SAMHI Hotels Limited, a prominent branded hotel ownership and asset management platform in India, holds the distinction of having the third largest inventory of operational keys (owned and leased) in India as of February 28, 2023, according to the JLL Report. Within a remarkable span of 12 years since its inception, SAMHI Hotels Limited has successfully curated a portfolio of 3,839 keys, distributed across 25 operating hotels located in 12 of India’s key urban consumption centers, including Bengaluru, Hyderabad, the National Capital Region (“NCR”), Pune, Chennai, and Ahmedabad, as of February 28, 2023.

SAMHI Hotels Limited primarily specializes in acquiring or constructing business hotels, diligently undertaking measures to upgrade properties, and establishing partnerships with well-established branded hotel operators to ensure the hotels are aptly positioned within their respective markets.

Currently, the company classifies its hotel portfolio into three distinct segments based on brand classification – Upper Upscale and Upscale, Upper Mid-scale, and Mid-scale. Notably, over 52.00% of their Total Income for the six months ending September 30, 2022, was generated by Upper Mid-scale and Mid-scale hotels. This is particularly significant as the Upper Mid-scale and Mid-scale segments offer substantial growth prospects in India due to their relevant price positioning and limited reliance on international travelers, according to the JLL Report.

Additionally, their Upper Upscale and Upscale hotels, which contributed to 46.93% of their Total Income for the same period, are strategically located in markets with high-density demand in cities such as Bangalore, Hyderabad, Ahmedabad, and Pune. There are expected that these cities are going to experience robust growth in airline passenger traffic and premium office space absorption, which is poised to benefit the overall demand base for SAMHI Hotels Limited’s hotels.

SAMHI Hotels Limited’s dominant position among the Upper Mid-scale and Mid-scale brands in India has empowered them to expand their portfolio of Fairfield by Marriott and Holiday Inn Express to 936 and 1,427 keys, respectively, as of February 28, 2023, making them the largest owner of these brands in India. SAMHI Hotels conducts detailed evaluations covering various parameters, such as hotel location profiles, demand/supply dynamics, competition, future business potential, product or brand profiles, development costs, timelines, and detailed financial analyses, during their careful acquisition process. They are still actively involved in hotel construction and the selection of suitable hotel operators with established brands.

SAMHI Hotels Limited’s hotels typically operate under long-term management contracts with well-recognized global hotel operators such as Marriott, Hyatt, and IHG. These partnerships help their hotels by providing access to demanding operating systems, sales, and distribution experience, a broader customer, and also access to prestigious hotel operators’ loyalty programs.

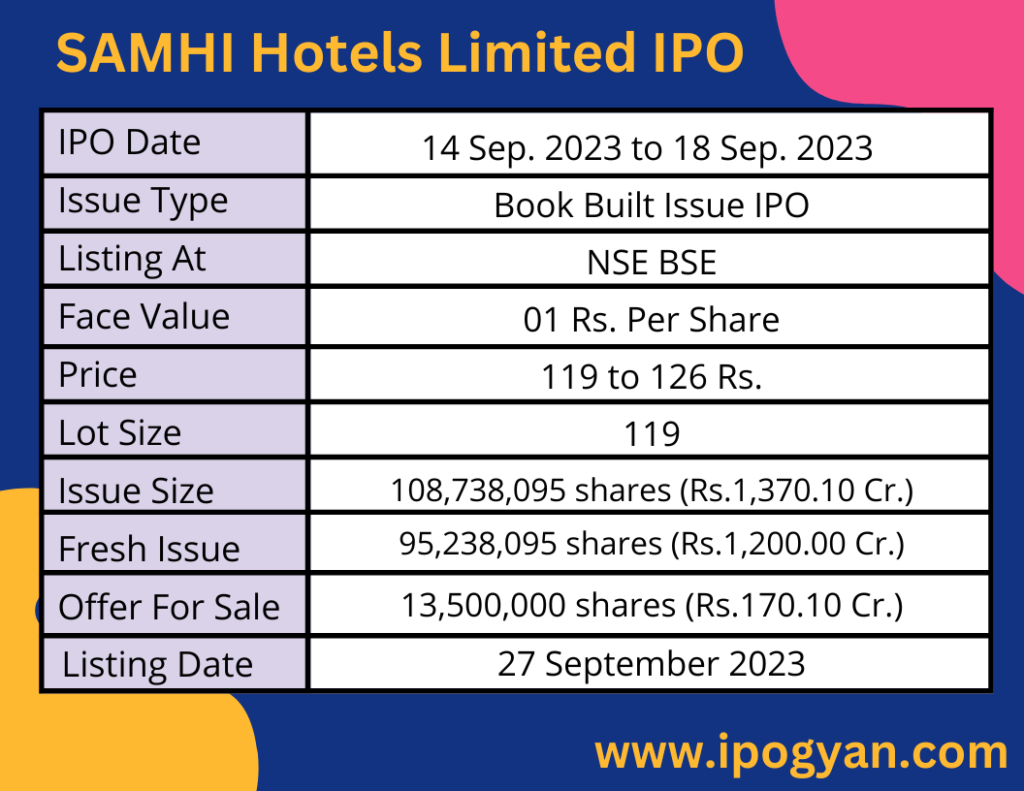

SAMHI Hotels Limited IPO Complete Details:

SAMHI Hotels Limited IPO Timetable:

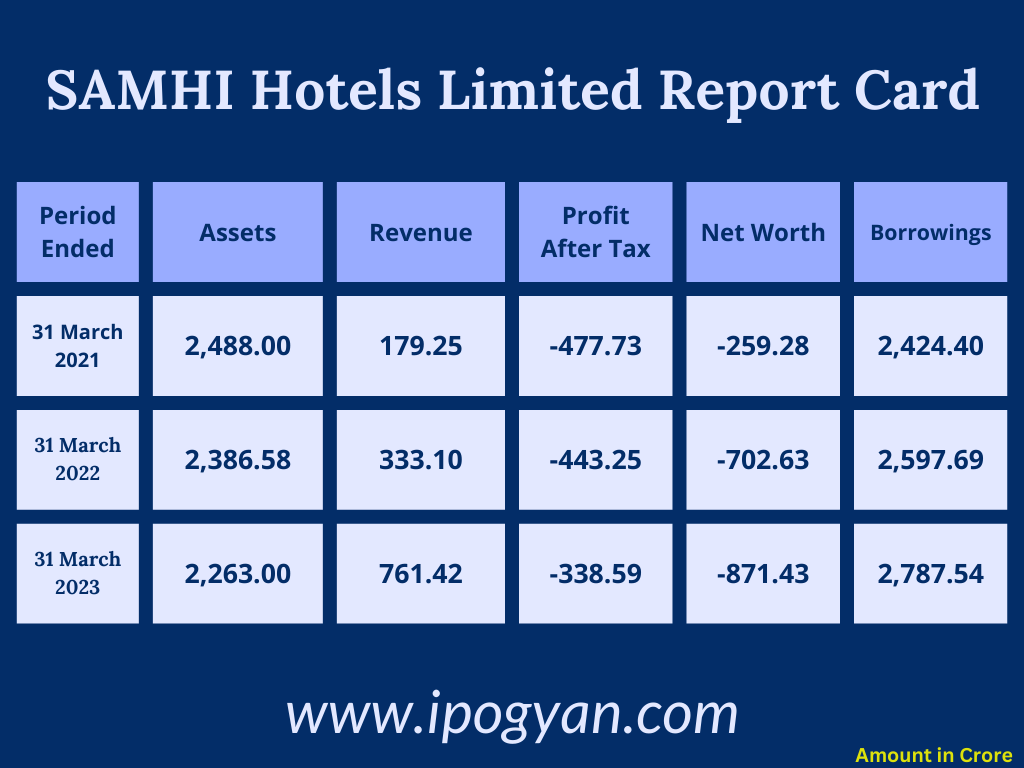

Company Financial Details:

AS OF NOW, the GMP OF SAMHI Hotels Limited is Around 07 Rs.

Objects Of Issue:

- The repayment, prepayment, or redemption, either in full or in part, of certain borrowings availed of by the Company and its Subsidiaries, including the settlement of accrued interest, is contemplated.

- For general corporate purposes, the utilization of funds is being considered.

Promoters and Group:

- Ashish Jakhanwala, the Chairman, MD, and CEO, joined the Board in 2010. He holds degrees in commerce, hotel management, and management.

- Manav Thadani, a Non-Executive Director, has a science and arts degree from NYU and is the founder of Hotelivate Private Limited.

- Michael Peter Schulhof, a Non-Executive Director, holds degrees in arts, science, and physics and chairs GTI Holdings LLC.

- Krishan Dhawan, an Independent Director, holds degrees in economics and management and has worked with Bank of America, Oracle India, and more.

- Michael David Holland, an Independent Director, is a fellow of the Royal Institution of Chartered Surveyors and has experience in the real estate sector.

- Aditya Jain, an Independent Director, holds engineering and MBA degrees and is the chairman of International Market Assessment India Private Limited.

- Archana Capoor, an Independent Director, holds an MBA degree and has worked in tourism, finance, and with Jet Airways.

FAQs:

When SAMHI Hotels Limited’s IPO is Opening?

SAMHI Hotels Limited IPO is Opening on 14 September 2023(Thursday).

When SAMHI Hotels Limited IPO is Closing?

SAMHI Hotels Limited IPO is Closing on 18 September 2023(Monday).

What is the IPO Issue Size of SAMHI Hotels Limited?

The IPO Issue Size of SAMHI Hotels Limited is 1,370.10 Crore.

Price Band of SAMHI Hotels Limited IPO?

The price Band of SAMHI Hotels Limited IPO is 119 to 126 rupees per share.

What is the minimum investment for SAMHI Hotels Limited IPO?

The minimum investment for SAMHI Hotels Limited IPO is 14,994 Rupees.

Allotment Date of SAMHI Hotels Limited IPO?

The Allotment of SAMHI Hotels Limited IPO is on 22 September 2023(Friday).

Listing Date of SAMHI Hotels Limited IPO?

The Listing Of SAMHI Hotels Limited is Scheduled on 27 September 2023(Wednesday).

One Should Apply SAMHI Hotels Limited IPO or Not?

Will Update soon.

How to apply for SAMHI Hotels Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find SAMHI Hotels Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for SAMHI Hotels Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find SAMHI Hotels Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for SAMHI Hotels Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find SAMHI Hotels Limited IPO from the list ——–> Click on SAMHI Hotels IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is SAMHI Hotels Limited IPO’s Lead Manager?

JM Financial Limited and Kotak Mahindra Capital Company Limited are the Lead Managers of SAMHI Hotels Limited IPO.

Where To Check the Allotment of SAMHI Hotels Limited IPO?

The allotment status for the SAMHI Hotels Limited IPO will be accessible on the Kfin Technologies Limited Website.

Also Read:

Zaggle Prepaid Ocean Services Limited IPO Review, Date, Price, GMP

R R Kabel Limited IPO Review, Date, Price, GMP