Owais Metal and Mineral Processing is skilled, at producing and processing metals and minerals showcasing a range of natural resources with a focus, on manufacturing and processing metals and minerals. The company is involved in creating and processing products:

1. Manganese Oxide (MNO)

2. MC Ferro Manganese

3. Wood Charcoal manufacturing

4. Mineral processing including Ferro Alloy, Quartz, and Manganese Ore.

- Their Manganese Oxide finds utility in the fertilizer industry and is essential for Manganese Sulphate Plants. Manganese Ore serves as a crucial ingredient in the production of Ferro Manganese, Silico Manganese, Manganese Oxide, batteries, and various other Ferro products, making it directly marketable as well.

- MC Ferro Manganese plays a pivotal role in steel and casting industries by enhancing steel properties, such as durability, machinability, and malleability, while also aiding in deoxidizing molten metal.

- Wood Charcoal supplied by the company is vital for industries requiring high heat, like the steel industry.

- Processed Quartz finds applications in the hotel industry, Ferro alloy industry, tiles & ceramic industry, glass industry, and the interiors & furniture industry.

At present, Owais Metal and Mineral Processing primarily supplies its major products to the states of Madhya Pradesh, Maharashtra, Punjab, Delhi, and Gujarat. Recently, the company has expanded its product portfolio to include Wood Charcoal and Processed Quartz. The Wood Charcoal manufacturing unit is located in Rajasthan and Meghnagar, while Quartz processing is carried out at the Meghnagar plant.

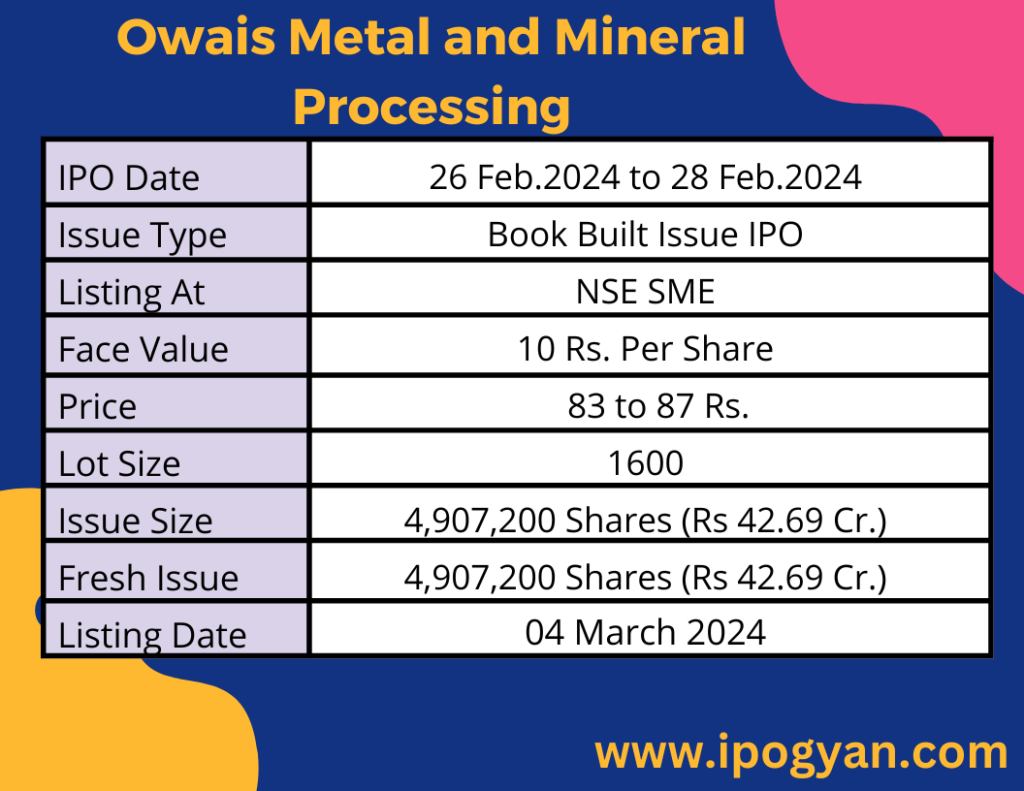

Owais Metal and Mineral Processing IPO Complete Details:

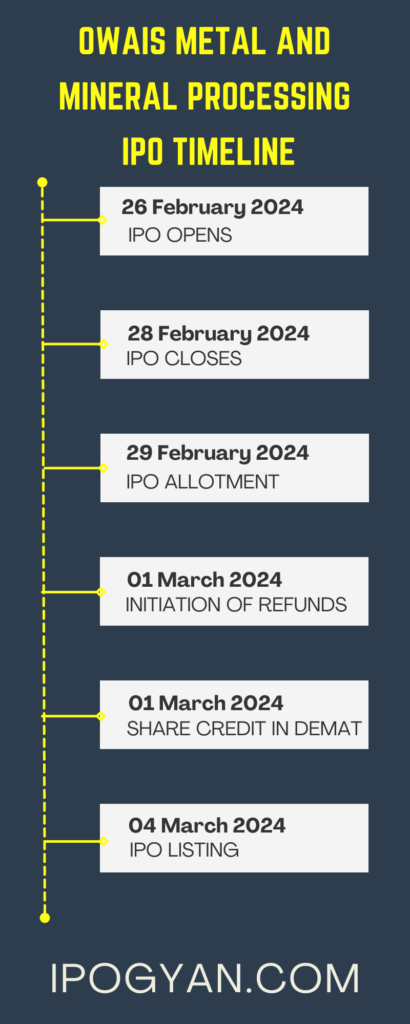

Owais Metal and Mineral Processing IPO Timetable:

