TBO Tek conceptualized the TBO platform as a technology tool to simplify the process for travel agents to book airline tickets across multiple airlines, aiming to address the challenges posed by the large and fragmented travel industry with limited technology adoption.

Remaining committed to its mission of empowering the travel industry with technology, TBO Tek has grown into a global presence, servicing buyers and suppliers in over 100 countries as of June 30, 2023. Positioned as one of the leading travel distribution platforms in the global travel and tourism industry, TBO Tek provides buyers with a comprehensive travel inventory according to the needs of their customers, while also offering support for a wide range of currencies and forex assistance.

TBO Tek simplifies the business of travel for suppliers such as hotels, airlines, car rentals, transfers, cruises, insurance, rail, and others, as well as for retail buyers such as travel agencies and independent travel advisors, along with enterprise buyers including tour operators, travel management companies, online travel companies, super-apps, and loyalty apps.

Overview Of TBO Tek

Global Reach

TBO Tek operates in over 100 countries, offering travel solutions to more than 7,500 destinations worldwide.

High Transaction Volume

The platform processes over 33,000 bookings every day, reflecting its efficiency and popularity among users.

Multilingual Support

With support for 11 languages, TBO Tek caters to a diverse user base, ensuring accessibility and ease of use for customers globally.

Extensive Workforce

TBO Tek boasts a global headcount of over 1,750 employees, ensuring smooth operations and robust customer support.

Currency Diversity

Transactions on the platform are facilitated in over 55 currencies, accommodating the needs of clients from various regions.

Global Commercial Presence

TBO Tek maintains commercial teams in 47 countries, enabling effective market engagement and localized service delivery.

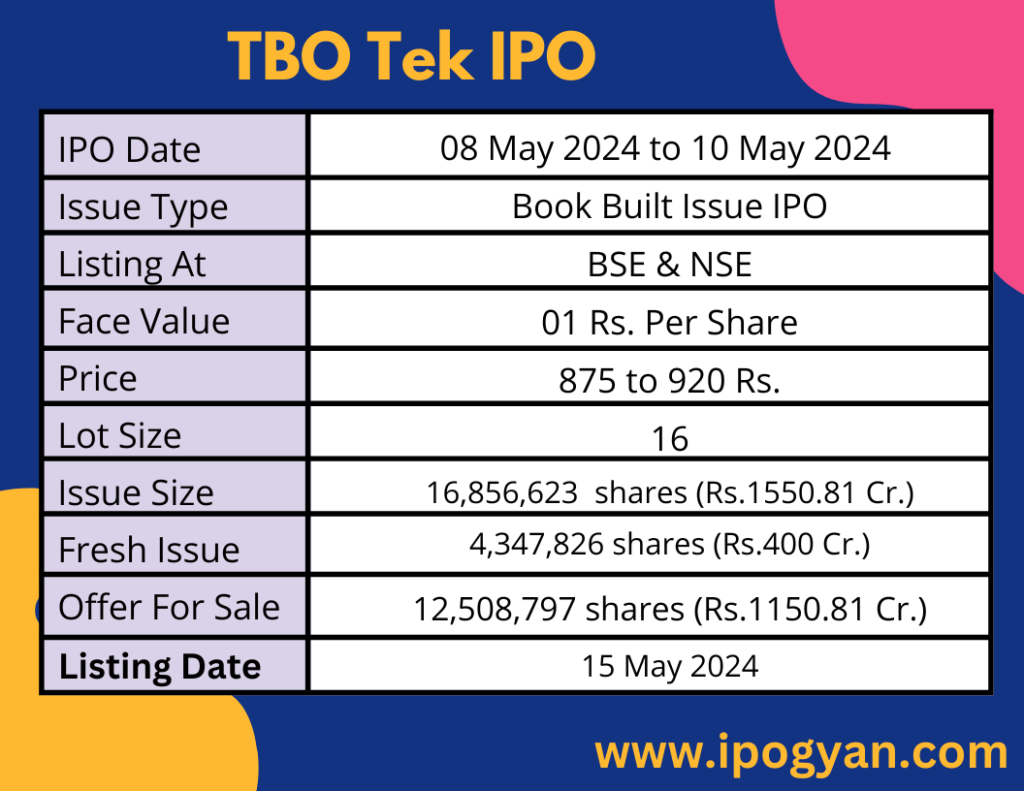

TBO Tek IPO Complete Details:

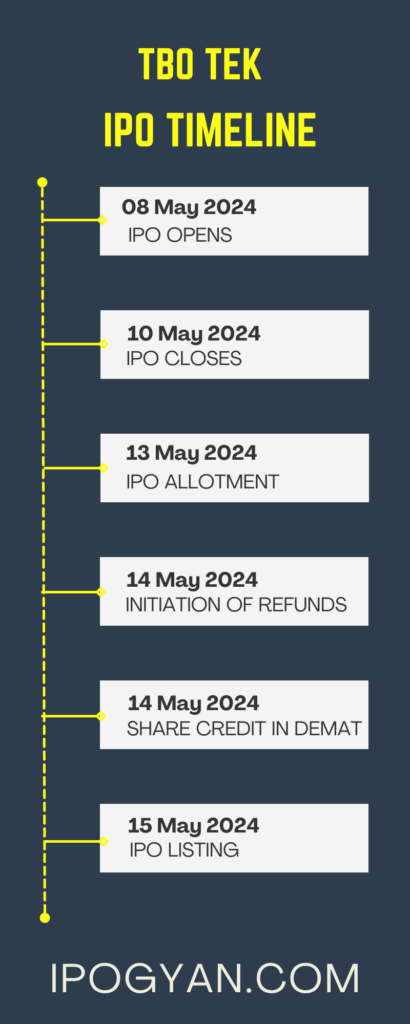

TBO Tek IPO Timetable:

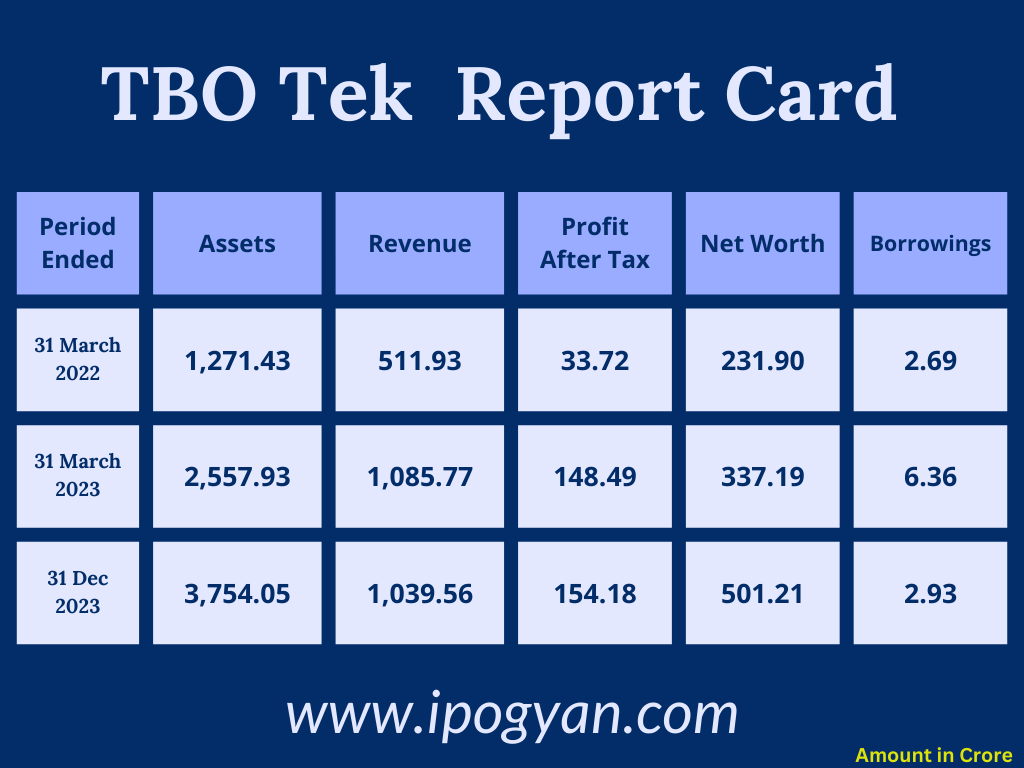

Company Financial Details:

AS OF NOW, the GMP Of TBO Tek is Around 534 Rs.

Objects Of Issue:

1. TBO Tek aims to expand its Supplier and Buyer base, fostering growth and diversity within its ecosystem.

2. The company seeks to amplify the value of its platform by introducing new lines of businesses, catering to evolving market demands.

3. TBO Tek plans to pursue inorganic growth through selective acquisitions, strategically building synergies with its existing platform.

4. Leveraging data procurement capabilities, TBO Tek aims to offer bespoke travel solutions to its Buyers and Suppliers, enhancing customer satisfaction and market competitiveness.

Promoters:

- ANKUSH NIJHAWAN

- GAURAV BHATNAGAR

- LAP TRAVEL PRIVATE LIMITED

- MANISH DHINGRA

FAQs:

When TBO Tek IPO is Opening?

TBO Tek IPO is Opening on 08 May 2024.

When is the TBO Tek IPO Closing?

TBO Tek IPO is Closing on 10 May 2024.

What is the Issue Size of the TBO Tek IPO?

The IPO Issue Size of TBO Tek is 1500.81 Crore.

Price Band of TBO Tek IPO?

The price Band of the TBO Tek IPO is 875 to 920 rupees per share.

What is the minimum investment for TBO Tek IPO?

The minimum investment for the TBO Tek IPO is 14,720 Rupees.

Allotment Date of TBO Tek IPO?

The Allotment of TBO TekIPO is on 13 May 2024.

Listing Date of TBO Tek IPO?

The Listing Of TBO Tek is Scheduled on 15 May 2024.

One Should Apply for TBO Tek IPO or Not?

Will Update Soon..

How to apply for TBO Tek IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find TBO Tek IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for TBO Tek IPO through the Upstox Old Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find TBO Tek IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for TBO Tek IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find TBO Tek IPO from the list ——–> Click on TBO Tek IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of TBO Tek?

Axis Capital Limited, Jefferies India Private Limited, Goldman Sachs (India) Securities Private Limited, and JM Financial Limited are the Lead Managers of TBO Tek.

Where To Check the Allotment of TBO Tek IPO?

The allotment status for the TBO Tek IPO will be accessible on the Kfin Technologies Limited Website.

TBO Tek IPO is going to be listed at?

TBO Tek IPO is going to be listed at NSE & BSE.

What is the Lot Size of the TBO Tek IPO?

The lot size of the TBO Tek IPO is 16 Shares.

What is the P/E Ratio of the TBO Tek?

The P/E Ratio of the TBO Tek is 64.58.

What is the EPS of the TBO Tek?

The EPS of the TBO Tek is 14.25.

What is the ROE of the TBO Tek?

The ROE of TBO Tek is N/A.

What is the ROCE of the TBO Tek?

The ROCE of TBO Tek is N/A.