Popular Vehicles & Services the rated dealership, in India, runs a comprehensive business model that caters to all aspects of owning a vehicle. Their services range from selling vehicles and providing maintenance to distributing parts selling pre-owned vehicles offering driving lessons and assisting with financial and insurance product sales. They divide their operations into three categories; passenger vehicles (including luxury cars) commercial vehicles and two-wheeler and three-wheeler vehicles.

Operating through a network of dealerships across multiple states, Popular Vehicles & Services has achieved significant revenue growth over the past years. They emphasize their presence in key segments:

1. Passenger Vehicles: They run showrooms for Maruti Suzuki, Honda, and JLR selling cars that cater to needs, from affordable to end including electric options. Their sales numbers and market presence have been impressive in the regions they serve, in Kerala and Tamil Nadu.

2. Commercial Vehicles: They operate dealerships, for Tata Motors (Commercial) and BharatBenz serving a selection of vehicles. Their sales success in Kerala and Tamil Nadu showcases their impact, on sales figures.

3. Electric Two-Wheeler and Three-Wheeler Vehicles: In 2021 they joined this sector. Manage stores for Ather and Piaggio. Their emphasis, on cars, matches the increasing need in the market, for friendly transportation options.

Popular Vehicles & Services’ expansion efforts include acquiring service centers and showrooms, enhancing post-sale services, and increasing sales of electric vehicles. They have received recognition for their achievements in various segments, further solidifying their position in the Indian automobile market.

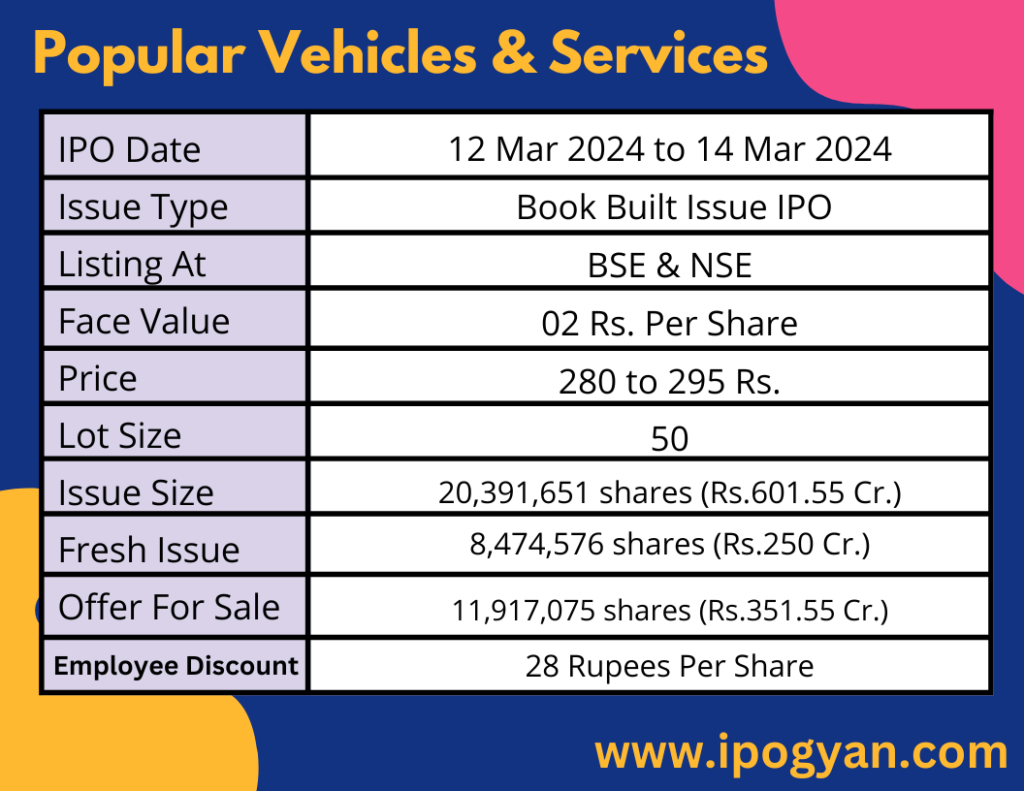

Popular Vehicles & Services IPO Complete Details:

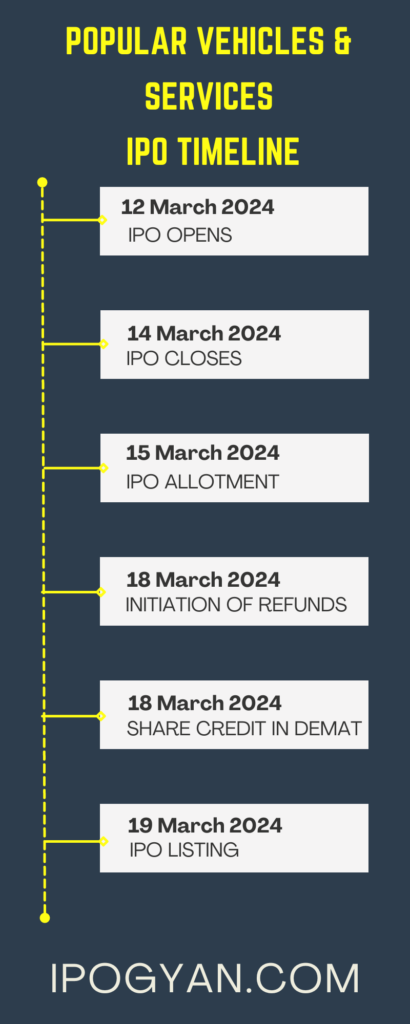

Popular Vehicles & Services IPO Timetable:

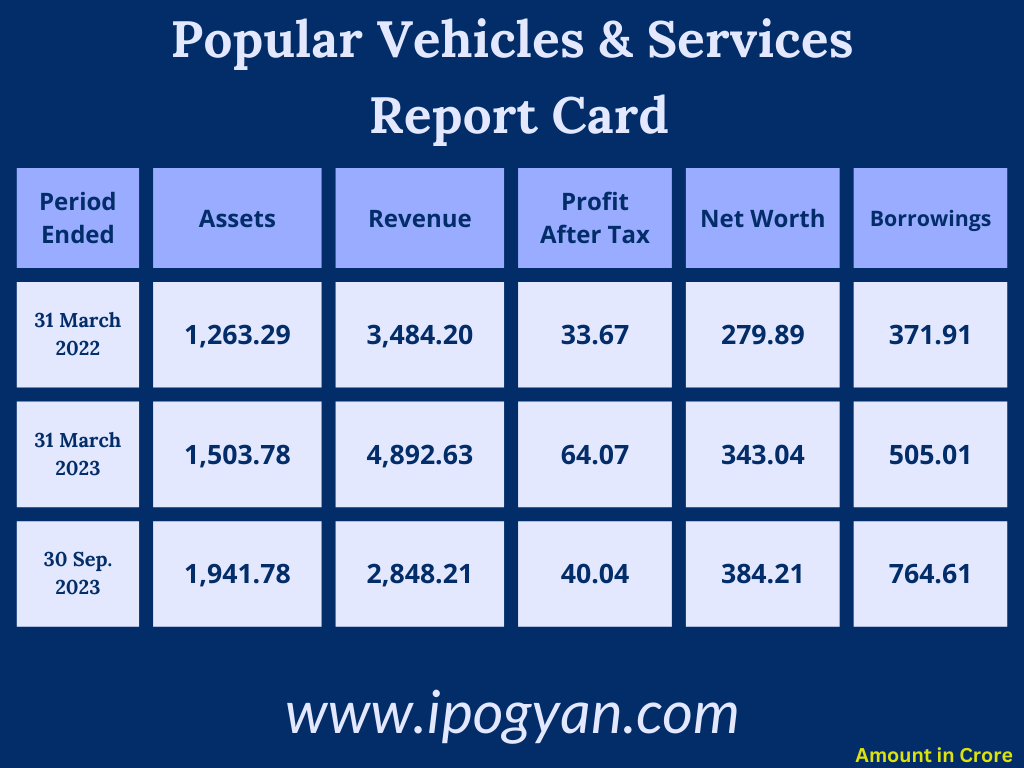

Company Financial Details:

AS OF NOW, the GMP Of Popular Vehicles & Services is Around 26 Rs.

Objects Of Issue:

1. Settling outstanding loans, either fully or partially, taken by our company and select subsidiaries including VMPL, PAWL, PMMIL, KGPL, KCPL, and PMPL.

2. Meeting general corporate requirements.

Promoters:

- JOHN K. PAUL

- FRANCIS K. PAULAND

- NAVEEN PHILIP

FAQs:

When Popular Vehicles & Services IPO is Opening?

Popular Vehicles & Services IPO is Opening on 12 March 2024.

When is the Popular Vehicles & Services IPO Closing?

Popular Vehicles & Services IPO is Closing on 14 March 2024.

What is the Issue Size of the Popular Vehicles & Services IPO?

The IPO Issue Size of Popular Vehicles & Services is 601.55 Crore.

Price Band of Popular Vehicles & Services IPO?

The price Band of Popular Vehicles & Services IPO is 280 to 295 rupees per share.

What is the minimum investment for a Popular Vehicles & Services IPO?

The minimum investment for the Popular Vehicles & Services IPO is 14,750 Rupees.

Allotment Date of Popular Vehicles & Services IPO?

The Allotment of Popular Vehicles & Services IPO is on 15 March 2024.

Listing Date of Popular Vehicles & Services IPO?

The Listing Of Popular Vehicles & Services is Scheduled on 19 March 2024.

One Should Apply for Popular Vehicles & Services IPO or Not?

Will Update Soon..

How to apply for Popular Vehicles & Services IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Popular Vehicles & Services IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Popular Vehicles & Services IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Popular Vehicles & Services IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Popular Vehicles & Services IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Popular Vehicles & Services IPO from the list ——–> Click on Popular Vehicles & Services IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Popular Vehicles & Services?

ICICI Securities Limited, Nuvama Wealth Management Limited, and Centrum Capital Limited are the Lead Managers of Popular Vehicles & Services.

Where To Check the Allotment of Popular Vehicles & Services IPO?

The allotment status for the Popular Vehicles & Services IPO will be accessible on the Link Intime India Private Limited Website.

Popular Vehicles & Services IPO is going to be listed at?

Popular Vehicles & Services IPO is going to be listed at NSE & BSE.

What is the Lot Size of the Popular Vehicles & Services IPO?

The lot size of the Popular Vehicles & Services IPO is 50 Shares.

What is the P/E Ratio of the Popular Vehicles & Services?

The P/E Ratio of the Popular Vehicles & Services is 28.88.

What is the EPS of the Popular Vehicles & Services?

The EPS of the Popular Vehicles & Services is 10.22.

What is the ROE of the Popular Vehicles & Services?

The ROE of Popular Vehicles & Services is 10.42%.

What is the ROCE of the Popular Vehicles & Services?

The ROCE of the Popular Vehicles & Services is 8.83%.