Zaggle Prepaid Ocean Services Limited is a leading provider of spend management sector which offers a unique value proposition and serves a diverse user base. Established in 2011, the organization operates in a segment that involves interactions with both its Customers (businesses) and end Users (employees). By doing partnerships with select banking institutions company becomes the leader in issuing prepaid cards in India. Their big portfolio includes various software-as-a-service (“SaaS”) solutions which include tax and payroll software, as well as a far-reaching network.

Zaggle Prepaid Ocean Services Limited works across numerous sectors and has a very good network of corporate Customers in industries such as banking and finance, technology, healthcare, manufacturing, FMCG, infrastructure, and automobiles. Zaggle’s has established relationships with well-known brands, including TATA Steel, Persistent Systems, Vitech, Inox, Pitney Bowes, Wockhardt, MAZDA, PCBL (RP – Sanjiv Goenka Group), Hiranandani Group, Cotiviti, and Greenply Industries.

Zaggle Prepaid Ocean Services Limited holds a unique position at the convergence of the SaaS and fintech ecosystems which offers solutions for business spend management, rewards and incentives management, and customer engagement management systems (“CEMS”). Their core product portfolio includes ‘Propel,’ ‘Save,’ ‘CEMS,’ ‘Zaggle Payroll Card,’ and ‘Zoyer.’

Through their automated rewards and recognition platform ‘Propel,’ Zaggle Prepaid Ocean Services Limited helps Customers solve everyday business challenges, driving growth and unlocking value in their operations. ‘Save’ allows Customers to digitize, aggregate, and manage business and employee expenses, while ‘Zoyer’ offers automation and intelligence in core invoice-to-pay workflows.

Zaggle Prepaid Ocean Services Limited adopts an ecosystem-based approach encompassing both SaaS and fintech, characterized by low customer acquisition and retention costs in the business-to-business (“B2B”) segment. The primary goal of the company is to cross-sell, up-sell, and offer products and services through partnerships with other players in the operational ecosystems. They have also partnered with banking institutions and fintechs to deliver a suite of SaaS and financial technology solutions to Customers.

Zaggle Prepaid Ocean Services offerings include features such as a configurable platform for each Customer and enhanced convenience through API integrations. This enables simple, distinct, and integrated access to their products, as well as an excellent opportunity to market and offer third-party affiliations via the same dashboard.. Their ability to offer diversified SaaS offerings to an existing customer base enables them to launch new products and cross-sell to their extensive User base. They have also issued co-branded prepaid cards in collaboration with banking partners.

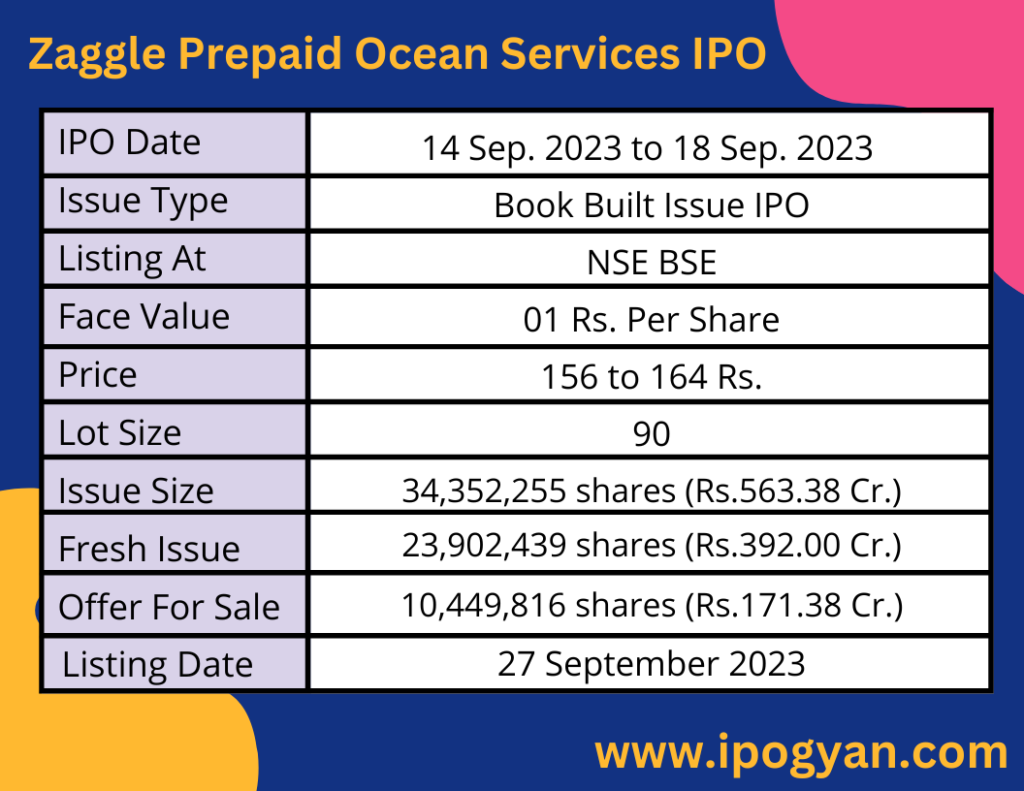

Zaggle Prepaid Ocean Services Limited IPO Complete Details:

Zaggle Prepaid Ocean Services Limited IPO Timetable:

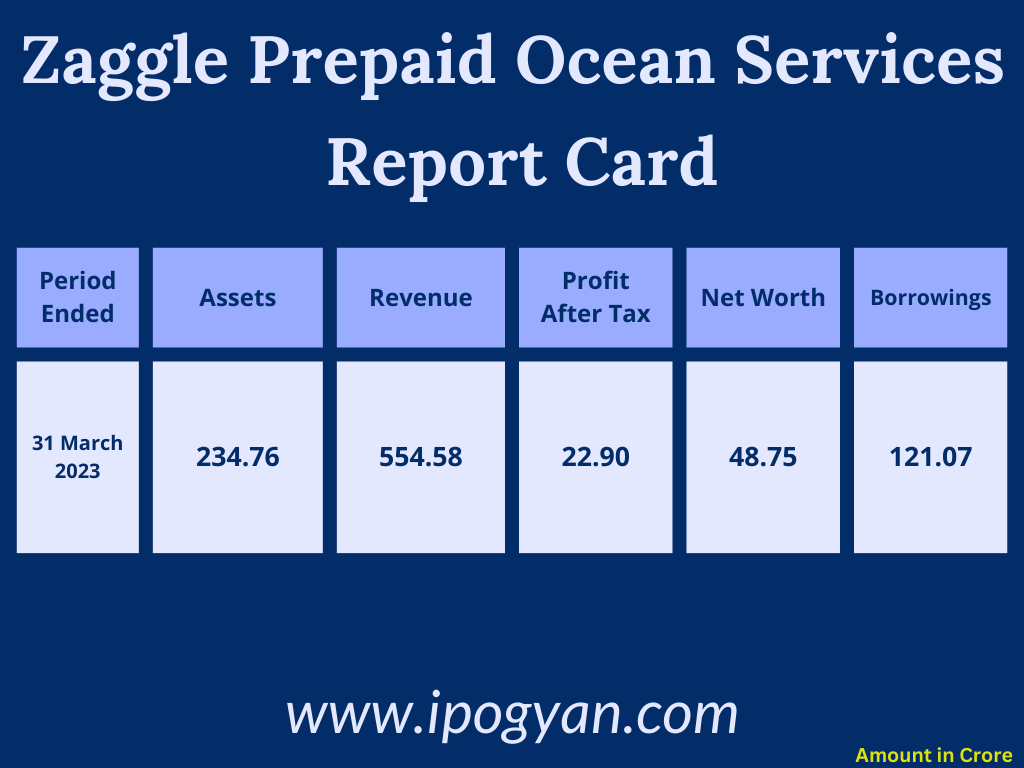

Company Financial Details:

AS OF NOW, the GMP OF Zaggle Prepaid Ocean Services Limited is Around 11 Rs.

Objects Of Issue:

- Investment in Customer Acquisition and Retention Expenses

- Allocation of Funds for Technology and Product Development

- Settlement or Early Repayment of Specific Loans Previously Obtained by Our Company, either in Full or Partially

- Utilization of Funds for General Corporate Purposes

Promoters:

Raj P. Narayanam is the Executive Chairman of the company, serving on the Board from April 30, 2012. He has very good experience in the sectors like IT and fintech, as well as Raj has invested in various companies

Avinash Ramesh Godkhindi the Managing Director and Chief Executive Officer of the company, joined the Board on May 7, 2012. He received the “Inspiring CEO” award from the Economic Times and previously worked as an Assistant Vice President at Citibank N.A., India.

FAQs:

When Zaggle Prepaid Ocean Services Limited’s IPO is Opening?

Zaggle Prepaid Ocean Services Limited IPO is Opening on 14 September 2023(Thursday).

When Zaggle Prepaid Ocean Services Limited IPO is Closing?

Zaggle Prepaid Ocean Services Limited IPO is Closing on 18 September 2023(Monday).

What is the IPO Issue Size of Zaggle Prepaid Ocean Services Limited?

The IPO Issue Size of Zaggle Prepaid Ocean Services Limited is 563.38 Crore.

Price Band of Zaggle Prepaid Ocean Services Limited IPO?

The price Band of Zaggle Prepaid Ocean Services Limited IPO is 156 to 164 rupees per share.

What is the minimum investment for Zaggle Prepaid Ocean Services Limited IPO?

The minimum investment for Zaggle Prepaid Ocean Services Limited IPO is 14,760 Rupees.

Allotment Date of Zaggle Prepaid Ocean Services Limited IPO?

The Allotment of Zaggle Prepaid Ocean Services Limited IPO is on 22 September 2023(Friday).

Listing Date of Zaggle Prepaid Ocean Services Limited IPO?

The Listing Of Zaggle Prepaid Ocean Services Limited is Scheduled on 27 September 2023(Wednesday).

One Should Apply Zaggle Prepaid Ocean Services Limited IPO or Not?

Will Update soon.

How to apply for Zaggle Prepaid Ocean Services Limited IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Zaggle Prepaid Ocean Services Limited IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Zaggle Prepaid Ocean Services Limited IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Zaggle Prepaid Ocean Services Limited IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Zaggle Prepaid Ocean Services Limited IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Zaggle Prepaid Ocean Services Limited IPO from the list ——–> Click on Zaggle Prepaid Ocean Services IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Zaggle Prepaid Ocean Services Limited IPO’s Lead Manager?

ICICI Securities Limited, Equirus Capital Private Limited, IIFL Securities Limited, and JM Financial Limited are the Lead Managers of Zaggle Prepaid Ocean Services Limited IPO.

Where To Check the Allotment of Zaggle Prepaid Ocean Services Limited IPO?

The allotment status for the Zaggle Prepaid Ocean Services Limited IPO will be accessible on the Kfin Technologies Limited Website.

Also Read:

Kundan Edifice Limited IPO Review, Date, Price, GMP

Chavda Infra Limited IPO Review, Date, Price, GMP

Jiwanram Sheoduttrai Industries Limited IPO Review, Date, Price, GMP