Magenta Lifecare, a known company, in India, focuses on producing foam-based items, including a selection of mattresses and pillows. Their range includes mattresses like memory foam latex-based bonded mattresses and pocketed spring mattresses. They also provide types of pillows such as memory foam pillows, molded memory foam pillows, and molded foam pillows. The company’s achievements are linked to the quality of its goods that are available, in retail stores, hotels, and institutional settings.

Magenta Lifecare consistently launches creative products. Some of the highlights are mattresses made with green tea and bamboo charcoal as well, as pet bed mattresses. The company also offers processed foam and hydraulic bed frames ( beds) imported under the Magenta Lifecare label.

Magenta Lifecare’s product offerings cater to a broad spectrum of society, ranging from value-added products to premium segments. The thoughtfully designed products provide comfort through ergonomic design, thermal comfort, pressure relief, motion isolation, easy position realignment, and long-term durability. These mattresses are designed to support, comfort, and cool the body, thereby enhancing sleep quality. Magenta Lifecare offers a wide array of customization options in terms of fabric, shape, firmness, material, height, foam type and density, personalization, utility, and structure.

The company has established a robust network of distributors and dealers/retailers across multiple states in India. Their products are sold through offline channels, including multi-brand outlets and a network of dealers, as well as online e-commerce platforms. Distributors are appointed on a regional basis, ensuring wide and efficient distribution of Magenta Lifecare products.

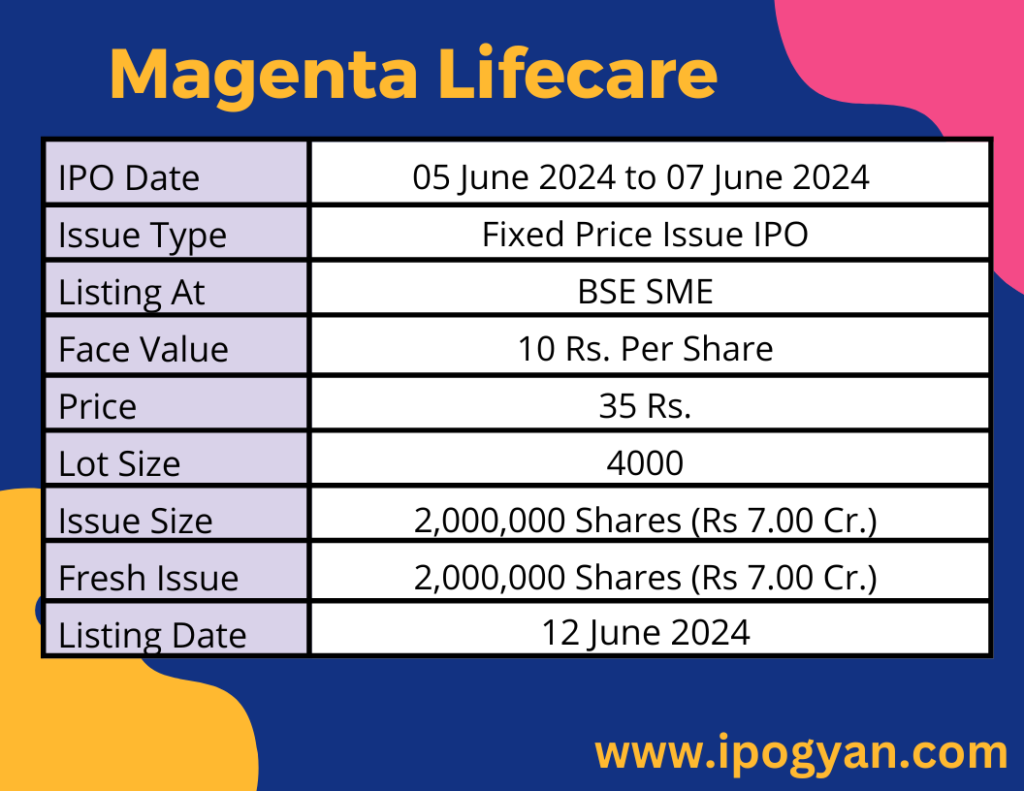

Magenta Lifecare IPO Complete Details:

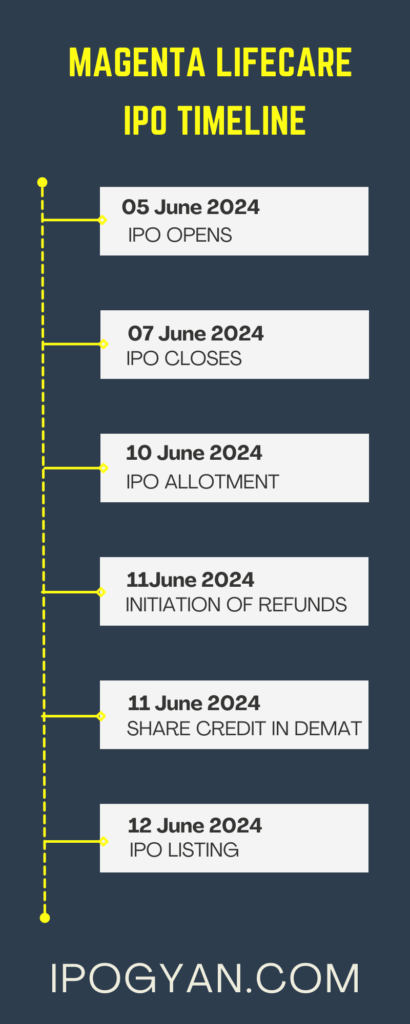

Magenta Lifecare IPO Timetable:

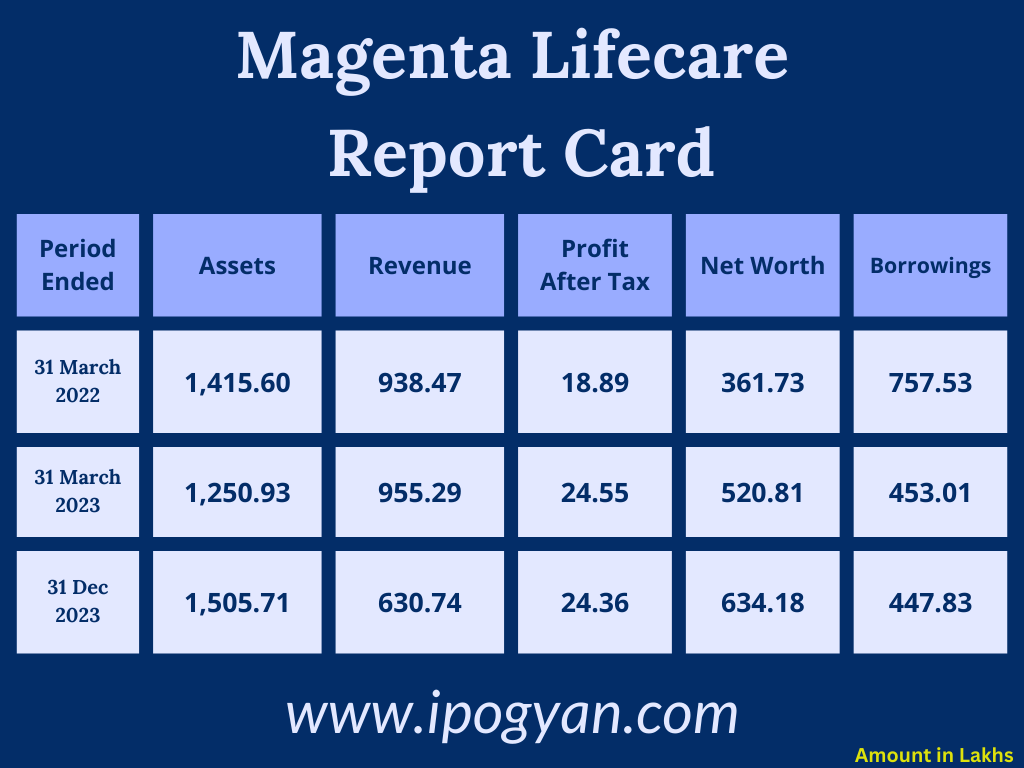

Company Financial Details:

AS OF NOW, the GMP Of Magenta Lifecare is Around 28 Rs.

Objects Of Issue:

1. Funding working capital requirements

2. General corporate purposes

Promoters:

- DIVYESH MODI

- KHYATI MODI

FAQs:

When Magenta Lifecare IPO is Opening?

Magenta Lifecare IPO is Opening on 05 June 2024.

When is the Magenta Lifecare IPO Closing?

Magenta Lifecare IPO is Closing on 07 June 2024.

What is the Issue Size of the Magenta Lifecare IPO?

The IPO Issue Size of Magenta Lifecare is 7.00 Crore.

Price Band of Magenta Lifecare IPO?

The price Band of the Magenta Lifecare IPO is 35 rupees per share.

What is the minimum investment for a Magenta Lifecare IPO?

The minimum investment for the Magenta Lifecare IPO is 140,000 Rupees.

Allotment Date of Magenta Lifecare IPO?

The Allotment of Magenta Lifecare IPO is on 10 June 2024.

Listing Date of Magenta Lifecare IPO?

The Listing Of Magenta Lifecare is Scheduled on 12 June 2024.

One Should Apply for Magenta Lifecare IPO or Not?

Will Update Soon..

How to apply for Magenta Lifecare IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Magenta Lifecare IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Magenta Lifecare IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Magenta Lifecare IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Magenta Lifecare IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Magenta Lifecare IPO from the list ——–> Click on IT SOLUTIONS AND TELECOMS (INDIA) IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Magenta Lifecare?

Fedex Securities Pvt Ltd is the Lead Manager of Magenta Lifecare.

Where To Check the Allotment of Magenta Lifecare IPO?

The allotment status for the Magenta Lifecare IPO will be accessible on the Cameo Corporate Services Limited Website.

Magenta Lifecare IPO is going to be listed at?

Magenta Lifecare IPO is going to be listed at BSE SME.

What is the Lot Size of the Magenta Lifecare IPO?

The lot size of the Magenta Lifecare IPO is 4000 Shares.

What is the P/E Ratio of the Magenta Lifecare?

The P/E Ratio of the Magenta Lifecare is 69.43.

What is the EPS of the Magenta Lifecare?

The EPS of the Magenta Lifecare is 0.5.

What is the ROE of the Magenta Lifecare?

The ROE of Magenta Lifecare is 5.62%.

What is the ROCE of the Magenta Lifecare?

The ROCE of Magenta Lifecare is 13.41%.