E Factor Experiences incorporated in 2003, is an award-winning Indian event management company specializing in delivering exceptional event experiences and services to consumers and communities. The company is renowned for its expertise in creating permanent and semi-permanent multimedia light and sound installations, as well as handling specialized turnkey event assignments, including wedding management and private and social event solutions.

E Factor Experiences offers a diverse portfolio that includes services, encompassing government-commissioned Tourism Events and Festivals, techno-cultural light and sound shows, Sporting Events and Contests, Conferences, Mega Ground Concerts, Televised Events, and a range of private and social events, such as weddings and anniversary celebrations.

E Factor Experiences takes pride in its track record of organizing and curating various turnkey events and experiences, including notable endeavors like “The Pushkar Fair” held from 2015 to 2019, the transformation of traditional Snake-Boat Races into a league format in 2019, and the creation of beach destinations through projects like the Eco retreat in Konark and other destinations in Bhitarkanika, Odisha, in 2021.

Beyond their core events business, E Factor Experiences has ventured into a permanent and thriving industry with their experiential tourism brand, “Sky Waltz,” operated through their subsidiary company, E-Factor Adventure Tourism Private Limited. Sky Waltz specializes in managing and operating hot-air ballooning and yachting activities across multiple locations in India. As a government-approved commercial hot air balloon operator for over a decade, Sky Waltz boasts a team of commercial pilots, trained operational staff, and equipment sourced from international vendors, upholding globally recognized safety standards and international operating procedures. Currently, their permanent Balloon Safari operations are active in Jaipur, with expansion plans for other regions of the country in the near future. Additionally, the company actively participates in various ballooning festivals in locations such as Agra, Varanasi, Mandu Festival, Araku Festival, and more.

E Factor Experiences started off in New Delhi and eventually expanded its network to include offices around the nation, including Noida, Jaipur, Odisha, and Delhi. The company has a dedicated team of 32 experienced members which gives the company a huge advantage of stability and growth and also in the execution of services within time, and by maintaining good quality.

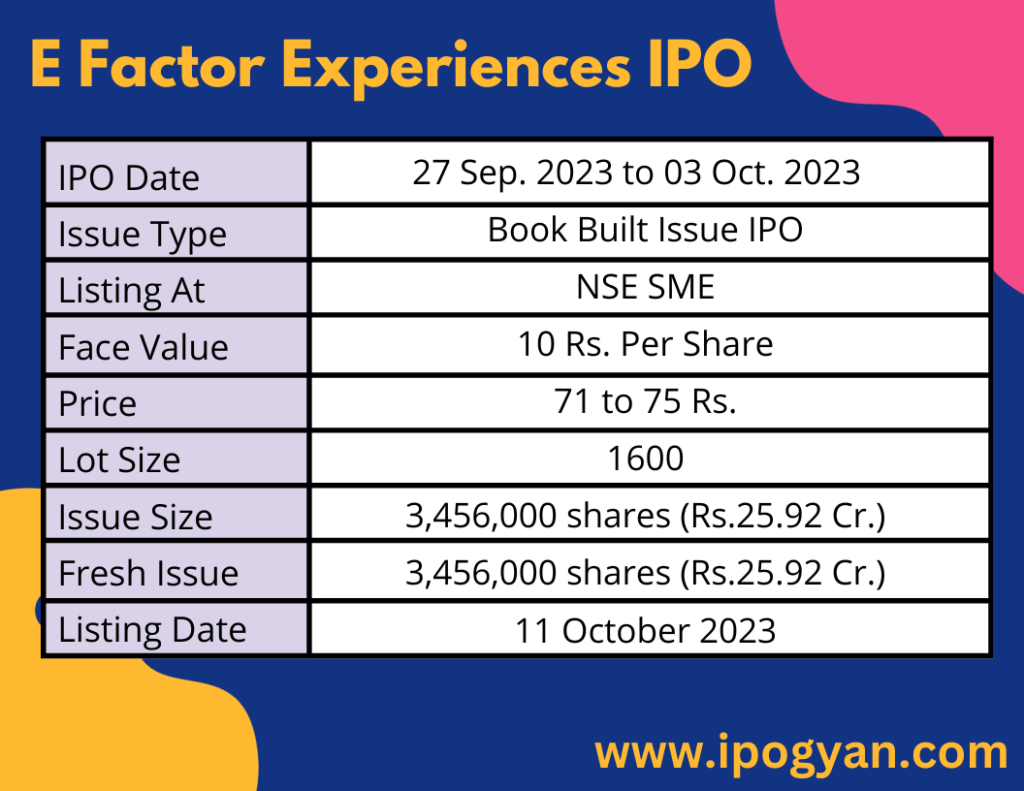

E Factor Experiences IPO Complete Details:

E Factor Experiences IPO Timetable:

