IBL Finance started its lending operations, for self-employed professionals and small business owners in the year that ended on March 31, 2019. From 2020 onward the company has transitioned into a fintech-based financial services platform utilizing technology and data science to streamline lending procedures. As a tech-driven fintech company, IBL Finance offers loans through its mobile application providing a nearly fully digitalized process. The digital personal loan service is designed to meet the needs of India’s connected population, which is growing.

The mobile application-based personal loans business operates under the brand name “IBL; Instant Personal Loan.” This division of the company offers loans of, up to ₹50,000 with repayment periods of up to 12 months exclusively through a fully digital mobile app process. Since its launch until March 31, 2023, IBL Finance has provided 163,282 loans totaling ₹7,105.44 lakhs. As of March 31, 2023, the personal loan business had an asset under management (AUM) worth ₹1,461.18 lakhs. Had disbursed 122,078 loans amounting to ₹5,234.70 lakhs. The average loan amount was around ₹4,500. The average remaining tenure for loans, at the end of Fiscal Year 2023 was approximately 5 months.

IBL Finance views their lending process as a factor, in driving the growth of its business. They highlight the convenience of downloading the IBL; Instant Personal Loan App filling out the loan application getting approval in, than 5 minutes, and receiving loan funds within 24 hours. The repayment of loans follows an installment plan (EMI) throughout the loan.

To achieve term and profitable expansion IBL Finance prioritizes two factors; the quality of credit and pricing. The company has effectively built an underwriting system that gathers data from sources resulting in a credit report that encompasses more, than 500 data points.

IBL Finance utilizes a method of organizing customers into cohorts taking into account factors such, as yield, risk, ticket size, and acquisition cost. This helps them identify cohorts that are both risk and profitable. In addition to this approach, IBL Finance conducts customer research. Employs advanced data analytics to offer customized products to their customers. The company strongly believes that profiling and pricing each borrower plays a role, in establishing a lending business.

IBL Finance IPO Complete Details:

IBL Finance IPO Timetable:

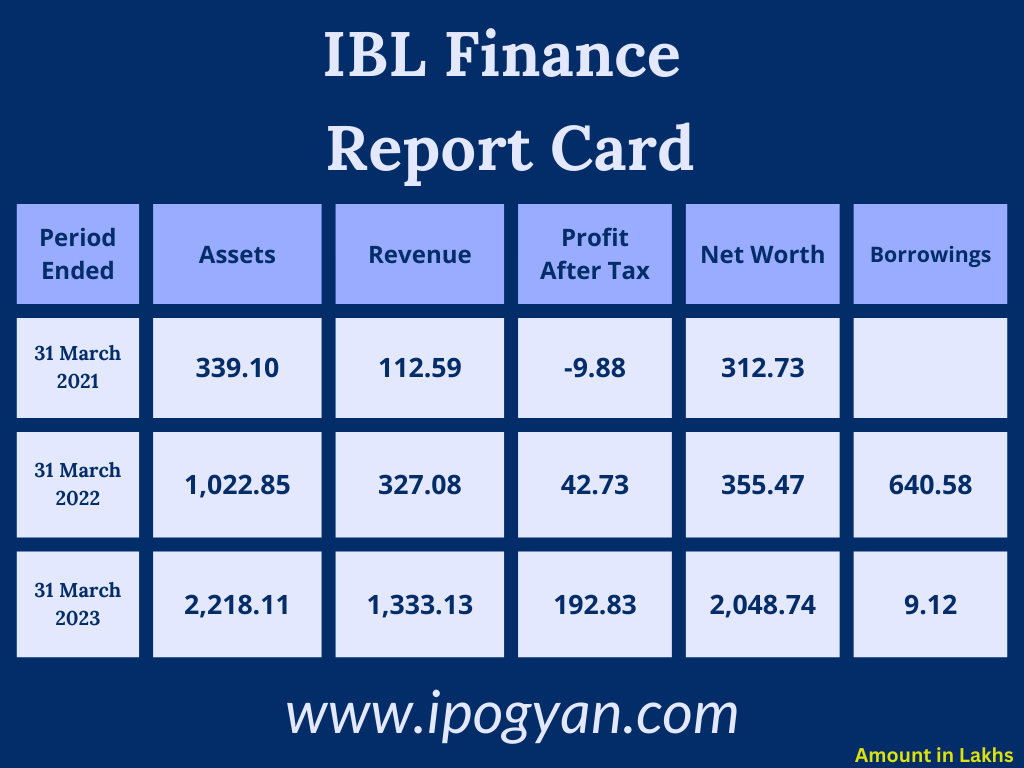

Company Financial Details:

AS OF NOW, the GMP OF IBL Finance is Around 00 Rs.

Objects Of Issue:

1. The company aims to augment its Tier-I capital base to address future capital requirements arising from the growth of its business and assets.

2. The company intends to utilize the funds for general corporate purposes.

Promoters:

MANISH PATEL:

– Position: Chairman and Managing Director

– Education: Bachelor’s degree in Business Administration from Sikkim Manipal University

– Experience: More than 5 years in the field of the company’s business.

PIYUSH PATEL:

– Position: Whole-Time Director

– Education: Undergraduate, completed senior secondary course from National Institute of Open Schooling

– Experience: More than 5 years in the field of the company’s business.

MANSUKHBHAI PATEL:

– Position: Whole-Time Director

– Education: Bachelor’s degree in Commerce from Gujarat University

– Experience: More than 5 years in the field of the company’s business.

FAQs:

When IBL Finance IPO is Opening?

IBL Finance IPO is Opening on 09 January 2024.

When is the IBL Finance IPO Closing?

IBL Finance IPO is Closing on 11 January 2024.

What is the Issue Size of the IBL Finance IPO?

The IPO Issue Size of IBL Finance is 34.30 Crore.

Price Band of IBL Finance IPO?

The price Band of IBL Finance IPO is 51 rupees per share.

What is the minimum investment for IBL Finance IPO?

The minimum investment for the IBL Finance IPO is 102,000 Rupees.

Allotment Date of IBL Finance IPO?

The Allotment of IBL Finance IPO is on 12 January 2024.

Listing Date of IBL Finance IPO?

The Listing Of IBL Finance is Scheduled on 16 January 2024.

One Should Apply for IBL Finance IPO or Not?

will update soon

How to apply for IBL Finance IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find IBL Finance IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IBL Finance IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find IBL Finance IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for IBL Finance IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find IBL Finance IPO from the list ——–> Click on IBL Finance IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of the IBL Finance?

Fedex Securities Private Limited is the Lead Manager of IBL Finance.

Where To Check the Allotment of IBL Finance IPO?

The allotment status for the IBL Finance IPO will be accessible on the Link Intime India Private Limited Website.

IBL Finance IPO is going to be listed at?

IBL Finance IPO is going to be listed at NSE SME.

What is the Lot Size of the IBL Finance IPO?

The lot size of the IBL Finance IPO is 2000 Shares.

What is the P/E Ratio of the IBL Finance IPO?

The P/E Ratio of the IBL Finance is N/A.

What is the ROE of the IBL Finance IPO?

The ROE of the IBL Finance IPO is 9.41%.

What is the ROCE of the IBL Finance IPO?

The ROCE of the IBL Finance IPO is 18.88%.