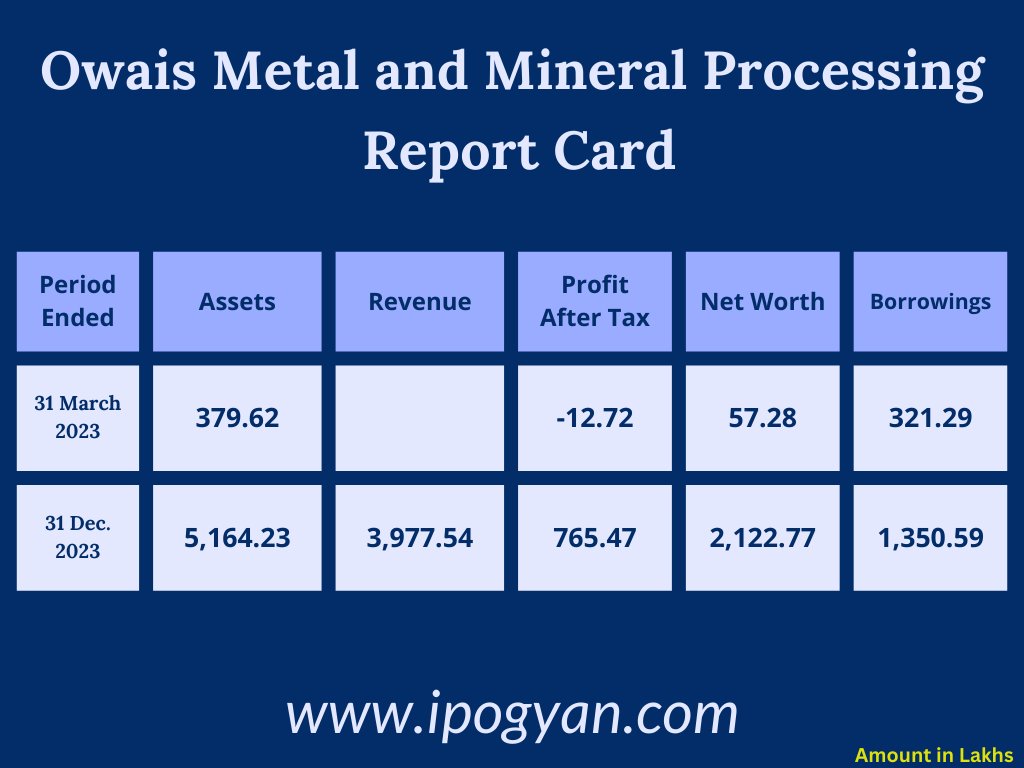

Company Financial Details:

AS OF NOW, the GMP Of Owais Metal and Mineral Processing is Around 00 Rs.

Objects Of Issue:

a) Purchase of Equipments to Facilitate Manufacturing

b) Working Capital Requirements

c) General Corporate Purposes.

Promoters:

- MR. SAIYYED OWAIS ALI

FAQs:

When Owais Metal and Mineral Processing IPO is Opening?

Owais Metal and Mineral Processing IPO is Opening on 26 February 2024.

When is the Owais Metal and Mineral Processing IPO Closing?

Owais Metal and Mineral Processing IPO is Closing on 28 February 2024.

What is the Issue Size of the Owais Metal and Mineral Processing IPO?

The IPO Issue Size of Owais Metal and Mineral Processing is 42.69 Crore.

Price Band of Owais Metal and Mineral Processing IPO?

The price Band of Owais Metal and Mineral Processing IPO is 83 to 87 rupees per share.

What is the minimum investment for an Owais Metal and Mineral Processing IPO?

The minimum investment for the Owais Metal and Mineral Processing IPO is 139,200 Rupees.

Allotment Date of Owais Metal and Mineral Processing IPO?

The Allotment of Owais Metal and Mineral Processing IPO is on 29 February 2024.

Listing Date of Owais Metal and Mineral Processing IPO?

The Listing Of Owais Metal and Mineral Processing is Scheduled on 04 March 2024.

One Should Apply for Owais Metal and Mineral Processing IPO or Not?

Will Update Soon..

How to apply for Owais Metal and Mineral Processing IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Owais Metal and Mineral Processing IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Owais Metal and Mineral Processing IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Owais Metal and Mineral Processing IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Owais Metal and Mineral Processing IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Owais Metal and Mineral Processing IPO from the list ——–> Click on Owais Metal and Mineral Processing IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Owais Metal and Mineral Processing?

Gretex Corporate Services Limited is the Lead Manager of Owais Metal and Mineral Processing.

Where To Check the Allotment of Owais Metal and Mineral Processing IPO?

The allotment status for the Owais Metal and Mineral Processing IPO will be accessible on the Bigshare Services Pvt Ltd Website.

Owais Metal and Mineral Processing IPO is going to be listed at?

Owais Metal and Mineral Processing IPO is going to be listed at NSE SME.

What is the Lot Size of the Owais Metal and Mineral Processing IPO?

The lot size of the Owais Metal and Mineral Processing IPO is 1600 Shares.

What is the P/E Ratio of the Owais Metal and Mineral Processing?

The P/E Ratio of the Owais Metal and Mineral Processing is 21.35.

What is the EPS of the Owais Metal and Mineral Processing?

EPS of the Owais Metal and Mineral Processing is 4.08.

What is the ROE of the Owais Metal and Mineral Processing?

ROE of the Owais Metal and Mineral Processing is -5.35%.

What is the ROCE of the Owais Metal and Mineral Processing?

The ROCE of the Owais Metal and Mineral Processing is N/A.