Sadhav Shipping, a Mumbai-based company founded in 1996 focuses on owning and managing assets to offer services for ports, coastal logistics, and other maritime operations. At present Sadhav Shipping manages a fleet of 24 vessels, including 19 owned ships and 5 leased ones catering to segments of the maritime industry.

Sadhav Shipping has broadened its service offerings in areas of shipping and coastal logistics attracting clients that include top firms, like ONGC Ltd., Mumbai Port Authority, Pradip Port Authority, Bhabha Atomic Research Centre, Shipping Corporation of India, and more.

Sadhav Shipping conducts activities such, as operating barges on Coastal & Inland Waterways for transporting goods or lighterage. Additionally, they manage port crafts. Offer high-speed security boats, for patrolling services as part of their Port Services operations.

Sadhav Shipping operates three key business verticals:

1. Offshore Logistics: They assist, the oil and gas industry by offering a range of ships designed for activities such, as towing delivering drilling supplies, and other related services. One of their clients is ONGC.

2. Port Services: They offer a range of harbor vessels, for activities such as pilot transfers, patrolling, surveys, and transporting cargo. Additionally, they provide services, for ports. Manage boats on behalf of clients.

3. Oil Spill Response: Pioneers in Tier-1 Oil Spill Response in India, offering long-term contracts to multiple ports with specialized equipment and trained manpower. Recognized for their efforts in containing incidents and participating in national-level exercises.

Sadhav Shipping IPO Complete Details:

Sadhav Shipping IPO Timetable:

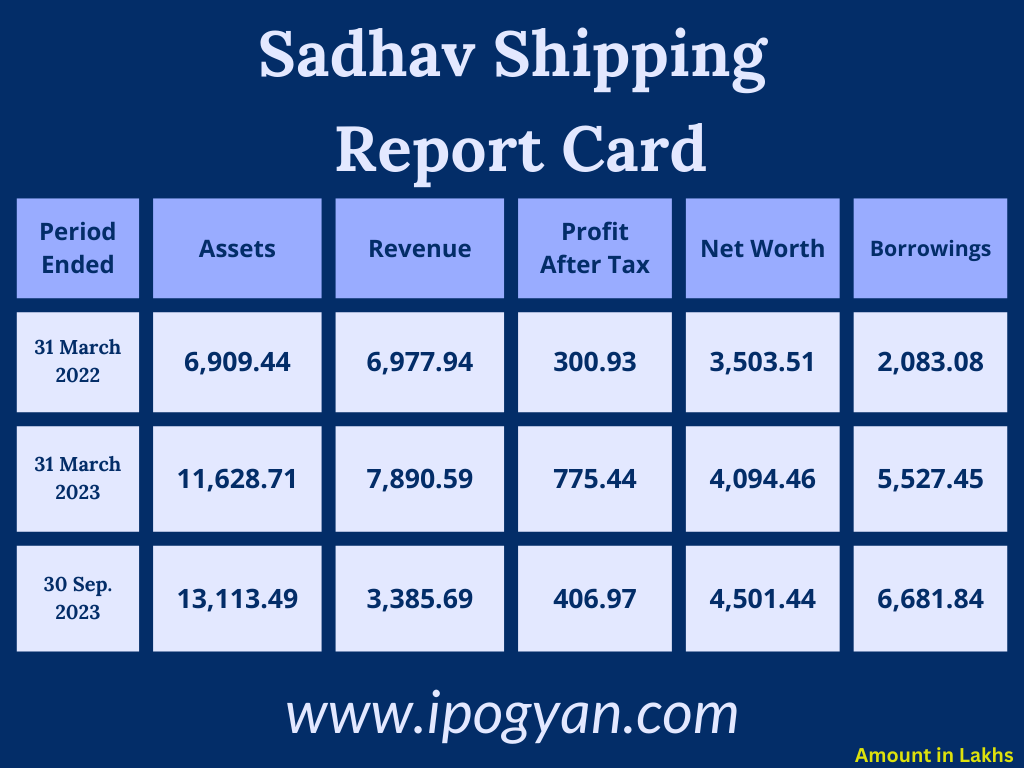

Company Financial Details:

AS OF NOW, the GMP Of Sadhav Shipping is Around 00 Rs.

