Mangalam Alloys Limited Incorporated in 1988 operates a unique integrated stainless steel, special steel, and higher alloys steel melting and further processing unit, which extends to the production of bright bar fasteners. Mangalam Alloys Limited’s manufacturing activities include the production of SS Ingots, Round Bars, RCS, Bright Bars, and various sections/profiles such as square, hexagonal, angle, and patti, as well as forging and fastener production.

The company’s integrated stainless steel manufacturing unit spans 40,000 square meters of land and has an installed capacity of 25,000 TPA (Melting Capacity). Mangalam Alloys Limited production plant is in Ahmedabad, Gujarat, one of India’s fastest-growing cities and the third-largest in the world.

The company has received various awards and certifications, including ISO 9001:2015 and PED certificates, and has been recognized as a Two Star Export House by the Directorate General of Foreign Trade (DGFT), India.

In the production process, stainless steel ingots are manufactured through induction furnaces, which involve melting stainless steel scrap in a continuous process controlled by uniform heating using electricity. The stainless steel scrap is placed into a crucible, and the temperature is raised to 1500°C with the help of electricity. Subsequently, argon gas and nitrogen treatment are applied for secondary refining. The molten metal is then poured into cast iron molds to produce ingots.

Mangalam Alloys Limited manufactures stainless steel ingots through three furnaces, followed by rolling the ingots into stainless steel rounds and flats and subjecting them to heat treatment in an annealing furnace.

The promoter of the company, Mr. Uttamchand Chandanmal Mehta, has over 40 years of rich experience in the stainless steel industry and has played a prominent role in expanding the company’s stainless steel business in an organized manner, venturing into various sectors.

The company maintains a diversified portfolio of products, primarily categorized as follows:

1. Ingots: The company offers a range of ingots in stainless steel, special steel, and alloy steel. These ingots stick to the highest quality standards which ensures excellence in hot working applications.

2. Black Round Bars: The company uses fully ground ingots as input materials in a walking pusher-type furnace, which then feeds the rolling mill. The process carefully controls the hot working temperature and the finishing pass, ensuring uniform surface quality, dimensions, and microstructure in the resulting black round bars.

3. RCS (Round Cornered Square): RCS is another hot-rolled product with a square shape. It is produced by heating ingots in a reheating furnace and then rolling them in predetermined passes.

4. Bright Forged Round Bars: Bottom-poured forging quality ingots are used to make various grades of forged round bars. The quality of ingots is very essential as an input material for steam hammers.

5. Bright Round Bars: Bright round bars represent a type of stainless steel long product. They are manufactured from black round bars through a process that includes peeling, centerless grinding, and polishing. These products are used in pumps, valves, machines, and other devices.

6. Hexagonal & Square Bars: Hexagonal and square bars come in two types: Cold Drawn and Polished. Various grades, including 304, 304L, 316, and 316L, are available for these bars.

7. Angle Bars: Stainless steel angle bars constitute another category of hot-rolled long products. These angle bars can be obtained with equal or unequal leg lengths.

8. Flat Bars: Stainless steel flat bars are produced through the hot rolling and pickling process. They are ideal for structural and engineering applications where strength, toughness, and excellent corrosion resistance are essential.

