Pune E-Stock Broking is a player, in the financial services industry known for its presence and impressive accomplishments. Since its establishment in 2007, the company has made strides through mergers innovative IT projects, and a consistent commitment to growing its footprint and impact, in the financial services field. This detailed overview explores the milestones that have defined Pune E-Stock Broking’s journey and contributed to its sustained prosperity.

Pune E-Stock Broking offers a range of products and services, including:

1. Client Broking: Pune E-Stock Broking offers a platform, for investing or trading in stocks providing real-time Stock prices, easy transactions via mobile app, website or phone call-up, up-to-date market news, and personalized customer assistance. Customers can also participate in offerings (IPOs) through the platform.

2. Depository Participant: Pune E-Stock Broking, a certified Depository Participant, with CDSL offers depository services to its clients who trade in equities. They proudly serve a client base of 23,155 customers.

3. Mutual Funds Distribution: Pune E-Stock Broking offers a variety of funds, from Asset Management Companies (AMCs) providing a wide selection of investment choices including equity, debt, and hybrid funds. The company gives support throughout the investment journey. Provides regular updates, on portfolios.

4. Corporate Deposits: Pune E-Stock Broking provides deposits as an investment option offering investors a stable way to earn returns. Investors have the choice to invest directly on the company’s website or use platforms and brokers for convenience.

5. Currency Trading: Pune E-Stock Broking offers a currency derivatives service that enables trading in forex through avenues offering opportunities, for hedging, speculation, and diversifying portfolios. Importers and exporters can make use of currency derivatives to hedge their payments and receipts managing the risks linked to currency fluctuations.

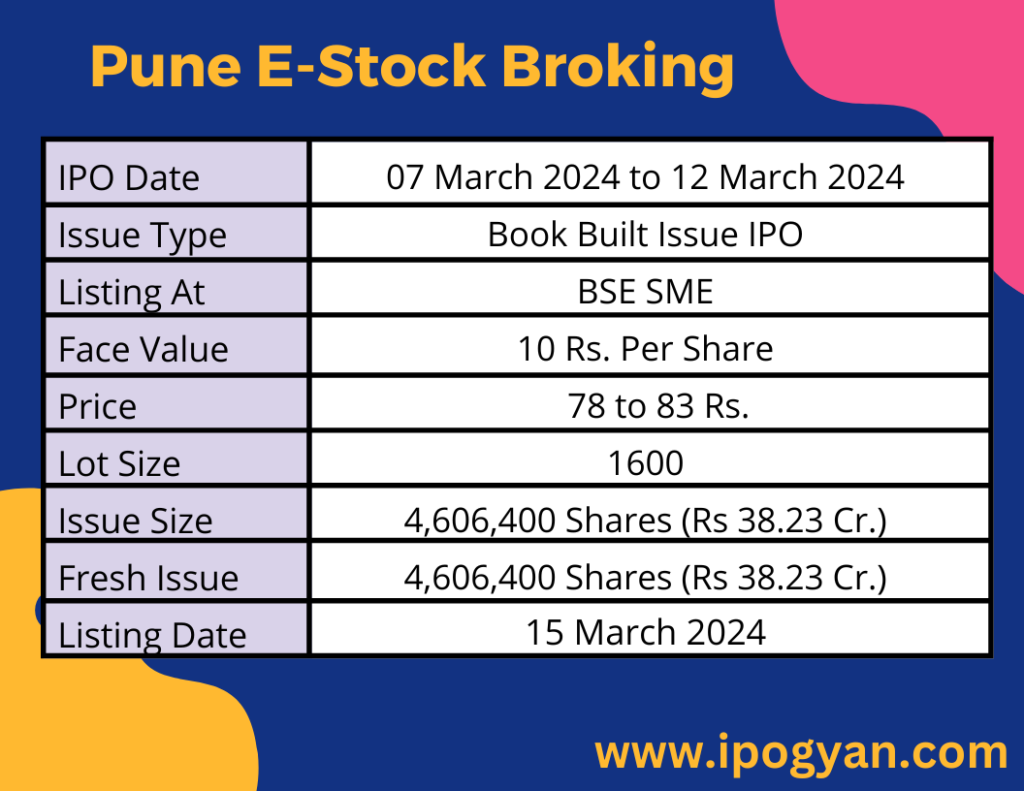

Pune E-Stock Broking IPO Complete Details:

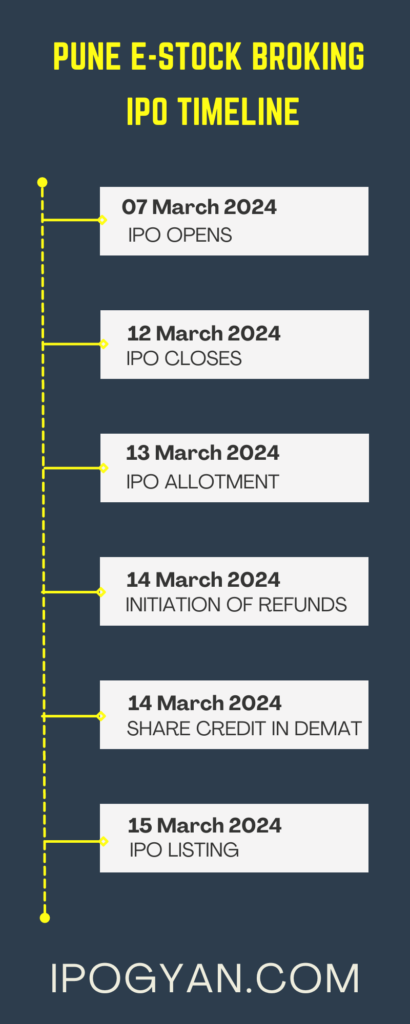

Pune E-Stock Broking IPO Timetable:

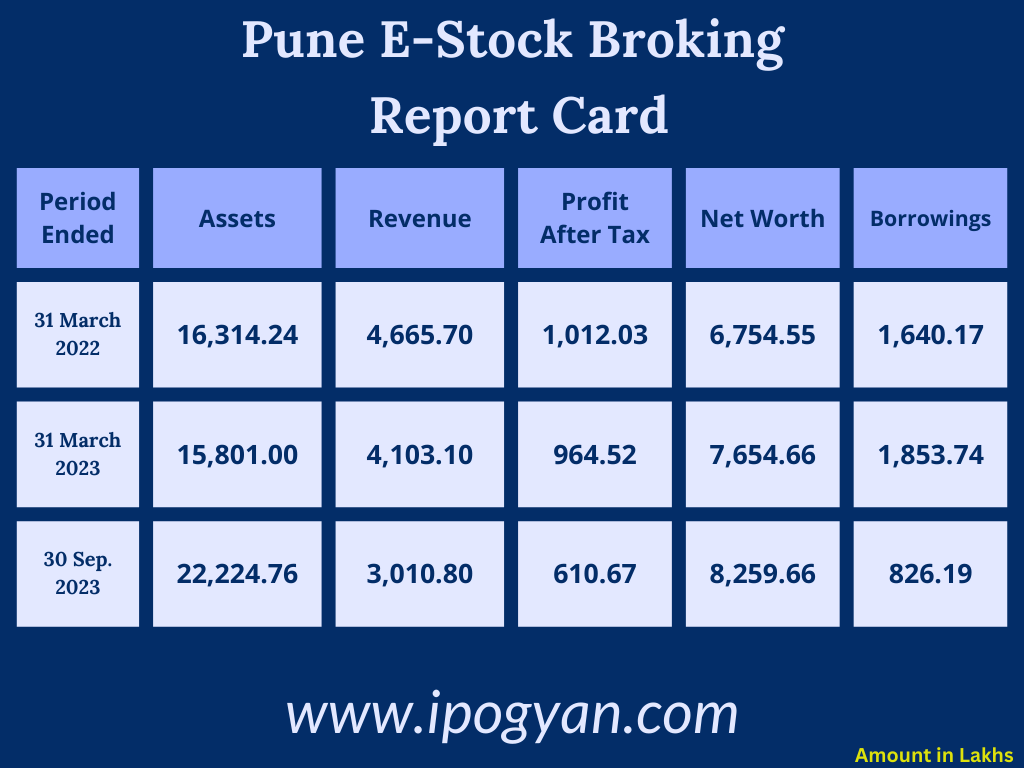

Company Financial Details:

AS OF NOW, the GMP Of Pune E-Stock Broking is Around 84 Rs.

Objects Of Issue:

1. Meeting working capital needs.

2. General corporate purposes.

Promoters:

- VRAJESH KRISHNA KUMAR SHAH

- DEVENDRA RAMCHANDRA GHODNADIKAR

- VRAJESH NAVNITBHAI SHAH

- SANDIP SUNDERLAL SHAH

- PARESH SUNDERLAL SHAH

FAQs:

When Pune E-Stock Broking IPO is Opening?

Pune E-Stock Broking IPO is Opening on 07 March 2024.

When is the Pune E-Stock Broking IPO Closing?

Pune E-Stock Broking IPO is Closing on 12 March 2024.

What is the Issue Size of the Pune E-Stock Broking IPO?

The IPO Issue Size of Pune E-Stock Broking is 38.23 Crore.

Price Band of Pune E-Stock Broking IPO?

The price Band of Pune E-Stock Broking IPO is 78 to 83 rupees per share.

What is the minimum investment for a Pune E-Stock Broking IPO?

The minimum investment for the Pune E-Stock Broking IPO is 132,800 Rupees.

Allotment Date of Pune E-Stock Broking IPO?

The Allotment of Pune E-Stock Broking IPO is on 13 March 2024.

Listing Date of Pune E-Stock Broking IPO?

The Listing Of Pune E-Stock Broking is Scheduled on 15 March 2024.

One Should Apply for Pune E-Stock Broking IPO or Not?

Will Update Soon..

How to apply for Pune E-Stock Broking IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Pune E-Stock Broking IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Pune E-Stock Broking IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Pune E-Stock Broking IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Pune E-Stock Broking IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Pune E-Stock Broking IPO from the list ——–> Click on Pune E-Stock Broking IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Pune E-Stock Broking?

Share India Capital Services Private Limited is the Lead Manager of Pune E-Stock Broking.

Where To Check the Allotment of Pune E-Stock Broking IPO?

The allotment status for the Pune E-Stock Broking IPO will be accessible on the Bigshare Services Private website.

Pune E-Stock Broking IPO is going to be listed at?

Pune E-Stock Broking IPO is going to be listed at BSE SME.

What is the Lot Size of the Pune E-Stock Broking IPO?

The lot size of the Pune E-Stock Broking IPO is 1600 Shares.

What is the P/E Ratio of the Pune E-Stock Broking?

The P/E Ratio of the Pune E-Stock Broking is 9.5.

What is the EPS of the Pune E-Stock Broking?

The EPS of the Pune E-Stock Broking is 8.73.

What is the ROE of the Pune E-Stock Broking?

The ROE of Pune E-Stock Broking is 7.30%.

What is the ROCE of the Pune E-Stock Broking?

The ROCE of the Pune E-Stock Broking is 8.25%.