Kontor Space Incorporated in 2018 specializes in providing “space-as-a-service” by renting and managing commercial spaces. The company’s major goal is to create a culture of collaboration and productivity by providing flexible, comfortable, and high-quality workplace solutions at low prices, by using their technology expertise. Their customer base goes from small-scale startups to major multinationals.

Kontor Space has built a strong brand image and a significant position in the co-working market as the trademark owner of the ‘Kontor’ brand. This success has enabled them to aggressively expand into new markets through the acquisition and management of additional spaces, in addition to their existing locations in Thane, Pune, Fort, and BKC (Mumbai).

The main business concept of Kontor Space is to provide co-working spaces. They offer “space-as-a-service” by either purchasing properties or leasing them and subsequently sub-renting or sub-leasing these spaces to individual or multiple clients to meet their workspace requirements. The spaces can be furnished or unfurnished, based on client preferences, and are available on a per-seat basis.

Kontor Space invests in fit-outs to customize properties according to their business model, conducting renovations and modernization efforts to align properties with evolving business needs. Furniture, work desks, open work areas, cabins, meeting rooms, conference facilities, cafeterias, play areas, reception areas, lockers, de-stress zones, and the installation of various peripherals such as printers, scanners, attendance devices, telephones, high-speed internet, air conditioning, water coolers, smoking zones, and other essential facilities are included.

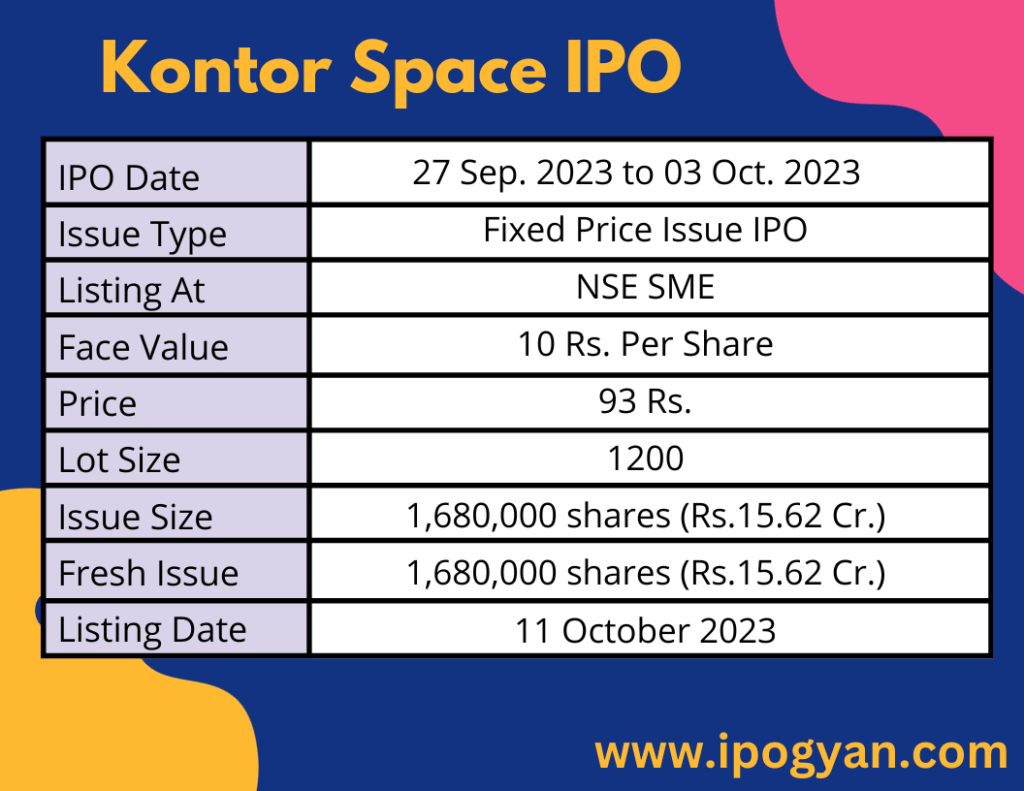

Kontor Space IPO Complete Details:

Kontor Space IPO Timetable:

Company Financial Details:

AS OF NOW, the GMP OF Kontor Space is Around 07 Rs.

Objects Of Issue:

a. To submit payment for rental deposits for new co-working centers.

b. To execute capital expenditures for the interior design and furnishings of new co-working centers.

c. For general corporate purposes.

Promoters:

Mr. Kanak Mangal:

- Position: Oversees and contributes to the overall business management of the Company.

- Education: Holds a Bachelor of Business Administration degree and a Post-Graduation in Management Studies from MIT School of Telecom and Management Studies.

- Career: Started his career as a banker with HDFC Securities and SVC Bank, followed by roles in sales and networking for a B2B trading company in Dubai.

- Experience: Over 12 years of business operation experience, including 5+ years in the commercial real estate and co-working spaces industry.

Mrs. Neha Mittal:

- Position: Engaged in brand building, and strategic management related to community building, customer experience, and customer retention.

- Education: Holds a Master in Business Administration degree and is licensed as an Independent Real Estate Consultant.

- Experience: Possesses 8 years of overall experience in Real Estate Consultancy and Business Administration.

FAQs:

When Kontor Space IPO is Opening?

Kontor Space IPO is Opening on 27 September 2023(Tuesday).

When Kontor Space IPO is Closing?

Kontor Space IPO is Closing on 03 October 2023(Tuesday).

What is the IPO Issue Size of Kontor Space?

The IPO Issue Size of Kontor Space is 15.62 Crore.

Price Band of Kontor Space IPO?

The price Band of Kontor Space IPO is 93 rupees per share.

What is the minimum investment for Kontor Space IPO?

The minimum investment for Kontor Space IPO is 111,600 Rupees.

Allotment Date of Kontor Space IPO?

The Allotment of Kontor Space IPO is on 06 October 2023(Friday).

Listing Date of Kontor Space IPO?

The Listing Of Kontor Space is Scheduled on 11 October 2023(Wednesday).

One Should Apply for Kontor Space IPO or Not?

Can Apply Kontor Space IPO For Listing Gains.

How to apply for Kontor Space IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Kontor Space IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Kontor Space IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Kontor Space IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Kontor Space IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Kontor Space IPO from the list ——–> Click on Kontor Space IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is Kontor Space IPO’s Lead Manager?

Srujan Alpha Capital Advisors LLP is the Lead Manager of Kontor Space.

Where To Check the Allotment of Kontor Space IPO?

The allotment status for the Kontor Space IPO will be accessible on the Cameo Corporate Services Limited Website.

Kontor Space IPO is going to be listed at?

Kontor Space IPO is going to be listed at NSE SME

What is the Lot Size of the Kontor Space IPO?

The lot size of Kontor Space IPO is 1200 Shares.

What is the EPS of Kontor Space IPO?

The EPS of Kontor Space is 9.46.

What is the P/E Ratio of Kontor Space IPO?

P/E Ratio of Kontor Space is 22.27.

What is the ROE of Kontor Space IPO?

The ROE of Kontor Space is 40.82%.

What is the ROCE of Kontor Space IPO?

ROCE of Kontor Space is 31.19%.