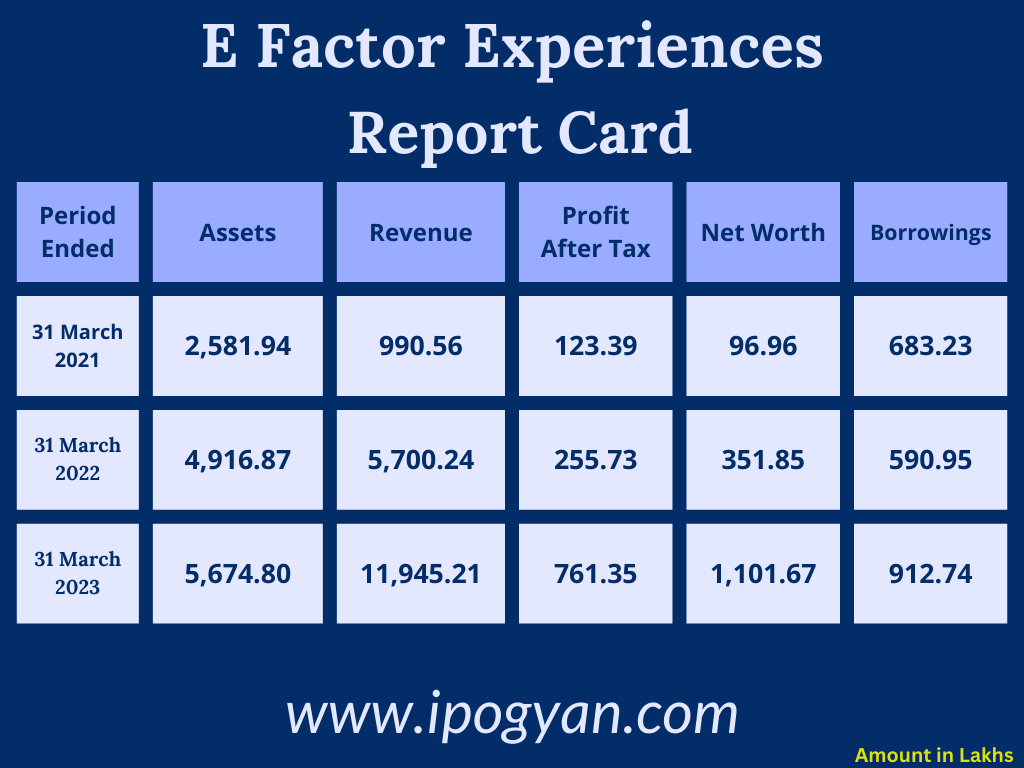

Company Financial Details:

AS OF NOW, the GMP OF E Factor Experiences is Around 32 Rs.

Objects Of Issue:

1. Investing in a Subsidiary

2. Fulfilling Working Capital Needs

3. Settling, either wholly or partially, specific loans taken by our company

4. Addressing General Corporate Needs

Promoters:

Jai Thakore:

– Position: Promoter, Chairman, and full-time director of the Company.

– Education: Completed a Bachelor in Commerce from Devi Ahilya Vishwavidyalaya, Madhya Pradesh in 1989.

– Experience: Has over 22 years of experience in event and wedding management, as well as the political activation industry.

Samit Garg:

– Position: Promoter and Managing Director of the Company.

– Education: Completed a Bachelor in Commerce from Lucknow Christian College in 1992.

– Experience: Possesses more than 20 years of experience in event and wedding management and the political activation industry.

Aruna Garg:

– Position: Promoter and full-time director of the Company.

– Experience: Has around 15 years of experience in the finance field.

– Responsibilities: Manages the financial and related activities of the Company.

Manika Garg:

– Position: Promoter of the Company.

– Education: Completed a Masters in Business Administration from Jaipuria Institute of Management Studies, Lucknow in 2000.

– Experience: Has approximately 23 years of work experience in the company’s industries.

FAQs:

When E Factor Experiences IPO is Opening?

E Factor Experiences IPO is Opening on 27 September 2023(Tuesday).

When E Factor Experiences IPO is Closing?

E Factor Experiences IPO is Closing on 03 October 2023(Tuesday).

What is the IPO Issue Size of Factor Experiences?

The IPO Issue Size of E Factor Experiences is 25.92 Crore

Price Band of E Factor Experiences IPO?

The price Band of E Factor Experiences IPO is 71 to 75 rupees per share.

What is the minimum investment for E Factor Experiences IPO?

The minimum investment for E Factor Experiences IPO is 120,000 Rupees.

Allotment Date of E Factor Experiences IPO?

The Allotment of E Factor Experiences IPO is on 06 October 2023(Friday).

Listing Date of E Factor Experiences IPO?

The Listing Of E Factor Experiences is Scheduled on 11 October 2023(Wednesday).

One Should Apply for E Factor Experiences IPO or Not?

May Apply

How to apply for Kontor Space IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find E Factor Experiences IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for E Factor Experiences IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find E Factor Experiences IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for E Factor Experiences IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find E Factor Experiences IPO from the list ——–> Click on E Factor Experiences IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is E Factor Experiences IPO’s Lead Manager?

Hem Securities Limited is the Lead Manager of E Factor Experiences.

Where To Check the Allotment of E Factor Experiences IPO?

The allotment status for the E Factor Experiences IPO will be accessible on the Maashitla Securities Private Limited Website.

E Factor Experiences IPO is going to be listed at?

E Factor Experiences IPO is going to be listed at NSE SME

What is the Lot Size of the E Factor Experiences IPO?

The lot size of Kontor Space IPO is 1600 Shares.

What is the EPS of E Factor Experiences IPO?

The EPS of E Factor Experiences is 7.82.

What is the P/E Ratio of E Factor Experiences IPO?

The P/E Ratio of E Factor Experiences is 9.59.

What is the ROE of E Factor Experiences IPO?

The ROE of E Factor Experiences is 103.79%.

What is the ROCE of E Factor Experiences IPO?

The ROCE of E Factor Experiences is 54.85%.