Objects Of Issue:

1. Repayment or prepayment, either partially or in full, of certain outstanding borrowings obtained by our company.

2. Partial funding of capital expenditure to purchase or acquire additional boats or vessels.

3. Meeting working capital requirements.

4. General corporate purposes.

Promoters:

- Mr. Kamal Kant Biswanath Choudhury

- Mrs Sadhana Choudhury

- Mr. Vedant Kamal Kant Choudhury

FAQs:

When Sadhav Shipping IPO is Opening?

Sadhav Shipping IPO is Opening on 23 February 2024.

When is the Sadhav Shipping IPO Closing?

Sadhav Shipping IPO is Closing on 27 February 2024.

What is the Issue Size of the Sadhav Shipping IPO?

The IPO Issue Size of Sadhav Shipping is 38.18 Crore.

Price Band of Sadhav Shipping IPO?

The price Band of Sadhav Shipping IPO is 95 rupees per share.

What is the minimum investment for a Sadhav Shipping IPO?

The minimum investment for the Sadhav Shipping IPO is 114,000 Rupees.

Allotment Date of Sadhav Shipping IPO?

The Allotment of Sadhav Shipping IPO is on 28 February 2024.

Listing Date of Sadhav Shipping IPO?

The Listing Of Sadhav Shipping is Scheduled on 01 March 2024.

One Should Apply for Sadhav Shipping IPO or Not?

Will Update Soon..

How to apply for Sadhav Shipping IPO through the Zerodha Application?

Open Zerodha Application ——–> At the Bottom Click on Orders ——–> Then at the Top Click on IPO ——–> Find Sadhav Shipping IPO from the list ——–> Then Click Apply Button ——–> Select Investor Type(Individual) ——–> Enter Your UPI ID ——–> Select @ Extension ——–> Click on Cut-Off Price Box ——–> Enter Quantity ——–>Tick Check Box Of Terms and Conditions ——–> Drag Submit IPO Button On Right Side ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Sadhav Shipping IPO through the Upstox Application?

Open Upstox Application ——–> At the Bottom Click on Invest ——–> Then Click On “View ongoing IPO” ——–> Find Sadhav Shipping IPO from the list ——–> Then Click Apply Button ——–> Enter Your UPI ID ——–> Select Investor Type ——–> Enter the Number of Lots to Purchase ( ENTER 1) ——–> Click on Cut-Off Price Box ——–>Tick Check Box Of Terms and Conditions ——–> Click on Continue ——–> Click on Confirm And Apply ——–> Accept IPO Mandate Received in Your UPI Application.

How to apply for Sadhav Shipping IPO through Angel One Application?

Open Angel One Application ——–> At the Bottom Click on Home ——–> Click on IPO Button ——–> Find Sadhav Shipping IPO from the list ——–> Click on Sadhav Shipping IPO Name ——–> Click on Apply Now ——> Enter Lot (1) ——–> Select Investor Type ——–> Enter UPI ID ——–> Click on “Apply For IPO” —>Click On Proceed ——–> Accept IPO Mandate Received in Your UPI Application.

Who is the Lead Manager of Sadhav Shipping?

ISK Advisor Private Limited is the Lead Manager of Sadhav Shipping.

Where To Check the Allotment of Sadhav Shipping IPO?

The allotment status for the Sadhav Shipping IPO will be accessible on the Maashitla Securities Private Limited website.

Sadhav Shipping IPO is going to be listed at?

Sadhav Shipping IPO is going to be listed at NSE SME.

What is the Lot Size of the Sadhav Shipping IPO?

The lot size of the Sadhav Shipping IPO is 1200 Shares.

What is the P/E Ratio of the Sadhav Shipping?

The P/E Ratio of the Sadhav Shipping is 12.66.

What is the EPS of the Sadhav Shipping?

EPS of the Sadhav Shipping is 7.5.

What is the ROE of the Sadhav Shipping?

ROE of the Sadhav Shipping is 20.41%.

What is the ROCE of the Sadhav Shipping?

The ROCE of the Sadhav Shipping is 14.36%.