Vishwas Agri Seeds started its operations in the city of Gondal, near Rajkot, Gujarat in 2009. Initially, it launched with a seed processing facility in Gondal. Currently, Vishwas Agri Seeds is involved in processing high-quality seeds and delivering them to farmers through its distribution channels. The company sells its seeds under the brand name “Vishwas.” With the help of a sorting machine, their seed processing unit detects colors, minor discoloration, size and shape irregularities, and foreign substances. In addition, the seeds undergo a seed treatment process where they are treated with fungicide, insecticide, or both to eliminate any organisms or pests present, in the seeds or soil.

The company focuses on providing top-notch seeds. Follows established procedures to ensure quality. Vishwas Agri Seeds is involved in every step of the seed processing cycle starting from collaborating with farmers, for seed planting conducting field inspections, processing, packaging, and storing seeds. They take an approach to their operations. With a designated land area of 14,000 feet at their seed processing facility in Ahmedabad the company grows sample seeds to monitor growth and improve product variety. Using their distribution network effectively Vishwas Agri Seeds supplies seeds to regions, across India.

As of March 31 2023 the company has developed seeds, for over 40 types of field crops and vegetables. Their sales and distribution network extends to Gujarat, Maharashtra and Rajasthan. Vishwas Agri Seeds provides a range of options with than 75 crop varieties, including groundnut, soybean, wheat, cumin, green gram, and black gram. They also offer research seeds and hybrid vegetable seeds, like chili, tomato, brinjal, watermelon, and sweet corn. Additionally, they have cabbage, onion, coriander seeds fenugreek mustard carrot in their offerings.

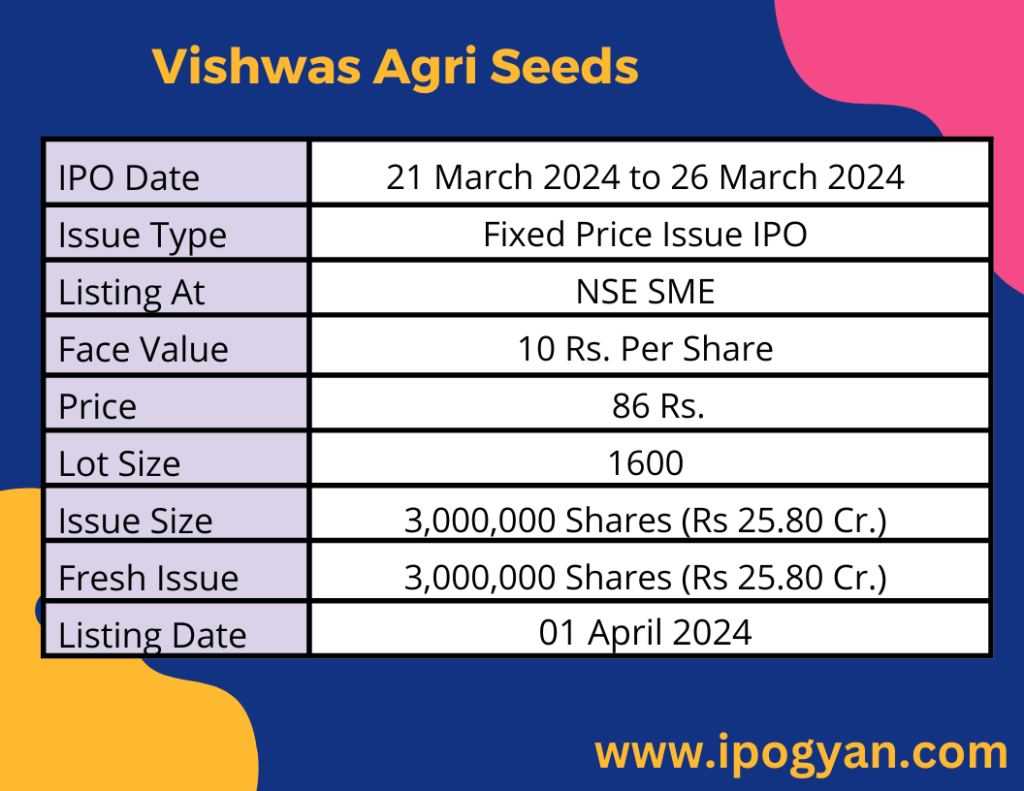

Vishwas Agri Seeds IPO Complete Details:

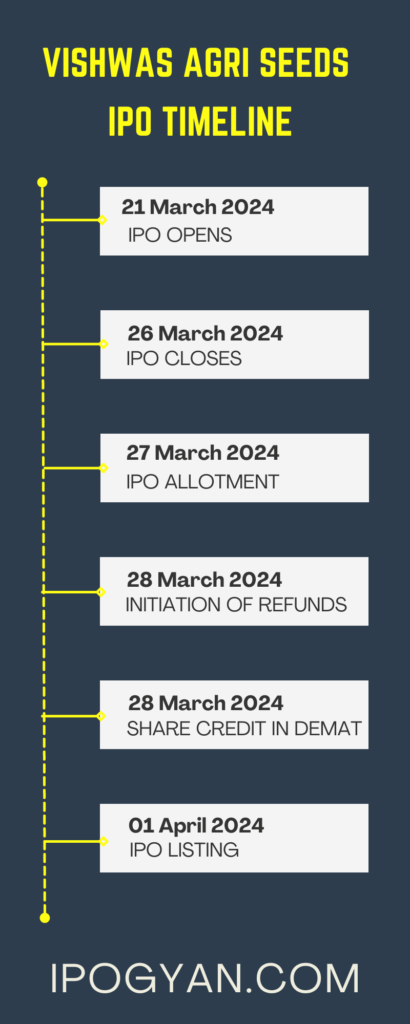

Vishwas Agri Seeds IPO Timetable:

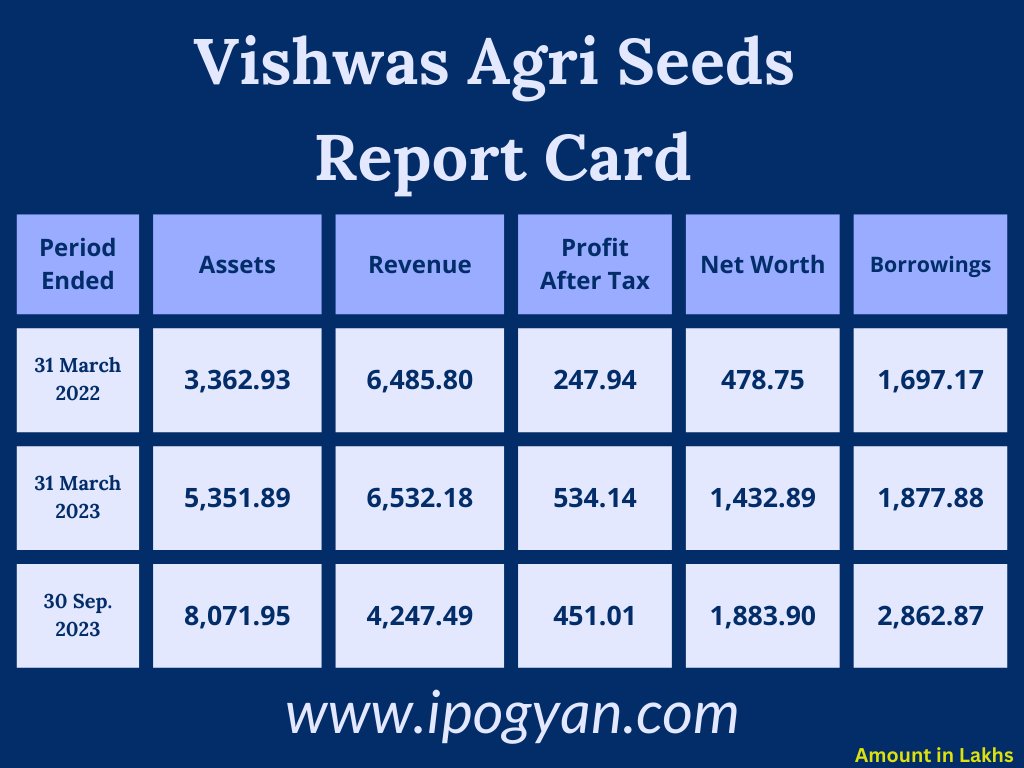

Company Financial Details:

AS OF NOW, the GMP Of Vishwas Agri Seeds is Around 00 Rs.

Objects Of Issue:

1) Investment in Assets:

- Investment in furnishing the corporate office building.

- Acquisition of equipment for establishing the seed testing laboratory.

- Establishment of a greenhouse equipped with a fan-pad system.

- Installation of 129.6KW monocrystalline rooftop solar panels.

2) Working Capital Needs.

3) General Corporate Expenditure.

Promoters:

- Mr. Ashokbhai Sibabhai Gajera

- Mr. Bharatbhai Sibabhai Gajera

- Mr. Dineshbhai Madhabhai Suvagiya

- Ms. Ilaben Pareshbhai Patel

- Mr. Kalubhai Maganbhai Vekariya

- Mr. Maheshbhai Sibabhai Gajera

- Mr. Ketankumar Babulal Suvagiya

- Mr. Babubhai Laljibhai Suvagiya

- Mr. Rameshbhai Laljibhai Suvagiya

- Mr. Shivlal Veljibhai Bhanderi

FAQs:

When Vishwas Agri Seeds IPO is Opening?

Vishwas Agri Seeds IPO is Opening on 21 March 2024.

When is the Vishwas Agri Seeds IPO Closing?

Vishwas Agri Seeds IPO is Closing on 26 March 2024.

What is the Issue Size of the Vishwas Agri Seeds IPO?

The IPO Issue Size of Vishwas Agri Seeds is 25.80 Crore.

Price Band of Vishwas Agri Seeds IPO?

The price Band of Vishwas Agri Seeds IPO is 86 rupees per share.

What is the minimum investment for a Vishwas Agri Seeds IPO?

The minimum investment for the Vishwas Agri Seeds IPO is 137,600 Rupees.

Allotment Date of Vishwas Agri Seeds IPO?

The Allotment of Vishwas Agri Seeds IPO is on 27 March 2024.

Listing Date of Vishwas Agri Seeds IPO?

The Listing Of Vishwas Agri Seeds is Scheduled on 01 April 2024.

One Should Apply for Vishwas Agri Seeds IPO or Not?

Will Update Soon..

How to apply for Vishwas Agri Seeds IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Vishwas Agri Seeds IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Vishwas Agri Seeds IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Vishwas Agri Seeds IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Vishwas Agri Seeds IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Vishwas Agri Seeds IPO from the list ——–> Click on Vishwas Agri Seeds IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Vishwas Agri Seeds?

Isk Advisors Pvt Ltd is the Lead Manager of Vishwas Agri Seeds.

Where To Check the Allotment of Vishwas Agri Seeds IPO?

The allotment status for the Vishwas Agri Seeds IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Vishwas Agri Seeds IPO is going to be listed at?

Vishwas Agri Seeds IPO is going to be listed at NSE SME.

What is the Lot Size of the Vishwas Agri Seeds IPO?

The lot size of the Vishwas Agri Seeds IPO is 1600 Shares.

What is the P/E Ratio of the Vishwas Agri Seeds?

The P/E Ratio of the Vishwas Agri Seeds is 5.06.

What is the EPS of the Vishwas Agri Seeds?

The EPS of the Vishwas Agri Seeds is 16.98.

What is the ROE of the Vishwas Agri Seeds?

The ROE of Vishwas Agri Seeds is 27.20%.

What is the ROCE of the Vishwas Agri Seeds?

The ROCE of the Vishwas Agri Seeds is 14.60%.