Madhusudan Masala Limited is engaged in the manufacturing and processing of over 32 types of spices under the brand names “DOUBLE HATHI” and “MAHARAJA.” The company also offers products such as whole spices, tea, and various other grocery items including Rajgira flour, Papad, Soya Products, Asafoetida (Hing), Achar masala, Sanchar (Black salt powder), Sindhalu (Rock salt powder), Katlu powder (Food supplement), Kasuri Methi (Dry fenugreek), etc., all marketed under the “DOUBLE HATHI” brand. Additionally, they also generates revenue by selling unbranded whole spices and grains.

Madhusudan Masala Limited has been a big player in the industry for four decades. Its founders, Dayalji Vanravan Kotecha, and Vijaykumar Vanravan Kotecha, established the business and formed a partnership firm M/s Madhusudan & Co. The company has been consistently delivering quality food products while focusing on cost-effectiveness and improved accessibility since 1977 under the “DOUBLE HATHI” brand and since 2003 under the “MAHARAJA” brand. The next generation, Rishit Dayalji Kotecha and Hiren Vijaykumar Kotecha have continued the family legacy, accumulating extensive experience in the industry.

The two primary types of spices offered by the company are:

1. Ground spices, such as different types of chilli powder, turmeric powder, coriander powder, and cumin powder.

2. Blend spices, featuring products like Garam Masala, Tea Masala, Chhole Masala, Sambhar Masala, Pav Bhaji Masala, Pani Puri Masala, Sabji Masala, Kitchen King Masala, Chicken Masala, Meat Masala, Chatpata Chat Masala, Butter Milk Masala, Chewda Masala, Dry Ginger Powder (Sunth), Black Pepper Powder (Mari), Dry Mango Powder (Aamchur), among others.

Madhusudan Masala Limited also deals in whole spices, both in retail and bulk quantities. In the fiscal years 2023, 2022, and 2021, their revenue from the sale of spices accounted for 75.07%, 69.94%, and 83.08% of their overall sales. The “DOUBLE HATHI” portfolio offers premium quality ground spices, while the “MAHARAJA” portfolio caters to the value-for-money segment.

Madhusudan Masala operates from its manufacturing facility situated in Jamnagar, Gujarat. This strategic location provides the company easy and quick access to raw materials which helps to reduce transportation costs. The manufacturing unit is very well-equipped with plant and machinery which enables an easy production process encompassing cleaning, drying, grading, grinding, and packaging. Madhusudan Masala Limited ensures that all spices and other products are manufactured with utmost care using natural processes and scientific methods, preserving the natural properties of the food, such as color and odor over time. The systematic procurement of raw spices in their respective seasons enables the company to consistently deliver high-quality spices throughout the year.

In addition to spices, the company also markets tea and other grocery products like papad, soya products, Asafoetida (Hing), black salt, rock salt, etc., which are sourced from third-party manufacturers and packaged under the “DOUBLE HATHI” brand name. Madhusudan Masala Limited’s manufacturing facilities hold accreditations, including ISO 9001:2015 for quality management systems, ISO 22000:2018 for Food Safety Management Systems, HACCP for Hazard Analysis Critical Control Points, and they possess an FSSAI license under the Food Safety and Standards Act 2006. The spices are available in both retail and wholesale packaging, with ground spices offered in packs ranging from 10 grams to 20 kilograms in polypacks and jute bags, and blend spices available in packs ranging from 10 grams to 100 grams in polypacks and cardboard boxes.

Madhusudan Masala Limited IPO Complete Details:

Madhusudan Masala Limited IPO Timetable:

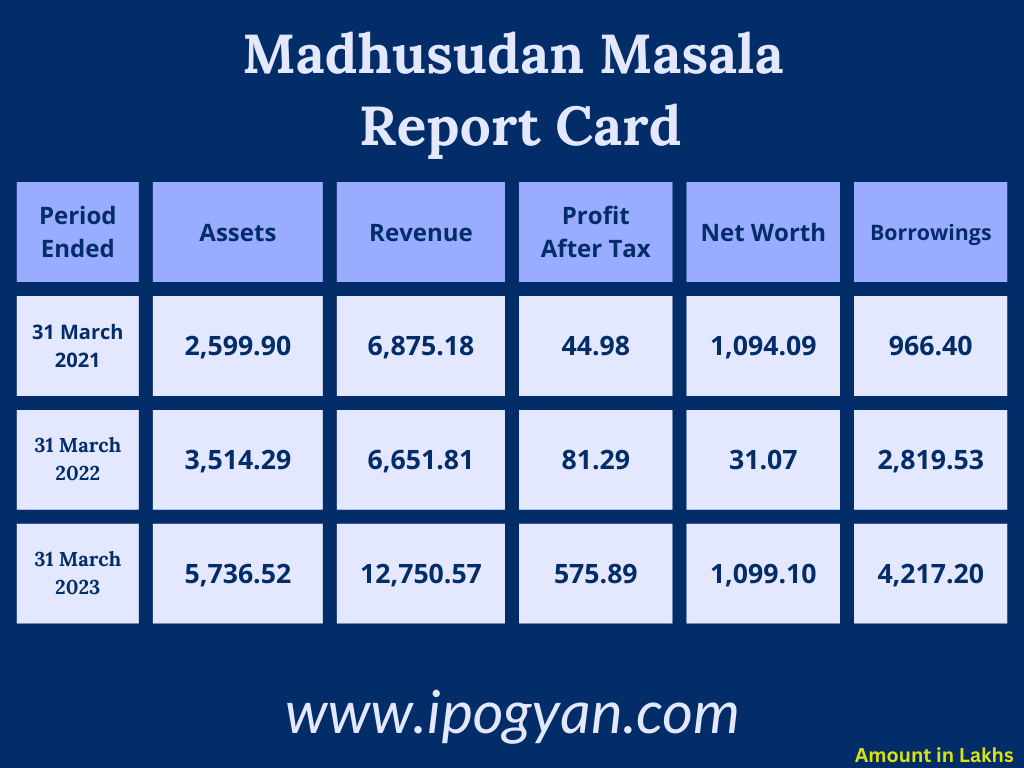

Company Financial Details:

AS OF NOW, the GMP OF Madhusudan Masala Limited is Around 59 Rs.

Objects Of Issue:

- Obtaining funds to fulfill working capital needs.

- Addressing general corporate objectives.

Promoters and Group:

1. Rishit Dayalaji Kotecha:

– Age: 41 years

– Position: Promoter, Chairman, and Managing Director

– Experience: Approximately 20 years in the spices industry

– Education: B.Sc. in Physics and Instrumentation from D.K.V. Arts and Science College, Jamnagar in 2003

– Expertise: Extensive knowledge in marketing and finance, overseeing financial, compliance, and marketing activities of the company.

2. Hiren Vijaykumar Kotecha:

– Age: 37 years

– Position: Promoter and Whole-Time Director

– Experience: Approximately 20 years in the spices industry

– Education: Bachelor’s degree in Commerce

– Responsibilities: Oversees planning, operations, and packaging activities of the company. Responsible for the expansion and overall management of the business.

3. Dayalji Vanravan Kotecha:

– Age: 75 years

– Position: Promoter and Non-Executive Director

– Background: Founder of the company

– Experience: Approximately 41 years in the spices industry

4. Vijaykumar Vanravan Kotecha:

– Age: 66 years

– Position: Promoter and Non-Executive Director

– Background: Founder of the company

– Experience: Approximately 41 years in the spices industry

FAQs:

When Madhusudan Masala Limited’s IPO is Opening?

Madhusudan Masala Limited IPO is Opening on 18 September 2023(Monday).

When Madhusudan Masala Limited IPO is Closing?

Madhusudan Masala Limited IPO is Closing on 21 September 2023(Thursday).

What is the IPO Issue Size of Madhusudan Masala Limited?

The IPO Issue Size of Madhusudan Masala Limited is 23.80 Crore.

Price Band of Madhusudan Masala Limited IPO?

The price Band of Madhusudan Masala Limited IPO is 66 to 70 rupees per share.

What is the minimum investment for Madhusudan Masala Limited IPO?

The minimum investment for Madhusudan Masala Limited IPO is 140,000 Rupees.

Allotment Date of Madhusudan Masala Limited IPO?

The Allotment of Madhusudan Masala Limited IPO is on 26 September 2023(Tuesday).

Listing Date of Madhusudan Masala Limited IPO?

The Listing Of Madhusudan Masala Limited is Scheduled on 03 October 2023(Tuesday).

One Should Apply Madhusudan Masala Limited IPO or Not?

Can Apply For Listing Gains.

How to apply for Madhusudan Masala Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Madhusudan Masala Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Madhusudan Masala Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Madhusudan Masala Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Madhusudan Masala Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Madhusudan Masala Limited IPO from the list ——–> Click on Madhusudan Masala Limited IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Madhusudan Masala Limited IPO’s Lead Manager?

Hem Securities Limited is the Lead Manager of Madhusudan Masala Limited IPO.

Where To Check the Allotment of Madhusudan Masala Limited IPO?

The allotment status for the Madhusudan Masala Limited IPO will be accessible on the Kfin Technologies Limited Website.

What is the P/E Ratio of Madhusudan Masala Limited?

The P/E Ratio of Madhusudan Masala Limited is 15.7.