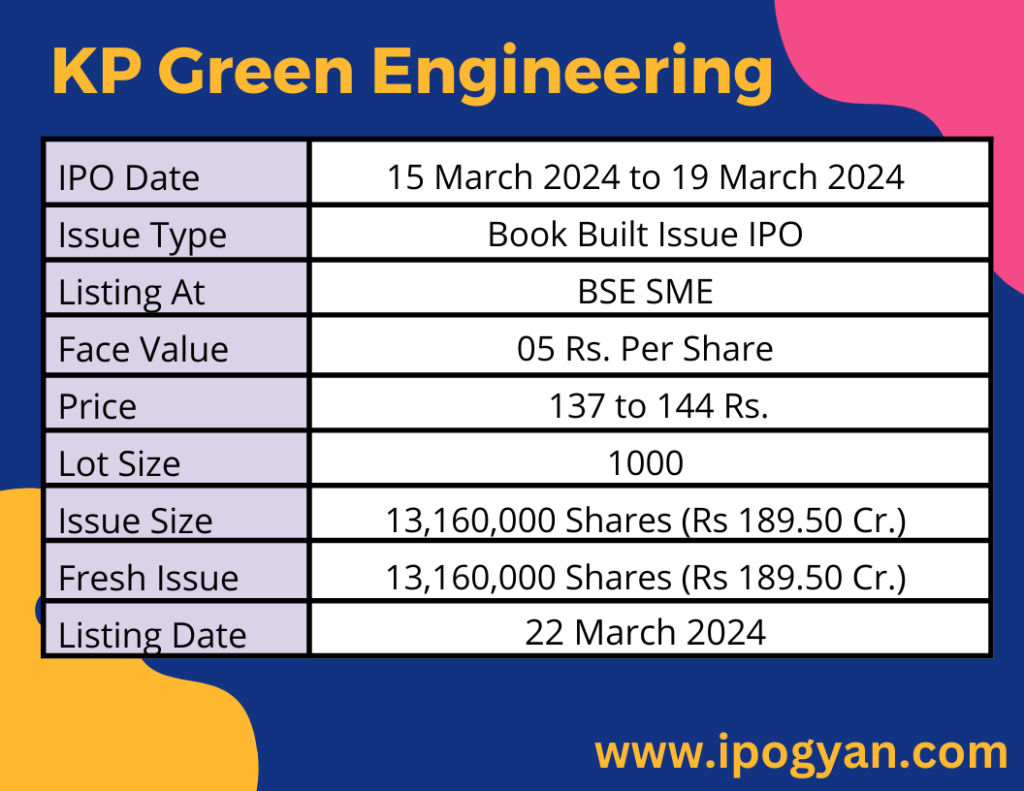

KP Green Engineering IPO Complete Details:

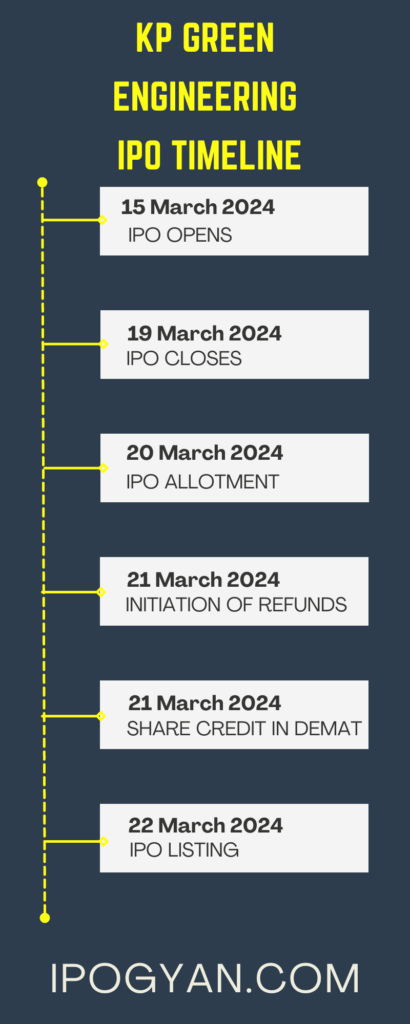

KP Green Engineering IPO Timetable:

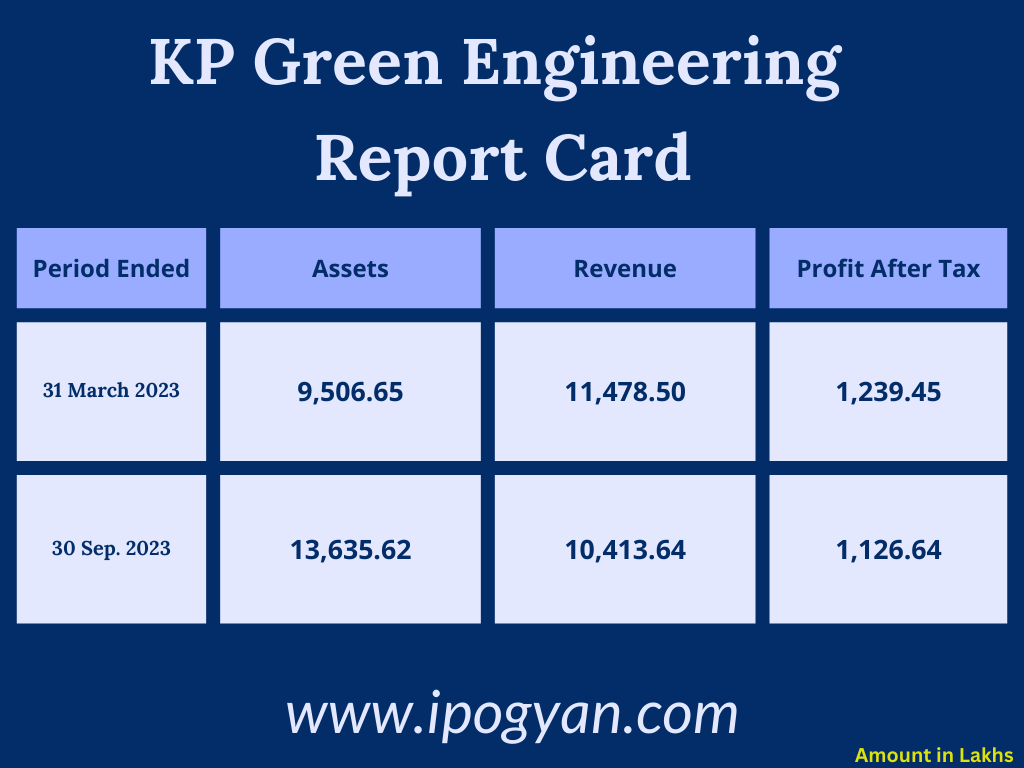

Company Financial Details:

AS OF NOW, the GMP Of KP Green Engineering is Around 25 Rs.

Objects Of Issue:

1. Partial financing for the capital expenditure required to establish a new manufacturing unit, aimed at enhancing our existing production capabilities and diversifying our product portfolio.

2. General corporate needs.

Promoters:

- DR. FARUKBHAI GULAMBHAI PATEL

FAQs:

When KP Green Engineering IPO is Opening?

KP Green Engineering IPO is Opening on 15 March 2024.

When is the KP Green Engineering IPO Closing?

KP Green Engineering IPO is Closing on 19 March 2024.

What is the Issue Size of the KP Green Engineering IPO?

The IPO Issue Size of KP Green Engineering is 189.50 Crore.

Price Band of KP Green Engineering IPO?

The price Band of KP Green Engineering IPO is 137 to 144 rupees per share.

What is the minimum investment for a KP Green Engineering IPO?

The minimum investment for the KP Green EngineeringIPO is 144,000 Rupees.

Allotment Date of KP Green Engineering IPO?

The Allotment of KP Green Engineering IPO is on 20 March 2024.

Listing Date of KP Green Engineering IPO?

The Listing Of KP Green Engineering is Scheduled on 22 March 2024.

One Should Apply for KP Green Engineering IPO or Not?

Will Update Soon..

How to apply for KP Green Engineering IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find KP Green Engineering IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for KP Green Engineering IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find KP Green Engineering IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for KP Green Engineering IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find KP Green Engineering IPO from the list ——–> Click on KP Green Engineering IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of KP Green Engineering?

Beeline Capital Advisors Pvt Ltd is the Lead Manager of KP Green Engineering.

Where To Check the Allotment of KP Green Engineering IPO?

The allotment status for the KP Green Engineering IPO will be accessible on the Bigshare Services Pvt Ltd Website.

KP Green Engineering IPO is going to be listed at?

KP Green Engineering IPO is going to be listed at BSE SME.

What is the Lot Size of the KP Green Engineering IPO?

The lot size of the KP Green Engineering IPO is 1000 Shares.

What is the P/E Ratio of the KP Green Engineering?

The P/E Ratio of the KP Green Engineering is 42.8.

What is the EPS of the KP Green Engineering?

The EPS of the KP Green Engineering is 3.36.

What is the ROE of the KP Green Engineering?

The ROE of KP Green Engineering is 29.24%.

What is the ROCE of the KP Green Engineering?

The ROCE of the KP Green Engineering is 23.05%.