Naman In-Store (India) stands out as a leading supplier of display and retail furniture solutions providing an array of products and, in-store options for industries and retail outlets. Focusing on creating furniture for offices, beauty salons, compact kitchens, schools, and supermarket shelves Naman In-Store follows a business-to-business approach, by crafting furniture and fixtures using wood, metal, and plastic materials.

They offer a variety of products such, as kiosks, complete stores, Countertop Units (CTU), Countertop Display Units (CDU), and Point of Sales Merchandising (POSM) to improve the appeal and usability of locations. Catering to a range of customers, across regions and sectors the company focuses on grasping customer requirements and industry trends to provide cost-effective products consistently.

Naman In Store has catered to 32 clients and their franchisees in addition, to servicing 4 industrial clients as of September 30 2023. The company takes pride in its professionals and skilled workforce who excel in design and innovation, with the support of a technical and design team.

Naman In-Store has expanded its services across India. Also landed export deals to supply furniture and fixtures in the United States. The company was co-founded by Mr. Raju Paleja and Ms. Bhavika Paleja, who together have, over 19 years of experience in the industry. With a management team and a workforce of 491 employees as of September 30 2023, Naman In Store remains successful in delivering, in-store solutions and managing manufacturing operations effectively.

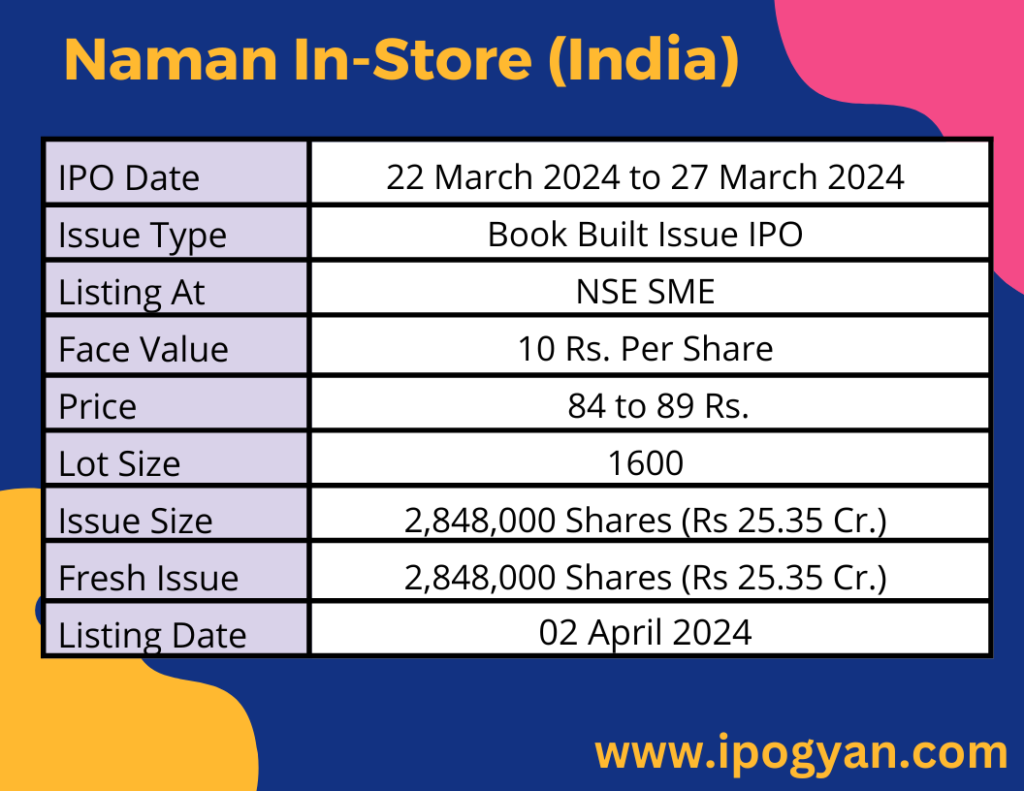

Naman In-Store (India) IPO Complete Details:

Naman In-Store (India) IPO Timetable:

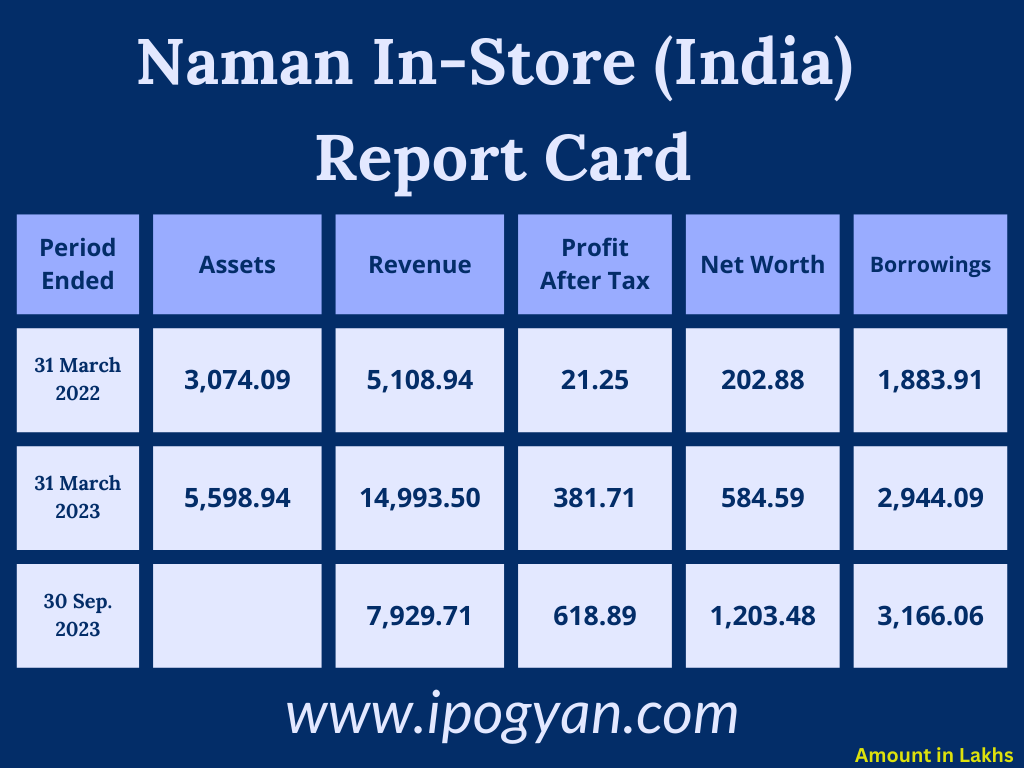

Company Financial Details:

AS OF NOW, the GMP Of Naman In-Store (India) is Around 69 Rs.

Objects Of Issue:

1. Financing the capital expenditure of our company to secure a leasehold land in Butibori, MIDC, to relocate the current manufacturing facilities.

2. Building a factory structure.

3. Meeting general corporate needs.

Promoters:

- MR. RAJU PALEJA

- MS. BHAVIKA PALEJA

- MR. JAY SHAH

- MR. MEHUL NAIK

- MR. ABDUL SHAHID SHAIKH

FAQs:

When Naman In-Store (India) IPO is Opening?

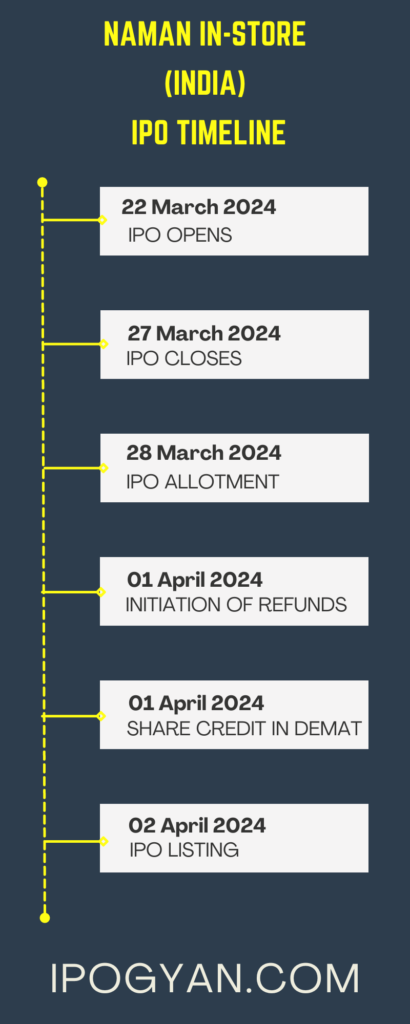

Naman In-Store (India) IPO is Opening on 22 March 2024.

When is the Naman In-Store (India) IPO Closing?

Naman In-Store (India) IPO is Closing on 27 March 2024.

What is the Issue Size of the Naman In-Store (India) IPO?

The IPO Issue Size of Naman In-Store (India) is 25.35 Crore.

Price Band of Naman In-Store (India) IPO?

The price Band of Naman In-Store (India) IPO is 84 to 89 rupees per share.

What is the minimum investment for a Naman In-Store (India) IPO?

The minimum investment for the Naman In-Store (India) IPO is 142,400 Rupees.

Allotment Date of Naman In-Store (India) IPO?

The Allotment of Naman In-Store (India) IPO is on 28 March 2024.

Listing Date of Naman In-Store (India) IPO?

The Listing Of Naman In-Store (India) is Scheduled on 02 April 2024.

One Should Apply for Naman In-Store (India) IPO or Not?

Will Update Soon..

How to apply for Naman In-Store (India) IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Naman In-Store (India) IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Naman In-Store (India) IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Naman In-Store (India) IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Naman In-Store (India) IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Naman In-Store (India) IPO from the list ——–> Click on Naman In-Store (India) IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Naman In-Store (India)?

GYR Capital Advisors Private Limited is the Lead Manager of Naman In-Store (India).

Where To Check the Allotment of Naman In-Store (India) IPO?

The allotment status for the Naman In-Store (India) IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Naman In-Store (India) IPO is going to be listed at?

Naman In-Store (India) IPO is going to be listed at NSE SME.

What is the Lot Size of the Naman In-Store (India) IPO?

The lot size of the Naman In-Store (India) IPO is 1600 Shares.

What is the P/E Ratio of the Naman In-Store (India)?

The P/E Ratio of the Naman In-Store (India) is 17.95.

What is the EPS of the Naman In-Store (India)?

The EPS of the Naman In-Store (India) is 4.96.

What is the ROE of the Naman In-Store (India)?

The ROE of Naman In-Store (India) is 69.22%.

What is the ROCE of the Naman In-Store (India)?

The ROCE of the Naman In-Store (India) is 24.51%.