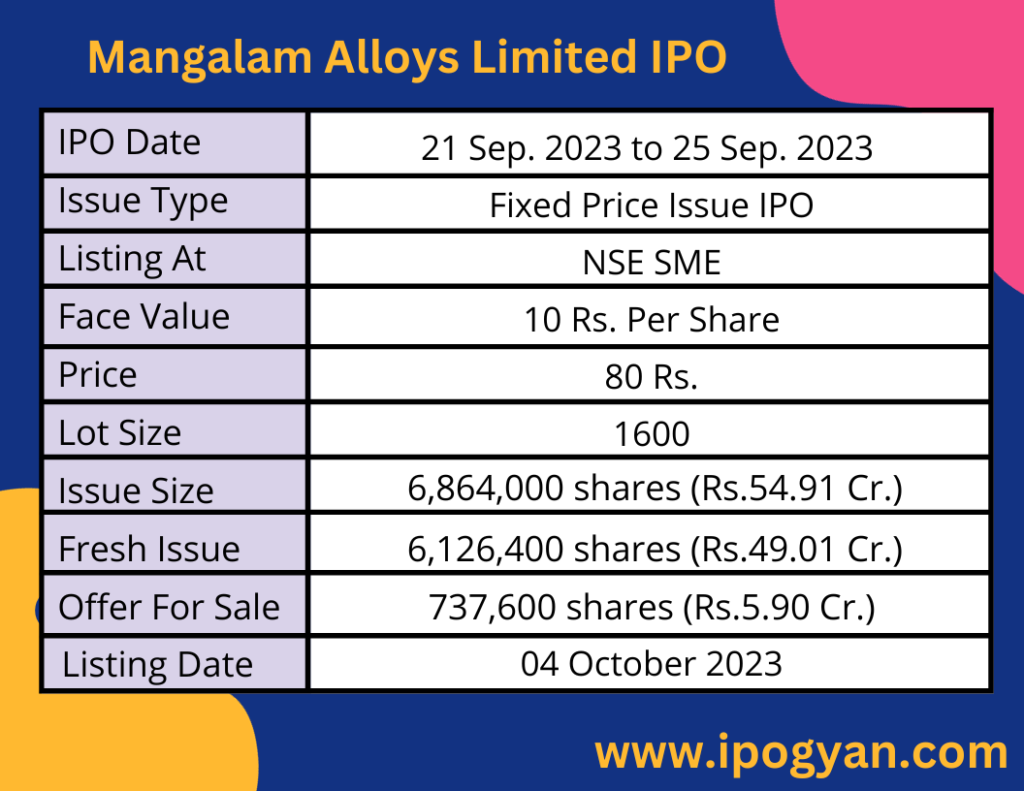

Mangalam Alloys Limited IPO Complete Details:

Mangalam Alloys Limited IPO Timetable:

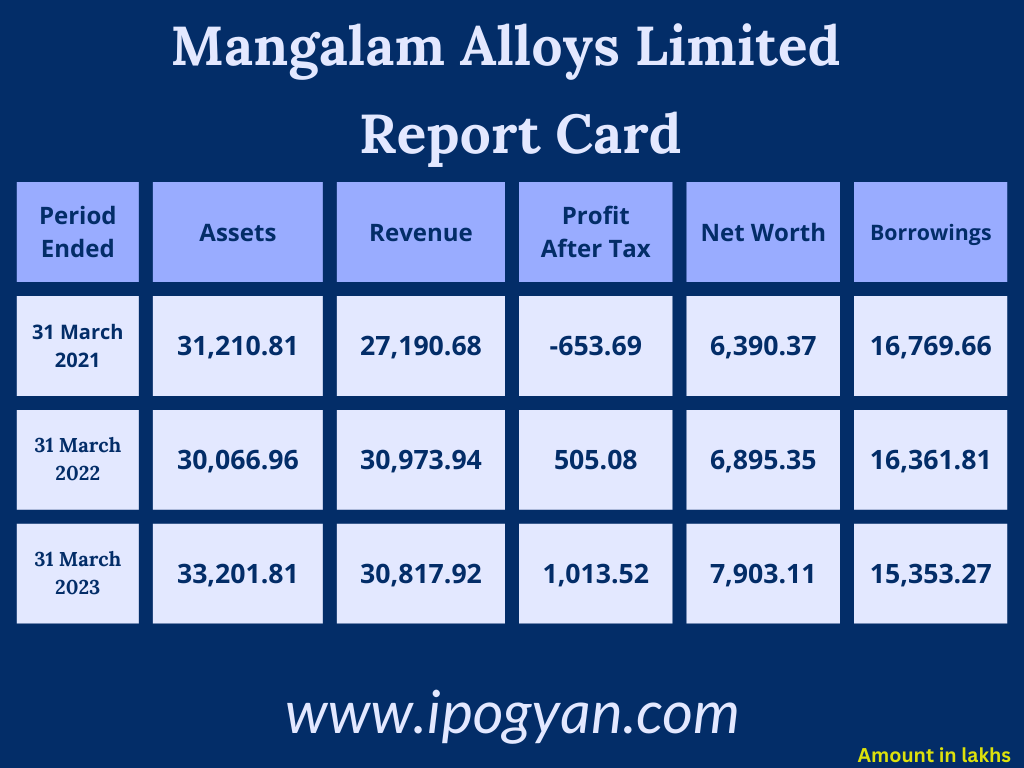

Company Financial Details:

AS OF NOW, the GMP OF Mangalam Alloys Limited is Around 00 Rs.

Objects Of Issue:

1) Meeting working capital needs.

2) Investment in business growth and research and development.

3) Funding general corporate objectives.

4) Covering issue-related expenses.

Promoters and Group:

Mr. Uttamchand Chandanmal Mehta:

- Age: 69

- Qualification: B.E. (Honours) in Chemical Engineering from Birla Institute of Technology and Science, Pilani.

- Role: Chairman and Whole Time Director since July 1, 2023.

- Background: Mr. Uttamchand Mehta has played a very important role in the group’s growth and success With 40 years of experience in the stainless steel industry.

Mr. Tushar Uttamchand Mehta:

- Age: 34

- Qualification: Bachelor’s degree in Mechanical Engineering.

- Role: Managing Director and Whole Time Director since July 1, 2023.

- Responsibilities: Mr. Tushar Uttamchand Mehta oversees Quality, Research & Development, Marketing, Purchase, and Imports & Exports departments at Mangalam Alloys Limited.

FAQs:

When Mangalam Alloys Limited’s IPO is Opening?

Mangalam Alloys Limited IPO is Opening on 21 September 2023(Wednesday).

When Mangalam Alloys Limited IPO is Closing?

Mangalam Alloys Limited IPO is Closing on 25 September 2023(Friday).

What is the IPO Issue Size of Mangalam Alloys Limited?

The IPO Issue Size of Mangalam Alloys Limited is 54.91 Crore.

Price Band of Mangalam Alloys Limited IPO?

The price Band of Mangalam Alloys Limited IPO is 80 rupees per share.

What is the minimum investment for Mangalam Alloys Limited IPO?

The minimum investment for Mangalam Alloys Limited IPO is 128,000 Rupees.

Allotment Date of Mangalam Alloys Limited IPO?

The Allotment of Mangalam Alloys Limited IPO is on 29 September 2023(Friday).

Listing Date of Mangalam Alloys Limited IPO?

The Listing Of Mangalam Alloys Limited is Scheduled on 05 October 2023(Thursday).

One Should Apply Mangalam Alloys Limited IPO or Not?

will update soon!

How to apply for Mangalam Alloys Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Mangalam Alloys Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Mangalam Alloys Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Mangalam Alloys Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Mangalam Alloys Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Mangalam Alloys Limited IPO from the list ——–> Click on Mangalam Alloys Limited IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Mangalam Alloys Limited IPO’s Lead Manager?

Expert Global Consultants Private Limited is the Lead Manager of Mangalam Alloys Limited.

Where To Check the Allotment of Mangalam Alloys Limited IPO?

The allotment status for the Mangalam Alloys Limited IPO will be accessible on the Skyline Financial Services Private Ltd Website.

What is the Earning Per Share (EPS) of Mangalam Alloys Limited?

The earning Per Share (EPS) of Mangalam Alloys Limited is 5.46 Rs.

What is the P/E Ratio of Mangalam Alloys Limited?

The P/E Ratio of Mangalam Alloys Limited is 14.65.