Trust Fintech is a company that focuses on SaaS products specializing in Core Banking Software, IT Solutions, ERP Implementation, and Customized Software Solutions Development, for the BFSI sector. Their goal is to provide core banking solutions and cutting-edge technology solutions to the banking and financial industry. Over the 25 years, Trust Fintech has evolved with changes, in technology and the market to establish its business model and product offerings.

The company has put resources into creating over 10 products tailored for Commercial and Cooperative Banks and Financial Institutions. These offerings encompass Core Banking Software, Loan Origination software, GST compliance software, Financial Accounting & Billing Software along with modules, for generating Statutory Reports reconciling ATMs preventing Anti Money Laundering supporting Agency Banking, and facilitating Mobile Banking.

Trust Fintech’s primary offering, TrustBankCBS is tailored for medium, banks and financial institutions. On the other hand, MicroFinS is designed to meet the requirements of Small & growing operative Societies, SACCOS & similar banking institutions. TrustBankCBS is a web-based software that can be accessed either on-premises with infrastructure or through a ‘Software as a Service’ (SaaS) model. It simplifies banking operations by providing modules, for customer onboarding KYC compliance, loan management digital banking interfaces statutory compliance reports, and anti-money laundering tools.

MicroFinS is a Core Banking Solution that operates in the cloud and caters, to Savings & Credit needs, for Cooperative Societies (SACCOS) Credit Unions and Microfinance Institutions. Built on an open source platform it provides a range of solutions at a total cost of ownership.

For, more than 25 years Trust Fintech has been excelling in operations with a team of over 250 employees. They offer cutting-edge software solutions to banks in India and worldwide. The company has branches in Nagpur, Pune, and Mumbai. Is looking to open another office, in Mihan SEZ, Nagpur to support expansion plans.

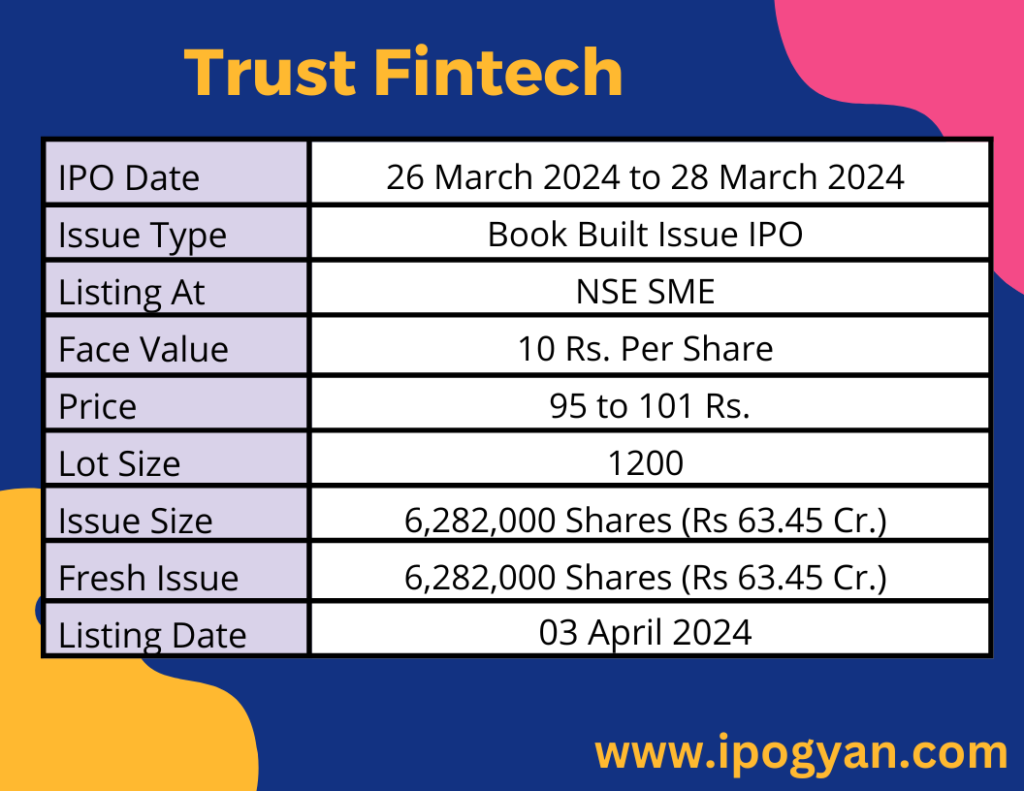

Trust Fintech IPO Complete Details:

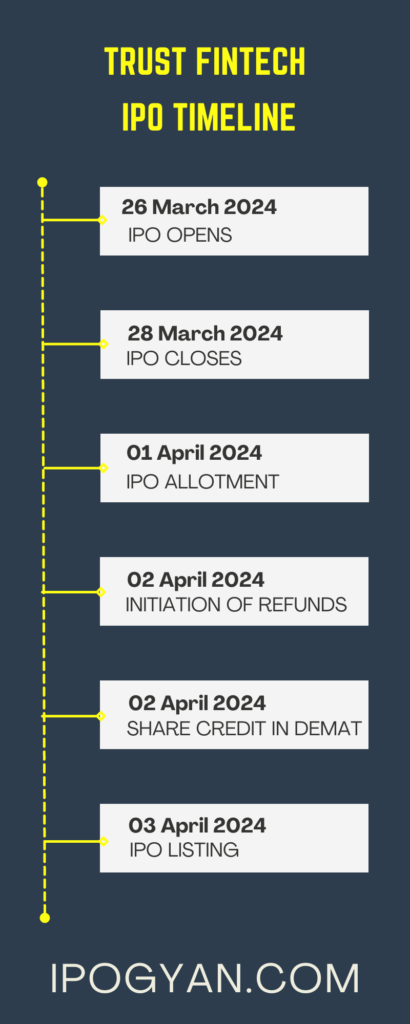

Trust Fintech IPO Timetable:

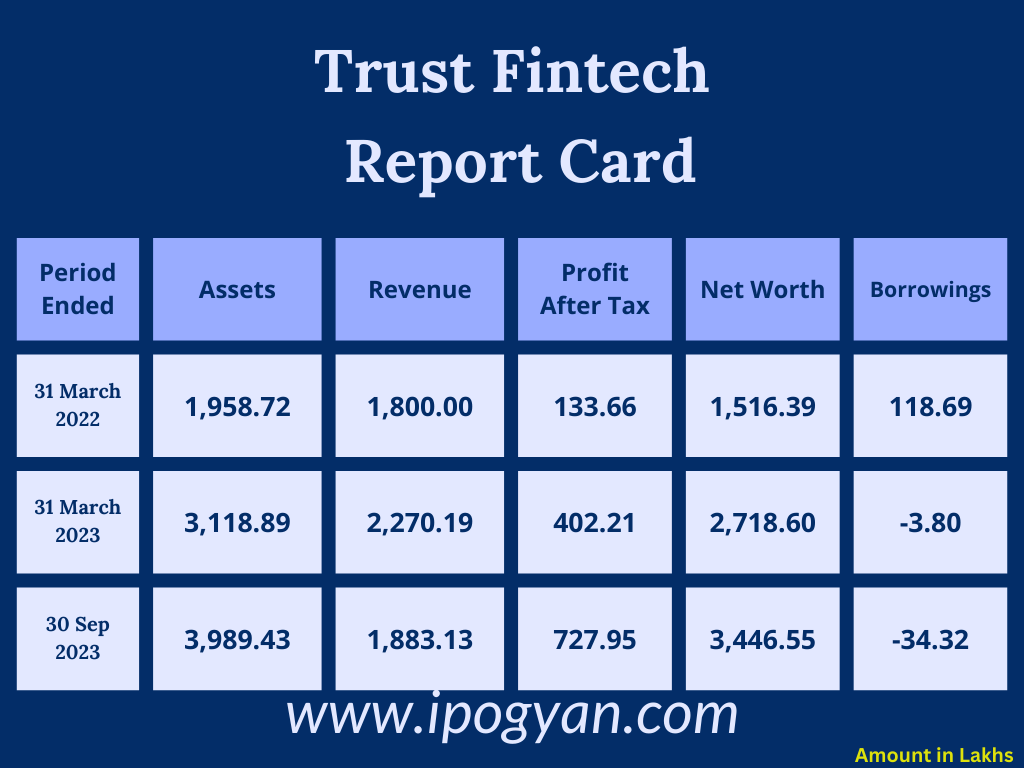

Company Financial Details:

AS OF NOW, the GMP Of Trust Fintech is Around 45 Rs.

Objects Of Issue:

1) Establishing an additional development facility in Nagpur, Maharashtra, including installing fit-outs and interior design works.

2) Investing in procuring hardware and upgrading IT infrastructure.

3) Funding expenditures for enhancing, maintaining, and upgrading existing products.

4) Covering expenses related to global and domestic business development, sales, and marketing for the company.

5) Managing general corporate expenses.

Promoters:

- MR. HEMANT PADMANABH CHAFALE

- MR. SANJAY PADMANABH CHAFALE

- MR. HERAMB RAMKRISHNA DAMLE

- SHANKER KANE

- MR. ANAND

- MR. MANDAR KISHOR DEO

FAQs:

When Trust Fintech IPO is Opening?

Trust Fintech IPO is Opening on 26 March 2024.

When is the Trust Fintech IPO Closing?

Trust Fintech IPO is Closing on 28 March 2024.

What is the Issue Size of the Trust Fintech IPO?

The IPO Issue Size of Trust Fintech is 63.45 Crore.

Price Band of Trust Fintech IPO?

The price Band of Trust Fintech IPO is 95 to 101 rupees per share.

What is the minimum investment for a Trust Fintech IPO?

The minimum investment for the Trust Fintech IPO is 121,200 Rupees.

Allotment Date of Trust Fintech IPO?

The Allotment of Trust Fintech IPO is on 01 April 2024.

Listing Date of Trust Fintech IPO?

The Listing Of Trust Fintech is Scheduled on 03 April 2024.

One Should Apply for Trust Fintech IPO or Not?

Will Update Soon..

How to apply for Trust Fintech IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Trust Fintech IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Trust Fintech IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Trust Fintech IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Trust Fintech IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Trust Fintech IPO from the list ——–> Click on Trust Fintech IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Trust Fintech?

Corporate Capitalventures Pvt Ltd is the Lead Manager of Trust Fintech.

Where To Check the Allotment of Trust Fintech IPO?

The allotment status for the Trust Fintech IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Trust Fintech IPO is going to be listed at?

Trust Fintech IPO is going to be listed at NSE SME.

What is the Lot Size of the Trust Fintech IPO?

The lot size of the Trust Fintech IPO is 1200 Shares.

What is the P/E Ratio of the Trust Fintech?

The P/E Ratio of the Trust Fintech is 44.05.

What is the EPS of the Trust Fintech?

The EPS of the Trust Fintech is 2.29.

What is the ROE of the Trust Fintech?

The ROE of Trust Fintech is 23.61%.

What is the ROCE of the Trust Fintech?

The ROCE of the Trust Fintech is 28.54%.